What will 2020 look like after the epidemic

New pneumonia completely opens the world in 2020, and countless people are saying that they hope to restart this New Year. Especially on New Year's Day, the American epidemiologist Dr. Eric Feigdin published his overseas views on the new type of pneumonia, which instantly exploded the circle of friends.

His core point was that the R0 value of new pneumonia reached 3.8. The R0 value refers to the expected number of new infections caused by an infected person in a susceptible population during the infectious period. It is the transmission rate of infectious diseases, and it is called the basic reproduction rate (R0).

In response to the comparison between new pneumonia and SARS in 2003, Dr. Eric Feigdin said: "The initial R0 of SARS was 2.9, then 2.0-3.5, and it fell to 0.4 after isolation. But SARS has more symptoms than Wuhan virus Obviously. "This study shows that only about 5.1% of the infected population is currently identified, that is, nearly 95% of the population is actually confused among the population and cannot be identified.

- Ray Dalio: Preliminary Analysis of Coronavirus Impact on Global Economy

- Rethinking the epidemic in Wuhan: What can blockchain do for disease control and early warning?

- The second half of the blockchain? Don't be funny, it hasn't started yet

From the comprehensive observation of the reports we have observed, simply put, this is the new type of pneumonia, although its power is not as good as SARS, but its transmission is far beyond. Everyone should know that Ebola virus killed more than 10,000 people within one year.

All the dead were in three countries in West Africa, and there were three reasons why it had not spread: the first was a lot of heroic deeds by health workers. They found many patients and prevented more people from getting sick. The second is the nature of the virus. Ebola is not transmitted by air. By the time you have enough contagion, most people are already sick in bed. The third is because the virus did not reach the urban area. This is pure luck. If the virus reaches urban areas, the death toll will definitely not stop there.

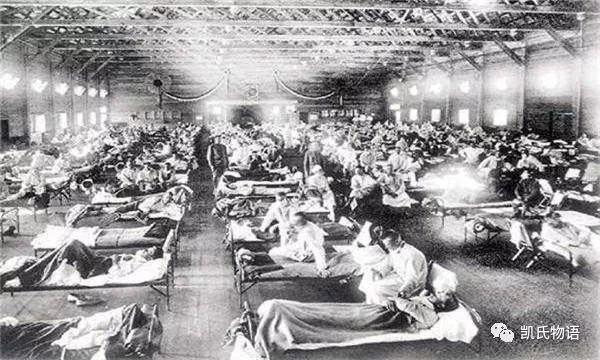

But this is not the case with the new pneumonia we see today. This is the most serious virus in humans since the Spanish flu in 1919. This is exactly the core of today when we see the country begin to close the city in a short period of time and even call for extended holidays to control the spread. This is the first case in human history.

You can imagine that based on Thailand is also a country that eats bats. If this virus does not occur in China, it is assumed that it occurred in Thailand. With Thailand's ability to accommodate international tourists and the government's response speed, when this happens, it is likely that there will be an increase on the basis of two more deaths.

The beginning of 2020 happened exactly in China, and the Chinese government responded quickly on the basis of the recognition of SARS governance in 2003. This is very worthy of recognition. I have never seen any country that can have such a speed of response, including such decision-making capabilities.

On the other hand, it happened to be the Chinese New Year, so the government was given a space to "correct" and "make mistakes." If it doesn't happen during the Spring Festival, a long vacation period, the difficulty of controlling the epidemic will go up at a geometric level. And it is precisely on the basis of vacations that help the government effectively control the spread of the epidemic, and at the same time can extend the holiday to stifle large-scale errors.

I often lament that the Chinese people have seen the most self-denying, sacrificing, strongest and most resilient nation since I have traveled to so many countries around the world. Whether it is to build a Vulcan Mountain Hospital or Wuhan to close the city in 10 days, or the first-level epidemic alert in various provinces and municipalities. Even from the formal confirmation of the epidemic to today, it is only a short period of ten days. In such a short period of time, we can control the disease from the country to the village and control the virus to the root. This is the first case in human history.

If new pneumonia does not occur in China, the consequences of restarting 2020 will be a devastating blow to the global economy.

