Battle for Singapore's Digital Bank License: 21 Ants, Xiaomi, Tencent, Headlines, etc. Who Can Win?

Author: Li Wei

Production: Zero One Think Tank

Xiaomi Finance announced that it has applied for a Singapore Digital Banking license. On January 7, 2020, according to Xiaomi Group's disclosure, AMTD Group, New Energy Group, Xiaomi Finance and FundingSocieties (collectively referred to as the "Union Party") jointly announced the establishment of an exclusive strategic partnership. Japan has formally applied to the Monetary Authority of Singapore (hereinafter referred to as the “Singapore Monetary Authority”) to initiate the establishment of a Singapore digital wholesale bank.

Ant Financial, Tencent and Toutiao are all fancy digital banking licenses. Earlier, on January 2, 2020, Ant Financial stated that it had applied for a digital wholesale banking license from the Singapore Monetary Authority to further promote the development of inclusive financial services worldwide. At the same time, Toutiao and Sea Limited, a Southeast Asian e-commerce company invested by Tencent, also said that they would compete for this license to expand the inclusive financial business opportunities in Southeast Asia.

- Viewpoint 丨 Restore the truth of African blockchain, an overview of African blockchain

- The EU Anti-Money Laundering Order No. 5 has officially entered into force. What impact will it have on the crypto field?

- Ethereum 2.0 final specification released! A key step away from going online in 2.0 years

Southeast Asian countries such as Malaysia and the Philippines attach great importance to digital banking. Not only Singapore, but also other Southeast Asian countries. In early 2020, the government and regulators successively proposed to promote the construction of digital banks, introduce e-commerce platforms, communication service providers, Internet car agencies and even major consortia to launch innovative digital banking services. To build a more diversified financial ecosystem.

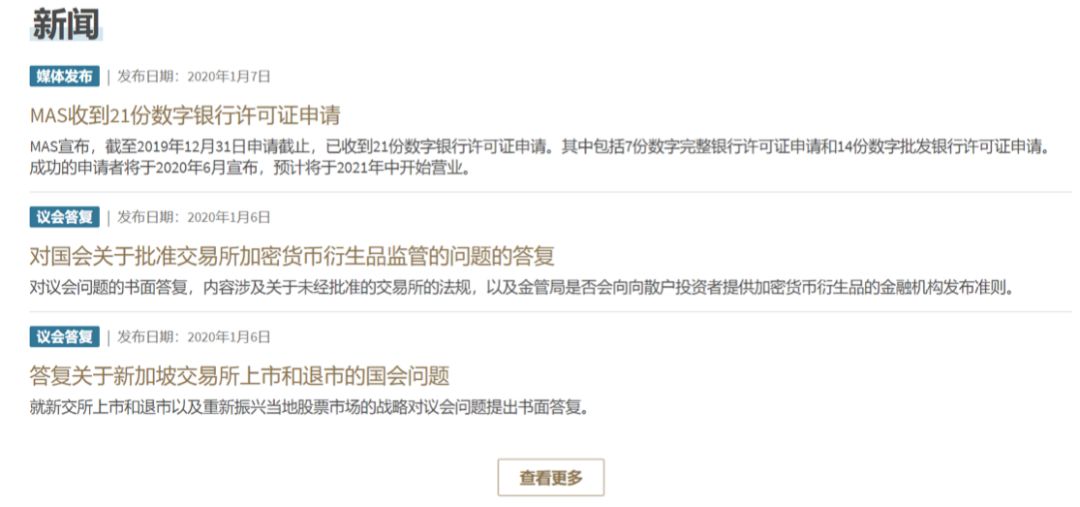

In early January 2020, the official website of the Monetary Authority of Singapore disclosed that as of December 31, 2019, 21 digital banking license applications had been received. Specifically, it includes 7 applications for digital full bank licences and 14 applications for digital wholesale bank licenses. Among the 21 applicants, a maximum of 5 digital banking licenses will be issued, and many Internet giants in China are scrambling to grab this "gold mine" market.

