"2020 Legal Industry Blockchain Development Report" released: What are the potential opportunities for blockchain policies and law firms?

Li Lei, founding partner of law firm, founder of Shanghai Fahe Information Technology Co., Ltd., and author of "The dusk of the corporate system: blockchain thinking and digital incentives" Legal Industry Blockchain Development Report ''

On December 28, 2019, the 2019 annual meeting of directors of the law firm was solemnly held in Phuket. Li Lei, the founding partner of the law firm, jointly with the Daqin think tank released the 2020 Legal Industry Blockchain Development Report.

The 2020 Legal Industry Blockchain Development Report states that there is a huge demand for blockchain + compliance in the blockchain industry, and that the law is in a low-competition blue ocean stage in the blockchain industry, which is mainly reflected in three points : The rapid growth of blockchain and the lag of law; frequent compliance cases, uneven supply and demand of lawyers; high barriers to entry for blockchain lawyers.

- 14 insurance companies join insurance risk control blockchain platform industry expect application results to accelerate landing

- People's Daily articles: digital currency, how much do you know

- On the Network Effect and Ecological Effect of Blockchain

The 2020 Legal Industry Blockchain Development Report is as follows:

I. Introduction

In the past few years, the development of the blockchain and digital currency industry has been remarkable. Reflected in the field of laws and policies, the regulatory framework for digital assets in various countries has gradually become clear. On October 24, 2019, the Political Bureau of the Central Committee of the Communist Party of China conducted the thirteenth collective learning on the current status and trends of blockchain technology development. General Secretary Xi Jinping pointed out that the application of blockchain technology has extended to many fields such as digital finance, the Internet of Things, intelligent manufacturing, supply chain management, and digital asset trading. At present, major countries in the world are accelerating the development of blockchain technology. China has a good foundation in the field of blockchain. We must accelerate the development of blockchain technology and industrial innovation, and actively promote the development of the integration of blockchain and economy and society.

Source: Xinhua News Agency

However, we cannot ignore that any emerging industry will inevitably have some problems with incomplete laws and compliance in its early stages. From the current point of view, China's blockchain is still in its early development stage, and the establishment of a blockchain long-term mechanism will take some time. Taking finance as an example, the problems arising from the blockchain-enabled financial process alone include privacy supervision, password attribution, tax collection, risk control, etc., and the overall compliance in the future will have systematic changes. .

In fact, as early as the Internet era, regulations on online payment, online lending, Internet insurance, and online crowdfunding have sprung up. Before the Internet became widespread, these regulations were unimaginable. However, if you can learn Internet technology and enter the market when the Internet is just in its infancy, it is unknown whether you can grasp the opportunities of the next generation.

History is always surprisingly similar, and the grand occasion of today's blockchain is inevitably reminiscent of the scene of the Internet. However, there is an essential difference between this grand occasion and the beginning of this century: Blockchain is a comprehensive technology combining multiple disciplines and fields, including cryptography, finance, economics, computer science, mathematics, and compliance and many more. There are few people who can have all the blockchain knowledge reserves, and this has also created the prosperity of the industry's learning atmosphere and cross-industry alliances.

Coupled with the broad enabling scenario of blockchain technology, the sooner people step into this field to study, the easier it will be to become a specialist in this field. Therefore, this is a market with obvious corporate effects. The big one is Evergrande. How to cut into the emerging blockchain industry from the traditional industry at an appropriate angle is definitely a problem facing major companies.

However, not only are we in such a good situation and environment, we still notice that illegal and criminal activities in the name of "blockchain, digital currency" are still banned, and large amounts of suspicious transactions or technical problems occur from time to time on exchanges. . As the industry's compliance and regulatory standards become clearer, the compliance obligations of relevant industry participants will only increase. More importantly, blockchain technology has fundamentally affected future models, whether law firms, courts or regulators. In view of this, in accordance with the concept that "blockchain compliance will be the only way for major companies to strategically go in the future", we have collected and analyzed a large amount of relevant information and completed this draft, hoping that it will be beneficial to you.

