Digital currency "national team": big countries have to control, the third world wants to overtake

In fact, a few years ago, central banks began to study digital currency (CBDC).

The International Monetary Fund (IMF) released a report on June 27th that central banks may issue digital currencies in the future.

The report said that central banks in several countries are considering introducing some form of central bank digital currency (CBDC). According to reports, Uruguay has launched the CBDC pilot project, while the Bahamas, China, the Eastern Caribbean Monetary Union, Sweden and Ukraine are “immediately” testing their respective CBDC issuance systems.

In January this year, the Bank of International Settlement released a report saying that 70% of the central banks participating in the survey are participating in or will be involved in the issuance of CBDC work or research, and the number in 2018 has increased from 2017.

- The Hollywood blockbuster "Cryptographic Currency" was released for 4 months without any interest? The director does not understand the blockchain?

- Wanchain launches the Global Ambassadors Program

- The well-known beverage manufacturer's share price soared 500% to alarm the FBI, just because the name is added to the blockchain?

Third world countries take the lead: CBDC perfects financial reform

What is the definition of the central bank's digital currency? In 2018, a report by the Bank for International Settlements used four dimensions of standards: whether it was widely available, whether it was in digital form, whether it was issued by the central bank, and whether it was similar to the tokens generated by Bitcoin-related technologies.

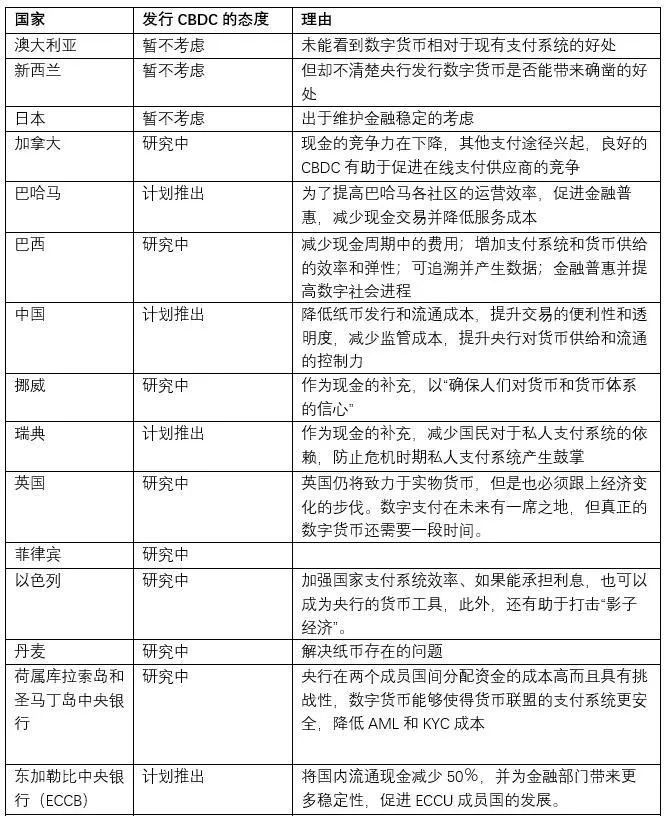

In March 2019, the Tsinghua University Institute of Financial Science and Technology released a report saying that among the 25 central banks, there are 7 central banks planning to launch CBDC, 9 of which have been explored, and 6 have been issued, and 3 are not considered.

The motivations for countries to introduce CBDC vary. Developed countries hope that in the case of a decline in the frequency of cash use, CBDC seeks alternatives to cash and also avoids the monopoly of private payment companies.

For emerging economies such as developing countries, the main purpose of CBDC is financial inclusion, reducing bank costs, and may be more open to citizens who do not have accounts, and to break through sanctions.

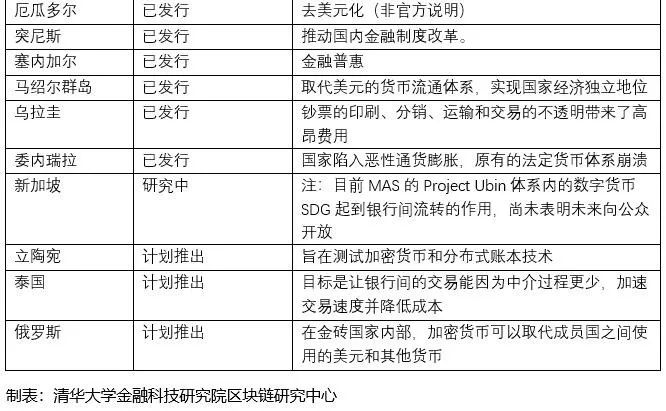

At present, there are six countries that officially launch legal digital currencies in the world, all of which are third world countries, including Ecuador, Tunisia, Senegal, Marshall Islands, Venezuela, and Uruguay.

