These data analysis results are quite interesting about stable coins.

Lasse Clausen, founder of the European blockchain investment fund 1kx, recently walked to China for participating in the Shanghai blockchain week. He sent a tweet in China, saying that "DeFi is really one thing in China, and DAI will have a 4% premium on the OTC market." Is DAI's premium for over-the-counter trading in China reaching 4%? This is really amazing. This push has caused a lot of discussion.

DeFi is indeed hotly debated in China, but it is not at all like Lasse Clausen's observations and his conclusions. According to the chain, the background was that Lasse Clausen had a meal with Wang Bowen, the co-founder of DDEX in China and the decentralized exchange. I learned that DAI usually has 1% to 4 in China's OTC market. % premium. So, there is this tweet.

Indeed, stable currency, even the entire DeFi ecosystem, has been a hot discussion, but lacks credible, transparent data and analysis.

- Facebook did not start Libra, but launched a currency war

- Explore: Bitcoin and Nash's ideal currency

- The successful landing of the digital renminbi needs to solve three difficulties

Another typical example is the recent surprising question from Rune Christensen, founder of MakerDAO, a cryptocurrency lending platform, in an online Q&A with the Chinese community:

- At present, China is the largest source of MakerDAO collateralized debt warehouse (CDP) smart contract users, compared with the United States only ranked second;

- MakerDAO earns $13 million a year for only $200,000, so it's completely self-sufficient."

This information is "fun" enough, completely unexpected, but how to confirm it is a problem.

Fortunately, research institutions have been trying to find out more facts worthy of deep thought through the analysis of data on the chain. For example, Jesus Rodriguez , chief technology officer of IntoTheBlock , a data analysis company on the chain, recently wrote an article that shares some interesting data on the stability of the currency chain. It is worth pondering:

Written by: Jesus Rodriguez, Managing Partner and Chief Scientist, Invector Labs, Chief Technology Officer, Angel Investor, IntoTheBlock.

In the cryptocurrency ecosystem, stable currency is a unique existence and is now receiving more and more attention.

At a higher level, stable currencies can be divided into three broad categories:

- Stabilized currency supported by fiat currency : This type of stable currency is usually linked to fiat money or other assets in the real world. The most typical examples are stable currency projects supported by legal tenders like Tether and TrueUSD , and Digix Global These are stable coins supported by commodities;

- Stable currency for cryptocurrency mortgages : This type of stable currency is supported by a pool of cryptocurrency assets. Typically, such stable currencies require excess collateral cryptocurrency to cope with market volatility, a typical example of which is Maker ;

- Unsecured Stabilized Coins : This type of Stabilized Coin is not supported by any real-world or cryptocurrency assets and relies entirely on algorithms to maintain its value. One of the most common unsecured stable currency methods is “ seigniorage shares” , which use smart contracts to automatically adjust the supply of non-collateralized stable currencies to achieve “inflation” and “deflation” in the market, thereby maintaining stable currencies. A typical example of this is Carbon .

In the current cryptocurrency market, the dominant currency is a stable currency based on fiat currency, and projects like Maker have gained greater market competitiveness in the cryptocurrency stabilization currency category. At this stage, unsecured stable coins are still in the experimental stage. Although some unsecured stable currency projects are very popular, we still know very little about their potential performance.

So let's focus on the statutory currency-backed stable currency and the cryptocurrency mortgage-stabilized currency to see what analysis results will surprise you.

There are five surprising results about the support of stable currency in French currency .