An airborne model of the virus showed that if a Spanish flu similar to 1918 appeared. The epidemic virus will spread to the world at a very rapid rate, and we may see 30 million people worldwide die from this disease. This result cannot be afforded by any country in the world.

What concept is this? Almost equal to the number of casualties worldwide in the First World War. The end result of a virus is no less than World War I. And everyone knows today that this virus is a new type of pneumonia. According to World Bank estimates, if we have an influenza outbreak, the global economy will lose more than $ 3 trillion. This would cause an instant collapse of the already fragile global economy. What follows is an avalanche of human society.

However, judging from the overall measures taken by the Chinese government today, I am more inclined that the big crisis node will reach its peak in a week and then gradually decrease. A large wave of outbreaks will occur at the end of the national holiday, and the incubation period of the epidemic has a maximum of 14 days. And international flows will trigger more cases in different countries, so the next wave of outbreaks will be in early March. However, due to the gradual increase in temperature and the heat resistance of the virus, the final end time may be in August. In general, each outbreak will lead to a more dispersed epidemic, but its effectiveness will be greatly weakened until it eventually dies.

I have no intention to discuss the medical causes of this new type of pneumonia, but I am more concerned about the political governance behind this battle. In fact, if we think carefully, we will find that today China has three huge social backgrounds in the face of epidemics:

First, Chinese society experienced SARS in 2003. Under such a collective trauma, the understanding of an extreme viral event will be linked to SARS again. In the past 20 years, Chinese society has been fighting more with natural disasters than with extreme viruses. Therefore, based on the lack of medical knowledge, there will be two extremes: relaxation and extremes of minor illness and pain. Panic of events.

Second, China ’s overall society is completely fragmented. Even if you do n’t need to go to the grassroots, you can understand that the behavior of different provincial and municipal governments is completely different. It is not easy to put it in the political environment of China Perceived, but people will have mistrust of local governments. In extreme cases, one-sided emotions can easily occur. In fact, emotions are accumulated, not formed overnight.

Third, today's Internet is inconsistent with 2003. In 2003, the network ecology was very small, there was no large-scale social media, the coverage was limited, and crisis PR was actually easier to handle. The public opinion ecology in 2020 is extremely complicated. Originally, liberalizing public opinion could bring positive results. However, because the people get the news from unofficial sources, it is difficult for the people to distinguish fake news from real news. In response to the disaster, the difficulty level of crisis public relations at the national level has increased significantly.

In view of the above three points, I think there will be three points for the future development of new pneumonia:

First, although the new type of pneumonia reflects the power of national governance, fundamentally, it has not seen the governance capabilities of local governments, especially some inland local governments, but it has largely exposed its shortcomings. This measure of closing the city is a commendable governance action from any aspect, but the people's incomprehension in the case of asymmetric information will exacerbate the emergence of panic. This becomes a paradox.

How to properly open information, allow authorities and experts to interpret it, and keep the public open to participate is the topic of government governance for a long time to come.

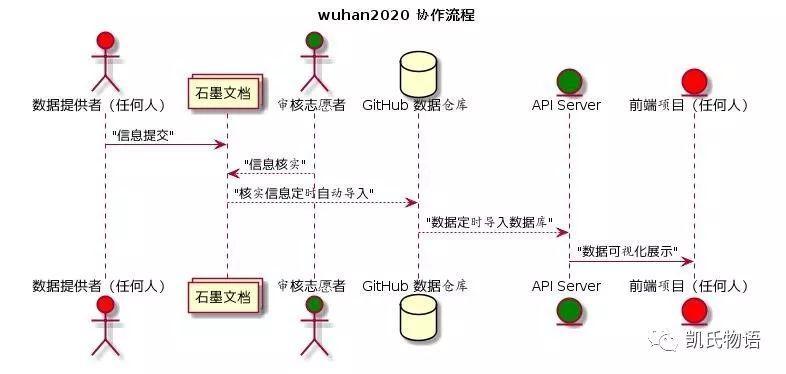

Second, the Wuhan National Biosafety Laboratory (Wuhan P4 Laboratory) of the Chinese Academy of Sciences is the only biosafety laboratory in China that is constructed in accordance with international standards and is the first to be put into formal operation. Chinese researchers can study the world's most dangerous pathogens in their own laboratories. But it is such a laboratory that has not played any role in today's new pneumonia. It is rarely even heard of various media reports about its existence and any latest medical reports and research progress. On the contrary, wuhan2020, an open source project, has become the hottest ranking on Github.

