Learn about Bitcoin market participants-the vulnerability of miners to push Bitcoin prices

Original source: Blockware

Compilation: Share Finance Neo

Editor's Note: The original title was "Understanding Bitcoin Market Participants-The Vulnerability of Miners to Push Bitcoin Prices"

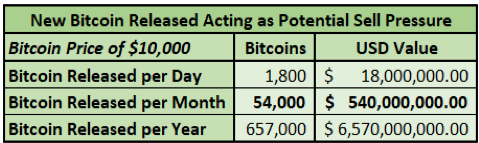

Many analysts believe that there is a price bottom for bitcoin, which is created by the break-even point of the production cost of bitcoin miners. This assertion is inaccurate. In fact, as bitcoin prices get closer to the production costs of miners, bitcoin selling tends to accelerate. The price of Bitcoin has been under selling pressure, and this pressure has come from miners. Price support is actually built on the surrender of miners and the net reduction of hash power on the network-a favorable adjustment of difficulty. Understanding game theory for miners is crucial.

- CME executives' proposal to expand the group's business to the bitcoin mining sector, is it good for the crypto industry?

- Lightning Network's "Big Three" Gathering for the First Time, Deciphering the Future of Lightning Network and the Crypto Market

- Microsoft files new patent: cryptocurrency system that uses physical activity data for mining