1) Investors will lose money when they purchase stable currency

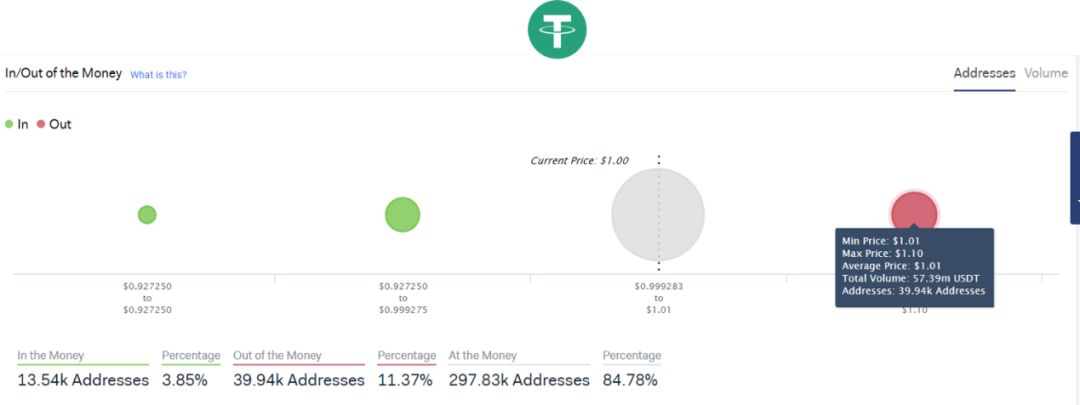

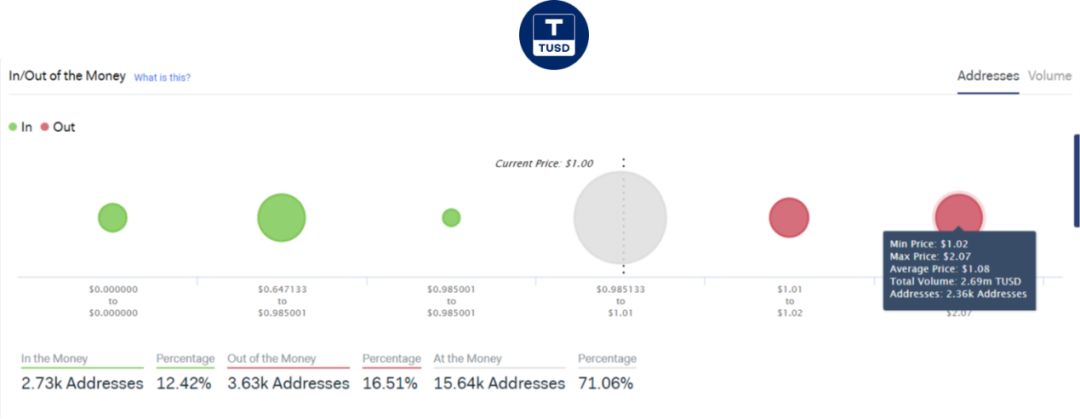

According to IntoTheBlock's In-Out Money analysis, some investors tend to buy legal currency-backed stable currencies at prices well above the base price, as seen in the analysis of Tether and TrueUSD in the chart below:

(Where, Tether's purchase price is $1.01 and the highest price is $1.10; TrueUSD's purchase price is $1.02, and the highest price even reaches $2.07. )

