Air currency warning: the market may be entering the sixth cottage season, beware of air players

Production | coinvoice

Text | Simba

Editor's Note: The original title was "Air Currency Early Warning". This article has been deleted without changing the author's original intention.

- Depth | Solve core pain points, blockchain opens up new space for supply chain finance

- Popular Science | Eth2 Beacon Chain: What You Should Know First (on)

- What Bitcoin will look like in 10 years, Satoshi Nakamoto says | Bitcoin Secret History

There are five cottage seasons in history, and the market may be entering its sixth cottage season.

In recent times, the price of Bitcoin has been fluctuating between a high above $ 10,000 and a support level of $ 9,500. However, this support level eventually failed, replaced by a more substantial decline (Bitcoin fell to $ 8823.68 as of press time), and ended the rebound trend in early 2020.

But this may be a good time for altcoins. History has proven that whenever Bitcoin's dominance declines, altcoins soar.

Cottage market

During Bitcoin's sideways shock, Ethereum told the currency circle with a wave of nearly 10% of the market, except for Bitcoin, which is still the boss.

During the sideways of Bitcoin, some altcoins have performed well. In particular, it has the rigid demand of the market itself-investors are eagerly waiting, especially those who have set foot in the crypto digital currency market in 2017-18.

Most altcoins easily complete 10 to 50 times their initial investment. FOMO sentiment is real, and after most ICOs have caused a chain reaction of capital inflows from around the world. This is what caused the altcoin to skyrocket and cost many naive investors millions of dollars.

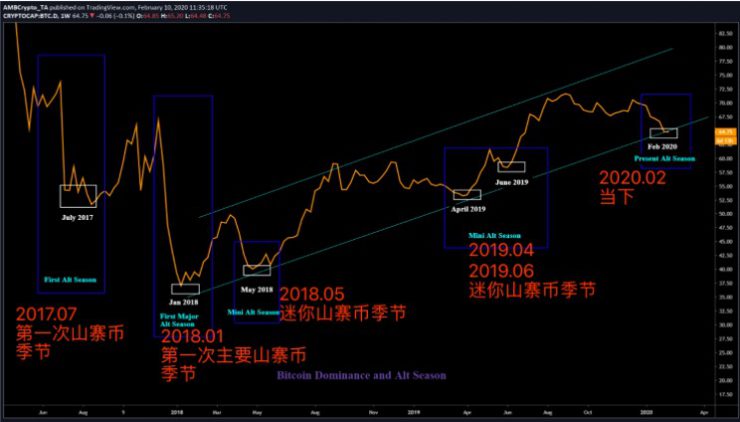

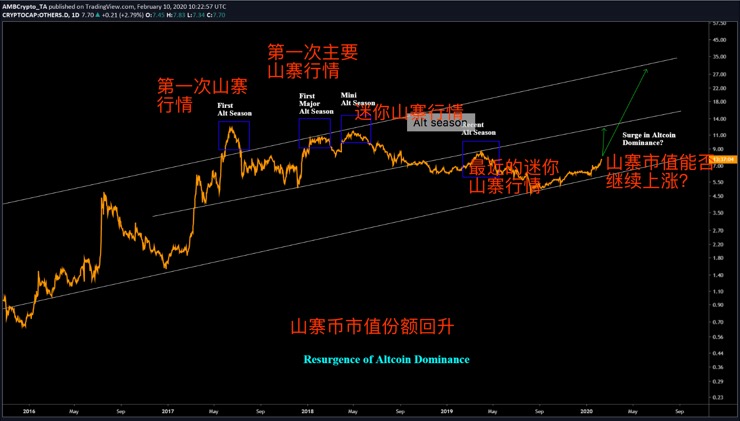

According to the soaring of altcoins and the dominance of bitcoin, there are a total of 5 cottage seasons in history, and the market may be entering its sixth cottage season.

Data source: BTC.D TradingView

Driven by the ICO boom, a large inflow of funds in mid-2017, altcoins peaked from mid-December 2017 to January 2018, creating the largest altcoin season in history. This has been the case for every altcoin season since, but on a smaller scale.