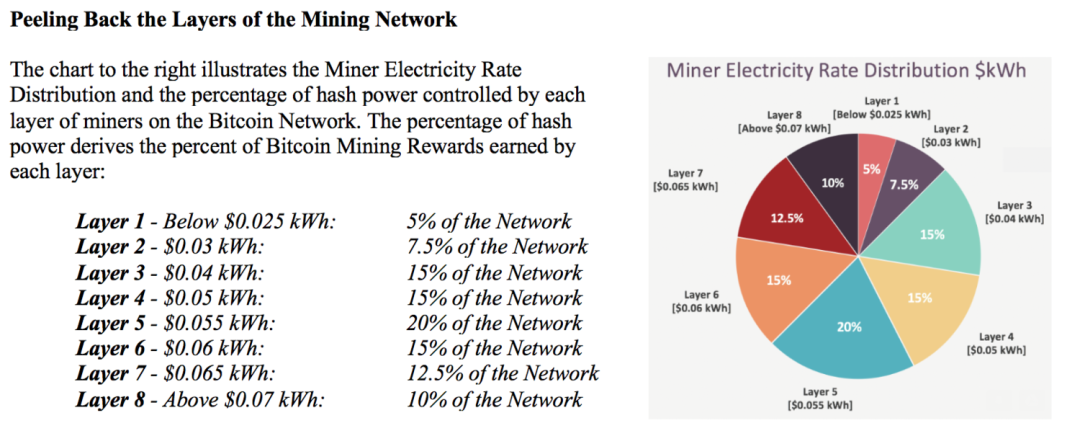

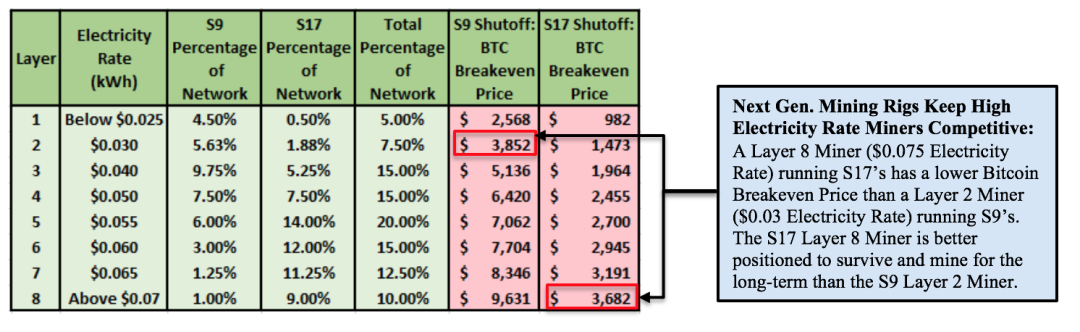

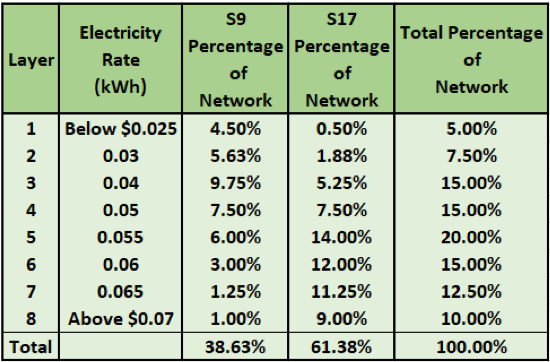

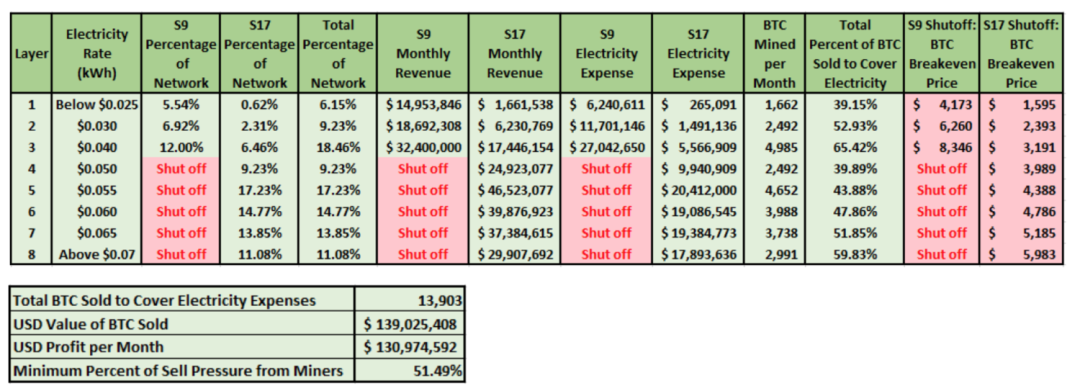

The cost of miners producing bitcoin is determined by their electricity bills, because 95% of the miners' operating expenses are electricity bills. Miners need bitcoin to reach a certain price, so that their bitcoin income will exceed the electricity bill. Mining tools with the lowest electricity prices have significant comparative advantages.

- Bitcoin Network: Who are the market participants and how do they affect the price of Bitcoin? Stripping all layers of the mining network