The current system does not give enough space for medical science to develop, but open source governance allows more people to participate in technological development and accelerate problem solving.

Third, public opinion opening will be the most important issue for the government for a long time to come. What we should do today should not be to limit or even shut down public opinion, but to actively take the commanding heights of public opinion. Faced with such a complicated public opinion environment, I believe that overseas hostile forces have misled the people and even intentionally released false information. How to distinguish fake news, control channels and terminals are not the most worrying. Controlling the source is the root cause.

In fact, what I'm talking about is a governance structure of crowdsourcing, governance, and win. Do you understand? Endogenous to internal and external compatibility will represent the next stage of government.

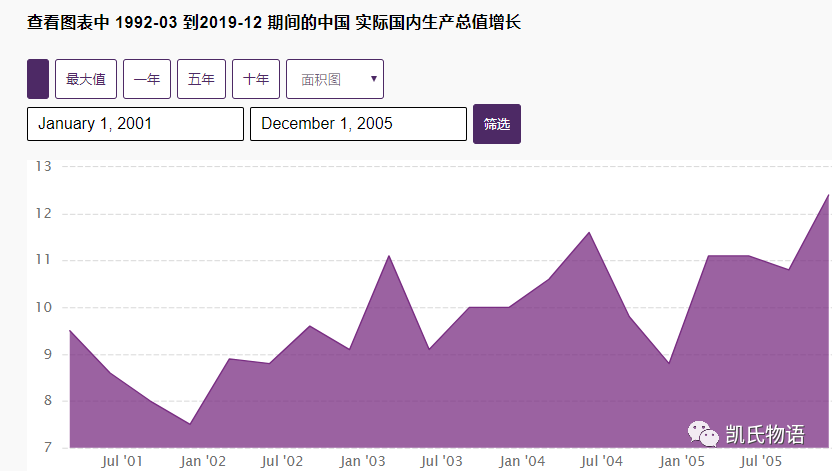

Will new pneumonia have a fatal effect on the Chinese economy? If we carefully study the stages of SARS in 2003, we will find that China ’s real GDP increased by 8.3%, 9.1%, 10%, 10.1%, and 11.4% from 2001 to 2005, and accelerated year by year.

2000-2004 was the culmination of the current economic cycle, so the global economy is on the rise. The emergence of SARS has affected the Chinese economy in the short term, and even the stock market has plummeted, but this only occurred in the early days of SARS. After the recovery of economic activity, the stock market began to rise and rebound.

In fact, in 2003, when China's economy was overheating, SARS only affected 0.8% of China's GDP that year. On the contrary, due to the impact of SARS, the economy that had been adjusted had self-adjusted. At that time, the state suspended raising the deposit reserve ratio until the epidemic subsided and responded to the overheating economy. In August, it increased the deposit reserve ratio by 1 percentage point.

Today, the problem facing China is the coming global crisis. On New Year's Day in 2020, the People's Bank of China announced that it would reduce the statutory deposit reserve ratio of financial institutions by 0.5 percentage points and release more than 800 billion yuan. On January 16, Sun Guofeng, director of the central bank ’s monetary policy department, stated that there is still room for further reductions in the reserve requirement ratio.

The new type of pneumonia may lead to the accelerated arrival of the central bank's RRR cut, which will also drive the economy into the final adjustment stage.

Why do you say that? In fact, you only need to look at one data to know: the national housing price income in 2019 is a 20-year high, and the most likely is to peak in 2020.

The ratio of house price to income refers to the ratio of the total price of a house to the disposable income of a resident household. Generally speaking, in developed countries, a housing price-to-income ratio exceeding 6 can be considered a bubble zone. Today, China's value has reached 8.8. Especially since 2016, China ’s GDP growth has continued to fall below 7%, and per capita disposable income has grown at 8%. It can basically be determined that there is no overdraft of housing prices without the support of high economic and income growth.