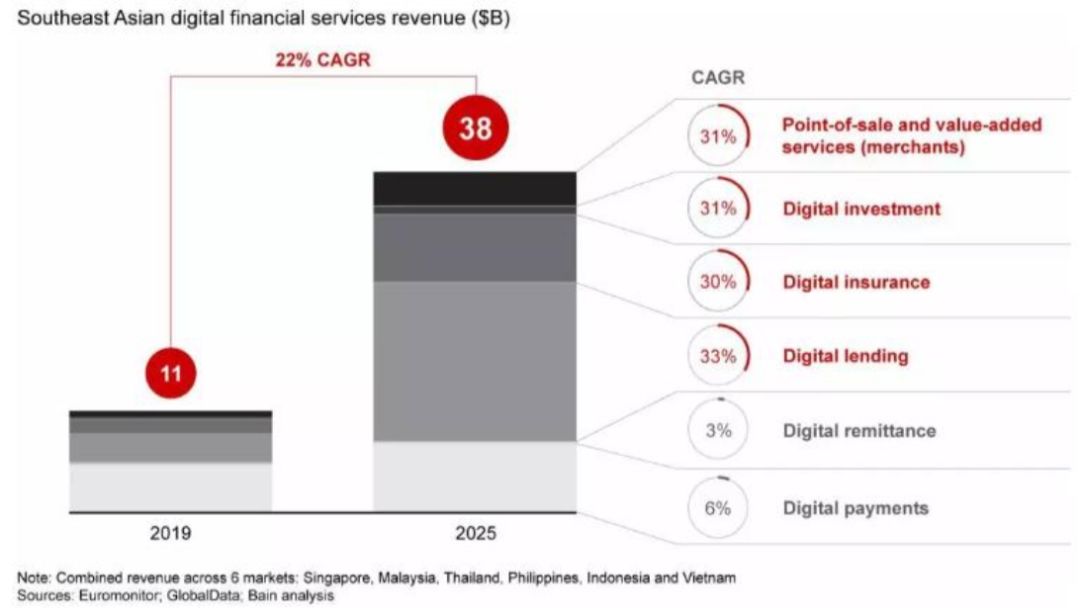

Southeast Asia is known as one of the regions with the most potential for development in the world. Especially in the development of financial technology, the market predicts that digital financial services revenue in Southeast Asia in 2025 is expected to exceed 38 billion U.S. dollars. After entering 2020, many Internet giants in China will accelerate their overseas market deployment, and will further promote the development of consumer credit, micro-finance and mobile payment services, thereby building a global and diversified inclusive financial product innovation system.

I. 21 applications: Why is the competition for digital banking licenses fierce?

The Monetary Authority of Singapore announced that 21 companies have applied for digital banking licenses. In the bidding process, the active participation of heads of multi-industries such as e-commerce companies, technology and telecommunications companies, fintech companies (such as crowdfunding platforms and payment service providers) and financial institutions. Which companies are these 21 institutions composed of? Null one think tank browsed the official website of the Singapore Monetary Authority and found that the specific list was not disclosed, but from the expressions of domestic fintech companies, they can judge their license application claims and main participants.

(I) Appeal for License

The core reason for China's fintech companies and local Singapore companies to compete for digital banking licenses is that Singapore, as an important base for the development of fintech in Southeast Asia, has frequent trade and economic cooperation with China, which is a good opportunity for China to export technology and expand its overseas customer base. . The launch of digital banking licenses is Singapore's largest banking liberalization in 20 years. It has a forward-looking impact internationally and will make it possible for online banks that can operate at lower costs and provide services different from existing ones.

