Articles about DAI - Section 2

9 projects with huge long-term development potential

Original Title Accumulation thesis 9 projects with immense long-term growth potential. Original Author Stacy Muur Ori...

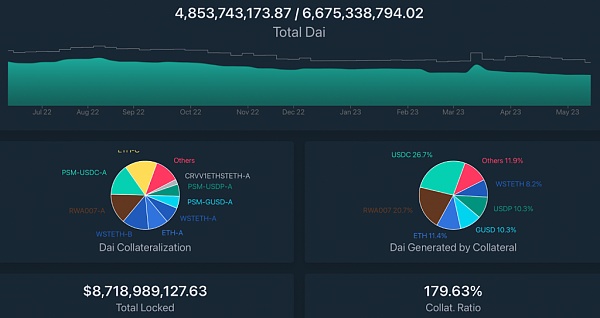

MakerDAO community initiates a vote to reduce the GUSD reserves of DAI from 500 million US dollars to 110 million US dollars.

MakerDAO community initiates proposal voting to reduce the amount of GUSD held in Maker's DAI stablecoin reserve from...

Comparison of Four New Decentralized Stablecoin Algorithms: Dai, GHO, crvUSD, and sUSD

This article will detail the characteristics and latest developments of the four most promising decentralized tokens...

Explanation of this week’s unlocked tokens: DYDX, TORN, and 7 other projects are set to unlock

The circulating market value of HOP token is 5.4 million US dollars, with 1.4 million US dollars unlocking this wee...

How much does it cost the well-known DeFi protocol MakerDAO per year to maintain the normal operation of its network?

MakerDAO is a decentralized currency market on Ethereum where users can borrow and lend assets including ETH. Accordi...

MakerDAO Core Development Team proposed to increase the DAI savings rate from 1% to 3.33%

MakerDAO's core development team has proposed to increase the Dai Savings Rate (DSR) to 3.33%. The proposal was made ...

Inspiration of stablecoins: analysis of the "Black Thursday" crisis and construction of a new borrowing and buffering model

Editor's Note: The original title was "Inspiration for Stable Coins-Building a New Debt Buffer Model"....

Introduction to Blockchain | How Does DeFi Liquidator Work?

Author: king Editor's Note: The original title was "DeFi Classroom | How Does DeFi Liquidator Work?" &...

MakerDAO's first debt auction ends, Paradigm becomes biggest winner

In a series of MKR auctions, cryptocurrency investment company Paradigm was the biggest winner. The auction was held ...

Crypto data analysis company Coin Metrics report shows that daily transactions in stablecoins reach $ 444 million

Source: CointelegraphChina Editor's Note: The original title was "Coin Metrics Report Shows Daily Trading V...

- You may be interested

- Bitcoin market share accounts for up to...

- Japan is leading the creation of an int...

- Babbitt column | Who are we going to ea...

- Cryptocurrency Update: Bitcoin ETF, Eth...

- The market oscillated and washed the ca...

- Dry Goods | Basic Principles of Chainli...

- A picture to understand the gap between...

- Talking about Polygon’s accusatio...

- The Dilemma of Funding Legal Defense fo...

- How long does it take to crack your pri...

- I understand the most common cryptograp...

- Cardano (ADA) Price Threatens Bearish B...

- dYdX unlocks over 33 million tokens Is ...

- Global government blockchain wrestling:...

- $14,000 sold BTC Novogratz regretted &q...

Find your business way

Globalization of Business, We can all achieve our own Success.