Blockchain Weekly | China's central bank digital currency "calls out", the global digital currency "race" opens

Central bank officials talk about legal digital currency, and three types of blockchain institutions are expected to benefit. On August 10, Mu Changchun, deputy director of the Payment and Settlement Department of the People's Bank of China (hereinafter referred to as the “Central Bank”), proposed at the China Financial Forty Forum that the research on the central bank's digital currency has been going on for five years, and the relevant personnel have started since last year. The 996 development related system, "it can be said that it is ready to go out." He summarized the design ideas and structure of China's central bank's legal digital currency (DC/EP), including positioning, DC/EP is an alternative to M0: DC/EP focuses on the replacement of M0 (banknotes and coins), not M1 , M2, and can load smart contracts that facilitate the performance of monetary functions.

The three types of blockchain institutions may benefit from the research and development of the central bank's digital currency . According to Zhou Xiaochuan, former president of the central bank, Yao Qian, former director of the Central Bank Digital Currency Research Institute, and Wang Xinhe, director of the Research Bureau of the People's Bank of China and the director of the Monetary and Financial Bureau, and his speeches, a possible central bank digital currency (hereinafter referred to as "CBDC" "or" DC/EP") The framework for R&D is gradually revealed: The Central Bank Digital Money Research Institute is co-organizing distributed R&D with the industry, relying on the way of cooperating with the market to develop digital currency; the preliminary definition of China's legal digital currency is dominated by the central bank. The digital currency based on the encryption algorithm is issued while maintaining the physical cash issuance, that is, part of M0 is composed of digital currency; China’s central bank digital currency may adopt the “one currency, two banks and three centers” structure; the blockchain is expected to be applied to The registration, circulation, inventory check and demise of China's legal digital currency are registered in the whole process to establish a centralized bookkeeping center with centralized distribution. We believe that at least the following institutions may benefit from the development of PBC digital currency: (1) market and technical institutions that develop digital currency along with the central bank's digital currency research institute; (2) big data analytics organizations; and (3) data security, identity Certification service agencies, etc.

Start the global digital currency competition with China and the United States as the head: On the one hand, the major countries have accelerated the pace of legislative supervision, and on the other hand, they are competing for the leadership of the upcoming digital currency era. The blockchain industry faces unprecedented developments and market opportunities.

- How to hide our privacy with Bitcoin wallet?

- US Securities and Exchange Commission postpones three bitcoin ETF rulings again

- 15 countries joined hands to create a "cryptocurrency monitoring system" to see how regulation changes

