Bank Blockchain Application and Case Analysis Report: Analysis from Patent Perspective, Screening 7 Application Scenarios

Author: Ren Wansheng

Production: Joint release by Zero One Think Tank & Digital Asset Research Institute

Editor's Note: The original title was "Bank Blockchain Application and Case Analysis Report"

Due to the particularity and strong supervision of the financial industry, it is difficult for technology companies to directly obtain the real and comprehensive business pain points and technical needs of financial institutions, which also directly results in that the products and services provided by financial technology companies rarely perfectly meet the needs of financial institutions. .

- Annual inventory: the mainstream of the crypto industry in 2019

- Popular science | Can't tell the difference between electronic money, virtual money and digital money? look here!

- Read through the blockchain series-Blockchain architecture from a business economic perspective

To this end, Zero One Think Tank interprets the financial pain points, technical needs, and solutions of financial institutions from the perspective of patent applications, and uses this information to infer future development trends and also provides a reference for the strategic deployment of technology companies.

This report takes banks as the research object, analyzes the distribution of blockchain technology in the banking industry from the perspective of patents, and screens 7 application scenarios for analysis.

- The report shows that as of December 1, 2019, a total of 15 banks in China have applied for blockchain technology-related patents, and the total number of patent applications has reached 433; the maximum number of patent applications for the three banks are Weizhong Bank, ICBC and Bank of China.

- From the perspective of business and scenarios, digital assets have attracted the most attention from banks. Industrial, agricultural, and medium-sized banks have applied for related patents, and the number of patent applications has reached 17; followed by credit business and supply chain financial business, each with 4 The bank applied for a related patent.

I. The cumulative number of bank blockchain patent applications reached 433

According to the Zero One Think Tank statistics, as of December 1, 2019, a total of 15 banks in China have applied for blockchain technology-related patents, and the total number of patent applications reached 433. The three banks with the largest number of patent applications are Wezhong Bank, Industrial and Commercial Bank of China and Bank of China, with 288, 50 and 40 cases respectively.

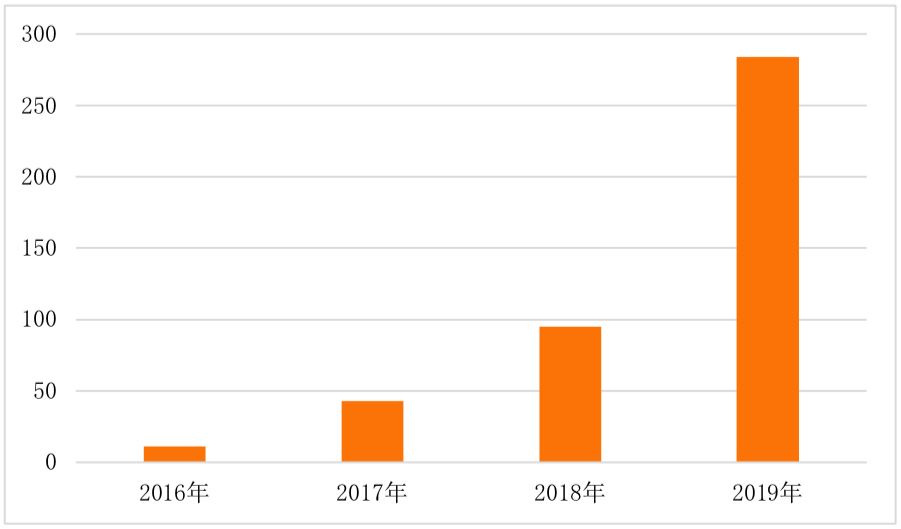

1. From 2016 to December 2019, the number of blockchain patents applied by the banking industry increased from 11 to 433

From 2016 to December 2019, the number of bank blockchain patent applications increased from 11 to 433, the number doubled by about 39 times, and the number of banks participating in blockchain patent applications increased from 2 to 15.

From the time of patent application, China's banking financial institutions applied for blockchain patents as early as 2016. Bank of China and Weizhong Bank have applied for 7 and 4 blockchain patents respectively.

Figure 1: Banks' application for blockchain patents from 2016 to 2019 (unit: case)

Source: WIPO Statistical Database, Zero One Think Tank

With the popularity of the concept of blockchain and the need for digital transformation of banks, the characteristics of blockchain decentralization, traceability, immutability, security and confidentiality have attracted more and more attention from banks. At the same time, it has also attracted some banks to invest time, manpower, and funds to develop the application of blockchain technology in the banking industry. The banking industry applying for blockchain patents has gradually increased from 2 to 15 and the number of patents has increased to 433.

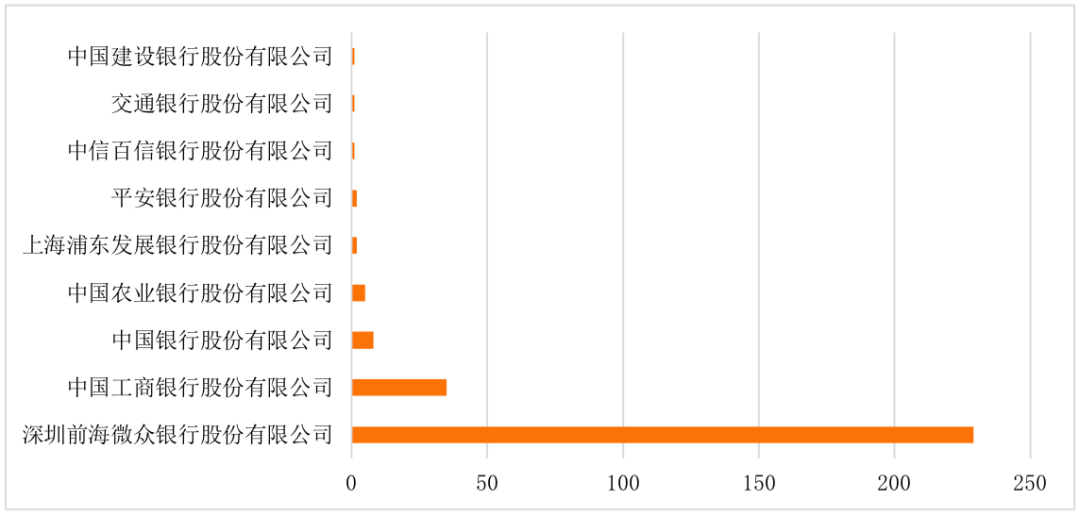

2. From January to November 2019, the banking industry applied for 284 blockchain patents, Weizhong Bank accounted for 81%

According to the statistics of the Zero One Think Tank, as of the end of November, a total of nine banks had applied for blockchain-related patents in 2019, with a total of 284 patents, which is almost a two-fold increase from 2018.