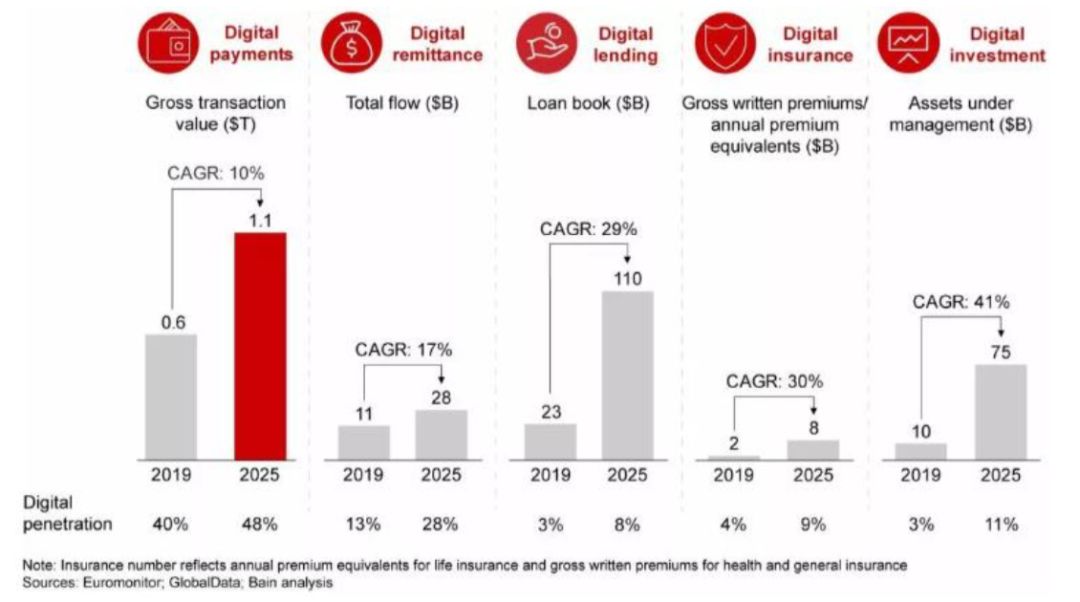

Temasek Holdings Singapore, Google, and Bain, an international management consulting firm, issued a report entitled "Fulfilling its Promise—The Future of Southeast Asia's Digital Financial Services Industry" at the end of October 2019. The research object of this report covers six major markets in Southeast Asia, namely Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam, and states that "Southeast Asia is one of the largest and fastest growing regions in the world. With the help of smartphones, Will promote more consumers to use embedded financial services. "

Figure 1: Comparison of the scale of digital economic services development in Southeast Asian countries in 2019 and 2025

Source: Southeast Asian Digital Financial Services Report

The report pointed out a set of core data-by 2025, digital financial services in Southeast Asia will generate approximately $ 38 billion in revenue annually, of which the lending industry will account for about half, mainly driven by consumer loans and financing of SME operating funds. . At the same time, in terms of market size, digital payments in Southeast Asia will exceed the US $ 1 trillion mark in 2020, and digital lending, insurance, and investment are growing at a rate of more than 20% per year.

Figure 2: Comparison of the proportion of digital financial services revenue in Southeast Asian countries in 2019 and 2025

