Analysis of exchange price-earnings ratios: Can platform currency lead the next bull market?

The just resigned 2019 is a year for users in the currency industry to see hope in a long bear market. The year has been mixed, and by category, only Bitcoin and platform currency have emerged from the obvious upward trend. Other currencies are still down. Endlessly. Even a well-known view of the currency circle at the time was:

Regardless of whether the opinion is true or not, platform coins have become popular with the fermentation of public opinion. Why is platform currency so attractive? Although the concept of the blockchain industry has been in existence for several years, it is still in the infrastructure stage. The main competition is still concentrated on the public chain track. Early participants found that the public chain project could not be valued at all because the public chain had no income. As the "water seller" of the industry, the exchange is the only project in the industry that can generate stable profits , and it is therefore regarded by many users as the top of the digital currency pyramid .

In this way, the logic of investing in platform currency is clear. Since the value of platform currency is a profit repurchase, holding platform currency is equivalent to being a "shareholder" of an exchange. It is basically the same as the stock market. The only difference is that the exchange will pay dividends. The money is used for repurchase, and the dividend will be reflected in the price of the platform coin itself.

- Futures delivered in kind prompt Bitcoin price to rise further, Bakkt futures investors prefer to use Bitcoin for physical settlement

- Opinion: What is the key to large-scale adoption of blockchain?

- Foreign exchange bureau strengthens the construction of cross-border financial blockchain service platform to ease the financing difficulties and expensive financing problems of small and medium-sized enterprises

Since it is similar to the securities market, the traditional method of valuation can naturally also play a role . The value of the platform currency is mainly reflected in the profitability of the exchange. As one of the important indicators of the securities market, the price-earnings ratio can also better reflect the value of the underlying assets. Therefore, this article will start with the price-earnings ratio of the platform currency of the three major exchanges, try to analyze its intrinsic value, and analyze whether the platform currency in the current situation has a good investment value.

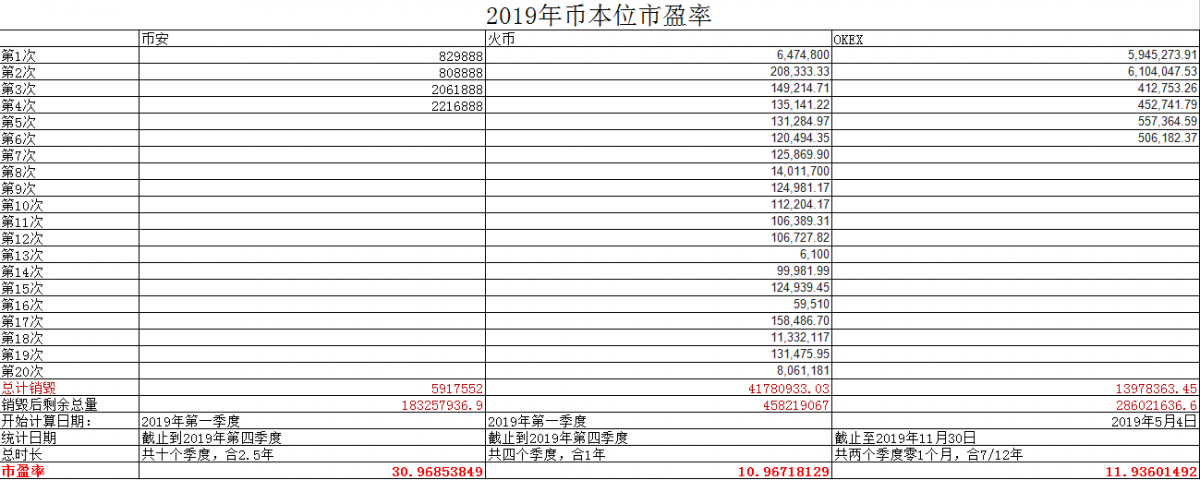

First, assuming the market is efficient, we use the "currency standard" concept to calculate the 2019 price-earnings ratios of the three major platform currencies:

Note: Because OKEX destroys 700 million uncirculated OKBs, OKB is directly calculated based on the total of 300 million

The above calculation assumes that the price of the platform coin will always float to an adapted price according to the changes in the market transaction value, that is, regardless of the price of the platform coin, the total amount / annual destruction amount will be directly used to calculate the BNB price-earnings ratio of 30.96 , HT price-earnings ratio of 10.96, OKB price-earnings ratio of 13.64. However, because Huobi Exchange has multiple "IEO" destruction records in 2019, after the boom, especially since this year, there has been no IEO behavior, so the quarterly earnings destruction is used to recalculate the price-earnings ratio:

From the figure we can see that in the price-earnings ratio calculated using the currency standard, the price-earnings ratio of HT and OKB are relatively close, while the price-earnings ratio of BNB is relatively high.

Below we consider the price and calculate the 2019 price-earnings ratio in US dollars. Note that since the platform currencies have risen a lot, this time the market value is calculated using the average price of each platform currency in 2019 (OKB began to destroy in May, so use Is the average price from May to December):

As mentioned above, considering the significant difference in trading activity between the bull market and the bear market in the digital currency market, the current price is not used to compare with the historical profit of the exchange, but the average price during the record period is BNB: $ 15, HT: $ 3.69 OKB: historical price-earnings ratio of 1.5 USD . Because the overall market in 2019 is mixed, the data is more representative than the obvious bull market.

Considering that the financial derivatives markets such as Binance Exchange's leverage and futures have been opened late, users have higher expectations in 19 years. With the improvement of the products in 2020, the profitability may further increase qualitatively, and thus the price-earnings ratio It is understandable that it is higher than Huobi and OKEX.

The profitability of exchanges mainly comes from transaction fees, so for the three major exchanges, the platform's trading volume is basically equivalent to profitability. In the above statistics, the price-earnings ratio = market value / profit, that is, if you want to keep the price-earnings ratio unchanged, double the market value, you need to double the transaction volume.

