2019 Global Blockchain Investment and Financing Report: The number of global blockchain field financings is 543, with a financing amount of 23.83 billion yuan

Author: Zhao Yue

Editor's Note: The original title was "2019 Global Blockchain Investment and Financing Report"

▪ In 2019, there were 543 financings in the global blockchain field, with a financing amount of 23.83 billion yuan. The amount of financing has an “inverted V-shape” feature, while the amount of financing fluctuates greatly. The average single financing is mostly in the tens of millions.

▪ Global block chain financing is mainly concentrated in round A and before round A. The seed / angel round and round A financing accounted for over 45%.

- Fidelity leads investment, blockchain settlement company Clear secures $ 13 million in Series A financing

- Intercontinental Exchange ICE acquires software service provider Bridge2, ready to launch applications for Bakkt

- SIM card exchange attacks stolen coins, how can Bitcoin practitioners protect themselves?

▪ Digital assets and underlying technologies are the most popular investment scenarios in the blockchain field. Enterprises' ability to land in real economy and financial applications needs to be improved.

▪ A total of 175 financings occurred in China's blockchain sector, and a total of 162 financings occurred in the United States. In terms of financing amount, China's publicly disclosed financing amount is less than one-half of that in the United States. From a domestic perspective, Beijing has the largest number of financings with 76 transactions; Guangdong has the highest financing amount with 2.46 billion yuan.

▪ Of the 21 institutions in the top 15 in terms of financing amount, 4 institutions had financing amounts exceeding 1 billion yuan. In terms of business distribution, there are 8 institutions whose main business is mainly digital assets. Of the 21 institutions, 12 are from the United States and 5 are from China.

▪ US investment agency Digital Currency Group is the world's most active investment institution, with a total of 14 investments. Among investment institutions in China, Genesis Capital and Distributed Capital invested the most, with 11 investments each.

On October 24, 2019, the Political Bureau of the Central Committee of the Communist Party of China conducted the eighteenth collective study on the current status and trends of the development of blockchain technology. General Secretary Xi Jinping pointed out that blockchain should be used as an important breakthrough in independent innovation of core technologies. This has injected a "heart-strengthening agent" into the Chinese blockchain industry, and the blockchain industry has also ushered in new development in China.

With the gradual deepening of the blockchain layout of various countries, in 2019, blockchain is still a popular investment area for capitalists.

In order to observe the development trend of the global blockchain field in 2019 and better predict the future development trend of the blockchain, Zero One Finance Zero One Think Tank United Digital Asset Research Institute and China Investment Association Digital Asset Research Center released the 2019 Global Blockchain Investment and Financing Report "sorts out and summarizes the investment and financing situation in the blockchain field.

For the convenience of statistics, the report excludes financing after ICO, IEO, STO, mergers and acquisitions, IPOs, and IPOs. It analyzes the financing profile of the global blockchain industry from the dimensions and amount of financing, financing rounds, and industry distribution. Out of the global blockchain financing list.

I. Overview of Global Blockchain Financing in 2019

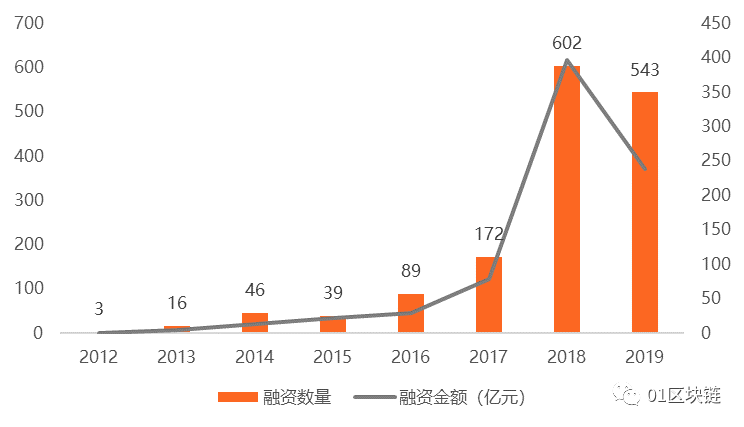

(1) The amount of financing is "inverted V", the average single financing amount is mostly in the tens of millions

According to incomplete statistics of the Zero One Think Tank, from 2012 to 2019, a total of 1,510 financings occurred in the global blockchain field, and the publicly disclosed financing amount reached 78.22 billion yuan. Among them, 2018 is the “explosion year” for blockchain financing. In 2019, blockchain financing has gradually become more rational. Compared to 2018, the amount of financing has fallen by nearly 40%. In 2019, the number of global block chain financings was 543, with a financing amount of 23.83 billion yuan.