In fact, starting in 2016, China's new house transaction volume has been at the top of history. Judging from national data, 2018 is likely to be the historical top. The next two years will be the time when China's economy will bottom out. This means that real estate will consolidate at a high level for a long time in the future, possibly in 5-10 years.

The core turning point is the introduction of real estate tax. At this time, my judgment is 2021.

There are two core reasons why the property tax is important: one is to allow a large number of invisible riches to surface. In this case, corruption will actually be severely hit; the other is to speed up the authors and let real estate return. Market level. In the past 20 years, China's economy has been summed up as the real estate economy, an economic model with real estate as its core development. The next two years are bound to be spent in the throes of transformation.

I don't know if you have heard of the Lewis Turning Point, which refers to the turning point of a country from labor surplus to shortage. Today, we know that 2020 will be the core turning point of China's demographic dividend. Once the demographic dividend is lost and the Lewis turning point is reached, labor costs will inevitably rise, and it will no longer be possible to rely on labor-intensive industries to promote economic development. Therefore, China is unlikely to continue to rely on real estate in the future.

In the future, China must rely on sophisticated technology and service industries to complete the upgrade.

We only need to take a look at the current production capacity of various industries in China to know that it has entered the end stage and the industry concentration has increased significantly. In the past, when everyone bought stocks, they first bought the best leader and then a follower who might surpass it. This year I found only the head and it's gone. Leading companies in traditional industries have opened up and down the industrial chain through scale effects, and established extensive barriers and moats.

What China is about to enter is an era in which the remainder is king, the winner takes all, and the strong are always strong.

On the other hand, with the increasing number of cases of new coronavirus infections worldwide, the market's anxiety has also begun to increase, and the Japanese, European and American markets have plummeted this week. Apple alone has lost about $ 41 billion in market value in a day. Facebook fell more than 8% a day, and $ 50 billion evaporated instantly.

The whole of Asia has begun to experience a round of plunge: Japan's Nikkei 225 index fell 2%, Hong Kong's Hang Seng Index plummeted 400 points and fell below 27,000 points; Taiwan's weighted index fell 5% during the day, and the FTSE China A50 index futures fell by 2%. If you count today, Hong Kong stocks have disappeared 3 trillion Hong Kong dollars.

Looking at Europe and the United States, Britain's formal Brexit and the bombing of the US embassy have been completely submerged in the background of the epidemic, leaving people out of focus. However, the most worrying signal appeared again: just yesterday, the U.S. March and October U.S. Treasury yield curve reverted again, only 3 months after the last time.

And just today, the shareholding of the rich Americans has reached an all-time high. In 2020, the rich will ebb from the US stock market. Who will be the last receiver? Probably the most feared voice in everyone's heart.

Long and short double kills are destined to become the theme throughout 2020.