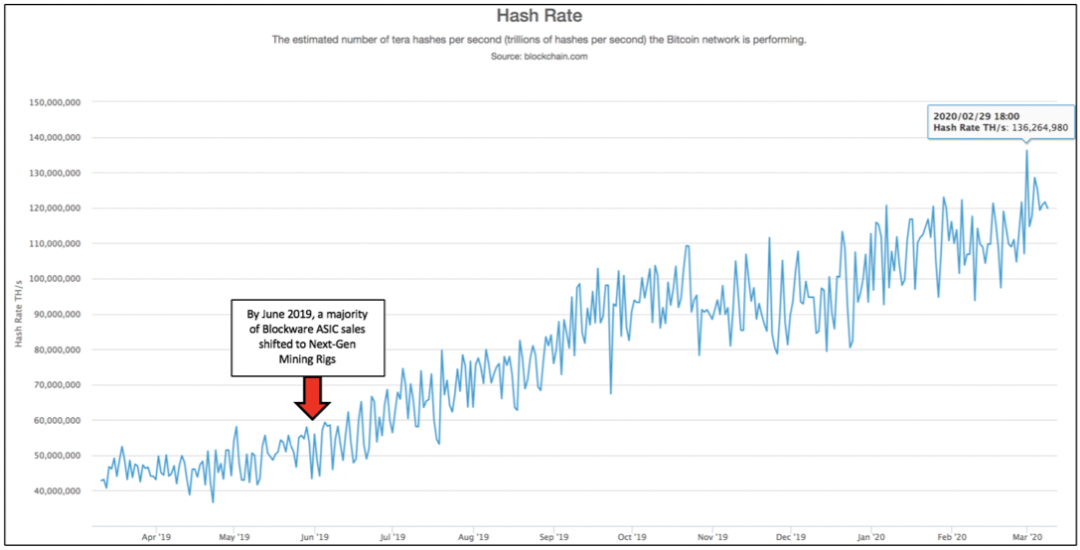

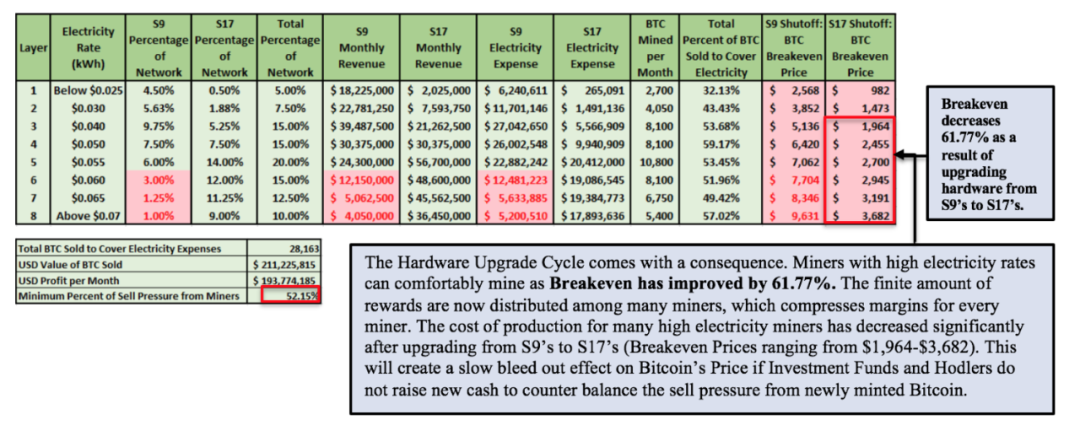

- How the new generation of mining equipment leveled the playing field-allowing miners to maintain high electricity prices during the game