Figure 1 Number and amount of financing in the blockchain field from 2012 to 2019

Source: Zero One Think Tank

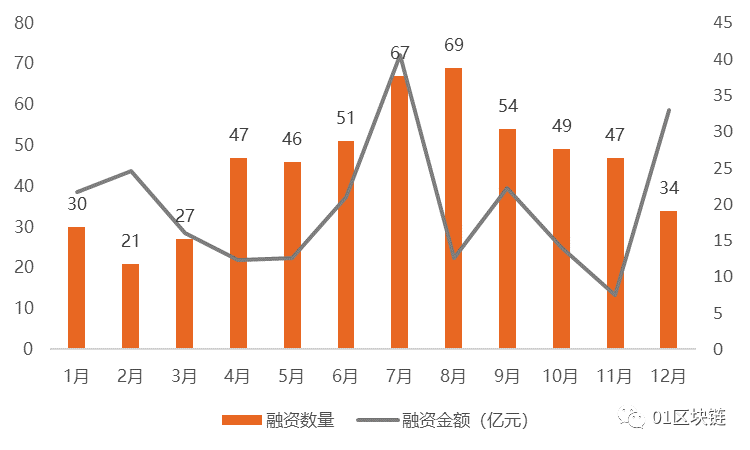

Observing the specific financing situation in each month of 2019, it can be seen that the amount of financing in 2019 is "inverted V", and the amount of financing has a large fluctuation. Starting in April, the enthusiasm of capitalists for investment in the blockchain field has gradually increased, reaching the highest peak in July and August, and then showing a downward trend. Only 34 financings occurred in December; the third quarter was the peak financing period, totaling There were 190 financings with a financing amount of 7.54 billion yuan, accounting for 35% and 35% of the total amount and amount of financing for the year.

Figure 2 Number and amount of financing in the global blockchain field in 2019

Source: Zero One Think Tank

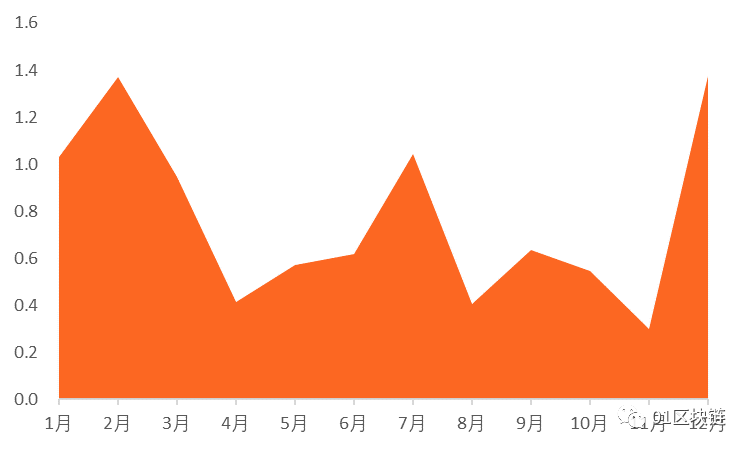

Judging from the average single financing amount, the single financing in the blockchain field in 2019 mostly belongs to the tens of millions. Among them, the average single financing amount in January, February, July, and December exceeded 100 million yuan, and the rest of the months belonged to the tens of millions; the average single financing amount in February and December was the highest, nearly 140 million yuan. .

Figure 3 Average Single Financing Amount in the Blockchain Field in 2019 (Unit: 100 million yuan)

Source: Zero One Think Tank

Note: Average single financing amount = publicly disclosed financing amount / publicly disclosed financing amount of projects