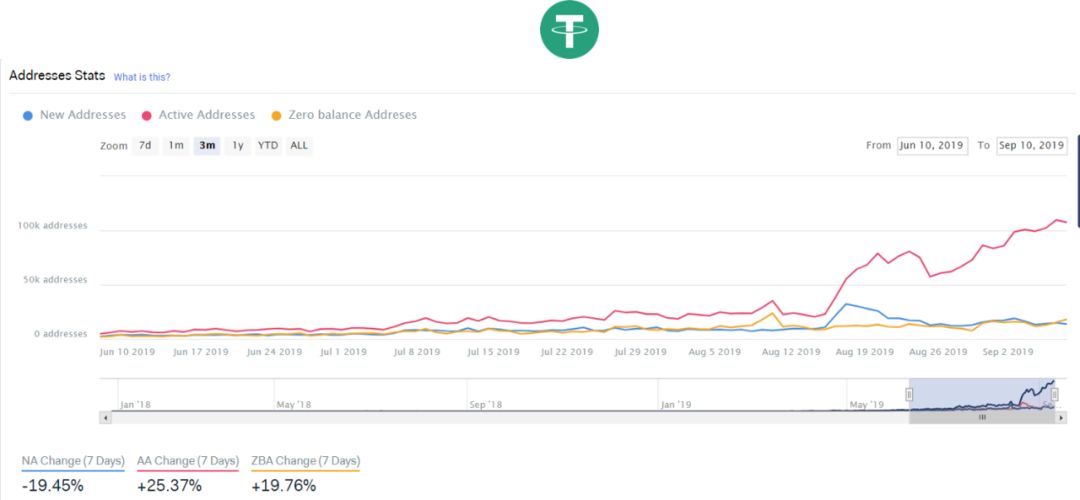

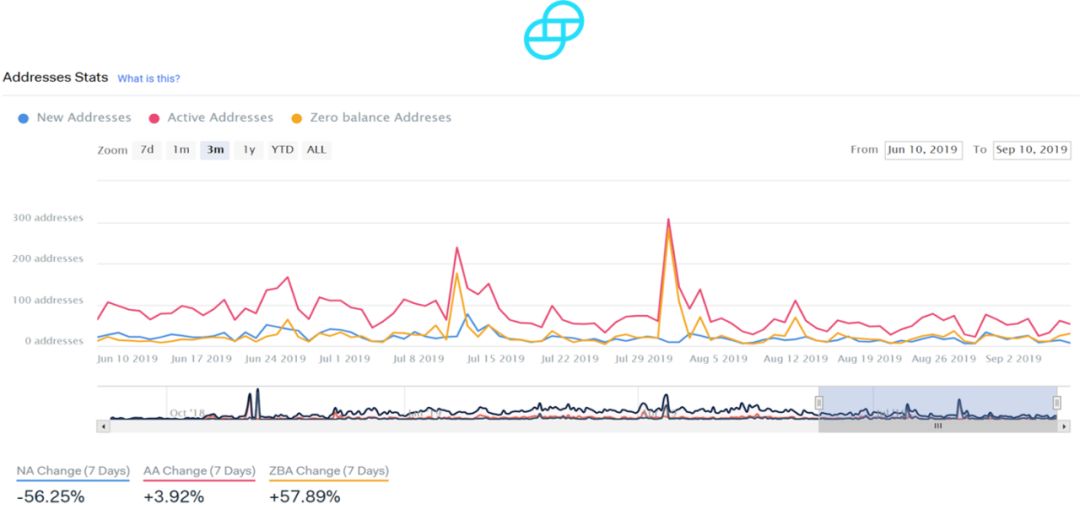

2) The stable currency network has not grown

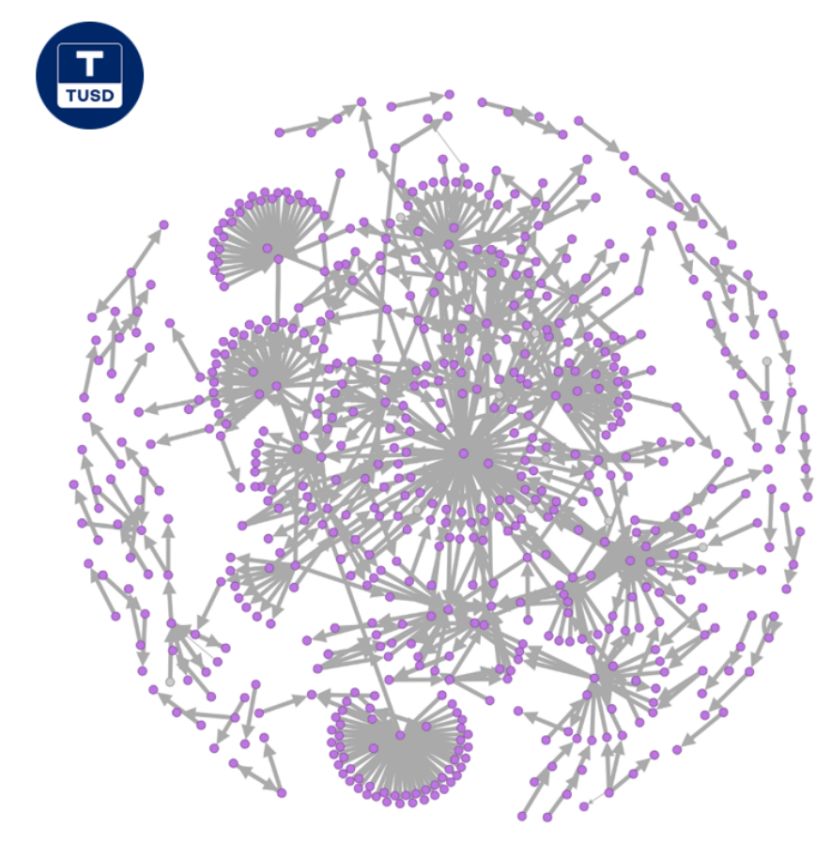

Despite the growing popularity of stable currencies, most of the fiat currency networks supported by fiat currencies have not grown as expected. Even