Air Player

During the Spring Festival, the 40-year-old Northeast Liu's main job was to recruit more members to join his community. He entered the blockchain industry under the leadership of another elder brother, and firmly believed that this was the biggest opportunity to change his destiny.

He didn't understand at first. The lead brother prepared a lot of popular science videos, and took him to a training class. The most profound news in the course is Lao Liu: the news said that the blockchain has risen to the height of national strategy, banks and governments Institutions are learning blockchain; blockchain is the hope and direction for the next ten to twenty years; today, if you do n’t do blockchain, you are like buying stocks 20 years ago and 10 years ago …

The old Liu who has worked for decades has moved his heart—the news will not be deceiving, and it is broadcast on TV. Although he still does not know what the blockchain can do.

This is not a new story. In the evening of July 2 last year, Cai Token, a loyal follower of Plus Token, emptied his circle of friends. In the past six months, he has invested more than 300,000 yuan and a book income of over 100,000 yuan. Cai Wenzhong has "amway" almost all the siblings, relatives and friends, asking everyone to join this "leading era" cause. Later, he and his relatives suffered heavy losses, and their income and principal were not taken out.

Northeast Liu and loyal follower Cai Wenzhong participated in an air project that had been planning to run from the beginning.

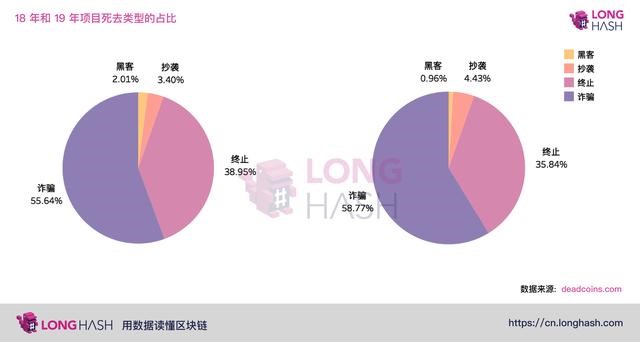

A total of more than 2,000 virtual cryptocurrency projects included by DeadCoins.com since September 2017. Since the middle of 2018, the market value of most virtual cryptocurrencies has returned to zero, and 518 projects have died in 2019. Among them, the projects that cut leek and ran roads accounted for more than 50%, and the projects that were ultimately unsuccessful accounted for more than 30%.

During this period, the most famous is that Bell Chain achieved a 158-fold surge through the multi-level promotion mode of the pattern; VDS achieved a 100-fold surge by virtue of the resonance mode and CX mode …

Application area

In Q4 of 2019, the industry talked about "the application of blockchain", finance, medical, public welfare, government affairs, energy, trade, supply chain, education, blockchain + in-depth industries, began to discuss "help …" Can … "," Promote … ".

In the process, the voice of "the development of blockchain industrialization in 2020" will continue.

As if the blockchain industry has reached a general consensus: on the premise that the technology is gradually maturing and the application is gradually promoted, blockchain technology will eventually help the society to build a solution to data and system security issues (encrypted attributes), and ensure social data and identity Authenticity (traceable and immutable), and a super chain that optimizes social business processes (smart contracts).

Under this consensus, the blockchain will become a social infrastructure like transportation, energy, and the Internet, connecting everything in the "chain."

This has been repeatedly transmitted, and it has become the "willingness" for the actual landing and great development of industries with extreme demand. The back of this "willingness" is to hope that the next vent will come.

In response to the risk of being harvested again and again by air players, the Blockchain Research Group of the Digital Currency Research Institute of the People's Bank of China wrote an early warning in the fourth issue of China Finance in 2020.

They objectively analyzed the main advantages of block technology: credibility of business data, equalization of participants, and multi-dimensional supervision.