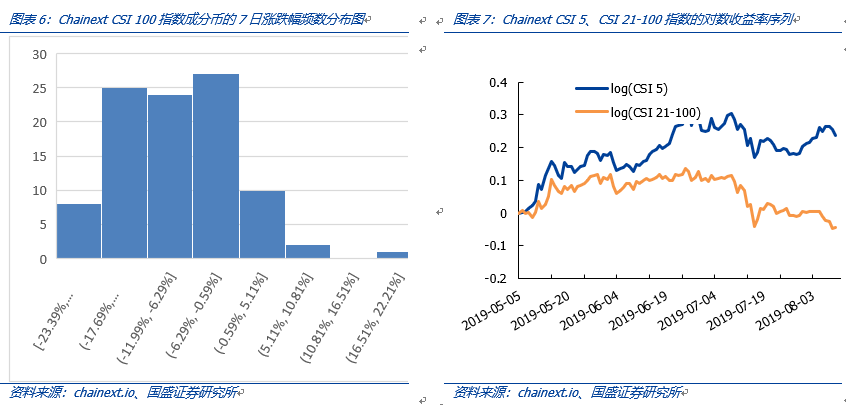

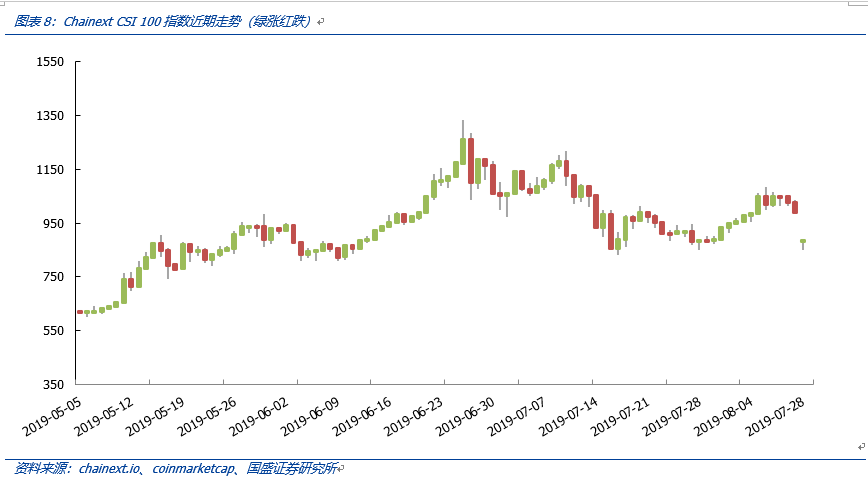

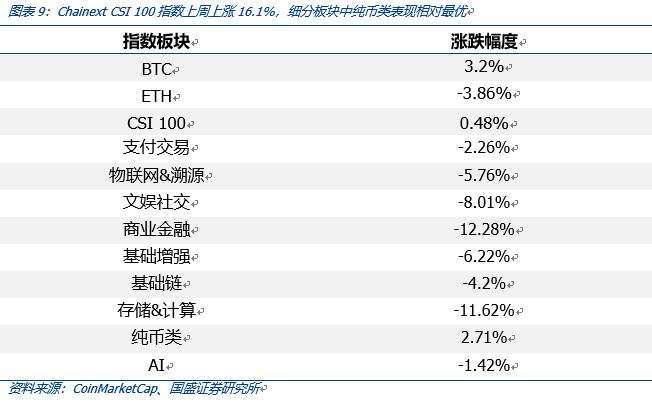

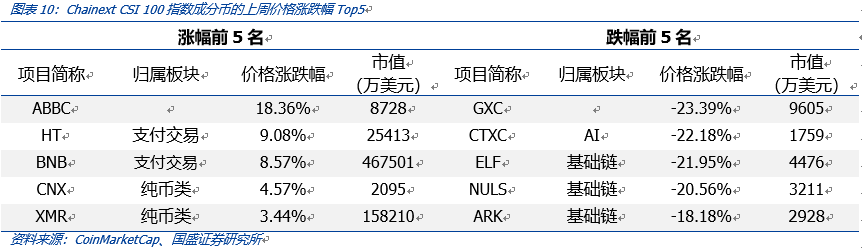

Last week's market review: Chainext CSI 100 decreased by 9.06%, and the Chinese entertainment social class in the segment was the best. From the perspective of the segment, the pure currency performance is slightly better than the Chainext CSI 100 average of 2.71%, payment transactions, Internet of Things & Traceability, Entertainment Social, Business Finance, Foundation Enhancement, Foundation Chain, Storage & Computing, AI Sector The performance of the sector was inferior to the Chainext CSI 100 average of 2.71%. Payment transactions, IoT & traceability, entertainment social, commercial finance, foundation enhancement, infrastructure chain, storage & computing, and AI sector performance were inferior to the Chainext CSI 100 average. -2.26%, -5.76%, -8.01%, -12.28%, -6.22%, -4.2%, -11.62%,

-1.42%

risk warning: Regulatory policy uncertainty, project technology progress and application fall short of expectations, and cryptocurrency-related risk events occur.

This week, the market continued to fluctuate. Event: On August 10, Mu Changchun, deputy director of the Payment and Settlement Department of the People's Bank of China, summed up the design ideas and framework of the central bank's legal digital currency at the China Financial Forty Forum. The Central Bank of China and regulators have all launched digital currency promotion efforts to open the global digital currency "race."

Central bank officials talk about legal digital currency, and three types of blockchain institutions are expected to benefit. On August 10, Mu Changchun, deputy director of the Payment and Settlement Department of the People's Bank of China (hereinafter referred to as the “Central Bank”), proposed at the China Financial Forty Forum that the research on the central bank's digital currency has been going on for five years, and the relevant personnel have started since last year. The 996 development related system, "it can be said that it is ready to go out." He summarized the design ideas and structure of China's central bank's legal digital currency (DC/EP):

(2) In terms of technology selection, the blockchain is expected to be selected: the pure blockchain architecture cannot achieve the high concurrency performance required by retail (at least 300,000 pens per second), and the central bank maintains technology neutrality without prior technical routes. Not necessarily dependent on a certain technical route.

