Annual Report | Verification in 2019: ICO, IEO, STO three cryptocurrency issuance models have all failed

Text: Interchain Pulse · King Go

Source: Interchain Pulse

Editor's note: This article has been deleted without changing the original intention of the author.

In 2019, the three major cryptocurrency issuance models of ICO, IEO, and STO may still have heartbeats, but they are no longer angry.

- Where is the wind blowing in 2020? 20 domestic and overseas institutions and big coffee forecasts in 13 dimensions

- What will happen to the crypto market under the control of "whale"?

- U.S. SEC compliance office's 2020 inspection focus includes digital assets

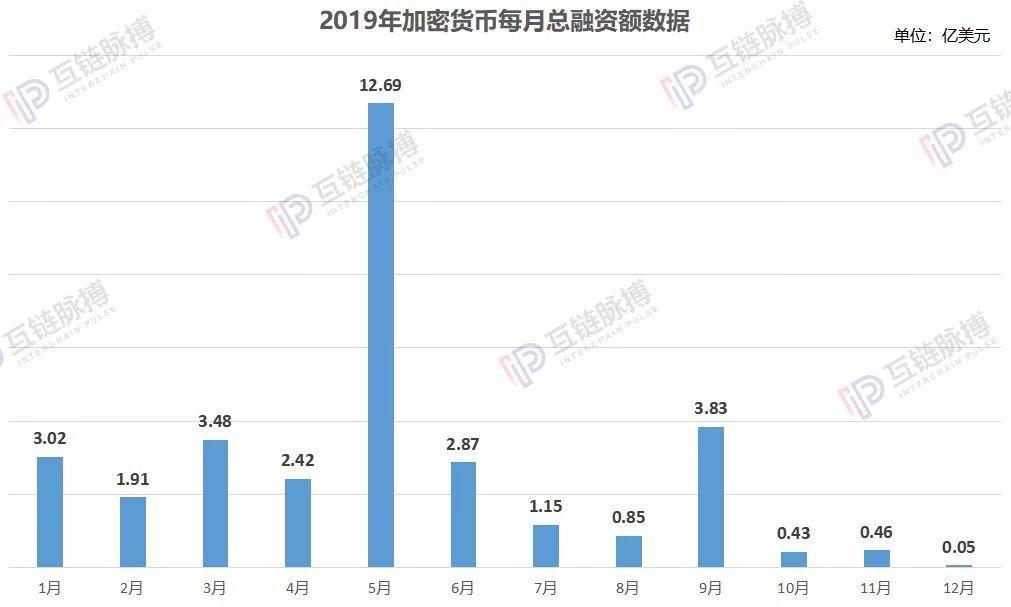

In early 2019, the IEO opened by Binance drove the currency price, and even triggered a bull market. In May, the $ 1 billion project on the Bitfinex exchange pushed the IEO financing to a high point. The market believes that IEO will become the main public issuance method of cryptocurrencies, but by the end of the year, the IEO issued in October and November for two consecutive months was zero, and in December there was only one project financed through IEO.

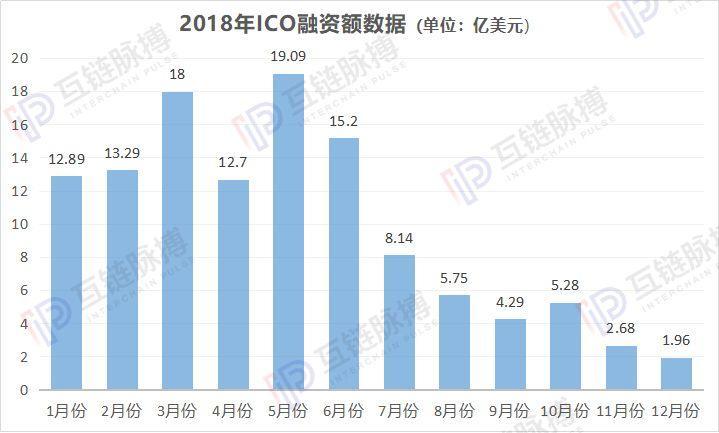

ICO and STO are even worse. According to the statistics of the mutual chain pulse, the total financing amount of ICO, IEO and STO in 2019 is 3.325 billion US dollars, and the financing amount of ICO alone in 2018 has reached 11.927 billion US dollars, a difference of more than three times.

From the perspective of the trend, the three major models in the second half of the year decreased almost monthly. The amount of ICO financing in December 2019 decreased by 98.75% year-on-year compared with the lowest value in December in 2018. The IEO financing amount in December 2019 also decreased by 58.33% compared with January of the same year. It was zero for four consecutive months, and there was only one STO financing project in the second half of 2019.