Source: Southeast Asian Digital Financial Services Report

(B) the main participants

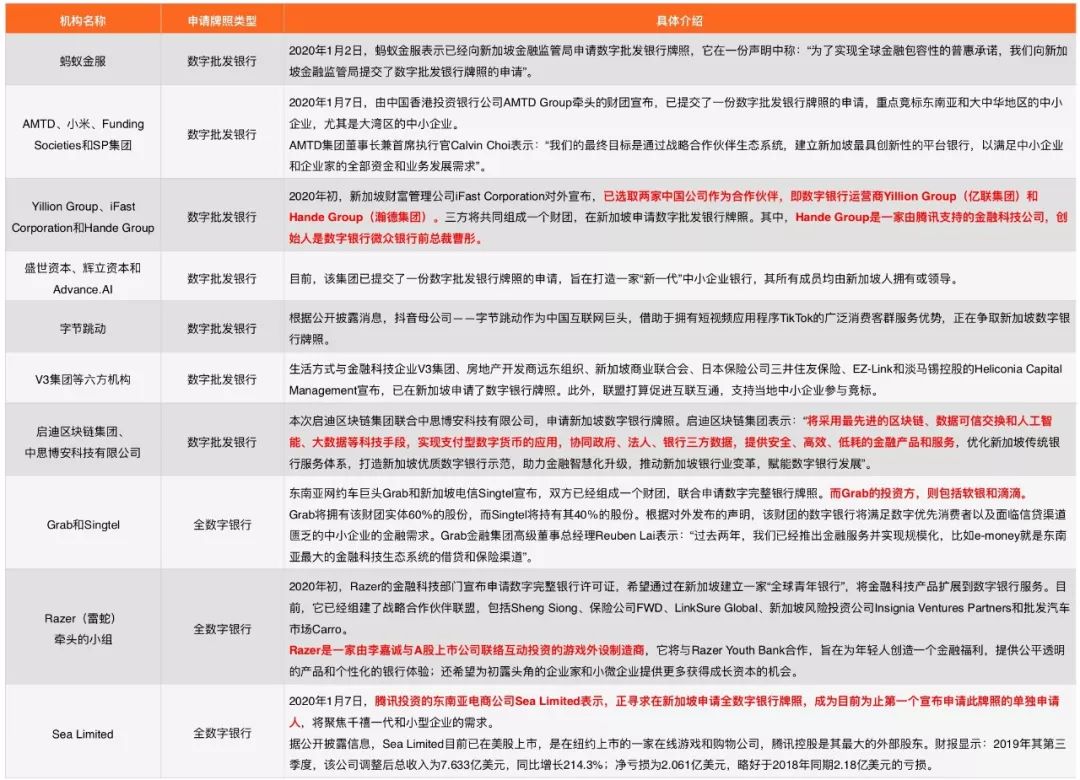

Although Singapore's regulatory authorities have not disclosed the list of 21 applicants, some participating bidders have stated that they have initiated applications for digital banking licenses. Therefore, the Zero One Think Tank has sorted out the following 10 main participants, including 7 digital wholesale banks and 3 all-digital banks, and most of them are promoted in the form of consortia for reference by peer institutions. (The classification of Singapore's digital banking license will be described in detail later.)

The 7 digital wholesale banks are mainly dominated or participated by mainland Chinese companies, including: one is Ant Financial; the other is the consortium led by AMTD (the participation of Xiaomi, Funding Societies and Singapore Energy Corporation); the third is the consortium led by iFAST Group (Yealink Group and Hande Group participate); the fourth is the consortium led by Shengye Capital (the participation of Phillip Capital and Advance.AI); the fifth is the byte beating; the sixth is the Beyond Consortium (V3 Group, Far East Organization, Singapore General Business SBF, Mitsui Sumitomo Insurance, EZLink and Temasek ’s Heliconia Capital); Seven is the Enlightened Blockchain Group with a state-controlled blockchain background, and jointly initiated the application in conjunction with Zhongsi Boan Technology Co., Ltd.

The three all-digital banks are mainly Singapore local companies, but there are also Chinese enterprises' investment holdings behind them. Specifically, they are: Grab and Singtel (Grab accounts for 60%, Singtel accounts for 40%), of which Didi is one of Grab's investors. One; the second is a consortium led by Razer (including Shengli Group, FWD, LinkSure Global, Insignia Ventures Partners and Carro, of which Razer accounts for 60%); the third is the Southeast Asian e-commerce company invested by Tencent, Sea Limited, which is The first individual applicant to announce the application for such a license is currently listed in New York, USA.

It is worth noting that the consortium headed by iFAST Group (the participation of Yealink Group and Hande Group) as one of the applicants for digital banking licenses has very strong shareholder strength. One of the two Chinese-owned shareholders is Yealink Group, which is backed by Yealink Bank with a private banking background, while Meituan, a Hong Kong listed company, is a shareholder of Yealink Bank; the other is Hande Group, The founder Cao Tong is the former president of Weizhong Bank. It can be seen that behind this license application agency, Meituan and two private banks (Yilian Bank and Weizhong Bank) are gathered.

Table 1: Introduction of some companies applying for Singapore Digital Banking License

Source: Public disclosure, Zero One Think Tank

To sum up, the Chinese-funded enterprises involved in applying for Singapore's digital banking license include Ant Financial, Tencent Holdings, Xiaomi Finance, Byte Beat, Didi, Meituan, Yealink Bank and Weizhong Bank. Very significant. These Internet giants are all trying to use their own resource endowments and domestic and overseas linkage advantages to further expand the inclusive financial business.

