Why did DeFi suddenly rise? Is the new model that relies on technology really reliable?

Every time in the face of major transformation, I always said that Internet companies are the fastest, but this time the "financial revolution" did not have Internet companies in the front, the first to start layout and do well is still JP.Morgan, Citi What about PwC? Finance has always been for oligarchy services, but it has only served the public by the way. This is charity. Under the banner of "service", it is the evil of the Internet companies that are deceiving users to buy and sell. Its era is over.

1

Traditional Finance → Decentralized Finance

Financial technology (FinTech), Wikipedia definition refers to a group of enterprises using technology to make financial services more efficient, thus forming an economic industry. The goal of these financial technology companies, usually when they are newly created, is to disintegrate the large financial institutions and systems that are not technologically advanced.

From this definition, we can clearly see that financial technology mainly serves traditional finance in the form of science and technology. Take Alipay's Alipay as an example. All his trading processes are carried out according to the user-Alipay-Bank. His role is to replace the cumbersome transaction process between the user and the bank. He will do the work and charge a certain fee from the middle. Users pay a small amount of money in exchange for transaction convenience. Friends who have studied physics and understand mechanics must know that driving an object is frictional. In the financial trading industry, friction is what you need in every transaction. The cost of paying.

In the past Internet era, how to complete the transaction quickly is the primary goal that everyone pursues. Nowadays, the transaction speed is no longer the focus of everyone, privacy is security. DeFi came into being. His key is not efficiency, but the problem of trust in a transaction without a third party. Decentralized financial DeFi is the use of open source software and distributed networks to transform traditional financial products into untrusted and transparent agreements. These protocols operate independently without the need for third-party intermediaries. The fewer institutions involved in a transaction process, the lower the cost. This kind of development is really ecstasy. To make an analogy, decentralized finance has the same impact on the financial world as open source software changes software products. It is revolutionary.

- The "TongRumen" report was announced, and the bitcoin was closed?

- Dry goods | Understanding BLS signature algorithm

- A big inventory of privacy technology, there are so many choices in Bitcoin.

On github we can see that Edwin Ong categorizes all #DeFi projects:

In the traditional financial ecology, it is mainly divided into several major institutions: central banks, commercial banks and investment banks, each of which is an independent system. In the decentralized finance, the core of these projects is to broaden the path of legal currency and various asset exchanges, so that users can participate in any trading node and realize their own value investment. The actual user, through the legal currency in his own hands, passes the assets through a series of platform transactions, and the assets are transferred to the world not controlled by the bank network, and the assets are in circulation in the form of numbers. In the past, everyone complained that financial transactions were too "shady". It was invisible to many ordinary users. In fact, he was originally serving the oligarchs, but only served the public by the way. For data, it is not open and transparent to express its trust, but to solve the problem of transaction costs. The lower the cost of each value exchange, the more people can participate, so that this new process can truly become " Infrastructure, so that every user is involved, power is dispersed in the hands of everyone, in such a world, a decentralized financial system will be formed.

The competitive environment of the decentralized financial system is equal, and the threshold of financial services is very low. Basically, as long as you have access to the Internet, you can participate in the entire decentralized financial ecosystem. The traditional financial tree-like power structure does not exist, no one has the privilege, and the low cost of the transaction ensures that everyone can participate. The lower the threshold, the more people participate, forming an open market. The higher the liquidity, the more stable the system will be. The end result is that the beneficiaries are ordinary users.

2

Based on Ethereum's digital lending program – MakerDao

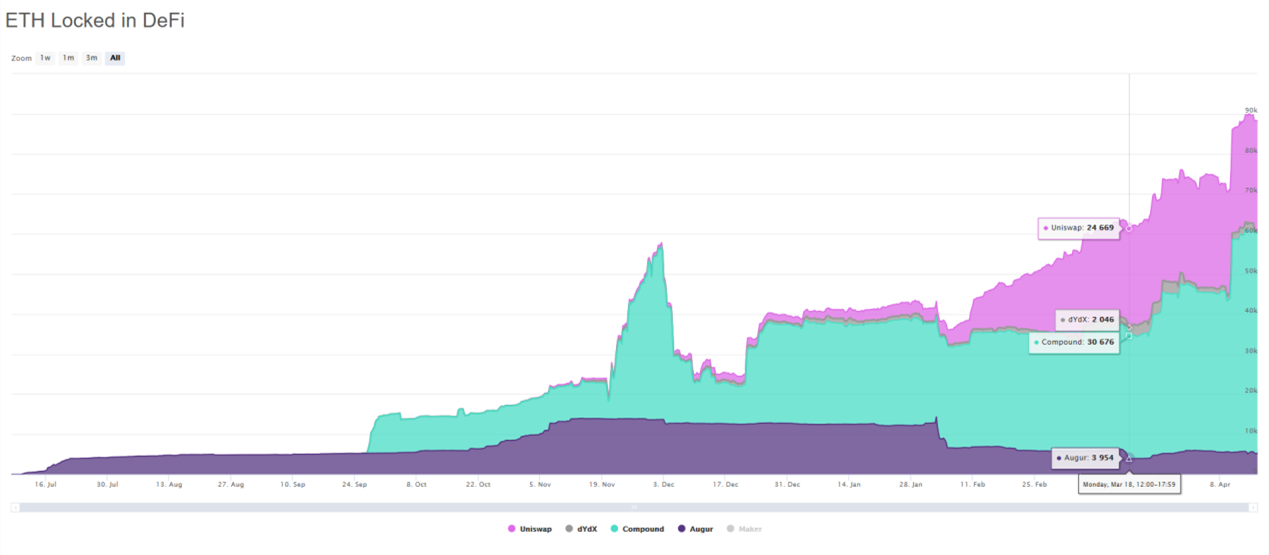

At present, Ethereum is the largest ecological platform for DeFi. There are many projects based on the Ethereum platform. This time, the main theme is digital lending projects. What is the main solution for this project? On ETH Locked in DeFi, we can see that the number of ETHs in the Maker, Uniswap, Augur, and Compound protocols is increasing rapidly.