Among them, Weizhong Bank ranked first with 229, accounting for 81% of the total number of new patents in 2019 (January to November); ICBC ranked second, with 35 applications in 2019, accounting for 12%; the number of patent applications of the remaining 7 banks is less than 10.

Figure 2: Bank blockchain patent applications in 2019 (January to November)

Source: WIPO Statistical Database, Zero One Think Tank

Compared with 2018, the number of banks applying for blockchain patents has been reduced from 11 to 9, and the number of blockchain patent applications has increased from 95 to 284, which has become the highest growth year. The large increase in the number of blockchain patents can be attributed to Weizhong Bank. In January-November 2019, a total of 229 blockchain patents were applied for.

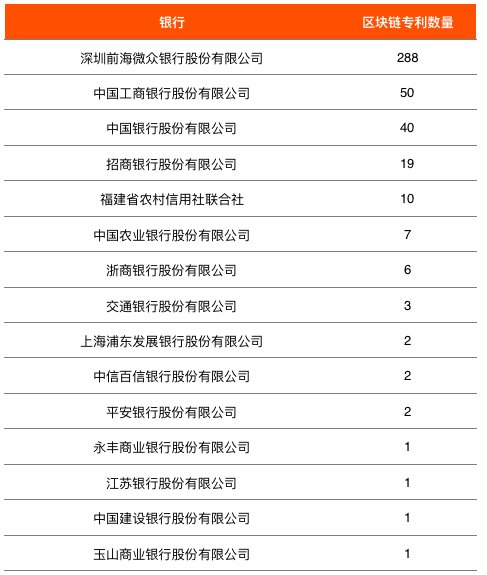

3. Weizhong, ICBC and BOC are the 3 banks with the most patent applications for blockchain in China

As of December 1, 2019, a total of 15 banks in China have applied for blockchain-related patents. The top three banks are Weizhong Bank, Industrial and Commercial Bank of China, and Bank of China.

Table 1: Ranking of Bank Blockchain Patent Applications in November 2019

Source: WIPO Statistical Database, Zero One Think Tank

According to the number of patent applications, it can be divided into three echelons: Wezhong Bank is the only one with more than 100 patent applications; there are 4 patent applications between 10 and 100, which are Industrial and Commercial Bank of China, Bank of China, and China Merchants. Banks and Fujian Rural Credit Cooperatives; there are 10 patent applications under 10.

Patent Map of Bank Blockchain

In order for patent applicants to be able to understand whether the patent applied for is innovative, practical, and unique, they often write the patent technical background, business pain points, technical pain points, solutions, and specific procedures into the patent application. . To this end, this report organizes and counts blockchain technology and application scenarios.

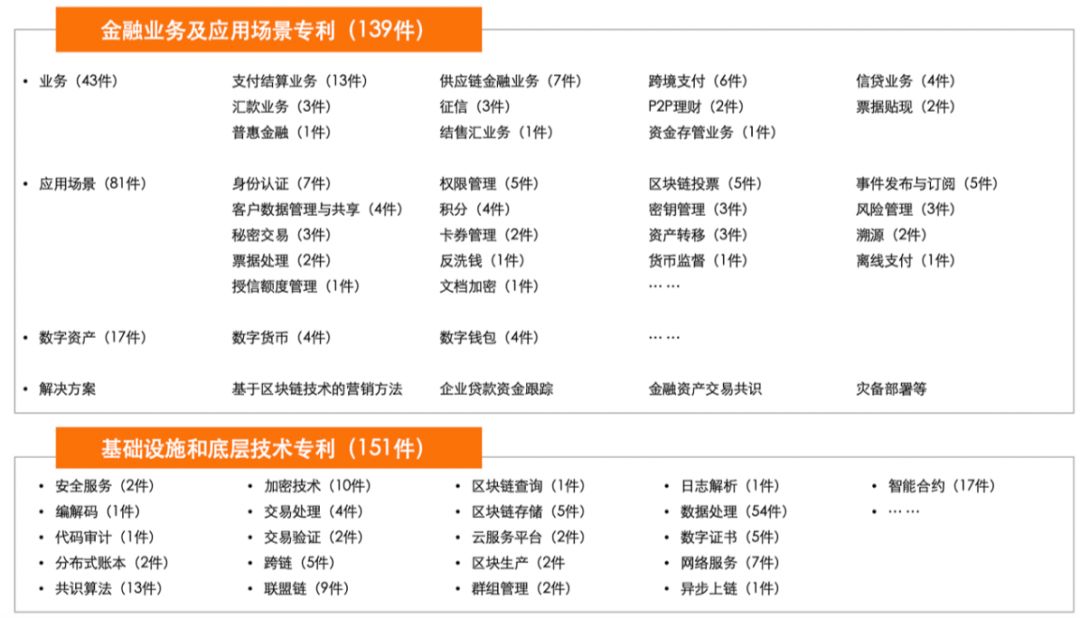

1. There are 139 blockchain patents related to financial business and application scenarios

According to incomplete statistics of the Zero One Think Tank, among the blockchain patents applied by banks, 151 patents are related to infrastructure and underlying technology, and 139 patents are related to financial business and application scenarios.