Blockchain compliance: low competition blue ocean

1.Blockchain grows fast

A. The industry is developing rapidly

In June 2019, the U.S. released the Department of Defense Digital Modernization Strategy, which will clearly explore the application of blockchain technology in the field of network security. On September 18, 2019, the German government reviewed and released the German Blockchain Strategy. It is clear that blockchain technology will take priority actions in five major areas, such as stabilizing finance, stimulating innovation, regulating investment, administrative services, and popularizing knowledge; on October 24, 2019, the Political Bureau of the Communist Party of China Central Committee on the development of blockchain technology on the afternoon of October 24 Status and trends for the eighteenth collective learning. The General Secretary of the CPC Central Committee Xi Jinping emphasized during the study that the integrated application of blockchain technology played an important role in new technological innovation and industrial transformation. We must regard blockchain as an important breakthrough in independent innovation of core technologies, clarify the main attack direction, increase investment, focus on overcoming a number of key core technologies, and accelerate the development of blockchain technology and industrial innovation.

Digital Defense Modernization Strategy, source: media.defense.gov

Throughout 2019, blockchain technology has realized "multi-point blossoming", and has been explored and applied in a number of vertical industries such as judicial depository, taxation, trade finance, supply chain, logistics, medical health, and agriculture. In the first 8 months of this year alone, there were 154 blockchain projects promoted by global governments, and the number of open blockchain patent applications worldwide reached more than 18,000.

B. Empowerment in the field of electronic certificate is obvious

On September 7, 2018, the Supreme People's Court of China issued the "Regulations on Several Issues in Internet Court Trial", which acknowledged the legal effect of blockchain certificate in Internet case proof, and currently includes Beijing, Hangzhou, Guangzhou, etc. Courts in at least 7 provinces and municipalities across the country have established a blockchain electronic evidence platform. In August 2019, the Supreme People's Court announced that it is building a unified judicial blockchain platform for the people's courts. At present, 21 courts in four provinces and cities, including the Supreme People's Court, the High Court, the Intermediate People's Court, and the grassroots courts, as well as the National Time Service Center and multi-dispute mediation, have been completed. The 27 nodes of the platform, the notary office, and the judicial appraisal center were completed. In conjunction with the fourth-tier courts, a total of more than 180 million pieces of data were completed to complete the on-chain certificate deposit and certification. "Chain Management Regulations" guides the standardization of national court data on-chain.

"Regulations on Several Issues in the Trial of Internet Court Cases", Source: China's Supreme People's Court

Example: Beijing Innovation Judicial Deposit

The Beijing Internet Court has innovative judicial evidence, and has completed the connection of application node data in the fields of copyright, copyright, and electronic contracts. The platform currently collects more than 4.72 million pieces of online evidence, and the number of cross-chain certificate data has reached tens of millions. During the trial of the case, 945 cross-chain certificate data were verified, involving 58 cases and 1 certification judgment case, which contributed to the parties. Settled 41 mediation cases.

2. Frequent compliance cases, uneven supply and demand by lawyers

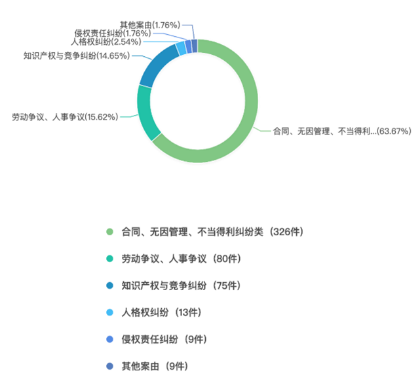

As of the end of November 2019, there were 512 civil judgment documents related to blockchain and 34 criminal judgment documents. Among the civil adjudication documents related to blockchain, the top three are contract disputes, competition disputes, labor and personnel disputes, and intellectual property rights.

2019 Blockchain Civil Judgment Document, Source: Chain Law

In the case of criminal judgments, the vast majority of cases are related to crimes that disrupt the order of the socialist market economy. In a sense, illegal fund-raising cases account for a large proportion of cases in the blockchain industry, and they are increasing year by year. According to incomplete statistics, in just two years from 2017 to 2019, the number of fraudulent scams that have been exposed on the blockchain has reached hundreds, and the total amount involved has exceeded 20 billion yuan, and the number of fraudsters has reached millions. .