(3) Operating system, DC/EP adopts the two-tier structure of “central bank-commercial bank”: Compared with the single-layer operation that directly issues digital currency to the public, the central bank will adopt “first convert digital currency to bank or other The two-tier operating system of the operating agencies, which are then exchanged for the public.

(4) In the management mode, DC/EP is still centrally managed by the central bank. The designated operator that can exchange currency is not over-issued.

(5) DC/EP can load smart contracts that facilitate the performance of monetary functions.

The central bank’s research and development of digital currency has continued. Since 2014, the central bank has been active in digital currency research and development. They include at least the following aspects: (1) Specially proposed “central bank digital currency” in the above two working conferences, and deployed relevant work; (2) set up special Digital Money Research Institute, the institute also initiated the establishment of a wholly-owned Shenzhen Financial Technology Company; (3) actively applied for relevant patents, the State Intellectual Property Office patent inquiry system showed that as of August 4, 2019, the central bank’s digital currency research A total of 74 patents involving digital currency were applied; (4) The pilot application scenario of using the digital ticket trading platform as a legal digital currency was determined, and relevant tests and trial runs were completed.

The three types of blockchain institutions may benefit from the research and development of the central bank's digital currency . According to Zhou Xiaochuan, former president of the central bank, Yao Qian, former director of the Central Bank Digital Currency Research Institute, and Wang Xinhe, director of the Research Bureau of the People's Bank of China and the director of the Monetary and Financial Bureau, and his speeches, a possible central bank digital currency (hereinafter referred to as "CBDC" "or" DC/EP") The framework for R&D is gradually revealed: The Central Bank Digital Money Research Institute is co-organizing distributed R&D with the industry, relying on the way of cooperating with the market to develop digital currency; the preliminary definition of China's legal digital currency is dominated by the central bank. The digital currency based on the encryption algorithm is issued while maintaining the physical cash issuance, that is, part of M0 is composed of digital currency; China’s central bank digital currency may adopt the “one currency, two banks and three centers” structure; the blockchain is expected to be applied to The registration, circulation, inventory check and demise of China's legal digital currency are registered in the whole process to establish a centralized bookkeeping center with centralized distribution. We believe that at least the following institutions may benefit from the development of PBC digital currency: (1) market and technical institutions that develop digital currency along with the central bank's digital currency research institute; (2) big data analytics organizations; and (3) data security, identity Certification service agencies, etc.

Starting with China and the United States to start the digital currency competition of the world's major powers: On the one hand, the major countries have accelerated the pace of legislative supervision, and on the other hand, they are competing for the leadership of the upcoming digital currency era. The blockchain industry faces unprecedented developments and market opportunities.

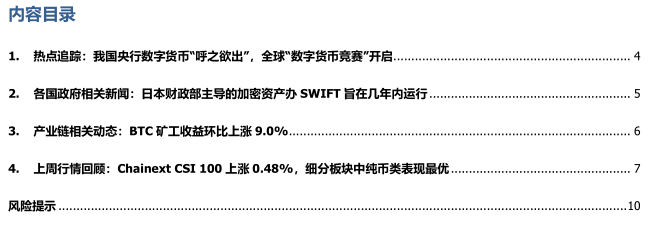

The Governor of New Jersey of the United States signed a bill to establish a blockchain special operations group. The US state of New Jersey official website recently announced that the state governor Phil Murphy recently signed a codenamed S2297, will set up the New Jersey Blockchain Initiative Task Force, which will release its first research report 180 days after its establishment, including the state government The costs and benefits of blockchain technology and recommendations for implementing these solutions. The above action group aims to study blockchain solutions that benefit the state, and will study the risks and rewards associated with blockchain and distributed ledger technology, blockchain public chains, private chain and formula algorithms, current projects, and global use cases. The global use case and its potential in New Jersey, and how the law may change in order to achieve safe paperless record keeping.