(3) Entry of State-owned Blockchain Enterprises

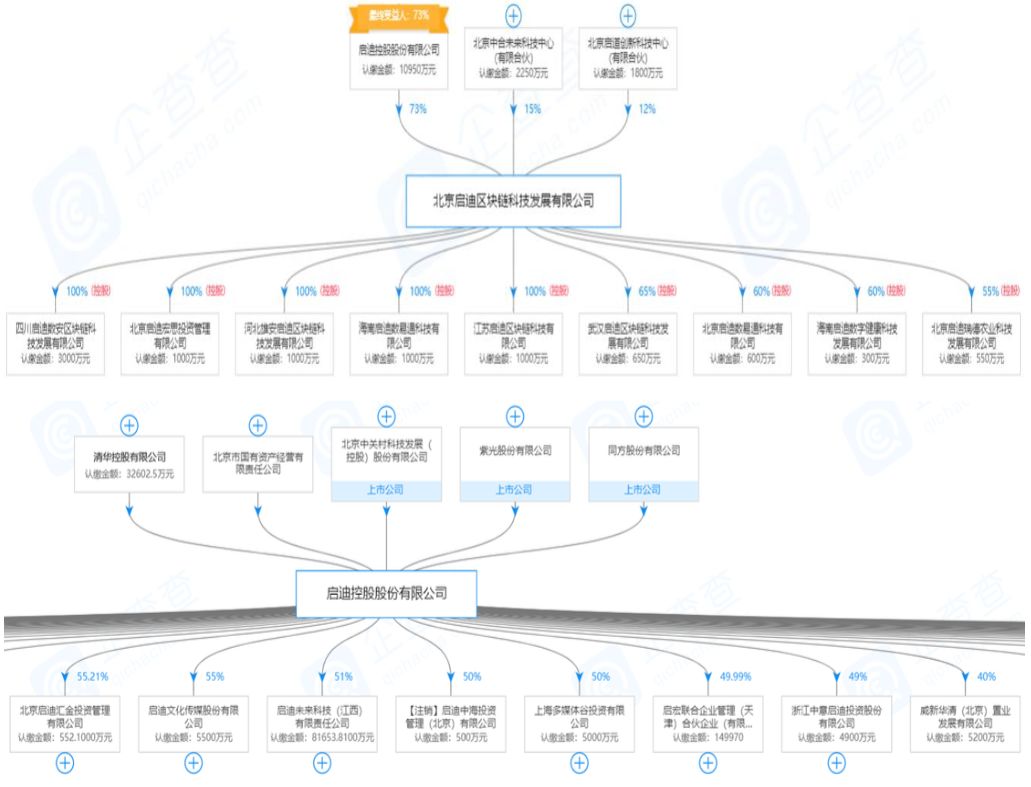

The One One think tank found that among the 10 applicants disclosed, one of the state-controlled blockchain technology companies-Beijing Qidi Blockchain Technology Development Co., Ltd. (hereinafter referred to as "Qidi Blockchain Company"). According to the company's information query, Qidi Blockchain Company was established in November 2018 with a registered capital of 150 million yuan and its operating address is located in Zhongguancun, Haidian District, Beijing.

From the perspective of the shareholding structure, its largest shareholder is Qidi Holdings Co., Ltd. (hereinafter referred to as Qidi Holdings), and one of Qidi's shareholders is Beijing State-owned Assets Management Co., Ltd. Known as a state-controlled blockchain technology company. Due to the large number of overseas investment companies held by Qidi Holdings, some of the foreign investment entities were shown.

Figure 3: Shareholding structure of TusDi Blockchain Company and its shareholder Tusdi Holdings

Source: Enterprise search

Enlightenment blockchain company applied for Singapore's digital banking license this time, and will take advantage of state-owned holdings to apply blockchain technology to the "Belt and Road" construction. Compared with other private entities' license application organizations, Qidi Blockchain Company has unique technical and industrial advantages. It uses secure and trusted data exchange technology to establish an efficient cooperation platform for "government and corporate banking", and establishes a "credit + finance" channel and services. In the fields of government affairs, enterprises, trade, finance, infrastructure, transportation, investment and other applications.

With the entry of a “national team” with a Chinese background, applying for a Singapore Digital Banking License will win even greater odds. Inspiration Blockchain has already owned 31 technology patents and 10 software copyrights, and has carried out digital financial layout in Xiong'an New District, Chengdu and Hainan Free Trade Zone, and built a new service model of data and algorithm joint decision-making, which will help Singapore build in the future "Financial Expressway" and accelerate the construction of the "Belt and Road".