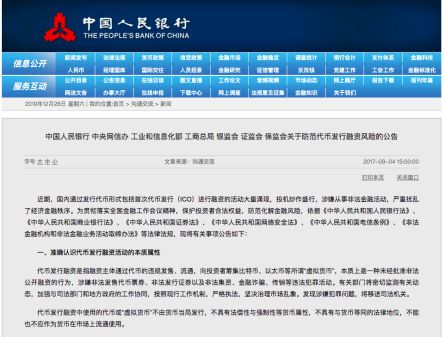

In addition, on September 4, 2017, the People's Bank of China and other 7 ministries and commissions jointly issued the "Announcement on Preventing the Risk of Financing of Token Issuance", which clearly defines the financing of token issuance as "essentially an unauthorized public financing without approval". Behavior, suspected of illegally selling token tickets, illegally issuing securities, illegal fundraising, financial fraud, pyramid schemes, and other illegal and criminal activities "; On November 14, 2019, the People's Bank of China Shanghai Headquarters Mutual Funds Remediation Office issued the" About Virtual Currency Trading Venues " The Notice of Remedial Remediation "clearly proposes the reorganization of virtual currency related activities. On December 4, 2019, the Hainan Free Trade Zone released the" Chain Shanghai South "plan, and the government also decided to implement sandbox supervision in Hainan.

The above-mentioned various policies indicate that due to its vague legal status, digital currency trading platforms have great needs in compliance consulting and other aspects. At present, it should be the best time for the lawyer industry to enter the blockchain track.

3.High barriers to entry for blockchain lawyers

As a multi-disciplinary and cross-disciplinary discipline, blockchain includes fields such as operating systems, network communications, cryptography, mathematics, finance, and production. Judging from the current situation, China still has a lot of fields to explore in cross-disciplinary areas. According to the "2018 Blockchain Talent Supply and Demand and Development Research Report", of the job applicants who submitted resumes, the remaining talents who truly possess blockchain-related skills and work experience only account for 7% of the demand. The current university curriculum and social professional training curriculum system is relatively backward. The content of the curriculum is biased towards knowledge popularization and industrial application guidance. There is no professional and extended blockchain professional curriculum.

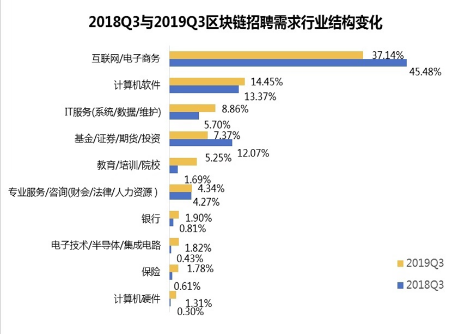

Blockchain recruitment demand industry structure change chart, source: Zhilian Recruitment

Blockchain project parties + compliance

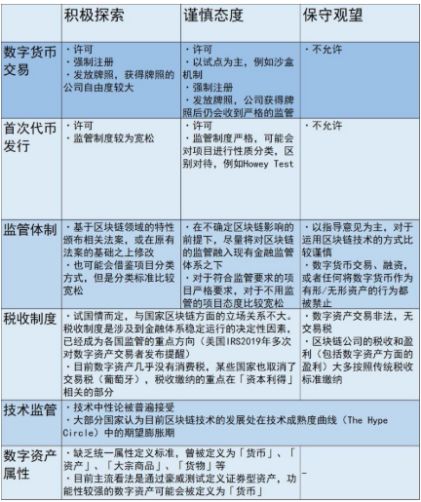

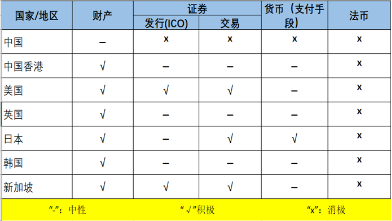

The following table shows the compliance attitudes of various countries towards blockchain projects, which are mainly divided into three categories: positive, cautious and conservative. Because the blockchain project needs to consider too many laws and regulations, including the illegal sale of token tickets, illegal securities issuance, illegal fundraising / financial fraud, pyramid schemes and so on. More importantly, the compliance of each time node in each country will vary greatly, and there are few precedents for compliance between different projects, so few people have made achievements in this field. But at the same time, the demand for the project is very huge. Like a stock IPO, there are many steps involved in compliance before each project is issued or listed. The nature of tokens is complex, unlike the stock system, which will involve multiple compliance risks, which can be divided into the following three types of compliance:

Introduction to Singapore's Blockchain Supervision, Source: HashKey Hub

1.Investment and financing consulting:

ICO and STO's various token financing regulations are mixed. The main sticking point is the nature of cryptocurrencies. The definition of the attributes of digital assets has been the subject of research in various countries, not only the discussion of its functionality, but also many issues related to how various circles view it. Taking the United States as an example, the "Virtual Currency Management Regulations" implemented in early 2013 supervised digital assets as a currency. In August of the same year, in the US Securities and Exchange Commission v. Trendon Shavers, the judge also identified digital assets as currency; 2014 In March, the U.S. Internal Revenue Service stipulated that digital assets should be considered as assets for tax purposes; in 2015, the US Commodity Futures Trading Commission supervised it as a commodity. In 2018, the SEC clarified the Regulatory methods, but did not propose a fundamental solution to the problem of how to classify digital assets.

This kind of policy confusion is not conducive to the healthy development of digital assets, but also easily breeds regulatory arbitrage, and even creates regulatory loopholes when the regulatory body is not clear enough. For example, whether the trading platform is a credit intermediary or an information intermediary. The platform actually acts as a credit intermediary by performing payment functions, but the relevant provisions of the payment business prohibit it from becoming a credit intermediary, resulting in regulatory confusion. Therefore, there are few experts in the field of investment and financing, but there are many needs. Although it can be imagined that the future of blockchain systematization and compliance will be introduced, the participation of lawyers in the entire project investment and financing process is absolutely indispensable.

Applicable blockchain regulatory regulations vary from country to country, source: network

2, fraud MLM rights:

In recent years, a large number of criminals have borrowed the concept of blockchain to conduct illegal financing in the form of tokens to the public. As early as September 4, 2017, the People's Bank of China and other 7 ministries and commissions jointly issued the "Announcement on Preventing the Risk of Financing of Token Issuance", which clearly defines the financing of token issuance as "essentially an unauthorized public financing without approval , Suspected of illegally selling token tickets, illegally issuing securities, and illegal fundraising, financial fraud, pyramid schemes and other illegal criminal activities. " However, 24 of the 34 criminal judgments this year alone involved illegal fund-raising cases such as organizing pyramid schemes, fund-raising fraud, and illegal absorption of public deposits. In addition, according to incomplete statistics, since 2017, there have been hundreds of cases of illegal fundraising that have been fraudulently borrowed in the name of the blockchain. Each case involves at least 100 million yuan, and the total amount involved has exceeded 30 billion. RMB.

"Announcement on Preventing the Financing Risk of Token Issuance"; Source: People's Bank of China

Take the superstar as an example, the financial fraud in the name of the blockchain involved as much as 5 billion in just 6 weeks. Most of these cases involve large amounts of money, many victims, and criminal suspects fleeing overseas, and the current legal compliance of illegal blockchain fundraising has not yet been perfected, and most victims' rights protection is blocked. Considering that a large number of cases of financial fraud in the name of blockchain have not yet been exposed, there is an approximately "vacuum" state in the entire blockchain fraud MLM rights protection, which is an excellent outlet for the entire lawyering industry. In addition, the participation of lawyers can also promote victims' rights protection in the blockchain industry.

3.Tax consultation:

At present, no country has issued detailed guidance on digital asset taxation, but from the current tax standards of most countries, how to tax digital asset transactions depends on the country's definition of digital assets. For example, "secure digital assets" in the United States pay taxes in accordance with the securities law, and "non-secure digital assets" mainly calculate personal income tax; Japan initially defined Bitcoin as a consumer product, and imposed an 8% consumption tax on it. It is defined as a currency in Japan, and the consumption tax has been abolished and it has begun to be converted into a "capital gain" tax. The United Kingdom and Germany, which adopt a "sandbox mechanism" for digital asset supervision, have adopted preferential tax policies or even tax exempt policies. In general, the country's position, attitude towards the blockchain field, existing taxation mechanisms, and national conditions determine that the taxation policies of different countries will not be exactly the same.