This data shows that the complete development environment has been established for three years, and the ecology is already alive.

DeFi project: MakerDao

Among them, the earliest and most well-known project MakerDao.

MakerDao is the central bank in the blockchain world. Everyone can generate Dai by creating a Mortgage Debt (CDP) on the MakerDAO platform, or redeem Dai directly on the trading platform. The Mortgage Debt (CDP) is a smart contract that allows users to borrow Dai by depositing valuable collateral. The stable currency Dai is issued by a full-backed mortgage guarantee on the chain, and is 1:1 anchored to the US dollar. Individuals and businesses can obtain safe-haven assets and liquidity without risk of centralization by redeeming Dai or lending to Dai.

DeFi Project: Augur

Augur is a decentralized forecasting market platform based on Ethereum blockchain technology. Instead of the market controlled by "invisible hands" like traditional finance, he lets users use digital money to make predictions and bets, relying on "the wisdom of the masses" to predict the outcome of the event. In financial terms, it can be expressed as: effectively eliminating the risk of counterparty and the risk of centralization of the server. The Augur forecasting system is a financial derivative. Why does it look different?

Bitcoin brings us a market-oriented currency, Ethereum will be decentralized, and Augur convened all the people who can connect online to participate in the "speculation" at a very low cost. It is unimaginable in history. Its emergence has brought a new energy source to the entire financial system, and solved the embarrassing situation of “there is no user in the blockchain industry”.

On Betfair, there is a fee of more than 10% per transaction, and on Augur, the fee will be 1% or less. This platform reduces the transaction cost to the point where the transaction is safe, and the user does not need To verify the identity of the opponent, everyone is facing an anonymous address, no one cares where you are from, this is global mobility.

3

The insecurity of the blockchain system affects the security of mortgages

DeFi has grown so long that the ecology is taking shape. Everything now depends on Ethereum's smart contract constraints, but we always believe in technology, that technology is "not guilty", is technology really neutral? Propose an algorithm that can be continuously optimized. How do you guarantee that he is safe?

I still remember Google's SEO optimization. In Google's own search engine, in order to erase all negative news of the company, modify the neutrality of the algorithm, and make the search result become "screening". The algorithm is not guilty, but understand him. The man is manipulating it all. Ethereum's smart contract innovatively proposed multi-person participation in development, and developed script permissions to developers. It seems very user-friendly, but it is actually irresponsible because it is dangerous to make user-programmable. It is not an ordinary traffic website. The more people are attracted to participate, the smarter financial platform with arbitration nature should not open the programming authority. This will not only increase the confusion of the community, but also lead to the failure to maintain the quality of the later code. Raise asset security issues. Even now, can you be sure that there is nothing missing from the testing framework for smart contracts? DeFi, which everyone participates in, is a huge lie. Auditing should be done to professional institutions. Smart contracts should not exist.

4

It’s not right to go completely to the center.

The key to traditional finance is reconciliation and liquidation. The key link to economic losses is also in liquidation, and there have been tragedies that have caused billions of losses due to liquidation. In the past, the clearing system was in charge of various agencies. It was tree-like, and the power was top-down. At present, the block-based clearing system is network-like. Every single transaction needs to be broadcast to the whole network. It can be said that it is a global one. Super clearing system. This system has a very large amount of resources, and the transmission efficiency decreases with the expansion of the range. If there is no traditional centralized small organization, the formation of the current super system is obviously not what we expect.

The growth of cells is not conscious. It grows to a certain stage and grows up again. But people in society are conscious, and centralization is the spontaneous behavior of people in society. Human nature is to "benefit and avoid harm". If left unchecked, it will only lead to chaos, but will not form a stable and open market according to the ideal situation. Human nature leads to the birth of such a center, then we naturally have to use reason to constrain them not to reach an irreparable point. Not every user has the ability to solve problems like this, obviously it is necessary to hand over the power. Everyone is going straight to the interests, but now everyone is talking about trust, will you believe it?

Disclaimer: This article is the original manuscript of the chain of finance, copyright belongs to the chain and finance, and can not be reprinted without authorization. The media that has been authorized by the agreement must be marked with the "source of the manuscript: chain and finance", and the offender will be held accountable according to law.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The BSV incident observation shouted for 10 years of "decentralization" slogan, and the encryption community went back to liberation overnight?

- What is the mentality of those who have announced their withdrawal but insist that they are still optimistic about Bitcoin?

- Before the second crowdfunding of Pokka Polkadot, talk about why Poca is so hot!

- Deng Jianpeng: Blockchain should promote international regulatory cooperation in a timely manner

- Forced crude oil, stock index, BTC won the best investment target in the first four months of this year

- The result of 1 million US dollars is handed over! Ernst & Young (EY) Releases Ethereum Blockchain Software

- Focus on KeyShard PlatON algorithm scientist Xie Xiang live premiere