By the end of 2019, the three models of ICO, IEO, and STO can already fail.

Decline: Cryptocurrency financing totals $ 3.325 billion in 2019, Bitfinex accounts for 30%

Interchain Pulse According to statistics from the CoinSchedule website, the total funding of cryptocurrencies (ICO, IEO, STO) in 2019 is $ 3.325 billion. Among them, the amount of ICO financing accounted for 45.8%, totaling $ 1.523 billion. Compared with 2018's ICO funding of US $ 11.927 billion, it is down 87.23% from the previous quarter.

And because in 2018, IEO, STO and other models have not yet emerged, the amount of ICO financing can also be counted as the total financing amount. In this comparison, the total amount of cryptocurrency financing in 2019 also decreased by 72.12% compared to 2018.

(Mapping: Interlink Pulse Academy Data source: icorating)

(Chart: Interlink Pulse Academy Data source: CoinSchedule)

In addition, it can be seen from the data chart that the monthly financing amount for half a year in 2018 was more than 1.2 billion U.S. dollars, and in 2019, it was only May. The main data source was the cryptocurrency exchange Bitfinex that issued 1 billion USD IEO Project LEO.

Bitfinex announced the official white paper for LEO on May 8. It also stated in the white paper that the background of its launch of the IEO was that Bitfinex urgently needed a working capital while it was frozen by the US government for $ 850 million. According to the white paper, the total number of LEOs issued is 1 billion. The US $ 10 financing amount of this project accounts for 30% of the total amount of financing in 2019. Also with the support of the project's huge amount of financing, the IEO financing amount rushed to a high point, ushering in the final madness.

But after May, the amount of IEO financing has been declining since August. In October and November, the financing amount for two consecutive months was 0; in the last December, there was only one IEO financing project. Although its annual financing amount is 1.692 billion US dollars, accounting for 50.9% of the total financing amount, higher than ICO financing. However, in terms of its performance in the second half of the year, IEO seems to die before ICO.

Although ICO also fell in the second half of the year, in September, the amount of ICO financing reached a high of this year, an increase of 3147.89% from August. This is mainly attributed to the Kinesis project, which totaled $ 193 million, accounting for 51.5% of the ICO financing in September. It is reported that Kinesis is a profitable digital currency based on 1: 1 distribution of physical gold and silver.

(Chart: Interlink Pulse Academy Data source: CoinSchedule)

On the other hand, the first to decline among the three cryptocurrency issuance models is actually STO, whose annual financing amount is only 110 million US dollars, accounting for 3.3% of the total financing amount. This decline was particularly evident in the second half of the year. In the second half of 2019, only one project financed through STO was the TapJets project in August, with a financing amount of US $ 1.5 million. It is reported that the project was initiated by the private jet instant booking platform TapJets. On March 15 this year, the Securities Token (STO) was announced. According to the Coin Schedule, TapJets finally ended STO financing on August 13.

In addition, the STO financing data for the second half of 2019 has been zero for five months and has been abandoned by the market.

Origin: Why did the ICO, IEO, and STO models fail

From the above data, all three cryptocurrency issuance models have failed. Looking back at its development, we can see why.

At the end of 2018, Interchain Pulse pointed out that the year was a watershed in which ICOs turned from prosperity to decline. At that time, there were certain limitations in the ICO model, such as the dishonesty and opacity of the project party, especially the investors' difficulty in grasping the actual situation of the project; the ICO model lacked self-restraint, and the cost of constraint was extremely low; compared with the IPO, ICO credit was extremely low. Therefore, without transformation, the ICO model will not be sustainable.

That is, during this period, the ICO model caused a wave of speculation to erupt and gradually lose momentum, and a new cryptocurrency issuance model appeared.

In September 2018, STO was re-raised and caused a market sensation, known as the next outlet after the ICO. STO is the legal issuance of publicly issued tokens in accordance with the requirements of laws, regulations and administrative regulations under a defined regulatory framework. However, if we observe its financing amount data, it can be seen that its early development has failed to exceed ICO and late development has failed to exceed IEO.

The reason for this is partly because the compliance cost of STO is high and it is difficult to land. Even in the United States where STO is legalized, investors must first be SEC-approved before they can participate. For other countries that are not yet open, the threshold is even higher. On the other hand, its fundraising audience is too narrow, and tokens cannot be listed on mainstream digital currency exchanges, and their liquidity is insufficient.