in some cases, some stable currency networks have shrunk, as shown in the two cryptocurrencies of Tether and Gemini Dollar in the following figure:

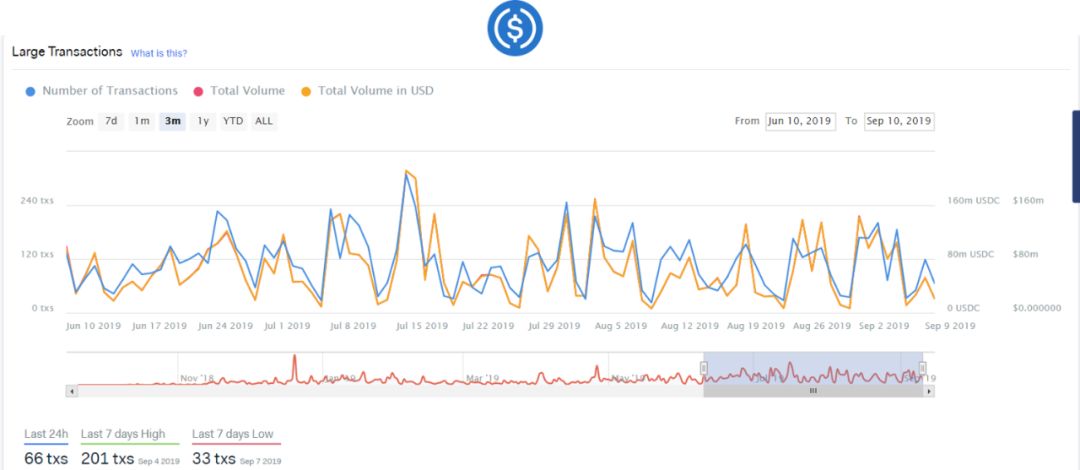

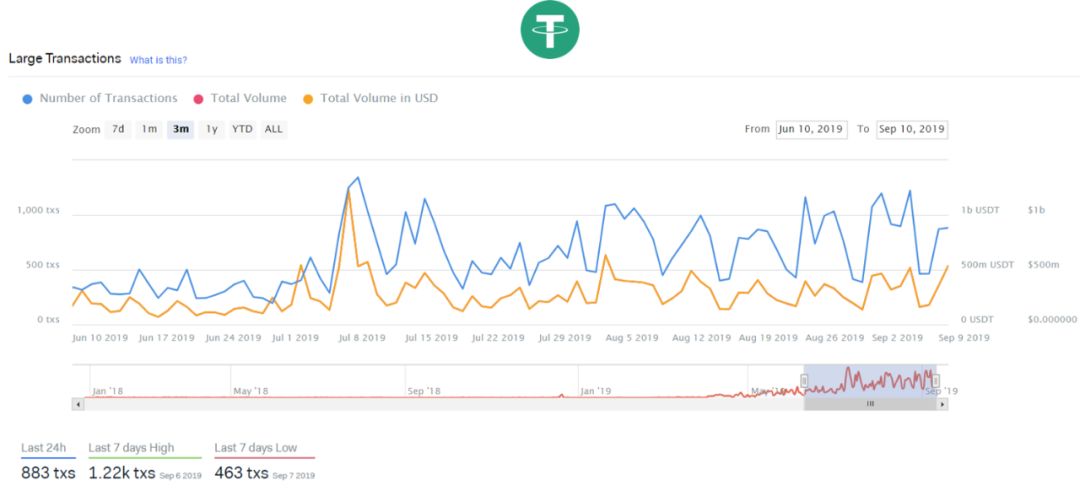

3) Most stable currencies are not used for large transactions, but Tether exceptions