47.3% of countries levy capital gains tax on cryptocurrency traders; 5 countries levy taxes on mining activities, accounting for 26.3%; 4 countries levy value-added tax on cryptocurrency transactions, accounting for 21%. Most countries that agree with cryptocurrencies have judged them as real estate similar to securities, and levied taxes in accordance with the relevant provisions of capital gains tax. However, the definition is complicated and usually requires the intervention of lawyers. Moreover, the project is established at home and abroad. As tax costs require precise control to make strategic decisions, lawyers can also play a key role.

Blockchain exchange + compliance

Since the birth of Bitcoin in 2008, the types and radiation range of crypto assets have been greatly improved. Up to now, according to CoinMarketCap data, there are at least more than 3,000 digital assets worldwide, and the entire crypto asset industry has spread to all global Internet coverage. Countries and regions. At the same time, the global regulatory system of the crypto asset industry is becoming increasingly clear. In order not to stifle financial innovation, although the current regulatory policies of different countries are different, a traditional license regulatory system, sandbox regulation and industry self-regulation have basically been formed Dynamic integrated supervision system.

In all links of crypto assets, due to the serious lack of identity information in most of the on-chain transaction information, but the transactions, circulation and custody of these assets occur in centralized exchanges. Focused compliance regulation is undoubtedly the most effective and reasonable regulatory approach. Obviously, as the development and influence of the crypto asset industry continues to expand, exchange compliance supervision will become the core link of the entire industry supervision. It is divided into the following three business opportunities:

1. License application:

The establishment of exchanges in different places requires different licenses and meets different specifications. For example, there are three major licenses required for US transactions. The application process is complicated and usually requires the assistance of a lawyer. There will be many problems when applying for a license for a specific exchange. First, who will be regulated and what kind of regulation? For example, in the United States, it is divided into federal legislation and state legislation. Regulators also cross the SEC, CFTC, IRS, FinCEN and other institutions. The US MSB license was first applied for by an American company, so exchanges often need to first register American companies and then To apply for a license, you can now apply with other offshore companies.

Most people will choose to apply with an archipelago company, because archipelagic company information is confidential and can avoid some things. You can also choose an archipelago to hold a U.S. company to apply for a license. Questions, so counselling by lawyers is particularly critical.

2.The exchange goes to sea:

There has been a saying in the chain that exchanges are easy to comply with and difficult to operate. Since 2018, the exchange has been inclined to set up overseas because the domestic compliance direction is still unclear. In 2018, Huobi Exchange went to Brazil and Australia. At that time, a grand press conference was held locally to announce the launch of 10 currency transactions. , And more trading pairs will be listed later. At the time, this was considered an important step in Huobi's global strategy. However, the development pace has been changed frequently because of difficult and incomprehensible compliance in the last few months. Not only has the number of employees been reduced by 60%, but the currency of the Shanghai Stock Exchange has also been poor. Different, including Seychelles, Luxembourg, Malta are popular destinations. More importantly, local regulations are changing at any time, and lawyers are urgently needed to analyze the most suitable places and strategies for going abroad.

3.Extradition and investigation:

In April 2018, the Office of The Attorney General NYAG of the New York State Attorney General's Office issued the "Virtual Markets Integrity Initiative" which raised 34 concerns in the supervision of entities engaged in digital currency transactions, and accordingly based on 13 The exchange conducted an investigation. Exchanges at home and abroad are easily targeted by the SEC and various regulations. How to correctly answer these questions is related to the survival of the exchange. Examples include ownership, basic operations, organizational structure, internal control, transaction privacy, and Prevention of money laundering, etc., will become the key reason for compliance, so blockchain lawyers can also provide good assistance in this area.

