China’s central bank’s digital currency and Libra may not directly confront each other, but they all impact payment institutions.

Recently, the Deputy Director of the Central Bank's Payment and Settlement Department, Mu Changchun, elaborated on the progress and specific design of the central bank's digital currency research and development at the China Financial Forty Forum. And pointed out that after five years of research, the central bank's digital currency has been "out of the box." Previously, according to Tencent’s “First Line” report, after Yao’s resignation as the director of the Central Bank’s Digital Money Institute, Mu Changchun also held the post. Therefore, the central bank's digital currency research leader's interpretation of the central bank's digital currency naturally caused widespread concern in the blockchain field.

However, the inter-chain pulse noticed that Mu Changchun’s speech described indirectly pointed out that China’s central bank’s digital currency is very different from Libra, and the two may not directly confront each other. Instead, Shao Fujun, chairman of UnionPay, raised the concerns of the future development of China's payment and clearing institutions at the China Financial Forty Forum.

China's "One Army" and the US "Two Armies"

Professor Cai Weide, a national special expert and a professor of Beihang University, once said: At the national level, the central bank is required to issue digital legal currency. The private company, such as Facebook or a commercial bank, is a digital currency issued by a company like JPMorgan Chase. military. If you deal with the Second Army with one army, it is not equal.

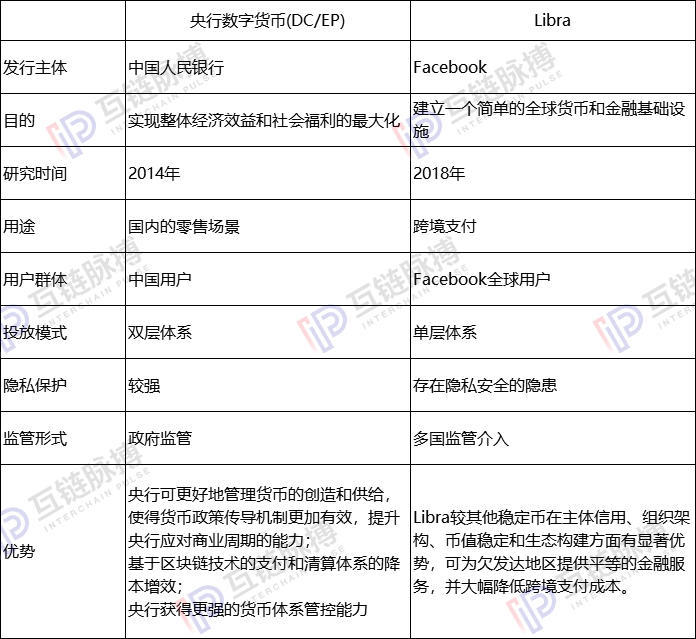

In Cai Weide's view, the primary difference between the Chinese central bank's digital currency and Libra is the difference between the ranks of the first and second armies. It is not appropriate to argue the two as peers. In addition, the inter-chain pulse observation, in fact, there are significant differences between the two, whether it is the issuer or the issue target.

- Blockchain Weekly | China's central bank digital currency "calls out", the global digital currency "race" opens

- How to hide our privacy with Bitcoin wallet?

- US Securities and Exchange Commission postpones three bitcoin ETF rulings again

Mu Changchun said that the central bank's digital currency is that the central bank first converts the digital currency to banks or other operating agencies, and then these institutions are redeemed to the public, mainly for China's 1.3 billion people; Libra is directly connected to Facebook by Facebook, based on It's Facebook's 1.6 billion users. In addition, there are certain differences between the two in terms of placement. China's central bank digital currency seems to always be based on the domestic market, focusing on M0 substitution, applicable to retail scenarios, and thus to maximize overall economic benefits and social welfare. Libra's goal is to create a simple global monetary and financial infrastructure that is based on international markets for cross-border payments.

The central bank's digital currency began research and development as early as 2014. Prior to this, Fan Yifei, deputy governor of the central bank, and Yao Qian, former director of the central bank's digital currency research institute, repeatedly mentioned the double-tiered system of central bank digital currency via commercial banks, and pointed out that privacy In terms of protection and supervision, the digital currency “front-end voluntary, back-end real-name” features will be used to manage the use of relevant data through security and privacy protection technologies, to achieve traceability under certain conditions, and to ensure that regulatory technologies such as big data analysis are useful. .

Libra started development in 2018 and is a single-layer system that directly connects users. Based on the 2018 Facebook user information disclosure incident, Libra's privacy security is still being questioned. At the same time, Libra is still receiving continuous attention from national regulators due to its possible impact. However, Libra has significant advantages over other stable currencies in terms of subject credit, organizational structure, currency stability and ecological construction, providing equal financial services to underdeveloped regions and significantly reducing cross-border payment costs.

The central bank's digital currency allows the central bank to better manage the creation and supply of money; the cost-effectiveness of the payment and clearing system based on blockchain technology; and the central bank's ability to control and control the monetary system.

(tabulation: interchain pulse)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 15 countries joined hands to create a "cryptocurrency monitoring system" to see how regulation changes

- Bitcoin makes the remittance fee as low as dust? International banking giants want to cry in the toilet

- What is the digital currency that the central bank will add for a year?

- Market analysis: funds are afraid of the situation, no trend opportunities

- The encrypted derivatives exchange Blade is invested by Coinbase and other institutions for $4.3 million with up to 150 times leverage

- Ripple promotes the follow-up investment plan with the world's second largest remittance company, focusing on enhancing the circulation of XRP

- Case Study: Stealing Bitcoin does not constitute theft?