4) Although stable currency has been widely used worldwide, most statutory currency-backed stable currencies are more popular outside of Asia.

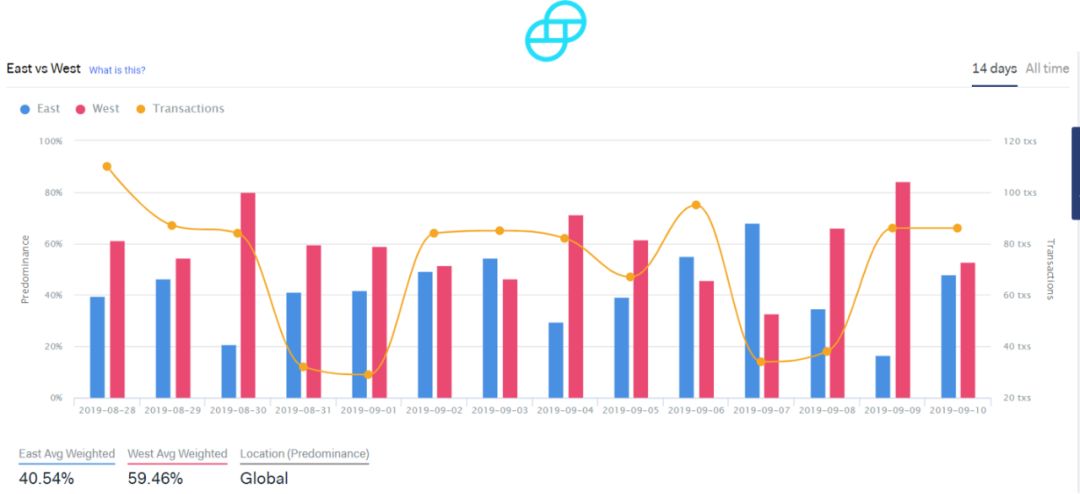

By analyzing the eastern and western markets, it was found that most stable currency supported by fiat currencies is more popular in Western countries. Although the Tether adoption rate has increased in the Asian market a few months ago, the adoption rate in Western countries has eclipsed the Asian market. The chart below shows the adoption rates of the two stable coins, Gemini Dollar and Tether, in the Eastern and Western markets:

5) Stable currency supported by stable currency has a higher daily usage rate

Tether is currently the most important legal currency support stable currency on the market, but the daily usage rate of other stable currencies in this category is not lower than Tether. The chart below shows the daily usage of TrueUSD, which also fully illustrates this:

Five amazing results about cryptocurrency mortgage stabilization coins

1) Some investors who bought the stable currency DAI are actually losing money.

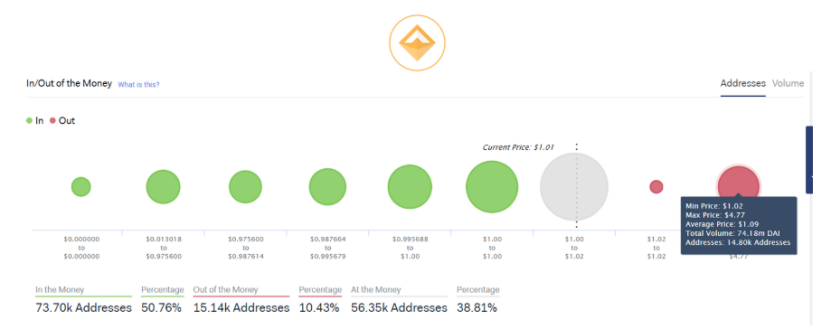

Similar to the stable currency supported by fiat money, according to analysis, some investors also purchased DAI for more than one dollar, as shown below:

The chart above shows that the minimum price for purchasing DAI is $1.02, while the highest price is $4.77, and the average price is more than $1, which is $1.09.

