Bitcoin’s 2023 Roller Coaster Ride: What’s Next for the King of Cryptos?

An Analysis of Exchange-Related On-Chain Activity in 2023Bitcoin’s 2023 Big Profits and Exchange Weirdness

Source: Glassnode

Source: Glassnode

So, 2023 has been pretty epic for Bitcoin. It’s like Bitcoin woke up and decided to flex its muscles big time. We’re talking a massive leap, over 140% in value – that’s huge! 📈💪 It’s not just about topping traditional rivals like gold; it’s also about leaving other cryptocurrencies in the rearview mirror. Let’s dive into the on-chain action and the exchange buzz, trying to piece together clues to see what Bitcoin might be up to in the coming year.

Bitcoin’s Blast from the Past

According to Glassnode’s report, we’re seeing a déjà vu with Bitcoin cycles in 2015-2017 and 2018-2022 in terms of how long it’s taking to bounce back and the drawdown since the all-time high (ATH).

In the current cycle, Bitcoin has seen a drawdown of about -37% from its ATH, which is pretty close to the -42% in 2013-2017 and -39% in 2017-2021. Plus, since the FTX lows in November 2022, Bitcoin prices are up a solid +140%, making it the strongest one-year return compared to the +119% in 2015-2018 and +128% in 2018-2022.

- Bitcoin Trading: A Trustless Future

- Texas Mineral Rights: A Precious Legacy 💎🤠

- 📚 Unlocking the Power of AI for Crypto Advisors

Exchange Activity: Bitcoin’s Trading Paradox

Despite 2023 being a banner year for Bitcoin, the number of transactions depositing funds to exchanges has surprisingly hit multi-year lows. But here’s the kicker: Glassnode data shows that the on-chain volume flowing in and out of exchanges has skyrocketed, jumping from $930 million to a staggering $3 billion – that’s a massive 220% increase. 🤯💸

This discrepancy between fewer deposits yet skyrocketing volume makes us wonder: what’s driving the intensified exchange activity if not retail investors? On one hand, the decrease in deposit transactions might suggest that investors are becoming more cautious about leaving their assets on exchanges, possibly due to security concerns or a desire for greater control over their funds. This is where the potential shift towards non-custodial exchanges like StealthEX comes into play. Given the FTX drama that’s still on everyone’s mind, it’s no surprise that these platforms where you can keep your private keys are becoming more popular.

There’s a serious uptick in on-chain volume showing that trading and speculation are buzzing more than ever. It seems that while investors might be shying away from depositing their funds, they are actively trading and moving large sums of money. This could be a sign of growing institutional interest, especially as we see the average size of deposits to exchanges nearing the previous all-time high of $30k per deposit, according to Glassnode.

Moreover, the fact that exchange deposits as a percentage of all transactions have dropped from around 26% in May to just 10% today, yet the decline is more modest (around 20%) when adjusted for Inscriptions, adds another layer to this narrative. Undeniably, we’re witnessing a dynamic shift in the blockchain sphere as novel transaction types emerge and new players grab their share of the limelight.

