🚀 Bitcoin Price Prediction and Key Financial Events: Analysis and Insights 💰

Despite Fed's Consistent Rates and PBoC's Changing Policies, Bitcoin Price Remains at $42,000, Influenced by Global Financial Trends and El Salvador's Ongoing Backing.Bitcoin Price Prediction BTC to reach $42,000 as PBOC makes moves; Fed maintains steady rate at 5.50%.

By Arslan Butt | Last updated: February 1, 2024 | 4 min read

On Thursday, Bitcoin price prediction remains a hot topic, especially as BTC hovers around the $42,000 mark, despite a recent 2% dip. This market activity unfolds against a backdrop of significant global financial events, including the Federal Reserve’s decision to maintain interest rates at 5.25%-5.50%, reflecting a cautious approach towards inflation management.

Additionally, the People’s Bank of China’s latest policy moves offer potential catalysts for Bitcoin’s price trajectory, signaling possible shifts in the cryptocurrency landscape. El Salvador’s commitment to Bitcoin, alongside Robert Kiyosaki’s endorsement of BTC as a defense against fiscal and banking system vulnerabilities, underscores the growing relevance of digital currencies.

Moreover, Bitcoin’s recent price surge prompts a closer examination of the environmental implications tied to cryptocurrency mining, blending economic trends with sustainability considerations.

- US Government Cracks Down on Crypto Mining Energy Consumption 🚀💡

- Core Scientific Emerges as North America’s Leading Bitcoin Producer 🚀

- DZ Bank to Launch Cryptocurrency Trading Pilot

1. 🏦 Federal Reserve Keeps Rates Steady at 5.50%; Signals Rate Hike Pause

The Federal Reserve’s recent decision to maintain interest rates at 5.25%-5.50%, while indicating a pause on further hikes, has introduced cautious optimism in financial markets.

This stance, reflecting the Fed’s intent to closely monitor inflation towards a 2% target without immediate plans for cuts, suggests a vigilant yet static monetary approach. Fed Chair Jerome Powell emphasized the need for more data to consider reducing rates, marking a March cut as unlikely.

This development, amidst fluctuating market responses, leaves Bitcoin’s future impact speculative, as investors digest the Fed’s cautious yet unchanged policy direction.

2. 🇸🇻 El Salvador’s Continued Bitcoin Endorsement Post-Vice Presidential Election

Felix Ulloa, the vice president of El Salvador, rejected requests from the International Monetary Fund (IMF) to rethink Bitcoin’s legal tender status during President Nayib Bukele’s second term in office.

Ulloa underlined the government’s support for cryptocurrencies, noting as evidence the recent approval of Bitcoin-related exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission.

🔥 El Salvador, which became the first nation to accept Bitcoin as legal cash in September 2021a>, intends to move forward with plans to establish Bitcoin-backed bonds and create Bitcoin City. El Salvador maintains its pro-Bitcoin position despite the IMF’s ongoing reservations, which may have an impact on public opinion of the cryptocurrency.

3. 💪 Robert Kiyosaki Advocates for Bitcoin as a Safeguard Against Fiscal Misconduct

Robert Kiyosaki, the well-known author of “Rich Dad Poor Dad,” revealed that he keeps Bitcoin as insurance against the “theft of our wealth via our money.” Kiyosaki accused Wall Street bankers, the government, and the Federal Reserve of stealing money through stock market manipulation, taxation, and inflation.

He expressed mistrust for fiat money and stressed the need to invest in and save Bitcoin as a safety measure. As a frequent critic of the US economy and the USD, Kiyosaki views gold and silver as “God’s money” and Bitcoin as “people’s money.”

💰 He acknowledges that he doesn’t know a lot about Bitcoin, but he still thinks it’s valuable, and in a previous comment, he said it would reach $150,000. His support might lead to a rise in the use of Bitcoin among his fans and the general public.

4. 🌍 US Crypto Mining’s Energy Consumption Under Scrutiny Amid Bitcoin’s Surge

The energy usage of cryptocurrency miners is being subject to an emergency examination by the U.S. Department of Energy (DOE), which mandates that they report on their usage for the following six months.