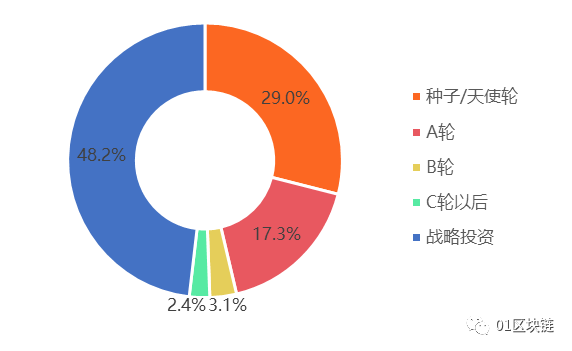

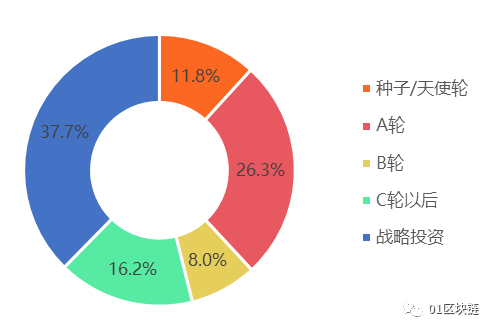

(II) Over 45% of financing occurred in and before Round A, and only 29 rounds of financing after Round B

Regardless of strategic investment, in 2019, the global block chain financing is mainly concentrated in round A and before round A. The seed / angel round and round A financing accounted for more than 45%. Among them, the seed / angel round has the largest number of rounds, accounting for 29% of the total amount of financing, followed by round A, which accounts for 17.3%; round B and round C rounds have 17 and 13 rounds, respectively, and the total proportion does not exceed 6%. .

Figure 4 Distribution of Global Blockchain Financing Rounds in 2019 (Classified by Financing Amount)

Source: Zero One Think Tank

Note: Round A includes Pre-A, A and A +; round B includes Pre-B, B and B +; round C includes CG round.

From the publicly disclosed financing amount, in addition to the strategic investment, the round A financing has the highest financing amount, followed by the round C financing. Although the seed / angel round has the largest amount of financing, due to the lower single financing amount, the total financing is Low, accounting for 11.8% of all financing amount.

Figure 5 Distribution of Global Blockchain Financing Rounds in 2019 (By Financing Amount)

Source: Zero One Think Tank

Note: Round A includes Pre-A, A and A +; round B includes Pre-B, B and B +; round C includes CG round.

(3) Digital currency exchanges / platforms are most favored by capital parties, and "blockchain + insurance" has become a "star industry"

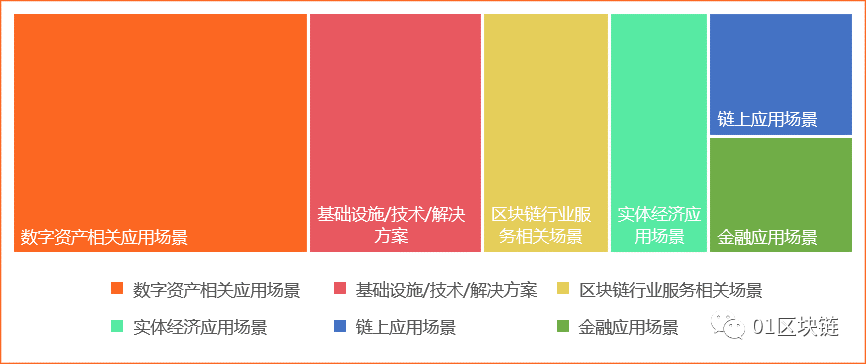

Based on the development of the blockchain industry, Zero One Think Tank has divided the blockchain industry into seven first-tier industries, namely infrastructure / technology / solutions, digital asset-related application scenarios, financial application scenarios, real economy application scenarios, and chain. There are seven major related industries such as the above-mentioned application scenarios and others. Among them, more than 60 secondary industries are included in the seven primary industries.

From the perspective of the distribution of financing in the first-tier industry, digital assets and underlying technology are the most popular investment scenarios in the blockchain field. Enterprises' ability to land in the real economy and financial applications needs to be improved.

Digital asset-related application scenarios have the largest number of financings, with 191 transactions, accounting for more than 35%; infrastructure / technology / solution financing ranked second, with 112 transactions, accounting for 21%; and blockchain industry service-related scenarios The real economy application scenario and the on-chain application scenario account for 15%, 12%, and 8% respectively; the financial application scenario has the least amount of financing, with 45 transactions.