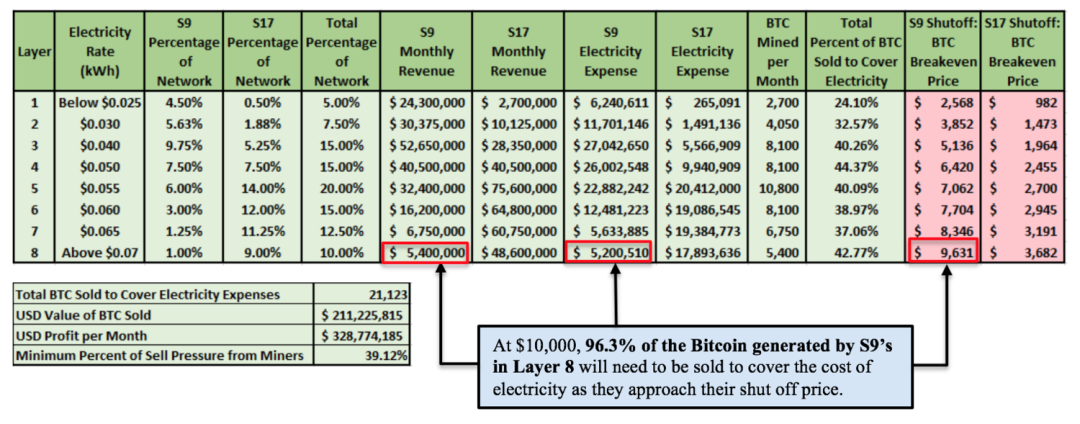

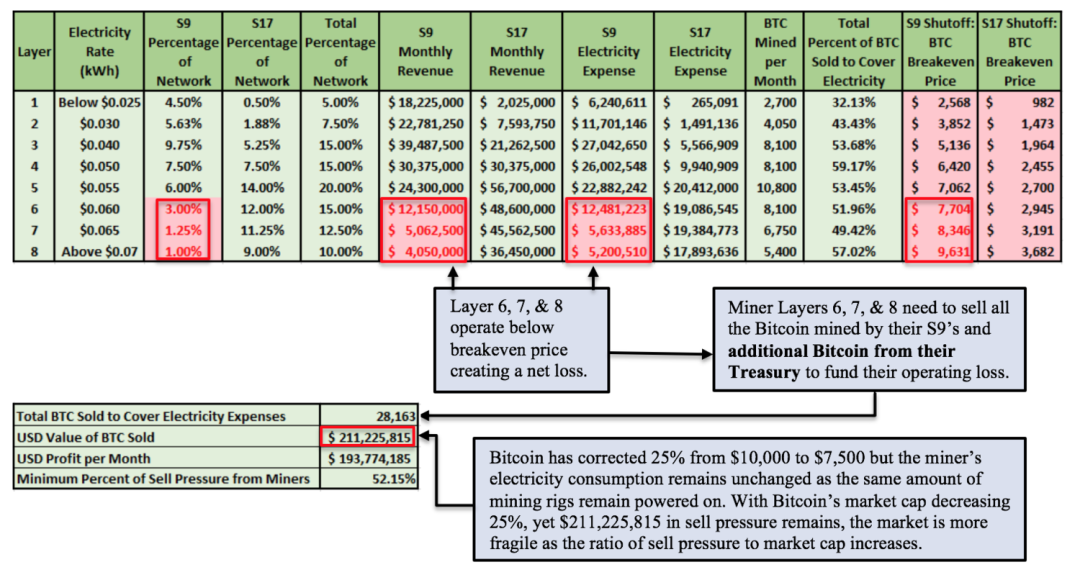

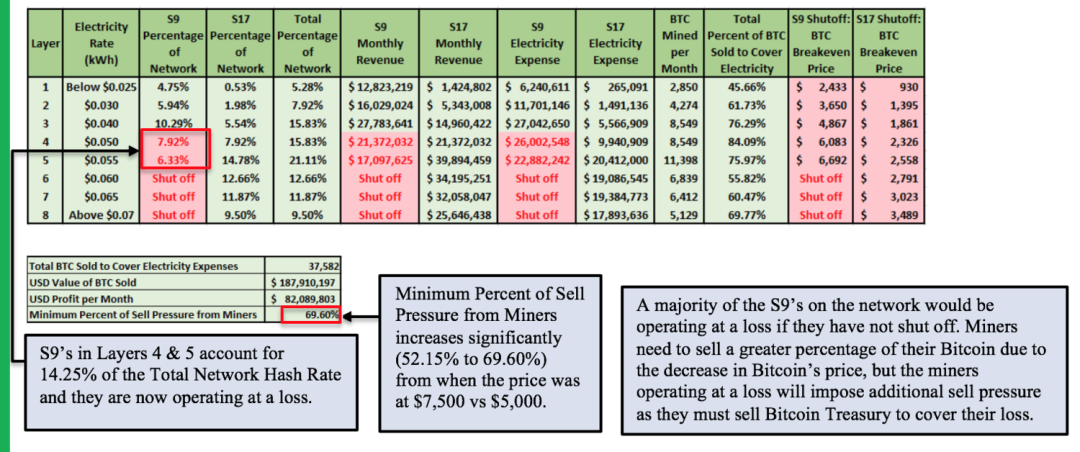

- Breaking the myth that the miner's break-even point price is a lower price limit

- Impact of halving in 2020 on the bitcoin industry-a three-pronged approach

- Difficult point: Satoshi Nakamoto's ingenious network stability mechanism-understanding its gravity