Digital Banking Supervision in Singapore: License Classification, Access Conditions and Consortium Application Process

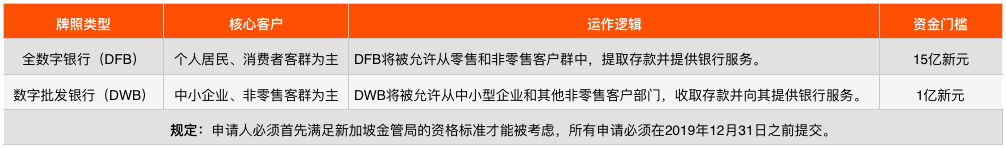

According to the relevant regulations of the Digital Banking License disclosed on the official website of the Singapore Monetary Authority, the term used locally is the “digital banking license”, which is specifically divided into two types: digital banking (DFB) license and digital wholesale banking (DWB) license. This classification is announced by the Monetary Authority of Singapore on June 28, 2019. The following sections introduce the development positioning, qualification standards and evaluation standards of the two types of licenses.

(I) Development Orientation of Two Types of Digital Banking Licenses

Table 2: Positioning of the two types of digital banking licenses required by the Monetary Authority of Singapore

Source: Official Website of the Monetary Authority of Singapore, Zero One Think Tank

(II) Eligibility criteria for applying for a digital banking license

The Monetary Authority of Singapore requires that applicants applying for a Full Digital Banking (DFB) license must currently be controlled by Singaporeans who are headquartered in Singapore and anchored in Singapore. Judging from the disclosure of the organizations applying for such licenses, it is mainly Singapore local enterprises.

This requirement not only reminds us of the number of licensed banks disclosed in Hong Kong in the second half of 2019. The number of licensed banks in Hong Kong has increased to 164, and 30 mainland banks and fintech companies have been deployed. It was pointed out in the article that Hong Kong divides licensed banks into two categories: the mainland and Hong Kong, and when they switch to Singapore, they will go overseas. , It is more cautious for applicants from different places, so it will give priority to all-digital banking licenses to Singapore local companies.

Regardless of which of the above two types of licenses are applied for, the Monetary Authority of Singapore requires the following:

(1) At least one entity in the applicant group has a track record of three years or more in the existing business in the field of technology or e-commerce;

(2) Key figures are appropriate;

(3) Demonstrated ability to meet applicable minimum paid-up capital requirements at the outset and continue to meet minimum capital requirements;

(4) Provide a clear value proposition, and use innovative technology to meet customer needs and cover the underserved market segment of the Singapore market;

(5) Prove that the proposed business model of the digital bank is sustainable;

(6) Submit a feasible plan to facilitate the orderly withdrawal of the proposed digital bank;

(7) Shareholders of the proposed digital bank undertake to provide the HKMA's letter of responsibility and commitments that may be required for the operation of the proposed digital bank.

(3) Evaluation criteria for digital banking licenses

The Monetary Authority of Singapore has proposed that the number of new digital banking licenses will not exceed five, including a maximum of two DFB licenses and three DWB licenses. However, as many as 21 institutions are currently participating in the application, competition is fierce. Judging from the progress, the application deadline is December 31, 2019, and the list of successful applicants will be announced in June 2020. It is expected to start business in mid-2021.

Which applicants can meet the entry requirements of the Monetary Authority of Singapore? The official pointed out that the assessment of the development status of the applicant institution in the following three areas is focused:

(1) The value proposition of the applicant's business model, combined with the use of innovative technologies to meet customer needs, and cover the underserved market segment of the Singapore market that is different from existing banks. The HKMA will also consider the applicant's ability to implement the proposal.

(2) Possess the ability to manage prudent and sustainable digital banking, including the level of understanding of the major risks of the banking business, as well as the strength of its compliance and risk management plans. The MAS will also consider the reputation, past performance, financial strength and commitment of the applicant shareholders.

(3) Growth prospects and other contributions to Singapore's financial center, such as the work it will bring to Singapore, the commitment to develop local labor skills, the capabilities (including technology) to be established in Singapore, and the headquarters functions to be established in Singapore Pinned here and its regional expansion plan.

3. New bank PK: from private banks, virtual banks, to digital banks

Faced with the rapid development of fintech on a global scale, the banking industry of all countries has rapidly promoted the digital transformation and upgrading of the banking industry. In the past two or three years, a variety of new bank titles have also appeared on the market. From the private banks in China that were set up at the end of 2014, to the approval of 8 virtual banks in Hong Kong in 2019, and to the Singapore Monetary Authority in early 2020, it will issue 5 digital banking licenses, which continues to refresh people's perception of new banks.