Figure 3: Distribution of bank blockchain patents

Source: WIPO Statistical Database, Zero One Think Tank

Infrastructure and underlying technology: Data processing is the most frequently occurring technology in patent applications. According to incomplete statistics, the number of patent applications related to data processing reached 54. Among them, data processing includes data storage, data reading, data access, data sharing, data detection, data reduction, data synchronization and other technologies. Secondly, three technologies including smart contracts, consensus algorithms and encryption technologies have appeared in patents more than 10 times.

Financial business and application scenarios: According to the business, blockchain patents can be divided into 11 businesses, of which payment settlement, supply chain finance, and cross-border payment are the three businesses with the most patent applications. The number of patent applications is 13, 7 And 6 pieces. According to the application scenario classification, identity authentication is the application scenario with the largest number of patent applications, with 7 patent applications, followed by rights management, blockchain voting, and event publishing and subscription. The number of patent applications is 5. In addition, there are 17 patents related to digital assets.

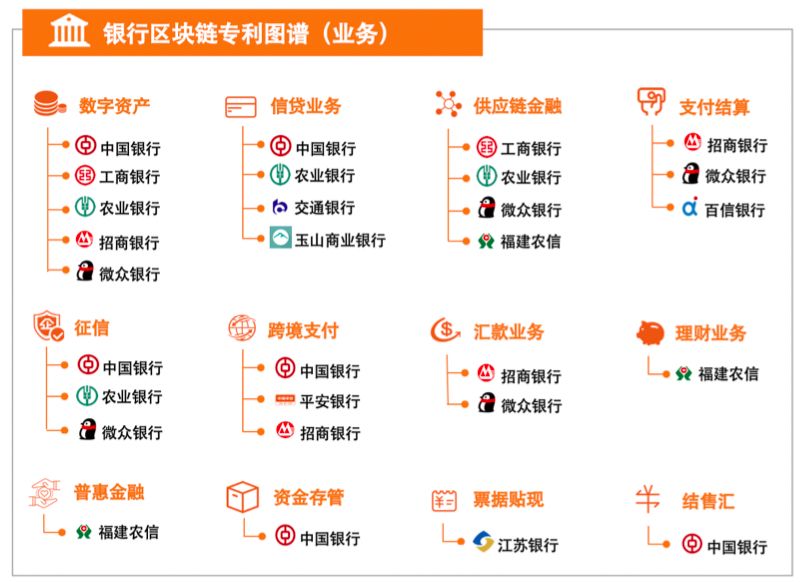

2. Bank Blockchain Patent Atlas (Business)

From a business perspective, digital assets, credit business and supply chain finance are the three areas that attract the most attention from banks. Five banks have applied for patents related to digital assets, including three large state-owned banks such as Bank of China, Industrial and Commercial Bank of China and Agricultural Bank of China. Credit business and supply chain finance business have applied for 4 patents respectively.

In addition, payment settlement, credit reporting, and cross-border payment are also the application scenarios that banks are more concerned about, and they have applied for 3 patent banks in these fields.

Figure 4: Bank Blockchain Patent Atlas (Business)

Source: WIPO Statistical Database, Zero One Think Tank

- Relying on its quantity advantage, Weizhong Bank is in a leading position in business distribution. Its blockchain patents cover digital assets, supply chain financial services, payment settlement services, credit reporting and remittance services.

- Bank of China's blockchain patents cover digital assets, credit services, credit reporting, cross-border payments, fund depository and foreign exchange settlement and sales.

- ICBC's blockchain patents are mainly focused on digital assets and supply chain financial services.

3. Bank Blockchain Patent Atlas (Application Scenarios)

From the perspective of application scenarios, identity authentication, blockchain voting and asset transfer are the three scenarios that banks are currently most concerned about. Followed by points management, blockchain traceability, secret transactions, risk management and bill processing.

Figure 5: Bank blockchain patent map (application scenario)

Source: WIPO Statistical Database, Zero One Think Tank

Case analysis of 7 banks' blockchain patent application scenarios

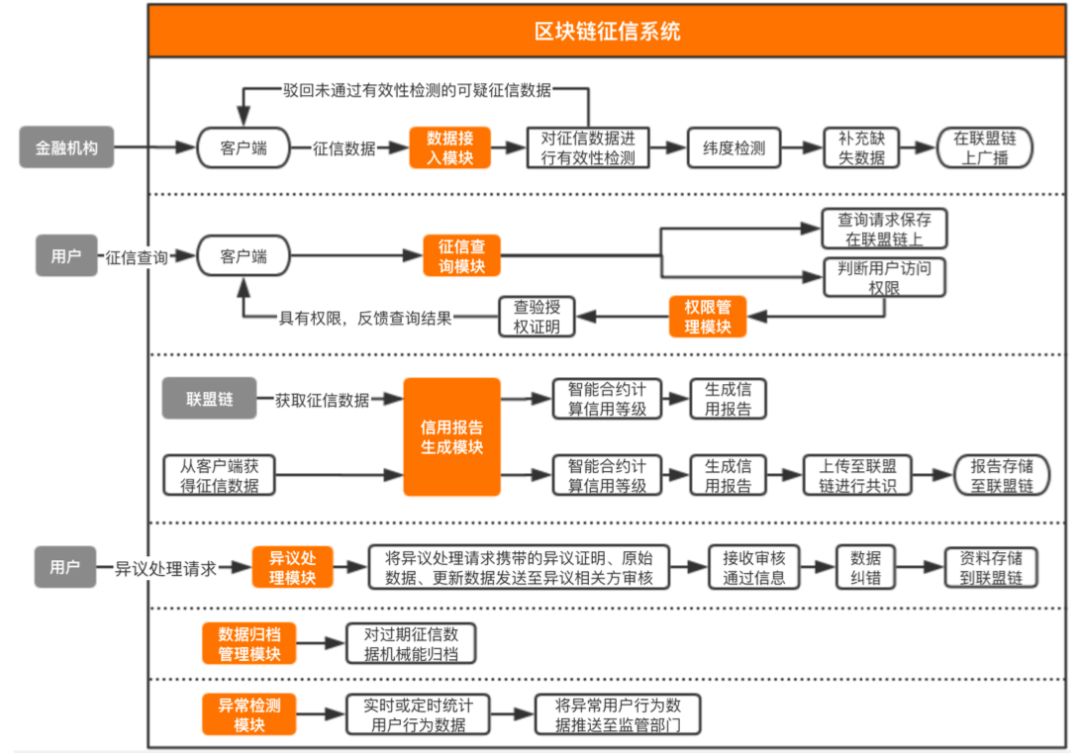

1. Agricultural Bank: Blockchain technology solves single point of credit failure

The current credit reporting system has a single point of failure. Once the credit reporting system has abnormal service, data loss, or loss, it will directly affect the normal operation of the entire credit reporting system.