Figure 6 Distribution of financing in the first-tier industry in the blockchain field in 2019

Source: Zero One Think Tank

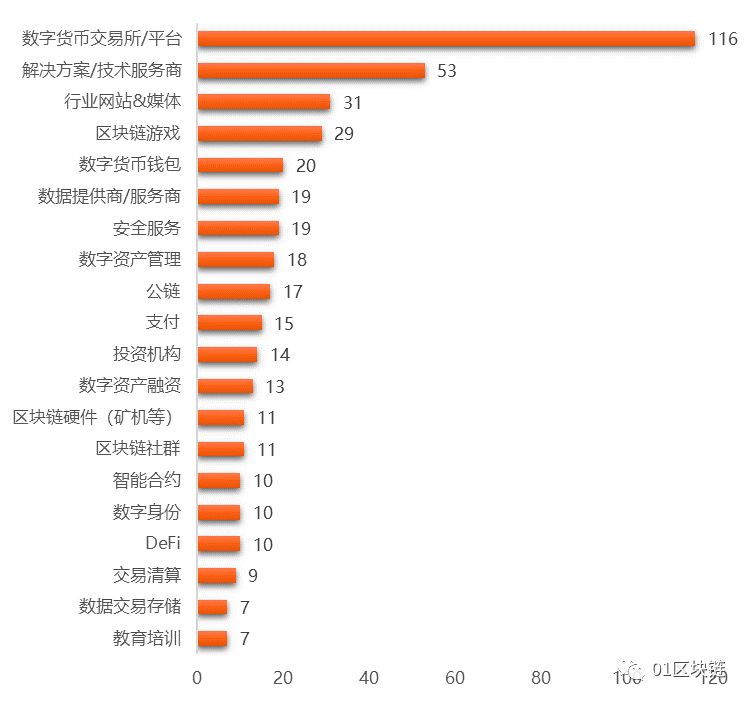

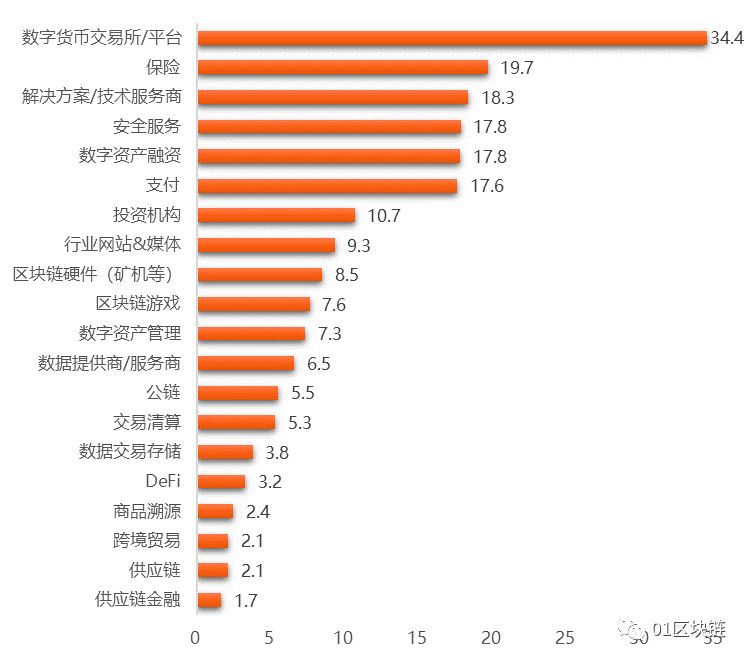

From the perspective of the secondary industry classification, digital currency exchanges / platforms are still the most favored by capitalists. In 2019, digital currency exchanges / platform-related financings totaled 116, accounting for 21% of total financing and accounting for digital asset-related industries. The proportion of financing exceeded 62%.

In addition, solutions / technical service providers, industry websites & media, blockchain games and digital currency wallets are also more popular, with financing amounts of 53, 31, 29 and 20, respectively.

Figure 7 Distribution of financing volume of secondary industries in the blockchain sector in 2019 (TOP20)