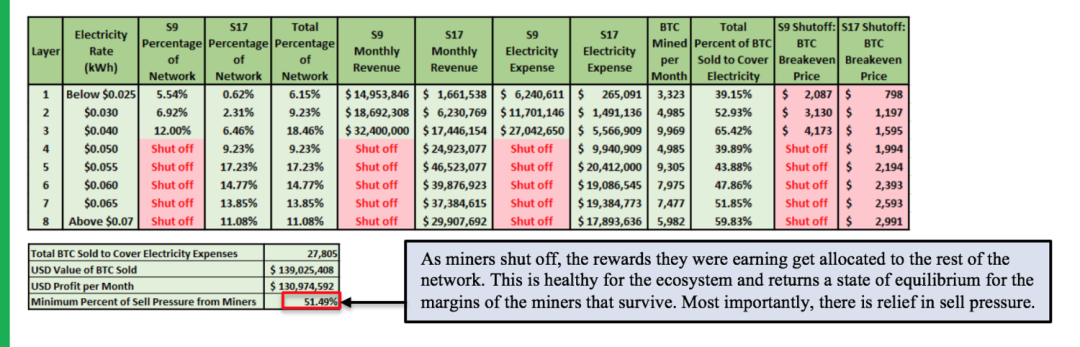

- How miners' surrender hastened the bottom of Bitcoin

Three main types of Bitcoin market participants

How the new generation of mining equipment can compete fairly

Understanding the behavior of Bitcoin miners

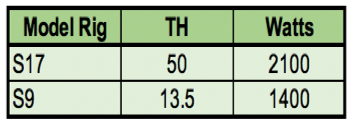

$ 10,000 bitcoin: considerable profit margins on each tier

$ 7,500 Bitcoin : Breaking the Myth of "Miners' Breakeven Price is the Price Bottom Line"