V. Potential opportunities for blockchain policies and law firms

1.Cryptography:

The cryptography law will be implemented from January 1, 2020, and its status is like the constitution of the blockchain and cyberspace, but most people are not yet familiar with it. Although the original purpose of national legislation is not to promote and regulate blockchain technology Development, but based on the importance of passwords to the security of national, social, and personal information, and a unified

Cryptography, source: National People's Congress

Basic law. However, since cryptography is the core technology of blockchain technology, the introduction of the "Cryptography Law" will inevitably have a profound impact on the normative development of the blockchain industry. There are two angles that specific law firms can cut into the track:

A. Commercial password compliance

In many application scenarios of blockchain technology (such as finance, Internet of Things, intelligent manufacturing, supply chain management, traceability of product anti-counterfeiting, etc.), because password technology protects mostly personal information or business secrets of enterprises, not state secrets Therefore, in most cases, the commercial blockchain is mainly involved in the blockchain industry. Under the previous system, commercial password products had to pass the testing by a password testing agency before they could be put on the market. However, the password law was changed to voluntary testing. However, for blockchain companies, if the commercial password products they produce and sell fall To enter the product catalog of the Cyber Security Law, an enterprise needs to select a certification testing agency from the agencies listed in the catalog of agencies undertaking certification testing tasks, and it can be put on the market after the products pass the testing requirements. After the “National Criteria for Network Critical Equipment and Network Security Specialized Products” is formulated, blockchain companies producing commercial password products must also comply with these national standards. Under the regulatory environment where multiple laws apply one thing, the interpretation of regulations has become very important. From then on, law firms can cut into professional password compliance consulting. After the blockchain penetrates into all fields in the future, the password law will become a frequent reference. Dafa.

B. Password patent and privacy protection

While encouraging the development of the commercial password industry, the "Password Law" stipulates that no organization or individual may steal the information protected by others 'encryption, illegally invade others' password protection systems, and may not use passwords to engage in endangering national security, social public interests, or the legitimate rights and interests of others. And other criminal activities. However, the cryptography law has not yet been implemented, and Chinese people have a poor understanding of intellectual property, let alone the concept of cryptographic patents. What's more, the long-term habit of open source blockchain has made it easy for project parties to violate the code at the same time. Law, so blockchain lawyers will be able to act as gatekeepers, avoiding compliance risks for project parties.

2.Blockchain justice:

Industry pain points

A. It is difficult to guarantee the confidentiality of important documents

The law firm and court business involves a large number of document review and management. Most of the business is currently stored in personal notebooks or a small part of the cloud. Lack of management system and security makes it more difficult for everyone to synchronize. The flow, the loss of files will be a heavy blow to the law. For the court, the preservation of evidence requires a variety of processes, often resulting in loss of evidence due to timeliness, and the fairness of the case will be greatly reduced.

B. Document procedures are cumbersome and inefficient

Law firms, courts, and parties involved in the communication of documents are cumbersome. Almost all stamps and signatures are required to produce the original documents. The transmission of documents often requires a certain period of mailing. If multinational business is involved, it will take more days. The forgery of the original document is also endless, and the security remains to be discussed.

C. Inefficient file management and search

Lawyers often need to deal with multiple cases at the same time, not only need to establish a process management table, but also often need to classify and file to a computer, which is very inefficient.

Solution

In simple terms, the biggest problem that blockchain technology can solve is trust. Using encryption technology, by encrypting files, you can achieve fast file transfer on the chain while ensuring the security and privacy of the files. By participating in the blockchain alliance, all participants involved in the same business can achieve data sharing, which will greatly help evidence preservation, information transparency, and intelligent file management, which can greatly improve the efficiency of law firms. No longer bothered by chores.

Application and case

A. Hangzhou and Shaoxing's first block chain deposit certification judgment has been successful in early November. Block chain deposit certification has greatly helped evidence preservation and non-changeable modification. In addition to the deposit certification, the Hangzhou People's Court also attempted bankruptcy. The case uses block chain voting to significantly reduce operating costs. The Guangzhou Arbitration Commission also used the arbitration chain to issue the industry's first blockchain award. It can be seen that the nationwide blockchain trial may also begin large-scale operation after the cryptographic law is listed early next year.