Among them, Ecuador and the Marshall Islands issued digital currency in order to achieve de-dollarization and change the status quo of the US dollar as its main currency; Venezuela, Tunisia and Senegal are intended to reverse the domestic economic difficulties and complete financial reforms.

In December 2014, the Central Bank of Ecuador launched the “e-money system”, which officially began operations in February of the following year, and issued “ Ecuadorian currency ”, with amber wax as the value carrier, equivalent to a new encrypted payment system, becoming the first in the world. A state-owned "electronic money system."

The system is strictly regulated by the Central Bank of Ecuador, and the exchange rate is relatively stable. Only eligible Ecuadorian residents have the right to use it. The citizens can use Ecuadorian coins to complete payments in supermarkets, shopping malls, banks and other places.

According to the Zinc Link, the Ecuadorian country abandoned its old national currency in 2000 and used the US dollar to get rid of the economic crisis. In 2014, the State of Ecuador banned bitcoin and launched the “e-money system”.

Tunisia issued the national digital currency eDinar in 2015, and the Swiss-based software company Monetas participated in its technology integration. The issuance of eDinar is supervised by Tunisian government agencies, and like other cryptocurrencies, eDinar is subject to transaction fees.

Monetas will support Android apps, and Tunisians can use smartphones for instant currency transfers, online payment of goods and services, payroll, billing, and more, as well as managing government official identification documents.

In December 2016, the Senegalese central bank issued a blockchain-based digital currency eCFA. eCFA relies entirely on the central bank's banking system and can only be issued by authorized financial institutions. Therefore, eCFA is designed to be circulated as a legal currency along with banknotes.

On November 3, 2017, the Central Bank of Uruguay (BCU) officially launched its peso digitization project in Uruguay. According to reports, the digital currency is not a cryptocurrency such as bitcoin, but a currency still in the responsibility of the BCU. It is basically the same as the Uruguay peso, but with technical support rather than materialized pesos.

According to the Argentine online news report:

"Everyone who owns the app has a limit of about $1,000, and the company will have a limit of about $6,600. The e-wallet can charge a collection network where the physical banknotes will be converted into electronic money. ”

In March 2018, the Marshall Islands issued the digital currency Sovereign as the legal currency. The island country has no central bank and has used the US dollar as its official currency.

David Paul, assistant minister of the Republic of the Marshall Islands, said that the release of SOV can be seen as a way to support local budgets. Israeli financial technology startup Neema cooperated with the Marshall Islands to issue SOV in the form of 1CO. The CEO of Neema told the media that SOV is completely decentralized and the government cannot control the money supply after 1CO.

To avoid inflation, the Marshall Islands has limited the supply of SOV to 24 million. The Marshall Islands attempted to rebuild its domestic currency circulation system through blockchain technology and gradually realize its economic independence.

In October 2018, Venezuelan President Nicolas Maduro officially announced through television live broadcast that PetroChina will become the world's first legally supported digital currency and will be officially opened on November 5th of that year. For sale. The value of petroleum coins is 50% oil, 20% gold, 20% iron, and 10% diamond.

Compared with ordinary digital currencies such as Bitcoin, petroleum coins do not need to be mined by power consumption and computer computing. They are pre-created by the Venezuelan government and are essentially an asset-based certificate issued by the Venezuelan government.

The Venezuelan government legally allows and encourages the use of petroleum coins. The applicable scenarios include oil trading, tax payment, fees, real estate, flights, etc. In addition to the country's encrypted remittance platform Sunacrip, there are also 16 digital currency exchanges such as Cave Blockchain and Cryptia.

Some analysts said that Maduro launched the oil coin in order to circumvent the economic sanctions imposed by US President Trump on the Venezuelan government. Buying and trading oil coins is likely to be an inevitable political act.

Britain, France and the United States enter the market cautiously, Russia and Sweden are ready to go

The developed countries led by the United States have expressed opposition, worry and cautious sentiment towards the digital currency.

US President Donald Trump said on July 11 that he "does not like" cryptocurrencies, and if Facebook wants to launch Libra, it may need to obtain a bank license.

“There is only one real reliable currency in the US, and its name is the US dollar.”

Trump questioned the value of Bitcoin and emphasized the volatility of its prices. He said that

"The cryptocurrency is not a currency, its value is highly unstable, and it is fabricated out of thin air."

On July 10, Fed Chairman Powell said in a report to the House Financial Services Committee that although Librae may provide public services, Librae has raised serious concerns about privacy, money laundering, consumer protection and financial stability, before the official launch. These issues must be resolved openly and thoroughly.