Understand the actual operation results and paper operation results

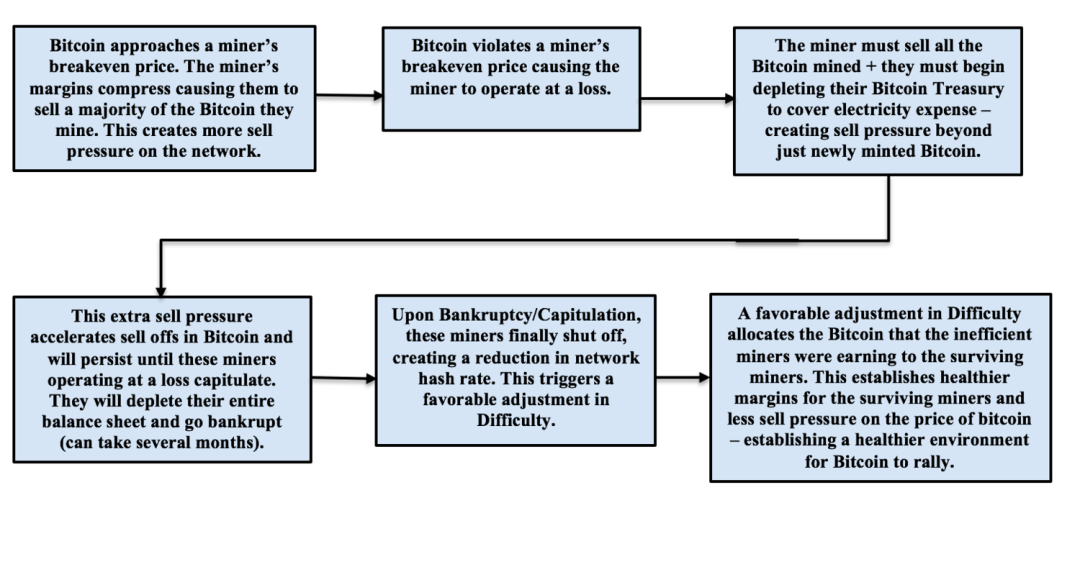

Miner Surrender Roadmap

Bitcoin price at $ 7,500- before halving

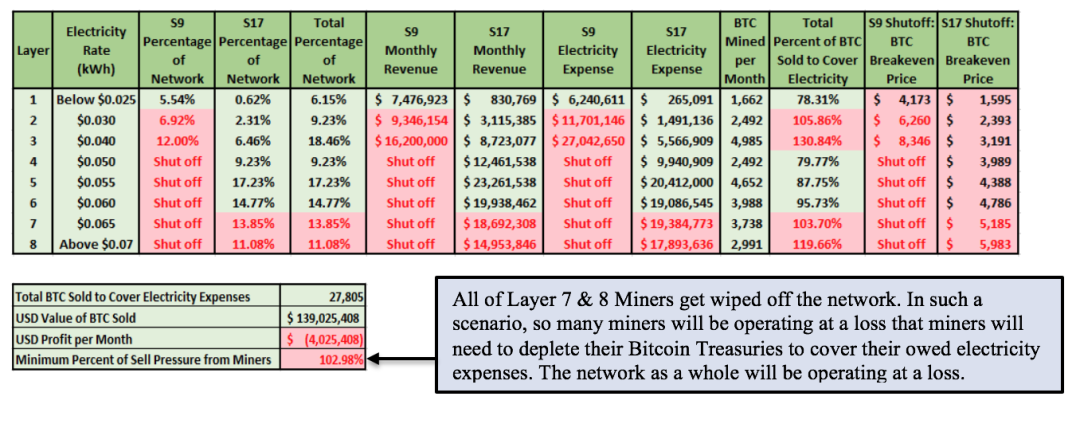

Bitcoin worth $ 5,000- before halving

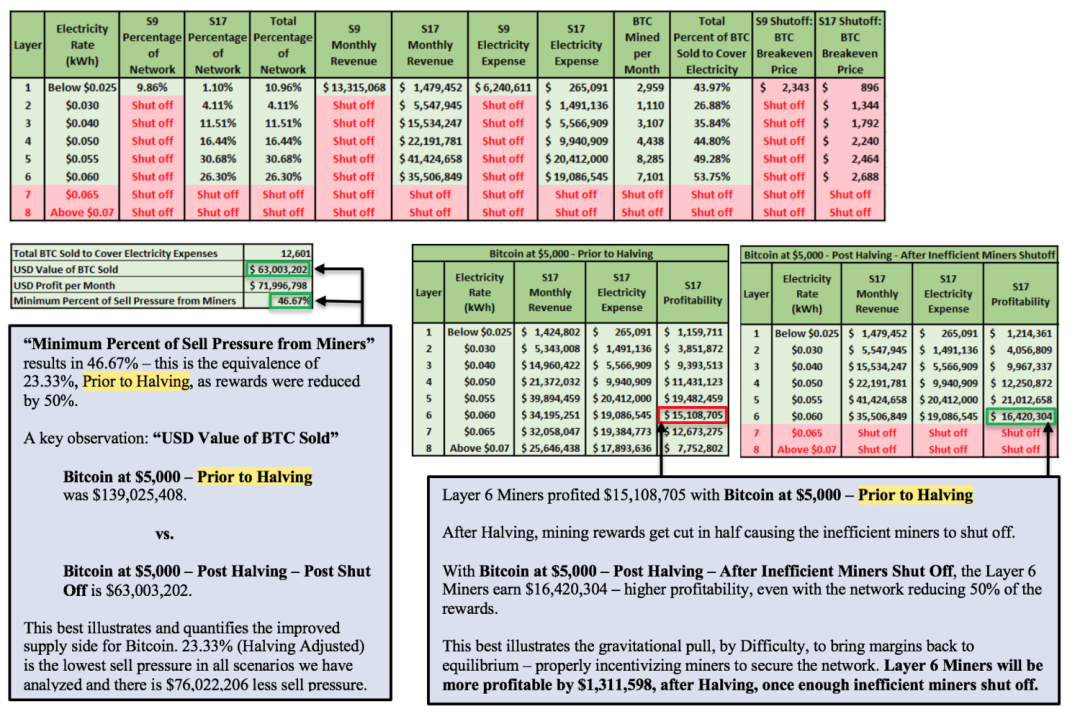

Bitcoin worth $ 5,000-after inefficient miners go out of business

Bitcoin at $ 5,000 – after halving

Bitcoin drops to $ 5,000 after inefficient miner failure-after halving

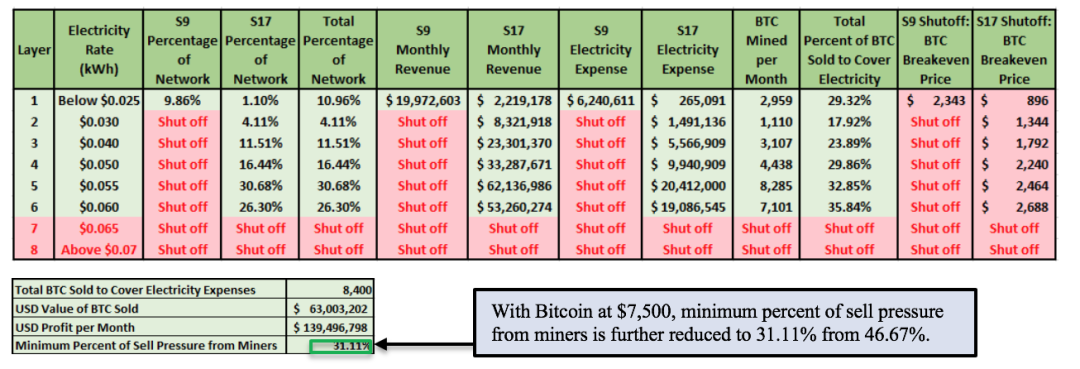

Bitcoin rebounds to $ 7,500- after halving -miner surrender-style selling accelerates bottom

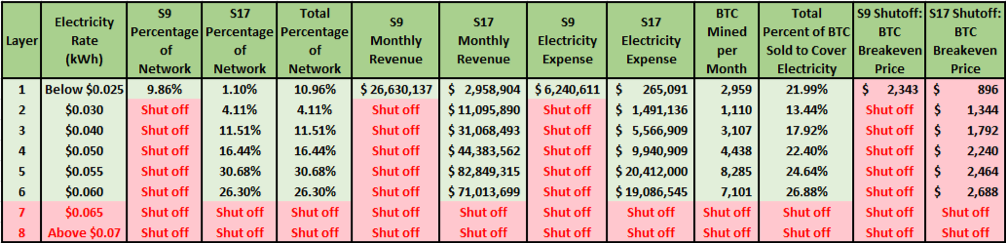

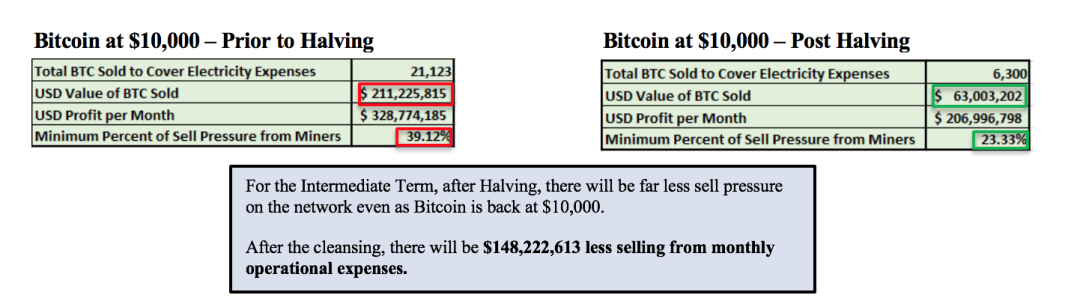

Bitcoin price rebounds to $ 10,000- after halving -miners' capitulation has accelerated Bitcoin price decline

This cycle reappears : Bitcoin rises to $ 10,000- after halving -rebound after difficult adjustment

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin that originally became the foundation of Web 3.0 and is the king of blockchain

- Secret history of Bitcoin: the black man behind the Silk Road extortion case is an American DEA agent

- Blockchain technology and the construction of open banks: 3 characteristics to meet 3 challenges, how to build an open banking ecosystem?

- New crown epidemic causes large foreign mines to close, bitcoin computing power drops by nearly 50%

- How does the Fed's unlimited "print money" affect the crypto market?

- Slump, dips, rebounds … what are the speculators discussing on Weibo?

- Is there a future for Bitcoin? Is the fundamentals of the blockchain industry stable? Disciple Ren Zeping tells you the answer