To this end, Agricultural Bank invented a credit information system based on blockchain technology, which can avoid single point of failure caused by the centralized credit information system through the alliance chain, which can effectively reduce the risk management cost of the bank.

The system consists of 7 modules, which are a data access module, a credit report generation module, a credit inquiry module, a permission management module, an objection processing module, a data archive management module, and an anomaly monitoring module.

Figure 6: Agricultural Bank's Blockchain Credit Reporting System Model

Source: Zero One Think Tank, Patent Application

Among them, the data access module is responsible for performing validity detection and consensus on the uploaded credit information, preprocessing the detected credit data, supplementing the missing data and storing it in the alliance chain;

Credit report generation module, calculates credit level through smart contract, generates credit report, and stores the consensus report into the alliance chain;

Credit inquiry module, which mainly receives user credit inquiry query and stores the request record on the alliance chain;

Objection processing module, which receives the objection processing request sent by the user and performs data correction;

Data archive management module to archive expired credit data;

The abnormality monitoring module collects real-time or regular user behavior data and pushes abnormal user behavior data to the regulatory department.

In addition, the system can support payment institutions as nodes to join the alliance chain, and the payment institutions upload their business data to the blockchain credit reference system, which enriches bank credit reference data and improves the reliability of credit reference data.

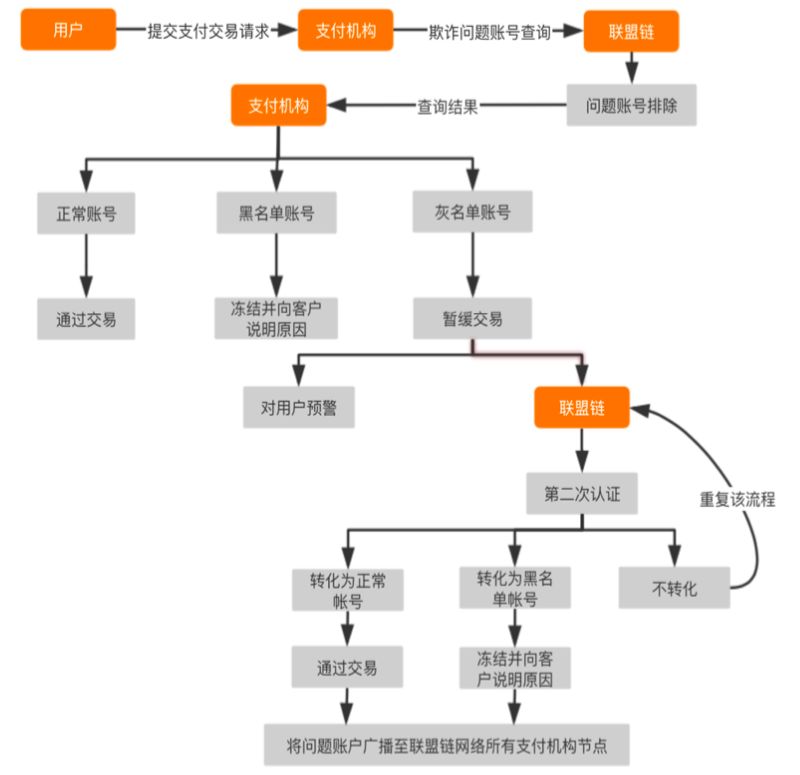

2. Bank of China: Using blockchain technology to solve online transaction fraud

At present, network telecommunications fraud is increasing, causing serious losses to users' property. Because the anti-fraud systems of banks and payment institutions are independent, when encountering the problem of online transaction fraud across payment institutions, it is difficult for banks to identify effectively and to provide users with early warning of risks.

Figure 7: Bank of China online transaction fraud solution

Source: Zero One Think Tank, Patent Application

To this end, Bank of China uses the blockchain technology to form an alliance chain and investigates problematic accounts through the alliance chain. The specific steps are:

1) The public security organ, the industry supervision department and the payment institution will screen out the problem account and formulate the criteria for determining the problem account. Problem accounts are divided into blacklist and graylist accounts; blacklist accounts are accounts that have been fraudulently traded. Greylist accounts are unfamiliar accounts and high-risk accounts.

2) Package these problem accounts into blocks and broadcast them to all payment institution nodes in the alliance chain network.

3) When a user requests a transaction across payment institutions, the bank uses the alliance chain to check the accounts of both parties in the transaction. If the account is a normal account, the transaction is directly passed; if the account is a blacklisted account, the blacklisted bank account is temporarily frozen and the reason is explained to the user; if the account is a graylisted account, the user is warned in the form of text messages or prompts , At the same time, the user performs the second risk confirmation and identity authentication.

4) After the second authentication is completed, the alliance chain will make a second judgment on the account, and convert the gray list account into a normal account and a black list account. If the judgment result is a normal account, the transaction is passed and the account is converted into a normal account; if the judgment result is a blacklist account, the account is frozen, the graylist account is converted to a blacklist account, and the reason is explained to the user; if the judgment result is If the account is still graylisted, repeat the above graylist processing steps.

5) The gray list account is converted into a normal account and a black list account, and this information will be broadcast to all payment nodes in the blockchain alliance network.

In this aspect, the problematic account is investigated by establishing an alliance chain to improve the bank's anti-fraud identification ability and risk management ability. Identify problem accounts through rule contracts, improve the efficiency of fraud event identification, and reduce operational risks caused by humans; package problem accounts into blocks and broadcast them to the alliance chain network, promote the sharing of data and information, and solve data silos between payment institutions Problem; real-time risk warning to users to increase user awareness of risk prevention.