In addition, due to historical reasons, with the development of Internet finance in China's banking industry, there have been names such as direct banking, Internet banking, and open banking. With so many names, which one represents the latest trend? Will digital banking lead the industry's innovation in the next few years? What exactly is digital banking and what changes will it bring? Focusing on these issues, Zero One think tank has reviewed related concepts, and the following explains from the perspective of its definition and the situation of Mainland enterprises going overseas, etc., and tries to give a relatively reasonable answer for reference.

(I) Concept of Digital Banking

At present, the regulatory authorities have not put forward the definition of digital banking, which is a new type of business for banks in various countries to explore digital transformation. Null think tank reviewed the mainstream market views and found that Christ Skinner gave a relatively reasonable explanation in the book "Digital Bank", which states: "Digital Bank The key differentiating from traditional banks is that whether or not a branch is established, it no longer relies on physical branch outlets, but instead uses digital networks as the core of the bank, and provides customers with online financial services with cutting-edge technologies. Services tend to be customized and interactive. Bank structure is flattening. "

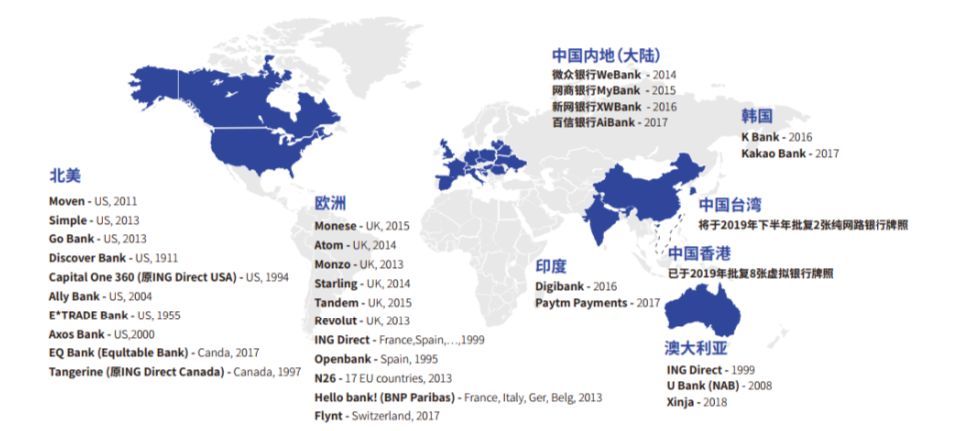

From this definition, digital banking has obvious pure online and strong technical characteristics. Based on this concept, the direct selling banks, private banks, and virtual banks formed today can all be considered as digital banking. At the same time, by comparing the results of digital banking practices in advanced countries in Europe and America and emerging countries in Asia, we find that the two implement a different development path:

On the one hand, the practice of digital banking in Europe and the United States started early, and appeared before the "first year of Internet finance" in 2013. Therefore, the applications of big data, cloud computing, artificial intelligence, and blockchain technology at that time were not very common. In the beginning of exploring financial reforms in Europe and the United States, they are more inclined to change the channel from offline to online, while less exploration of emerging technologies;

On the other hand, emerging Asian countries are just the opposite. They have made greater use of emerging technologies and accelerated the transformation and upgrading of the banking industry in recent years. Focusing on the rapid popularization of Internet infrastructure and smartphones in recent years, a group of Internet companies have driven the development of inclusive finance with technology, and special financial licenses have been set up at the national level to promote the continuous innovation of digital banking service models.

To sum up, it can be seen that the emerging format of digital banking will become an important weathervane for the transformation and innovation of the global banking industry in the next few years. Earlier, Weizhong Bank proposed in the “ Top Battle Digital-2019 Global Digital Bank Report '' released by 2019. According to incomplete statistics, the layout of digital banks in many places around the world is as follows:

Figure 4: Distribution of Digital Banks by Region (as of 2019)

Source: Top of the Digital: Global Digital Banking Report 2019

(II) Focus on China: 3 companies apply for virtual banking and digital banking at the same time

Looking at the 8 Hong Kong virtual banks and the 10 Singapore Digital Bank license applicants who have been informed, the Zero One Think Tank found that from the shareholders' background of the applicant for the license institution, there are 3 Chinese-funded enterprises participating in two license applications at the same time, respectively. It is Ant Financial, Tencent Holdings and Xiaomi.