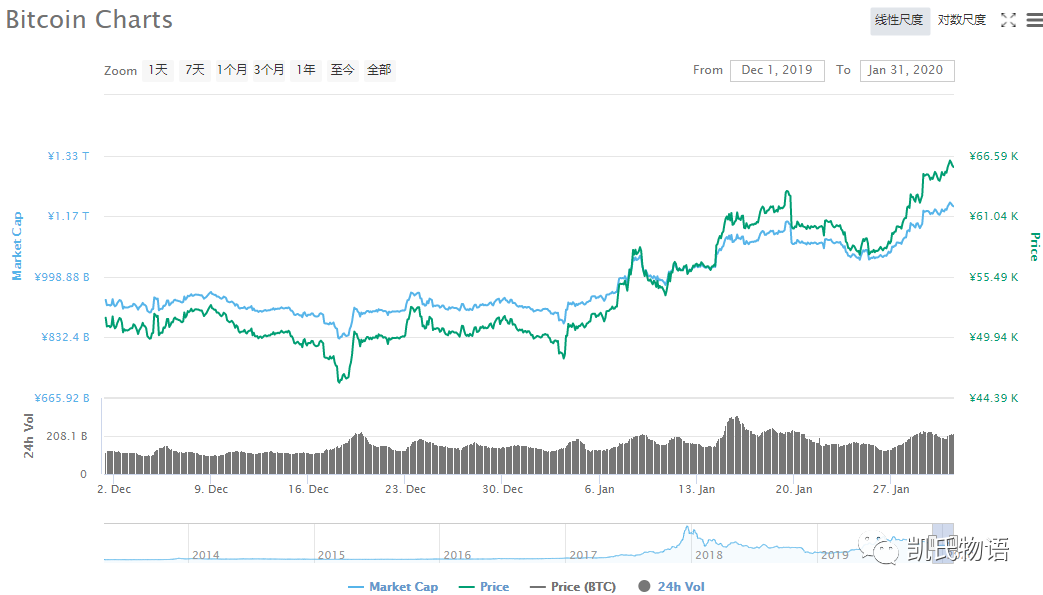

For Bitcoin, in the past two months, I have "just happened" to hit the bottom of the market and "just happened" to hit its point in time. Let's re-examine the data for 18 years. In mid-December 18, it was the period's lowest point of bitcoin at 3215. Then on February 6, 19, the second best buying point of the Chinese New Year appeared at 3405 . Afterwards, the pattern of rising all the way was opened.

In fact, in 19 years, we will also find that the same data took effect at the same time. In December of 19, a phased minimum of 6477 for this round of Bitcoin appeared. After that, the market rose along the way and appeared on January 24, 20 The second best buy point was 8250.

This has a lot to do with the paradigm shift of Bitcoin since 18 years. The main purchasing power before 2018 came from people inside the digital currency circle. After 2018, with the intervention of various national forces and the involvement of Wall Street Capital, the entire logic has changed.

Everyone used to say that the Spring Festival was the lowest point of bitcoin in previous years, but because of Western capital's intervention on Wall Street, this time happened significantly earlier, that is, in mid-December. The main reason is because Wall Street started the Christmas holiday in late December and New Year's Day brought the lowest point of Bitcoin ahead of time. After that, on the day of the Chinese Spring Festival, the time when the funds in the East were the most lax, there was a second low.

What you need to pay attention to is actually Ethereum. One of the more typical signals is that there have been 6 Lianyang on the Ethereum weekly line. In fact, the trend has been established as early as January. When was the last time Ethereum had 6 consecutive suns? It just started on January 31, 2017. The following year, everyone knew what was going on.

In the coming year, the head effect of the blockchain will become more obvious, the original story will no longer be universal, and a large number of public chains will likely return to zero. Market funds will return to the mainstream currency, and the head effect will be more obvious. Before the market finds new hotspots, projects that clarify concepts and technology cannot be implemented will be accelerated.

In any market, this is a rule. In the face of the upcoming Great Depression in the global economy, traditional funds and resources are accelerating back to the top stock projects. However, there is one exception. Projects that represent the future direction will likely open the bottom of funds. For example, Tesla, even on the premise that US stocks have plummeted and Internet stocks have plummeted, there has been a daily increase of more than 13%.

Blockchain is also a reason. Ultimately, this is a technology-driven market. The market is waiting for a killer application, like Ethereum in 2016, leading the blockchain to the next large-scale ecological story. This time point will appear in the second half of 2020.

This killer application will become the underlying application system of the blockchain, and we will all witness the birth of a legend.

PS: Titan is working overtime to make a global epidemic map on the chain. The first version will be launched in Discovery as soon as next Monday. In the face of the epidemic, I hope I can do my best. In the end, thousands of words were converged into that sentence-God Bless China.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bank of Japan deputy governor: Japan must be ready to issue central bank digital currency

- Hitting another record high, the trading volume of bitcoin futures products on the Chiba Exchange exceeded US $ 100 billion

- Featured on Twitter | Dark Web 2019 Cryptocurrency Trading Doubles, Privacy Coin Usage May Increase

- Learn to think on the demand side to find the holy grail of blockchain

- Fighting the epidemic, the chain industry is not lagging behind: more than 30 blockchain companies help fight the epidemic

- Decentralized exchanges: development trends and investment logic

- Deutsche Bank report: cryptocurrency and P2P payments will drive global digital economy transformation