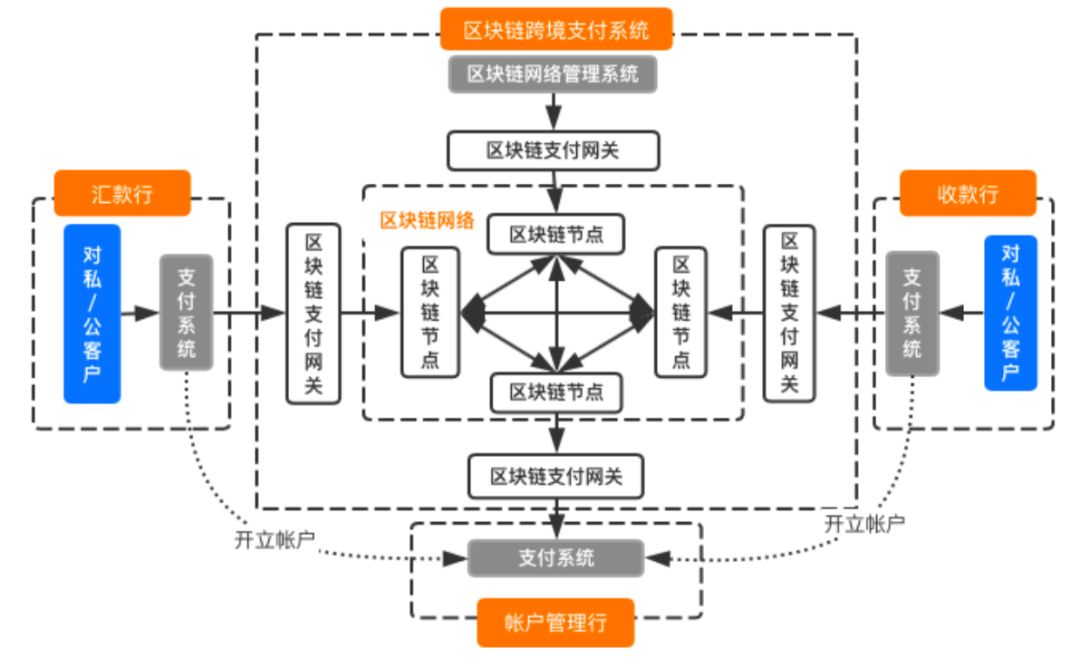

3. Bank of China: Cross-border payment method based on blockchain payment system

The current cross-border payment business is based on the SWIFT agency model for transactions, but there are the following pain points: the cross-border payment business needs to go through multiple agency banks, the payment path is too long, and the efficiency is low; due to the time difference between banks or during holidays, As a result, cross-border payments take a long time; cross-border payments need to pay fees to correspondent banks, increasing costs; lower write-off rates; and inability to query transaction status in real time.

Bank of China has developed a blockchain cross-border payment system based on blockchain technology. The system consists of a blockchain network, a blockchain payment gateway, and a blockchain network management system. The blockchain network includes multiple blockchain nodes; the blockchain payment gateway is responsible for connecting the blockchain nodes, the blockchain network management system, and the participating bank payment system, and receiving and accessing payments submitted by ordinary bank payment systems. Data; The blockchain network management system is responsible for receiving requests for account opening from participating banks, authorizing participants to act as ordinary banks or account management banks, and to open blockchain escrow accounts and blockchain accounts.

Figure 8: Cross-border payment system architecture of Bank of China's blockchain patent

Source: Zero One Think Tank, Patent Application

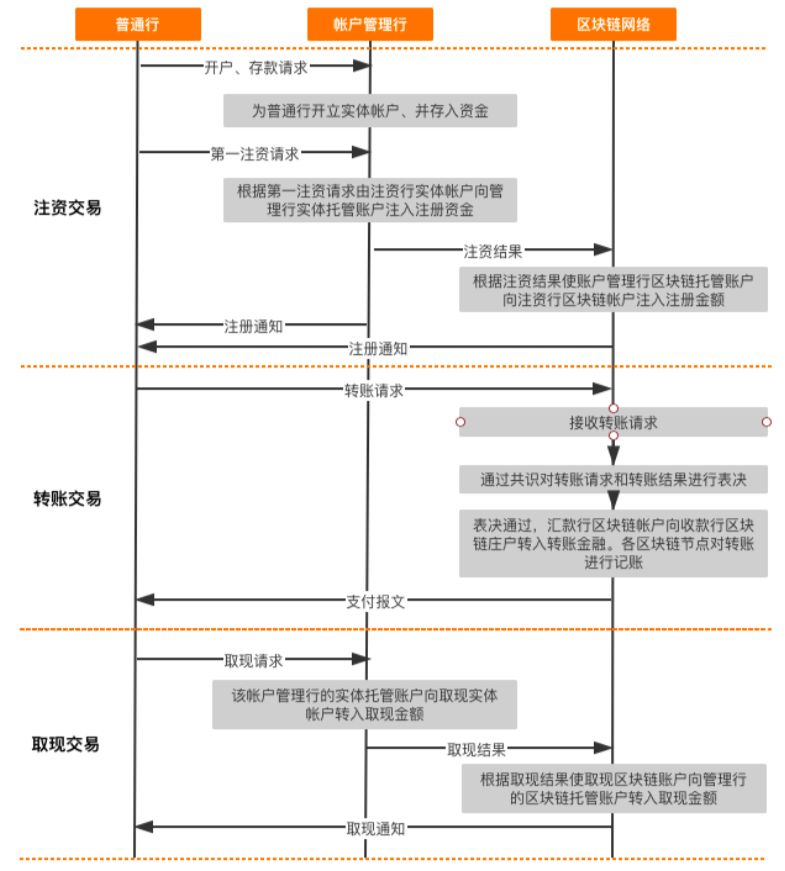

The specific payment method is divided into 3 processes, the registration transaction process, the transfer transaction process, and the cash withdrawal transaction process.