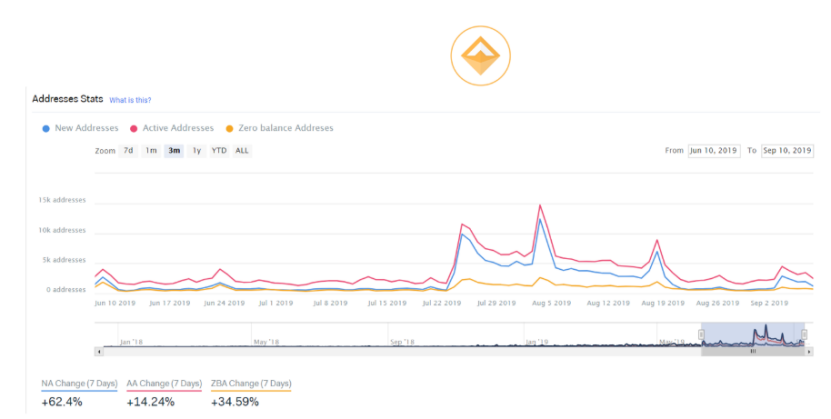

2) Stabilizing currency DAI is still growing

The stable currency network supported by most fiat currencies did not grow as expected, but the DAI is completely different and its network is growing very fast. The following figure shows the results of statistical analysis of DAI network addresses:

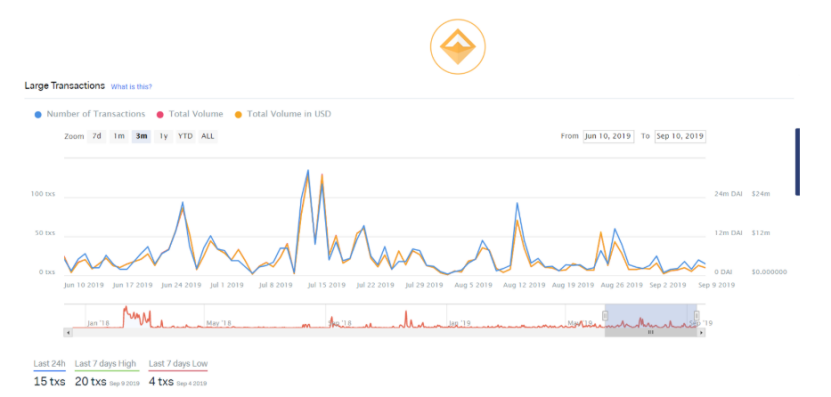

3) DAI's large transaction is not sustainable

According to IntoTheBlock's large-value transaction analysis, the stable currency DAI does not show continuity, and the fluctuation is more obvious, as shown in the following figure:

4) DAI has a higher adoption rate outside of Asia

This is somewhat surprising. The adoption rate of the stable currency DAI in Western countries is actually higher than that in Asia, as shown in the following figure:

5) DAI's daily trading activities are impressive

If you feel that TrueUSD's daily trading activity is very robust, then let's compare DAI's:

The above is just an interesting analysis of a part of the stable currency. There are more things in the future stable currency world worth exploring.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BTC sees more emotions falling back and returning to the shock pattern

- Market analysis: more patience in the trend, BTC is nearing change

- I heard that as long as this technology matures, the centralized trading platform will disappear.

- State-owned enterprises enter! Blockchain application progress has exceeded 50 during the year

- Viewpoint | The boundaries between primary market and secondary market are slowly becoming blurred

- Market Analysis: Market sentiment still needs to be stable, BTC and mainstream currency enter the pending stage

- Singapore Banking Corporation OCBC Bank joins JP Morgan Chase Blockchain Network