As the heat of STO dissipates, IEO will soon become a hot spot in 2019. In early 2019, the first project of Binance Launchpad's BTT skyrocketed, and the exchange started the IEO battle. In March, IEO gradually became the first choice for cryptocurrency project financing, and its financing volume rose linearly, more than 15 times. According to the statistics of the research team of the Chain Tower, 88 IEO items emerged in 4 copies, involving more than 40 exchanges; in May, the exchange of Bitfinex's $ 1 billion LEO project pushed the IEO financing to a peak. .

IEO is different from ICO. Financing through the IEO model requires a series of examinations by the exchange before financing, and to a certain extent, it avoids risks for users. But at the same time, there are hidden dangers. If the exchanges are not strict in review and due diligence, inferior projects will flood the market, causing investors damage. Moreover, some inferior exchanges will use the IEO model to collect money together with the project party. Based on this, IEO is gradually declining in the second half of 2019.

In general, there are two reasons for the failure to go from the ICO model to the IEO model. On the one hand is because it has no sustainable value. Taking the traditional stock investment as an analogy, the stock is a "time transaction", using the current property in exchange for the value that the investment subject may generate in the future. The ICO and IEO financing models also have the nature of "time trading", but their financing project entities rarely bring sustainable value. Passive water naturally does not have a long history of energy.

On the other hand, ICO and IEO financing models ignore supervision. The bills and documents represented by the "September 4 Supervision" have repeatedly proposed to regulate cryptocurrency financing. Just in March 2019, when the battle of the IEO of the exchange officially started, the Beijing Mutual Fund Association also issued a risk alert on the issuance of tokens by IFO, IEO and other names to conduct virtual currency speculation. While disregarding supervision, the ICO and IEO models themselves are not sufficiently binding, which has led to the creation of criminal funds and fraud.

Although STO has perfected the problem of regulatory constraints, it still faces the problem of high thresholds and insufficient liquidity. As a result, the three major cryptocurrency issuance models have declined in 2019.

Future: Learning from history 2020 Exploring new models of cryptocurrency issuance

Therefore, it is the focus of 2020 to explore a cryptocurrency issuance model that can meet the multilateral balance of regulatory compliance, efficiency, convenience, and high trust.

Mutual Chain Pulse is concerned that in the past two years, Singapore, Hong Kong, Lithuania and other places have gradually promoted STO supervision, and issued STO issuance guidelines, regulatory rules, guidelines, etc. This aspect reflects that countries are promoting the development of compliant cryptocurrency issuance models.

Cryptocurrencies are less granular and are associated with more subtle scenes. The issuance of cryptocurrencies through the STO model is, after all, too costly, and it is difficult to achieve efficient circulation that is consistent with the application. If the government can launch a new model suitable for digital asset issuance, it may be a future direction.

In addition, Interchain Pulse is concerned about the sustainable development of projects under the ICO and IEO financing model. In 2019, financing methods such as PIP, DAICO, and IMO were proposed.

In August 2019, the blockchain architect of a decentralized exchange proposed a new financing model, the Public Interest Project (PIP). In this model, investors can send funds to a smart contract, and since then, the asset is automatically generated to generate interest, thereby creating a continuous flow of interest funds for the token project. Once the decision is made to withdraw the investment, the investor can also obtain the project's native token equivalent to the pledged interest, so that the investor will only lose the opportunity cost during this period.

In addition, IMO conducts private placement as the project progresses, and the duration of the project usually lasts 3 months, 6 months, one year or more. This method also provides a correction for the project party if there is a problem in the initial fundraising, and at the same time as the project progress also provides an opportunity for the exchange and investors to decide whether to continue investing or exit.

But whether these models work is still to be tested in practice. As a new industry, blockchain is also in the process of continuous exploration. I believe that with the development of the ICO, IEO, and STO, with the development of the industry, the future cryptocurrency issuance methods will be more in line with the needs of the regulatory and market parties.

This article is the original [Interlink Pulse], please indicate the source when reproduced!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Apple aligns with Samsung? The new iPone will have built-in encryption components and private key storage

- Beijing News Review: Squeeze the virtual currency exchange bubble

- Zhongcai Review: Blockchain and fiscal and taxation naturally attract each other, realizing smart fiscal and taxation in a real sense

- Babbitt Column | An interesting perspective, distinguishing between true and false decentralization

- Babbitt Column | Why is the streaming industry the best application scenario for blockchain technology?

- Interview with Chen Weigang: Banking Regulatory Commission strictly forbids banks from providing payment channels for speculation

- IBM and Farmer Connect launch blockchain-based applications: let's learn about the journey of coffee beans