Registration transaction process: The ordinary bank sends a capital injection request to the account management bank, and the account management bank injects the physical account of the capital injection bank into the physical escrow account and updates it to the blockchain network; the blockchain network updates the blockchain based on the capital injection result The escrow account injects the injected capital into the injection bank's blockchain account.

Transfer transaction process: The remittance bank records the customer account and the blockchain account of the remittance bank according to the transfer request initiated by the remittance customer, and sends the transfer request to the blockchain network; each node of the blockchain network uses a consensus algorithm to transfer the request Vote with the transfer result. If the vote is passed, the blockchain account will be transferred to the receiving bank's blockchain account and the payment message will be sent to the receiving bank.

Cash withdrawal transaction process: the account management bank receives the cash withdrawal request sent by the ordinary bank, transfers the physical custody account of the account management bank to the current physical account, and updates the cash amount to the blockchain network; the blockchain network sends the account management bank The amount of cash transferred from the blockchain escrow account.

Figure 9: Cross-border payment transaction flowchart of Bank of China's blockchain patent

Source: Zero One Think Tank, Patent Application

Compared with the cross-border payment of the SWIFT agency model, the blockchain cross-border payment system has the following advantages: point-to-point transactions between the remittance bank and the beneficiary bank, eliminating the time and capital costs caused by the agent bank, and increasing inter-bank Cross-border payment efficiency; support 7 * 24 time transactions, not affected by time difference and holidays; real-time cancellation of transactions through the distributed ledger of the blockchain; support real-time query of transaction transfer status; can ensure the security of data storage and prevent the risk of data leakage; Promote data sharing and improve work efficiency through the blockchain network.

4. Weizhong Bank: Debt collection based on blockchain technology

In our country, debt collection through court arbitration has become one of the main methods of bank collection. However, the current arbitration process mainly includes a series of conventional steps such as submitting to arbitration, adjudicating by the arbitral tribunal, collecting evidence, adjusting according to previous rules, presenting evidence in court, and organizing a court ruling, which are time-consuming and inefficient.

To this end, Weizhong Bank has developed a debt collection system that automates and collects debt collection based on blockchain technology. The system is based on blockchain smart contracts, consensus algorithms and other technologies to automatically trigger arbitration processes, reducing manual intervention, simplifying the collection process, and improving collection efficiency.

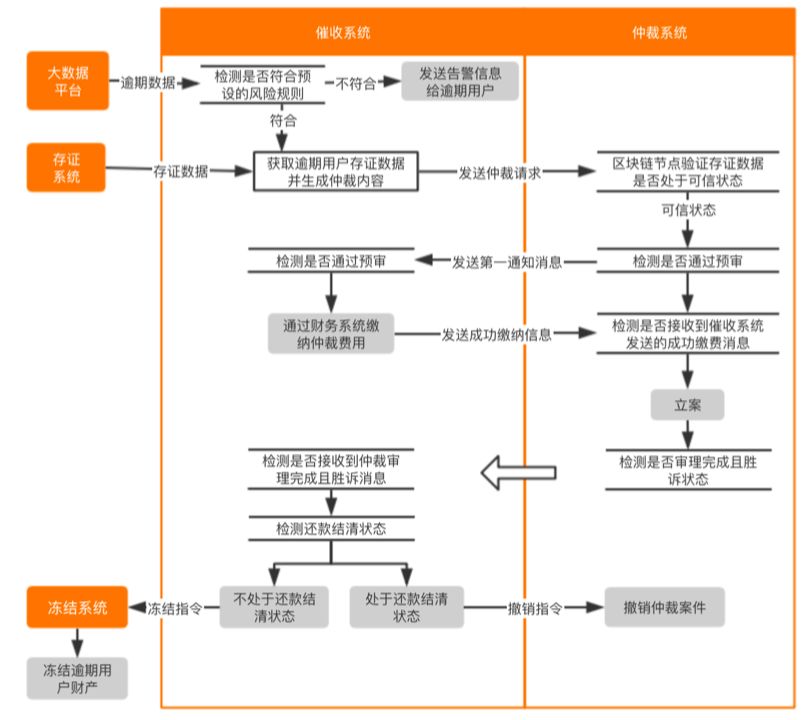

When the system finds that the user's loan is overdue, it can automatically judge whether to arbitrate according to the rules; automatically generate the arbitration content based on the overdue data and the blockchain node's certificate data and send it to the arbitration system; automatically pay the arbitration fee; Carry out debt collection requests and automate arbitration cases.

Figure 10: Arbitration collection flowchart of Weizhong Bank's blockchain technology

Source: Zero One Think Tank, Patent Application

This system is also connected with collection system, arbitration system, certificate storage system, freezing system and big data platform, which can realize the whole process management of arbitration collection. Among them, the big data platform will regularly calculate the overdue interest of overdue users in the loan system, and send the overdue interest and overdue information to the collection system.

The collection system is responsible for detecting whether overdue users are blacklisted users. The deposit certificate system is responsible for storing loan contract documents, repayment schedules, face verification data when loans, loan commitments, and telephone recordings. The arbitration system is responsible for real-time reminding of the progress of the arbitration. An online arbitration tribunal can also be established to confront the parties through the arbitration system. The freezing system is responsible for asset freezing.

The specific process is:

1) The collection system receives overdue data issued by the big data platform and detects whether the overdue data meets the preset risk rules; if the overdue data meets the risk rules, it obtains the corresponding certificate of overdue data from the blockchain node of the certificate storage system Data, and generate arbitration content based on documented data and overdue data; if the risk rules are not met, an alert message is sent to the overdue user.