Source: Zero One Think Tank

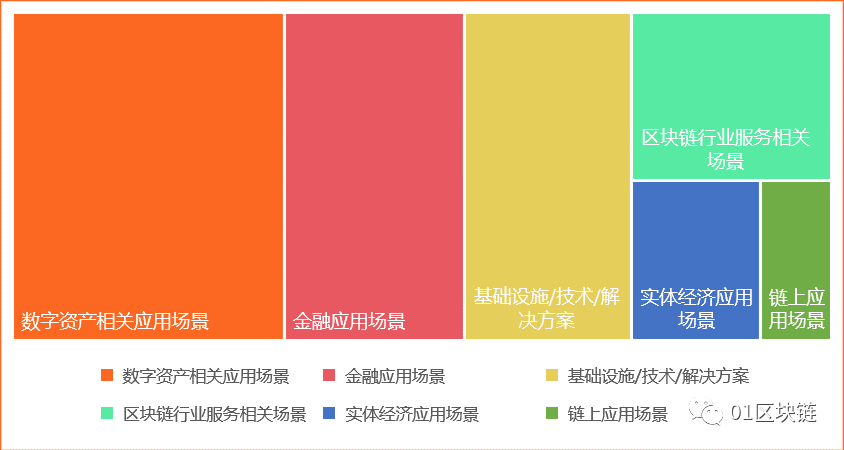

In addition to being far ahead of other industries in terms of financing, digital assets are also the most “gold-absorbing” industries. In 2019, the amount of financing for digital asset-related application scenarios reached 7.32 billion yuan, accounting for 33% of the total financing of the industry. Although the financial application scenario has a small amount of financing, due to the higher average single financing amount, the financing amount ranks second in the industry with 4.84 billion yuan.

Figure 8 Distribution of financing amount of the first-tier industry in the blockchain field in 2019

Source: Zero One Think Tank

In 2019, the digital currency exchange / platform has the highest financing amount, accounting for nearly 16% of the financing amount of the blockchain industry, and 47% of the financing amount in digital asset related application scenarios flows to digital currency exchanges / platforms.

It is worth noting that "insurance + blockchain" has become the "star industry" of the blockchain industry in 2019, with a financing amount of 1.97 billion yuan, ranking second in the industry. The third place in financing for solutions / technical services was 1.83 billion yuan.

Figure 9 Distribution of financing amount of the secondary industry in the blockchain field in 2019 (TOP20)

Source: Zero One Think Tank

Second, the list of global blockchain financing in 2019

(1) TOP10 list of global blockchain financing areas

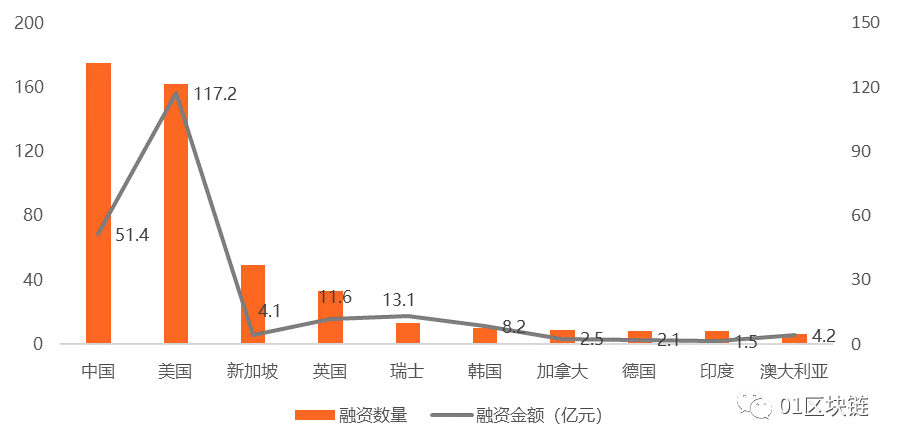

China and the United States are big countries in blockchain financing. According to incomplete statistics of the Zero One Think Tank, in 2019, China's blockchain sector has the largest number of financings, with a total of 175 transactions, accounting for 32.3% of the total financing for the year; the amount of US financing is slightly lower than China, with a total of 162 financings Pen 29.9%.

In terms of financing amount, the publicly disclosed financing amount in China's blockchain field is less than one-half of the United States, which is 11.7 billion yuan in the United States, accounting for nearly 50% of the total annual financing; China is 5.1 billion yuan, accounting for twenty one%.

Singapore ranks third in the world in terms of financing, but due to the low amount of single financing, the total financing is far lower than that of the United Kingdom, which ranked fourth.