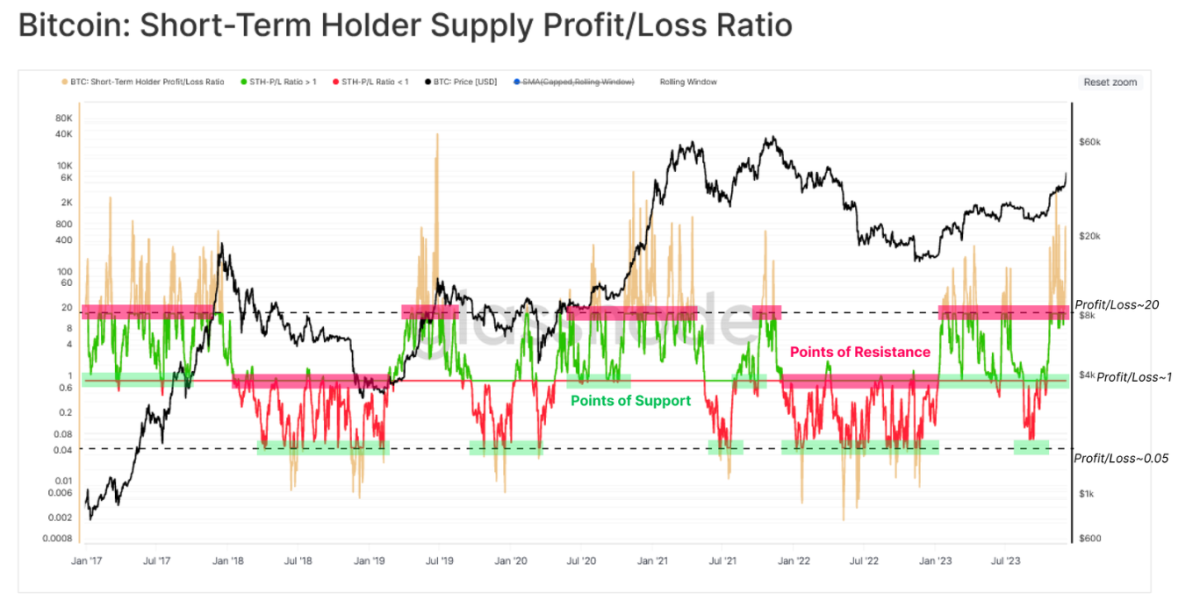

Short-Term Holders Cashing In

Short-Term Holders (STHs) have been making some smart moves lately, cashing in on their Bitcoin investments at just the right time. Glassnode’s got the stats to prove it – the STH-Supply Profit/Loss Ratio has been hovering above ~1 since January. This means these savvy traders have been playing the ‘buy-the-dip’ game pretty well, a classic move in uptrends. However, these STHs are moving hefty amounts of coins to exchanges, and the gap between what they paid and what they’re selling for is pretty sizable.

The first week of December, when Bitcoin hit $44.2k, STHs jumped into action, seizing the moment to take profits. It’s like they saw the wave coming and rode it all the way to the shore, capitalizing on the demand liquidity. This activity has put a bit of a pause on Bitcoin’s upward climb, demonstrating STHs’ sway over crypto prices.

Wrapping It Up: Bitcoin and Beyond

So, there you have it – Bitcoin’s 2023 story is a mix of triumphs, challenges, and a whole lot of excitement. Bitcoin, in its digital universe, never fails to keep us intrigued with its roller-coaster ride of strong recoveries and declines that resonate with historical patterns, even bouncing back recently despite a few bumps on the road. The play of STHs and the unpredictable ebbs and flows of exchange activities knit together a complex, yet intriguing narrative. Regardless of whether you’re in it for the highs or the lows, or simply out of sheer curiosity, observing Bitcoin’s ride is undoubtedly one to watch. 👀

This is a guest post by Maria Carola. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Q&A:

Q: Why has the number of transactions depositing funds to exchanges hit multi-year lows while the on-chain volume flowing in and out of exchanges has skyrocketed?

A: This discrepancy can be attributed to several factors. One possible reason is that investors are becoming more cautious about leaving their assets on exchanges due to security concerns or a desire for greater control over their funds. This has led to a potential shift towards non-custodial exchanges, where users can keep their private keys and have full control over their assets. Additionally, the significant increase in on-chain volume suggests that trading and speculation are still buzzing, with investors actively moving large sums of money despite depositing fewer funds to exchanges.

Q: What is the significance of Short-Term Holders (STHs) cashing in on their Bitcoin investments?

A: The actions of Short-Term Holders (STHs) can have a noticeable impact on crypto prices. These savvy traders have been playing the ‘buy-the-dip’ game exceptionally well, capitalizing on the opportunities presented by Bitcoin’s price fluctuations. They have been cashing in on their investments at opportune times, taking advantage of demand liquidity. This demonstrates their influence over crypto prices and highlights the importance of monitoring their actions in assessing market trends.

Q: What can we expect for the future of Bitcoin?

A: The future of Bitcoin remains full of possibilities. While it’s impossible to predict with certainty, considering historical patterns and current market trends, several factors suggest continued growth and adoption. The growing institutional interest, the shift towards non-custodial exchanges, and the active trading and movement of substantial amounts of Bitcoin indicate a maturing market and increased participation from various players. It will be interesting to observe how these dynamics shape Bitcoin’s journey and its role in the evolving digital economy.

Reference List:

- Glassnode’s report

- StealthEX

- Blockchain trends and developments

- Glassnode’s Bitcoin market statistics

Remember, investing in cryptocurrencies involves risk, and it’s essential to do thorough research and consult with financial professionals before making any investment decisions.

If you found this article insightful, don’t hesitate to share it with your friends who are interested in cryptocurrencies. And let us know your thoughts in the comments below! 😄🚀

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- You will return to dust

- Bitcoin: The Unshakeable Digital Gold

- The Battle Between Techno-Optimists and Pessimists: Exploring the Evolution of the Internet

- When is a Ponzi scheme truly a Ponzi scheme?

- Shift in Illicit Crypto Activity: Beyond Bitcoin

- 💼 Introducing Billy Mullins: MatterFi’s New CTO

- 🚀 Spot Bitcoin ETFs: A Roller Coaster Ride for Bitcoin, But Don’t Give Up Hope! 🎢💰