2) The collection system sends the arbitration content to the arbitration system and checks the progress of the arbitration hearing;

3) After receiving the arbitration request, the arbitration system will verify whether the certificated data is in a credible state and meets the filing conditions through the blockchain node; if the certificated data is in a credible state, it passes the pre-trial and sends information to the collection system And check whether the collection system has successfully paid the arbitration fee

4) After the collection system receives the pre-trial approval information, it will pay the arbitration fee through the financial system. If the collection system does not receive the information within the specified time, the collection system determines that the arbitration case does not meet the conditions for filing. ;

5) The arbitration system receives the payment information, files the arbitration case, and checks whether the case is completed and in a successful state;

6) If the collection system receives the arbitration victory, it will detect the repayment settlement status; if it is in the repayment settlement status, it will trigger the revocation order to cancel the arbitration case; if it is not in the settlement status, it will trigger the freezing instruction and will freeze the instruction Send to the freezing system to freeze overdue user property.

5. Fujian Rural Credit: Simplified poverty alleviation loan process based on blockchain technology

At present, China's poverty alleviation loans have pain points such as complex processes, asymmetric information, low data credibility, and difficult supervision. Compared with ordinary loans, poverty alleviation loans involve government departments at all levels, which need to integrate the processes of different departments; and also need to evaluate and judge user borrowing needs, repayment ability, repayment willingness, and whether they are poor households; In addition, it needs to be linked through the bank loan system, financial system, poverty alleviation loan management system and other systems to confirm the progress of loan approval and loan progress.

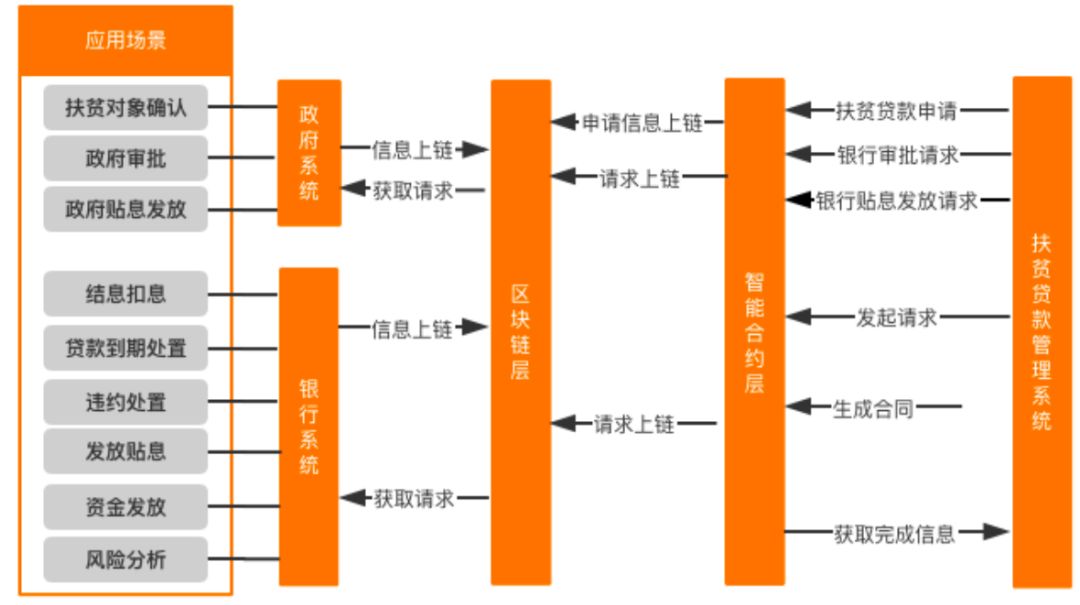

To this end, Fujian Rural Credit has invented a poverty alleviation loan management system based on blockchain technology, which has significantly improved precision poverty alleviation, loan processes, and regulatory supervision.

Figure 11: Poverty Alleviation Loan Solution of Fujian Rural Credit Blockchain

Source: Zero One Think Tank, Patent Application

First, the system broke through the data barriers with various government systems and banking systems, and saved the data of each system in the blockchain network. Banks can directly obtain customer data scattered between various departments through the blockchain network, which promotes data sharing between financial institutions and government departments. In addition, based on the characteristics that the blockchain is not tamperable and traceable, it can ensure the authenticity, security, timeliness and comprehensiveness of the data, effectively reduce the difficulty of the bank's poverty alleviation loan business, and improve the accuracy of poverty alleviation loan user identification.

Secondly, the system uses smart contracts to simplify the review process and issuance of poverty alleviation loans, increase the speed of loan approval and fund disbursement, and onlineize and automate loan operations. Based on smart contracts, Fujian Rural Credit Co., Ltd. has added loan approval process contracts, loan management contracts, and poverty alleviation loan interest application contracts to the poverty alleviation loan management system. Users can trigger smart contracts when they apply, and the system automatically collects them on the blockchain network. Organize and analyze user data.

In addition, the system also provides data acquisition interfaces for government departments. Government departments can monitor the information flow, capital flow, and approval flow of the poverty alleviation agent process through the blockchain network. Government departments can learn about the progress of loans through this system, and supervise and manage violations and laws during the loan process.

6. Fujian Rural Credit: Product Marketing Based on Blockchain Technology

The current marketing methods of banks can use the big data analysis platform to screen out potential customers for related financial products or services. However, in practical applications, due to regulatory requirements, the bank's marketing methods are subject to many restrictions. To a large extent, customers still need to come to the bank outlets or account managers to go to market; telephone, SMS, email and other marketing methods are subject to regulatory requirements. The effect is not ideal.

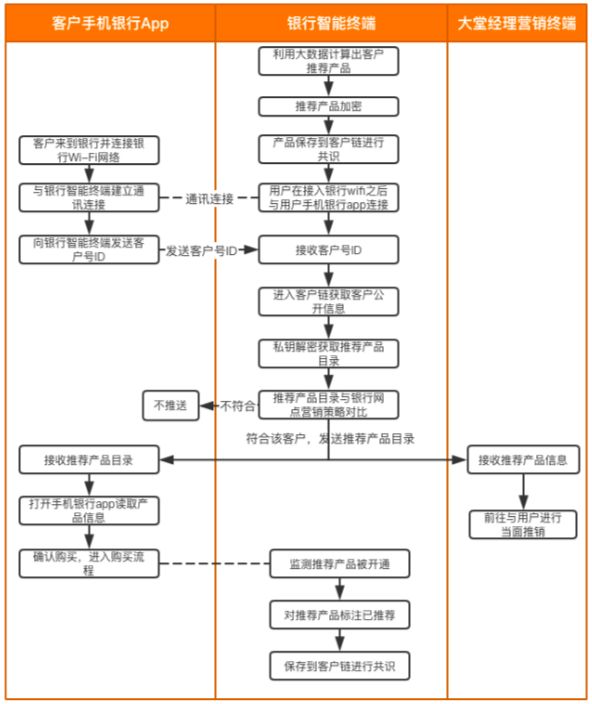

Based on the blockchain and the Internet of Things technology, Fujian Rural Credit has invented a marketing method that uses blockchain to target customer marketing and open customer marketing between IoT devices, which can improve bank marketing accuracy, effectiveness, and convenience.