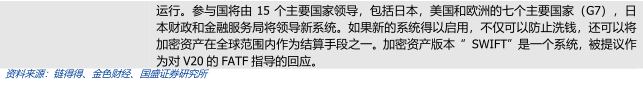

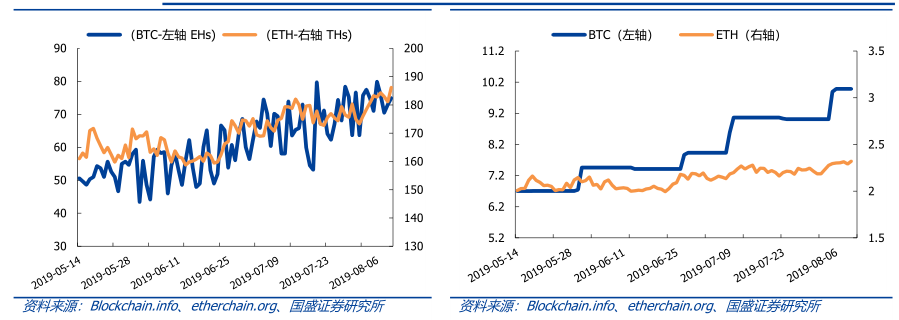

Last week, BTC added 2.36 million new transactions, up 2.1% from the previous month; ETH added 4.81 million new transactions, a decrease of 5.3% from the previous month.

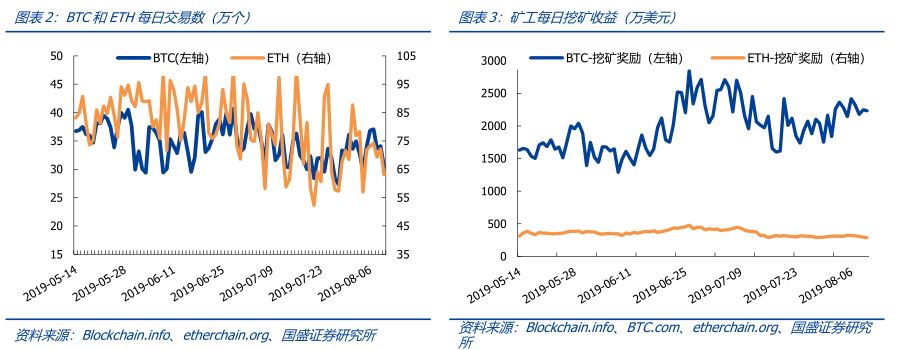

Last week, BTC miners' average daily income was US$22.61 million, up 9.0% from the previous month; ETH miners' average daily income was US$3.09 million, up 2.3% from the previous month.

Last week, BTC's average daily computing power reached 74.3EH/s, up 1.8% from the previous month; ETH's daily average computing power reached 183TH/s, up 3.8% from the previous month.

Last week, the difficulty of mining the whole network of BTC was 9.99T, up 9.1% from the previous month; the next difficulty adjustment date was on August 18th, the estimated difficulty value was 10.78T, and the difficulty increased by 7.93%; the average mining difficulty of ETH whole network last week was 2.3T, a 3.7% increase from the previous month.

From the perspective of the segment, the pure currency performance is slightly better than the Chainext CSI 100 average of 2.71%, payment transactions, Internet of Things & Traceability, Entertainment Social, Business Finance, Foundation Enhancement, Foundation Chain, Storage & Computing, AI Sector The performance of the sector was inferior to the Chainext CSI 100 average of -2.26%, -5.76%, -8.01%, -12.28%, -6.22%, -4.2%, -11.62%, -1.42%.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin makes the remittance fee as low as dust? International banking giants want to cry in the toilet

- What is the digital currency that the central bank will add for a year?

- Market analysis: funds are afraid of the situation, no trend opportunities

- The encrypted derivatives exchange Blade is invested by Coinbase and other institutions for $4.3 million with up to 150 times leverage

- Ripple promotes the follow-up investment plan with the world's second largest remittance company, focusing on enhancing the circulation of XRP

- Case Study: Stealing Bitcoin does not constitute theft?

- Libra's development challenges continue: Chinese officials suggest it as a foreign currency, reserve or depository