They also rationally analyzed its shortcomings mainly due to the limited performance and scalability of the blockchain, the lack of systematic security protection of the blockchain, the full backup storage mechanism easily encountering storage bottlenecks, and the interactivity of different blockchain systems The problem is difficult to solve, the problem of business continuity cannot be underestimated, the blockchain cannot guarantee the finality of settlement, the decentralized nature of the blockchain conflicts with the centralized management requirements of the central bank …

According to the analysis of the Blockchain Research Group of the Digital Currency Research Institute of the People's Bank of China, a correct understanding of the applicable scenarios of blockchain technology requires that not all projects require the blockchain, and not all data need to be uploaded. However, in areas where the requirements for trusted information sharing are high and the requirements for concurrency are low, such as transaction settlement, trade finance, property rights transfer, etc., blockchain has been widely used …

They also warned that financial chaos, such as speculation, token financing, and fraudulent investment, are making a comeback, and asset bubbles and financial risks caused by crypto assets need to be warned.

Investment Strategy

The blockchain industry is still young, but road packages are very mature. Everyone is not strange about running, but the success of defending rights is very rare.

There may be cases where ICO investors have been compensated across the ocean.

The SEC has announced that it has accused blockchain technology startup Enigma MPC of issuing unregistered securities in the form of an initial coin offering (ICO). Enigma has agreed to return funds to the damaged investor through a claims process, register its tokens as securities, file periodic reports with the SEC, and pay a $ 500,000 fine.

"All investors have the right to obtain certain information about the issue of securities from the issuer, whether it involves traditional assets or novel assets," said John Dugan, executive deputy director of the Securities and Exchange Commission's Boston area office. "The remedies in today's order provide ICO investors the opportunity to receive compensation and provide investors with the information they are entitled to when making investment decisions."

It is undeniable that the blockchain and cryptocurrency industries are developing rapidly, and it is expected that in the next five to ten years, it will become a key part of global public infrastructure and even lead a new generation of Web-based Internet services. This is accompanied by the confusion and risks in the early stages of the industry, but the huge opportunities it contains can not be ignored, including professional venture capital planning.

Venture Capital Ventures can focus on two types of crypto investments, one is a crypto network, and the other is a crypto ecosystem / crypt infrastructure.

Crypto networks can be divided into token investment, equity investment and SAFT investment. And future claims on tokens, SAFT is a simple protocol for future tokens that users can exchange for tokens when the blockchain network goes online.

Crypto ecosystem / crypto infrastructure looks similar to traditional venture capital. Ecosystem investments include direct investments in native cryptocurrencies.

It is worth mentioning that the best performing ecosystem infrastructures in the cryptocurrency industry are mainly exchanges and blockchain analysis companies such as Coinbase, Kraken, Chainalysis, etc.

The application mode of blockchain technology is mainly reflected in establishing the information foundation and trust foundation of the value Internet; providing a point-to-point transparent and reliable value transmission protocol for the value Internet; and building an intelligent service model on the upper layer of the Internet …

Taking the charity donation management traceability platform led by China Xiong'an Group Digital City Company and FunChain Technology Company as an example, in the fight against the epidemic, the blockchain technology features are used to improve the transparency and credibility of donation information, and optimize the release of donation needs to The whole process of receiving donations, tracing and managing the donated materials and use of donated funds from various social institutions, providing all sectors of the society with a publicly traceable, traceable, and feedbackable monitoring approach to help prevent and control the epidemic.

Under the influence of this epidemic, the reorganization of the traditional organizational management process by the blockchain will operate and develop strongly in the complex and unsuitable. We need not only more efficient, but also new collaborative relationships.

It needs to be emphasized that the solution based on blockchain technology is not completed by a single blockchain technology, but is a technology integration and upgrade based on "on-chain", including artificial intelligence, big data, cloud computing, the Internet of Things and other new generations. information Technology.

Encrypted digital currency market and the evolution of the blockchain ecosystem are unstoppable, but air players are still rampant.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Vicious competition causes frequent DDos attacks on exchanges. What is the cost of the attack?

- Organizational form from the future: DAO

- Can Bitcoin, which has an edge over gold, be a true safe haven?

- The future of Ethereum determines the future of the blockchain?

- What exactly is Bitcoin, money, currency or value storage?

- From the perspective of investment, should we focus on business or technology? Babbitt Industry Welcome Class

- Chain Security founder Yang Xia talks about asset security issues that ordinary users should pay more attention to behind the whale attack | Chain Node AMA