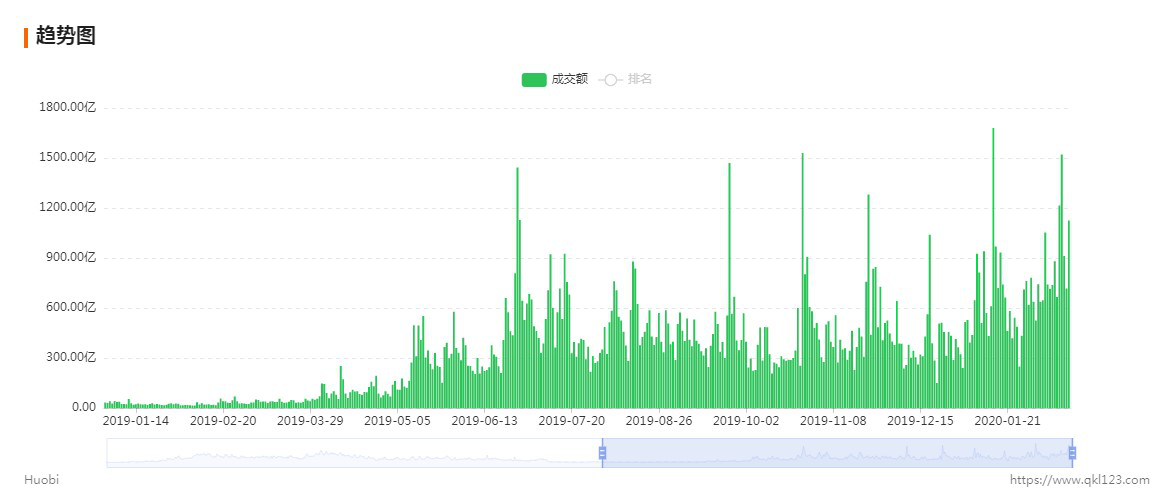

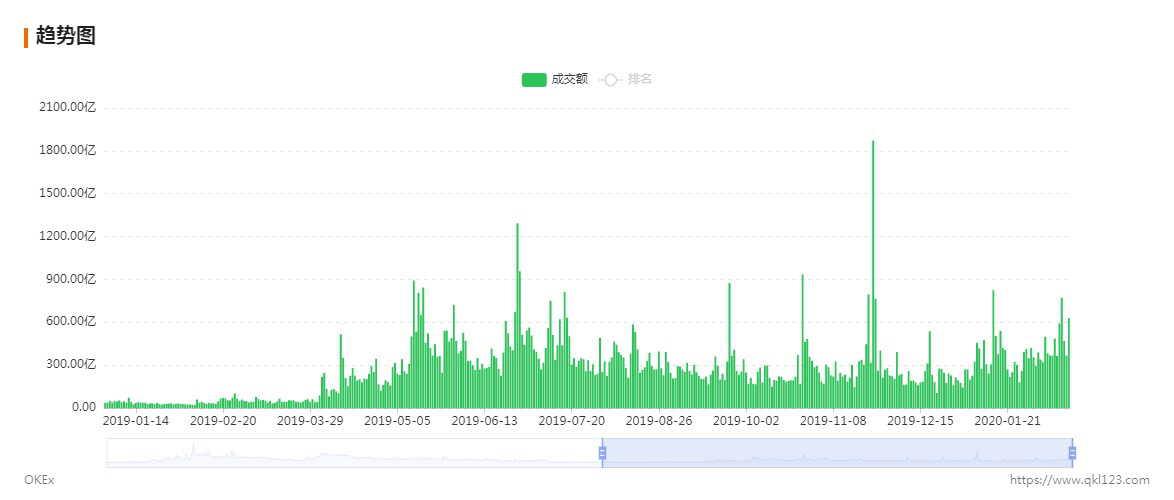

Let's take a look at the trading volume of the three major exchanges since this year (data from QKL123):

Because the futures opened late, only the data of Binance spot is counted here, and no comparison between platforms is made. It can be clearly seen in the figure that the average daily trading volume when trading is inactive in 2019 is about 5 billion, and the average daily trading volume when it is active can reach 10 billion. Since entering 2020, the transaction value has shown a clear upward trend. At present, the average daily transaction value has reached about 15 billion.

Due to the rapid development of the Huobi contract in 19 years, the spot + futures trading volume of Huobi has gradually increased. After 2020, the average value of the trading volume will be directly raised from 30 billion to 60 billion.

OKEX's trading volume has its own pin effect … A pin at the end of 19 made the entire chart look much smaller, and the rising trend of trading volume was not obvious.

The above data are from QKL123 . Users can check the spot and futures transactions of the three exchanges.

In the securities market, the price-earnings ratio of mature brokerage stocks is generally maintained at about 20, and high-growth stocks will be higher. From the above data, it can be seen that since 2020, the average daily trading volume has increased by about 2 times.As the 2019 price-earnings ratio is calculated, the price benchmarks are BNB: $ 15, HT: $ 3.69, and OKB: $ 1.5. The platform currency has increased too much. Like OKB, it has already exceeded this price by 5 times. Based on the transaction amount calculated at 2 times, its price-earnings ratio has increased by 2.5 times to 37. The other two platform currencies are of interest to everyone and can be roughly approximated Go calculate.

In summary, before the platform has no significant incremental business income, I don't think that platform currency can achieve explosive growth like IEO in 19 years, and with the exchange business becoming more and more complete and the market gradually becoming more popular, the platform currency's The price will be closer to its own value.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How to sell a guy who makes money? Is the miner's money coming from the gale?

- DeFi lending agreement bZx suffers a mysterious attack, losing hundreds of thousands of dollars

- Read through the conclusions of the blockchain series: Blockchain is essentially a governance model

- The Ministry of Civil Affairs urges Tencent Ali's epidemic software to be designed using blockchain

- BTC's market capitalization has fallen to a 7-month low. Has the bull market for mainstream currencies come?

- Coin price is too high to store coins? A giant whale with 100-1000 bitcoins can continue to store coins

- Read the overview of China's blockchain policy as of 5 minutes