Articles about MakerDAO

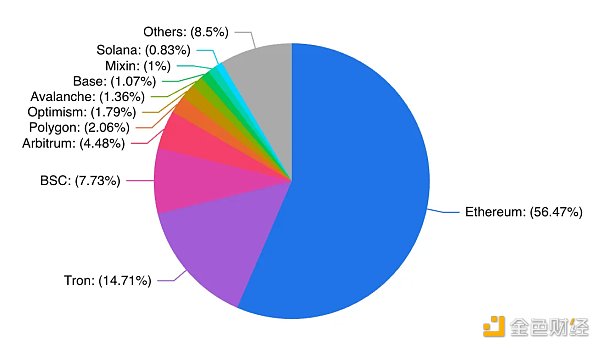

Stablecoins The Holy Grail of Offshore Funds, Leverage, and Liquidity

The main purpose of this article is to explain some of the tricks and techniques of stablecoin protocols, including s...

Riding on MakerDAO’s back, Centrifuge has emerged as a leading provider of on-chain credit. Learn all about the underlying service provider for Real-World Assets (RWA) in this article.

With the goal of becoming the infrastructure of RWA, how does Centrifuge facilitate real asset collateralized lending...

From Basics to Advanced, Comprehensive Discussion on the Liquidation Mechanism in DeFi

The best liquidation mechanism is one that minimizes the risk of bad debt for users at the lowest possible cost. Howe...

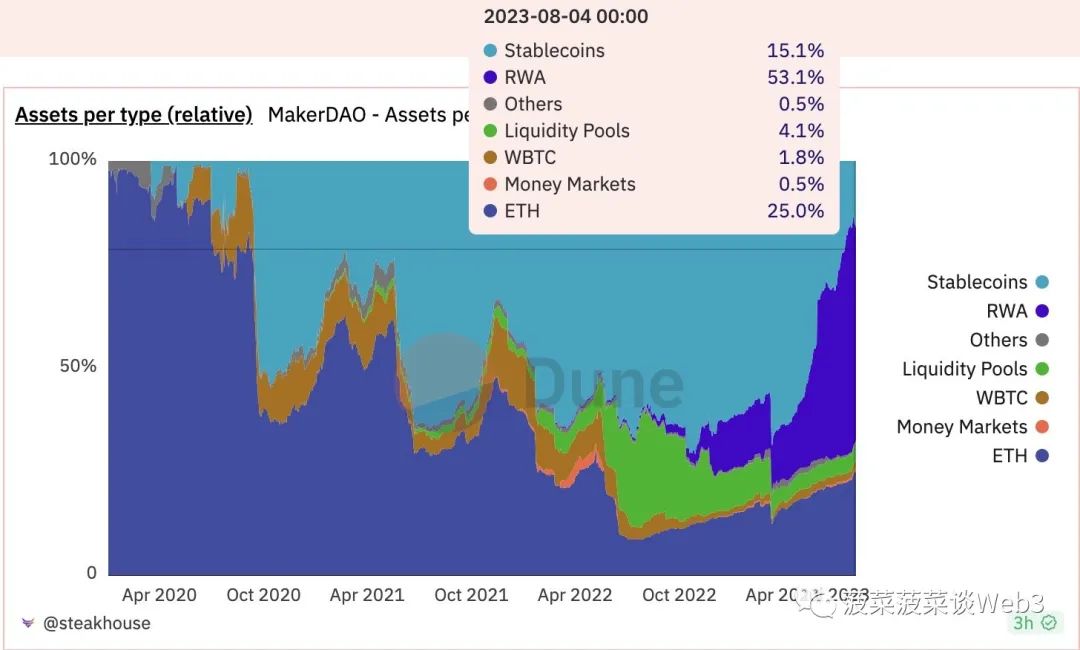

Current Status and Potential Variables of MakerDAO, the ‘DeFi Veteran

This article is the latest research report on MKR in October 2023.

The Stablecoin Landscape after MakerDAO’s EDSR Transformation, Response, and Opportunities

With MakerDAO allocating a 5% annual return to DAI holders, many stablecoins have suffered as a result. LianGuaiNews ...

Does the future of MakerDAO belong to Cosmos rather than Solana?

Cosmos has advantages in building AppChains that other ecosystems cannot match.

Starting with three escape methods Why doesn’t MakerDAO build Layer2 scaling solutions based on Ethereum?

MakerDAO's proposal to launch a NewChain in its Endgame has sparked heated discussions in the industry. Many people a...

LD Macro Weekly Report China’s Expectations Hit Bottom, Who are the Long-Term Beneficiaries of AI

Risk assets in the market have stabilized over the past week, but the level of uncertainty has increased. Contradicto...

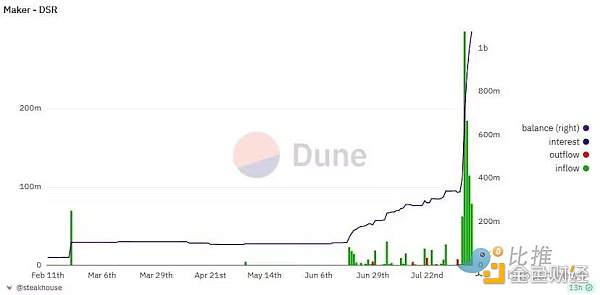

In less than a week, MakerDAO has attracted a deposit of 700 million US dollars. Is the 8% interest rate really that enticing?

Delphi Digital believes that the enhanced version of DAI DSR offers an attractive on-chain alternative compared to US...

Is DAI’s 8% excess risk-free rate a Ponzi scheme?

MakerDAO officially adjusts the deposit interest rate of DAI in its lending protocol SLianGuairk Protocol to 8%. This...

- You may be interested

- "Bitcoin Secret History": Bit...

- VanEck Unleashes the Beast Spot Bitcoin...

- Bitcoin’s Bearish Sentiments Open the D...

- Viewpoint | Reward points are meaningle...

- New “anti-epidemic” tacti...

- PancakeSwap Introduces veCAKE for Enhan...

- South Korean Province Cracks Down on Ta...

- Ethereum Under Pressure: Is the Buoy Si...

- Joe Biden’s Cryptic Post: A Closer Look...

- In 2019, will the speculators still hav...

- Getting started with blockchain | Read ...

- The first Chinese-American presidential...

- 80% of ETH addresses are at a loss, but...

- Haidian District promotes “one n...

- Behind the Balancer attack incident In ...

Find your business way

Globalization of Business, We can all achieve our own Success.