Figure 12: Intelligent Marketing of Fujian Rural Credit Blockchain Patent

Source: Zero One Think Tank, Patent Application

The specific method is: establishing an advertising chain and a customer chain in the network structure between the blockchain participants; establishing a customer chain ledger and an advertising chain ledger respectively on the two blockchains; sponsored by the financial blockchain alliance Establish and save the advertising credit general ledger, and be responsible for advertising credits; Fusion of the Internet of Things and blockchain for targeted customer marketing and open customer marketing.

This article only describes how banks use IoT and blockchain technology for targeted customer marketing. The specific steps are:

First, the bank will calculate the customer corresponding to the financial product or service based on the big data technology, and use the blockchain encryption technology to encrypt and save the customer's recommended product to the customer chain for consensus. After the customer enters the bank and connects to the wifi network of the bank branch, the bank app in the customer's mobile phone will automatically establish a communication connection with the bank's smart terminal.

After that, the bank obtains the customer's public information and the customer's recommended product catalog through the blockchain based on the customer number ID sent by the mobile banking app. Whether the bank compares the recommended product catalog with its own outlet marketing strategy. How to comply, the bank sends the recommended product catalog to the customer's mobile banking app and lobby manager marketing terminal. If not, the smart terminal cancels the push.

After the customer receives and purchases the recommended product, the bank's smart terminal will mark the recommended product to avoid duplicate marketing, and at the same time save it on the customer chain for consensus.

The patent is based on blockchain technology and has created a new marketing model for banks, which can avoid the problems of traditional marketing methods. The marketing model that interconnects the customer chain and the advertising chain can further achieve the purpose of precise marketing by the bank. Targeted marketing based on the Internet of Things and blockchain technology makes the marketing model more accurate and timely. Advertising through advertising points can effectively prevent the sending of mattress wool time.

In addition, the recommended product catalog is stored in the blockchain, and information can only be obtained through bank terminal equipment, which can effectively protect data security and avoid data leakage risks.

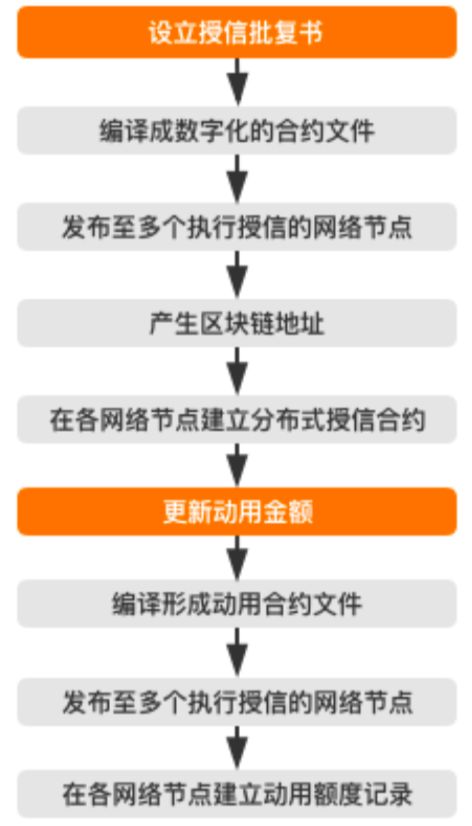

7. Yushan Commercial Bank: Quota authorization management based on blockchain technology

At present, multinational corporations can apply for cross-border credit grants when they encounter funding needs, expand the use of corporate credit lines abroad, and enable overseas businesses to be supported by credit grants. When a bank authorizes an overseas company, it is extremely inconvenient to check cross-border quotas because the credit lines and utilization information of branches at home and abroad are stored in their respective systems.

And the cross-border mobile business mainly relies on traditional communication methods such as email and telephone for confirmation, which increases the difficulty of credit line management. To this end, Yushan Commercial Bank invented a patent that uses blockchain technology to implement a credit line management method.

Figure 13: Cross-border credit line management for blockchain patents of Yushan Commercial Bank

Source: Zero One Think Tank, Patent Application

First, a private blockchain network is established by the bank, with branches around the world as nodes performing credit granting. Each node runs the same consensus software program, distributedly stores credit line approval books and credit line data, and records all historical utilization record information, and encrypts the information based on encryption technology.

Then, users can set up credit approval letters, add cross-border sharing quotas, establish cross-border sharing quota approval letters, etc. at the bank's head office, branch or branch. The node system compiles the credit approval letter into a digital contract file, packages it into blocks, and distributes it to multiple nodes that perform credit granting.

When a user grants a credit line in an overseas branch or branch, the usage record is compiled into a digital contract file, which is packaged into a block and released to multiple credit nodes.

This method not only improves the utilization rate of corporate credit lines and relieves cash flow pressure; it also improves the bank's ability to manage cross-border lines.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Technical Interpretation | Full Analysis of Polkadot Cross-chain Solution

- "2020 Legal Industry Blockchain Development Report" released: What are the potential opportunities for blockchain policies and law firms?

- 14 insurance companies join insurance risk control blockchain platform industry expect application results to accelerate landing

- People's Daily articles: digital currency, how much do you know

- On the Network Effect and Ecological Effect of Blockchain

- Professor of Tongji University: How Blockchain Keeps Being Innovative

- Perspectives | Digital currency opens a new global financial track