Data | DeFi Transaction Cannibalizes Ethereum Block Capacity

According to data released by Ganesh Swami, co-founder of ETH analysis company Covalent, decentralized financial (DeFi) transactions account for an increasing proportion of Ethereum block capacity, while the share of ETH transfer is declining.

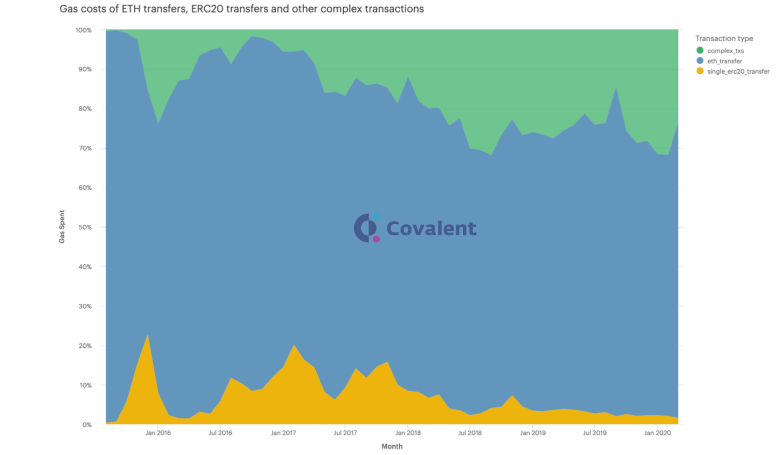

Swami analyzes the gas cost of Ethereum transactions over a period of time to estimate the share of network activity represented by ETH transfers, simple ERC-20 transactions, and complex interactions with smart contracts typically associated with the DeFi protocol. ratio. Because, the gas cost of each transaction category is constantly increasing.

DeFi transaction "cannibalizes" Ethereum block capacity

Swami noted that "the total amount of gas consumed by all types of transactions seems to be a natural upper limit", which shows "strong demand for Ethereum block capacity" and its network "lacks scalability", he added:

- Week in review: Bitcoin prices fluctuate, US stocks laugh

- DeFi Ultimate Getting Started Collection, the basics of DeFi you want to know are here

- New progress in the regulatory sandbox! Fintech institutions can declare independently, and there is no hope for coin-issuing blockchain companies

"In an ideal scalable blockchain network, there is room for growth for all types of transactions. But in today's Ethereum, the growth of one of these transactions must eat away at the share of other transactions."

When looking at the relative proportions of transactions represented by each of these three categories, the data shows that the number of complex transactions at the cost of ETH and ERC-20 transfers has steadily increased-the network activity of complex transfers was 5% from the beginning of 2017 It has grown to around 20% to 30% in recent months.

Relative share of gas fees generated by each transaction category on Ethereum: Covalent

The figure also shows the ups and downs of the ICO. In early 2017, ERC-20 transfers accounted for 20% of network activity. For the rest of 2017, ERC-20's transaction volume accounted for 10% to 15% of network activity, and it fell to 5% by mid-2018.

After a brief rebound to 10% in the last few months of 2018, ERC-20 transactions have been declining, and ERC-20 transfers currently account for less than 5% of Ethereum network activity.

Covalent expects a big reversal on Ethereum

Swami predicts that as more and more decentralized organizations (DAOs), games, and other irreplaceable token (NFT) applications are launched on Ethereum, the proportion of complex transactions in network activity will continue to rise.

As a result, the analyst expects that this trend will soon drive a "big reversal," in which complex transactions (as a percentage of online activity) will exceed ETH transfers.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- "No Feed" Synthetic Tokens: Minimizing the Use of the oracle

- Zhu Jiaming's latest thinking on digital currencies: traditional loose monetary stimulus policies are fully ineffective

- Trillions of market opportunities in blockchain under new infrastructure wave | Roundtable

- Blockchain invoices go to midfield: giants have already laid out "new infrastructure"

- Financial market black swan incidents occur frequently, how is the layout of cryptocurrencies? See what senior analysts suggest

- Market analysis: the market rebound is weak, be wary of further retreat

- Bitcoin Secret History: Bitcoin Pizza Incident Follow-up