The poll is to comprehend and address the possible increase in cryptocurrency mining activities and its impact on electricity usage, which has been prompted by a recent spike in the price of Bitcoin.

The Energy Information Administration (EIA) of the DOE will gather information and feedback from the general public while concentrating on the energy demand development for bitcoin mining, pinpointing regions with rapid expansion, and estimating the sources of electricity.

⚡ This action is a component of the U.S. government’s continuous efforts to control and comprehend the cryptocurrency mining sector, tackling issues related to energy usage and environmental effects. The effect on Bitcoin pricing is contingent upon prospective regulatory measures arising from the review.

💭 Bitcoin Price Prediction

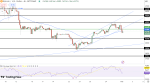

Bitcoin is currently trading at $42,064, showing a dynamic interplay between buyers and sellers. The cryptocurrency maintains its stature within the market, with a pivot point set at $42,643. Looking ahead, Bitcoin faces immediate resistance levels at $43,922, $45,229, and $46,446. Conversely, support levels are established at $40,790, $39,006, and $37,514, delineating critical junctures for potential price stabilization or decline.

The Relative Strength Index (RSI) stands at 45, indicating a neutral momentum that leans neither towards overbought nor oversold territories. However, the Moving Average Convergence Divergence (MACD) presents a value of -197.00 below its signal of 154, suggesting a bearish outlook as it indicates downward momentum.

The 50-day Exponential Moving Average (EMA) is positioned at $42,186, closely aligning with the current price level. Despite a recent breakout above the upward trendline at approximately $42,185, the formation of a bearish engulfing pattern on the 4-hour timeframe signals a potential shift towards a downtrend for BTC.

In conclusion, the overall trend for Bitcoin appears bearish below the $42,185 mark.

👀 Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Blocking.net, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

💡 Q&A: What Readers Might Be Interested In

Q: How can the Federal Reserve’s decision on interest rates affect Bitcoin’s price?

A: The Federal Reserve’s interest rate decisions can indirectly impact Bitcoin’s price. If the Fed raises interest rates, it may lead to a decrease in investor demand for Bitcoin as it becomes less attractive compared to traditional investment options. On the other hand, if the Fed keeps interest rates low or adopts an accommodative monetary policy, it may fuel inflation concerns, driving investors towards alternative stores of value like Bitcoin.

Q: What are the potential environmental implications of cryptocurrency mining?

A: Cryptocurrency mining, particularly Bitcoin mining, requires significant energy consumption. As Bitcoin’s price surges, more miners join the network, increasing the energy demands. This can have environmental consequences, especially if the electricity used for mining comes from non-renewable sources. The focus is now on finding sustainable solutions, such as mining using renewable energy sources, to mitigate the environmental impact of cryptocurrency mining.

Q: What other cryptocurrencies should I keep an eye on besides Bitcoin?

A: While Bitcoin remains the dominant cryptocurrency, there are several other promising digital assets worth monitoring. Some popular alternatives include Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and Cardano (ADA). Each has its own unique features and potential for growth, making them viable investment options for those interested in the cryptocurrency market.

✨ As the landscape of digital assets continues to evolve, it’s essential to stay informed and make educated investment decisions. Share this article with your friends and followers to spread the knowledge!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- El Salvador’s President Bukele Confirms Bitcoin Plans Despite IMF Pressure

- Bitcoin Stumbles as Federal Reserve Leaves Interest Rates Unchanged: What Does This Mean for BTC?

- Bitcoin must address scaling concerns as ETFs gain momentum

- The European Union Considers Banning Proof-of-Work Networks: What You Need to Know

- 🌐 Goodbye Global X: Spot Bitcoin ETF Application Withdrawn

- Revealing Tether’s $2.8 Billion Bitcoin Holding: A Solid Foundation for Stablecoin Stability

- Bitcoin, Stablecoins, and CBDCs: A Future of Coexistence in Lugano