B. In May 2018, Chancheng District, Foshan, Guangzhou, released the nation's first "blockchain + community correction" application project-"Social Correction Chain", and applied the blockchain to community correction practices. As a non-custodial punitive measure, community corrections must have some seriousness. The traditional social correction supervision mode is mainly carried out through regular reports, field surveys, electronic monitoring, etc., with high cost and low efficiency. After the blockchain is involved, the information of social correction personnel can be stored on the chain through hardware such as electronic positioning bracelets, which is convenient for staff management, and there is no need to worry about tampering with social correction information. In addition, community corrections also involve public security, prosecution, law, local subdistrict offices, and flow management offices. Banks, insurance, telecommunications, public railways and other systems often need to read social correction system information. The social correction information is uploaded to the chain, which improves the linkage ability of various departments, and social correction staff can also simplify the document handling procedures.

Source: Chancheng Political Consultative Conference

Impact of Blockchain Technology on Law Firms: Digital Incentive Management

Blockchain has changed the company system to become the latest trend. For example, the law firm promotes the digital incentives of law firms. How to balance the maximization of company efficiency and compliance with the issuance of tokens and corporate compliance requires the professional participation of lawyers. The company system has evolved for more than 400 years. Among them, in the law firm management scene, royalty lawyers are attached to the law firm, and often have low stickiness with the law firm, while salary lawyers and administrative staff are not good. Distribution mechanism to guarantee equity.

Imagine that if you can quantify the value through a certain type of digital identification, including personal workload, contract information, the corresponding value of equity, and even performance pay, just like the share of shares in the current trading market, this kind of rights can completely circulate with each other. There is also no need to go through any agency, so the cost of trust will be minimized.

Specific digital incentive management is not just for the law. It can be applied to various industries in the future. Not only can it eliminate the tedious paperwork, the workload and performance can be seen at a glance. Compared with the previous time of financial application and financial accounting, the speed is very fast. Quickly, employees can immediately receive performance bonuses and start working. At the same time, the company's payroll data was fully recorded. Employees can clearly know their salary composition, income generation in the company and their contribution to the company. Companies can also use these records to clarify the composition of the company's revenue generation, so as to understand the extent of each lawyer's contribution to the law firm, and select talents from it. The root of all these trusts is based on the irreversible and irreversible nature of the blockchain.

The era of future benefits has passed. Now, after 90 and 00, they are more and more motivated by the Internet, high-quality consumption and games. Real-time incentives have become a trend. Talking to employees about five or ten years later will not bring much. Good incentive effects, such as traditional equity incentives, look at the company's future development. On the contrary, under digital incentives, you can get one token for completing one thing. This real-time motivational feedback can make employees full of vitality and continuous stimulation, which will greatly help the overall company's progress. Blockchain minimizes the cost of trust, and distrust in the workplace will gradually die out with the widespread application of blockchain. In the future, blockchain will be inseparable in the management of law firms and other companies.

Conclusion

The Internet revolution has just entered its 40th year, and the blockchain revolution has also entered its 11th year. The theory of technological singularities brought by the Internet has gradually become invalid, and the paradigm brought by the blockchain will change in the future. According to the legal circles, law is a system of behavior norms that regulates certain social relations; it can also be said that the object of adjustment of law is human behavior. Blockchain as an information technology is, of course, the result of human intelligence and the result of human behavior. Therefore, the law on blockchain refers to a set of behavior rules system that regulates the creation and use of blockchain technology by human beings. Therefore, entering the blockchain is like using the Internet, and the initial bonus is great, especially in the field of multi-professional integration. Whether it is blockchain + law, blockchain + AI, or blockchain + any industry, how to integrate the blockchain with the original industry has become the most concerned issue for everyone. This year, whether you look at the world or China, the block Both the blockchain and digital currency fields have entered a period of rapid development. While the technological foundation and business model are continuously innovating, legal policies and regulatory trends are becoming increasingly clear. I also look forward to seeing the day when blockchain will penetrate our lives.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Professor of Tongji University: How Blockchain Keeps Being Innovative

- Perspectives | Digital currency opens a new global financial track

- Why is it important to mine a Filecoin header?

- God of V: Breaking the conventional thinking of the relationship between layer1 and layer2 of the blockchain

- Opinion: why oracles with economic guarantees are necessary components to create large-scale DeFi products

- 0.1% – 0.9% – 99% of blockchain rules

- Featured Twitter | A detailed article on 2019: What progress have been made by Bitcoin and Ethereum?