The above three companies are of the nature of Internet companies and are in the head position among Chinese fintech companies. These institutions are accelerating their "going overseas" layout and continuously optimizing and improving their digital financial service system. However, it cannot be ignored that whether the core resources are dispersed in multiple regions can truly exert the advantages of linkage and export scientific and technological capabilities, and ensure that branches in all regions can achieve profitability. This is a severe test facing these Internet giants.

Table 3: Comparison of the background of the application institution shares of virtual banks and digital banks

Source: Public information, Zero One Think Tank

(3) More than Singapore: Malaysia and the Philippines have successively proposed digital banks

When sorting out the process of issuing digital banking licenses in various countries in the past two years, Zero One think tank found that in addition to Singapore, Malaysia has also proposed to issue this license. On December 27, 2019, Bank Negara Malaysia (Central Bank of Malaysia) issued the Exposure Draft on Licensing Framework for Digital Banks, which stated that the first batch of the Bank of Malaysia will issue the most Five digital banking licenses, one of the country's important measures to promote financial innovation. From the perspective of public disclosure, institutions that may participate in Malaysian digital banking license applications include: Boost, Grab, TNG e-wallet, and BigPay.

In addition, the Philippines is also proposing new initiatives to develop digital banking. On January 6, 2019, Joey Salceda of the House of Representatives Fundraising Committee of the Philippines said: "Digital banks can provide financial services to more user groups that traditional finance cannot cover in a more convenient and cheaper model, and it is important to realize the development of inclusive finance. Approach. If the proposal No. 5913 just submitted can be successfully passed, it will provide an effective and unified central regulatory framework for the development of digital banking in the Philippines, and provide consumers with multiple guarantees such as deposit insurance and data security. "

The emergence of new banking forms is undoubtedly a strong competitor for many traditional commercial banks. Judging from the approval of Singapore's digital banking license, it will change the competitive landscape that has long been monopolized by the three major local banking giants in Singapore, including DBS, OCBC, and UOB. The issuance of digital banking licenses will promote traditional banks to accelerate the speed of digital transformation and accelerate the integration of business with each other, thereby forming a more open, intelligent and scenario-based financial ecological service circle.

Fourth, concluding remarks

Since the beginning of 2020, the global banking industry has focused its attention on digital banking, which has a huge impact and challenge on traditional commercial banks. Starting from the second half of 2019, the Bank of Singapore has proposed to issue digital banking licenses, which has instantly attracted many Internet giants in China. These leading Fintech companies are gradually accelerating their "going overseas" layout. At present, 21 companies have initiated applications for licenses, but the regulator said that they only approved a maximum of 5 companies. Who is dead? Let us wait and see.

At the same time, the Bank of Singapore divides digital banking licenses into two categories, that is, all digital banks and digital wholesale banks. It stipulates that forward-looking innovative businesses must have domestic companies as major shareholders. The intention is to prevent and control financial risks. This model will also be used by others National lessons. This time, Ant Financial, Xiaomi and Tencent jointly participated in the application of Singapore's digital bank license, indicating that Fintech will set off a greater wave worldwide.

Especially in Southeast Asian countries, the consumer groups in terms of inclusive finance have a very strong demand and have close economic and trade relations with Chinese enterprises. Fintech companies with e-commerce platforms and communications technology operation experience can better leverage their resource endowment advantages to achieve Cross-border business linkage.

Looking forward to the whole year of 2020, in the face of more and more Internet giants accelerating the deployment of bank licenses, the scope of cooperation between traditional banks and fintech innovators will be broader in the future. With the help of technology, we can expand ecological partners and jointly expand Market size, achieving "win-win" cooperation.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Former Vice President of the People's Bank of China Suning: The payment cost of adopting digital currency is expected to drop to one tenth of the original

- The Rule of Law Weekend: At least three basic problems must be solved for digital currency to replace banknotes and become the standard of circulation

- Anchor determines success or failure? Comparison of the digital currencies of the four central banks

- Interpreting Blockchain: Efficiency and Cost

- Nothing is more important than scene innovation

- Philippines' "Asian cryptocurrency valley" will have its own airport

- Technical analysis: What are the differences between smart contracts on Ethereum, Bitcoin, and Bitcoin Cash?