Figure 10 TOP10 Rankings of Global Blockchain Financing Areas

Source: Zero One Think Tank

(II) TOP10 List of China's Blockchain Financing Areas

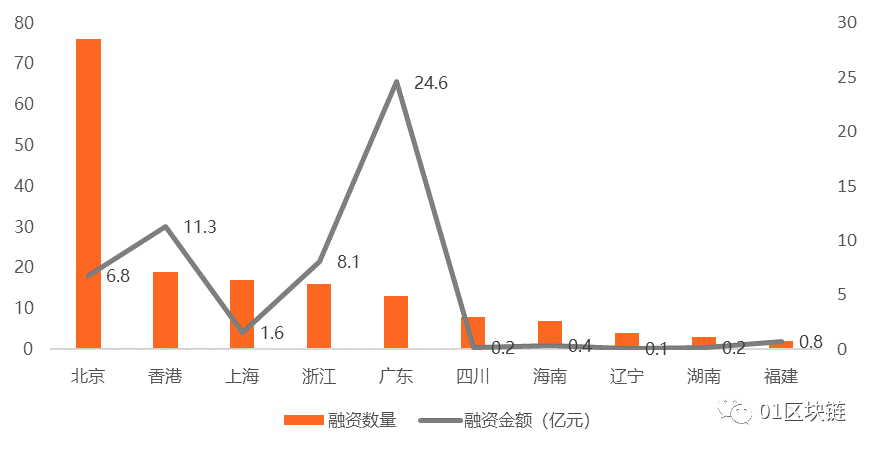

Affected by factors such as policy support, economic development level, industrial development foundation, and innovation and entrepreneurship capabilities, China's blockchain company / project financing is mainly concentrated in the Bohai Rim, Yangtze River Delta, Guangdong, Hong Kong, Macao and Sichuan-Chongqing regions.

From the perspective of the regional distribution of blockchain financing in 2019, Beijing has the largest number of financings, with a total of 76 financings. The amount of financing is much higher than Hong Kong, which is ranked second, but the amount of financing in Beijing is lower than Hong Kong; Guangdong is the financing. In the regions with the highest amount of funds, although only 13 financings occurred, the amount of financing was as high as 2.46 billion yuan.

Figure 11 TOP10 Rankings of China's Blockchain Financing Areas

Source: Zero One Think Tank

(3) TOP15 of Global Blockchain Financing Institutions

According to the incomplete statistics of the Zero One Think Tank, of the 21 institutions that ranked in the top 15 in terms of financing amount, 4 institutions had financing amounts exceeding 1 billion yuan. In terms of business distribution, there are 8 institutions whose main business is mainly digital assets. Of the 21 institutions, 12 are from the United States and 5 are from China.

Among them, among the Chinese companies, Zhongan Technology has the highest financing amount of 1.961 billion yuan. It mainly focuses on the application of blockchain technology to related fields such as insurance; the second place is the "mining machine giant" Jia Nan Yun Zhi.

Table 1 TOP15

Source: Zero One Think Tank

(IV) TOP5 Ranking of Global Blockchain Investment Institutions

From the 15 active investment institutions ranked in the top five in 2019, it can be seen that, with the exception of SBI Group, other institutions are focused on investment in related fields such as blockchain and digital currency. Seven of these institutions are from China and have been established since 2015, and there are five investment institutions from the United States.

Among them, the US investment agency Digital Currency Group is the world's most active investment institution, with a total of 14 investments. Currently, Digital Currency Group has invested in more than 150 blockchain companies in more than 30 countries around the world, represented by North America, and its investment business has spread all over the world.

Ranked second is the investment institution of Australia, Ke Yin Capital, with 13 investments; the largest number of Chinese investment institutions is Genesis Capital and Distributed Capital, both with 11 investments, ranking third, of which distributed Capital is the earliest venture capital institution focusing on investment in the blockchain field in China; the fourth place is also all Chinese investment institutions, including NEO Global Capital, Benrui Capital, Consensus Lab, and Capital Capital, all conducted 7 transactions investment.

It is worth noting that the cryptocurrency exchange Coinbase and its affiliated investment agency Coinbase Ventures have invested in 6 transactions.

Table 2 TOP5 Ranking of Global Blockchain Investment Institutions

Source: Zero One Think Tank

Source: Zero One Think Tank

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Under the epidemic, blockchain is expected to make up for shortcomings in social online operations

- Pantera led, Square and DCG participated in the investment, and the decentralized settlement network Transparent received US $ 14 million in financing

- "The Secret History of Bitcoin": A Few Things You Did Not Know About the Bitcoin Genesis Block

- Trade-offs in blockchain projects: climb, walk, run

- Where did the supplies go? Questions that Wuhan Red Cross cannot answer, blockchain can

- 2019 DeFi industry research report: DeFi industry will become the best application scenario for blockchain landing in vertical industry

- Ethereum 2.0 development team AMA: Phase 0 will be deployed as early as 3 months