According to foreign media reports, Bank of England Governor Mark Carney said in June: "Facebook's digital currency must be safe, otherwise it will not be allowed to be born. The Bank of England, the Federal Reserve, all major global central banks and Regulators need direct supervision (supervision) power."

Carney added that in the past, Facebook relied on a free environment that was not regulated by the government to gain a dominant position in the social networking field. Today, Facebook should not expect the new Libra to repeat the past.

According to a report by Tencent Technology on July 16, the French financial supervisory agency is preparing to approve the first companies related to cryptocurrencies in accordance with the new digital currency regulations.

According to the new rules in force at the end of July, digital cryptocurrency-related companies will voluntarily comply with capital requirements and consumer protection standards and pay taxes in France in exchange for regulatory approval.

Anne Marechal, executive director of legal affairs at the French Financial Markets Authority (FMA), said:

“France is a pioneer in this regard. We will have a relevant legal, tax and regulatory framework.”

France is using its rotating presidency of the Group of Seven to set up a special working group to study how central banks can ensure that digital currencies like Libra are regulated.

European Central Bank President Mario Draghi is the latest central bank governor to pressure Libra. On July 25th, Draghi's press conference in Frankfurt listed a series of issues facing Libra, including cybersecurity, money laundering, terrorist financing, privacy, monetary policy transmission and financial stability.

He believes that all these concerns are substantial and that they need to be addressed before regulators can look at it with real interest and positive interest.

In addition, many countries plan to introduce central bank digital currency.

Russian central bank governor Nabiulina said in June that the Russian central bank will one day launch its own digital currency. She believes that the key to CBDC's utility is that technology must ensure "reliability and continuity"; technology must mature, including distributed registry technology. Previously, she also stated that the Russian central bank will consider using a cryptocurrency backed by gold to facilitate international settlement.

On July 9, the Turkish government joined the central bank's issue of digital currency in its 2019-2023 economic roadmap. The 11th development plan proposed by the Turkish President shows that

“The digital central bank currency based on blockchain will be implemented”.

According to statistics, about 20% of residents in Turkey are cryptocurrency investors. Turkey's per capita cryptocurrency rate is the highest among all surveyed countries.

In April 2018, the Swedish Central Bank revealed that it will cooperate with IOTA to launch the national digital currency E-Krona, which is mainly used for small transactions between consumers, enterprises and government agencies. It is expected to be completed and put into use in 2019.

In addition, Japan, Singapore, Canada and other countries are also considering issuing their own digital currency.

Chinese version of CBDC: arrow on the string

Domestically, although it has been in a strong regulatory situation, in 2014, under the advocacy of Zhou Lanchuan, the then central bank governor, the central bank has begun to develop digital currency and central bank digital currency.

When Facebook launched Libra, the central bank's digital finance research platform was also established. At present, the central bank has been officially approved by the State Council and is organizing market institutions to conduct central bank digital currency research and development.

On July 8, at the launching ceremony of the Digital Finance Open Research Program, Wang Xin, the director of the Central Bank Research Bureau, said that the digitization of the central bank's currency would help optimize the central bank's monetary payment function and increase the central bank's monetary status and monetary policy effectiveness.

Wang Xin said that the central bank's digital currency can become an interest-bearing asset, satisfying the holder's reserve demand for safe assets, and can also become the lower limit of bank deposit interest rates. In addition, the central bank's digital currency interest rate can become a new monetary policy tool. The central bank can help to break the zero interest rate lower limit by adjusting the central bank's digital currency interest rate to affect the bank loan interest rate.

Yao Qian, former director of the Central Bank's Institute of Digital Monetary Research and general manager of China Securities, said that in terms of technical structure, the central bank's digital currency system can be divided into two categories: the one-yuan system and the binary system.

The unary system means that the central bank provides services directly to customers in a manner similar to Super Alipay.

However, most central banks in the world do not recognize this approach. They are not willing to provide central bank digital currency services directly to the public. Instead, they hope to reuse the traditional financial system and cooperate with financial institutions to place the central bank on the back end. Submitted by financial institutions.

The dual system proposed by the People's Bank of China is this idea, which is called the dual structure in the international arena. This idea is gradually forming the consensus of all countries.

Whether it is a one-dimensional system or a binary system, it is the idea that digital currency is developed within the financial system. Now it is relatively hot to stabilize tokens, especially the digital stable tokens that anchor legal currency, outside the traditional financial system. Expand in an incremental manner.

Meng Yan, deputy dean of the Digital Assets Institute, told Zinc Link that there are two key issues for CBDC: First, where is the central bank's digital currency? In the wallet, or in the account?

Second, if there is a digital currency account, who is the account? Is it a central bank or a commercial bank? If a commercial bank can open a digital currency account, is it entitled to create digital currency credit? If a commercial bank has the right to create digital currency credit, how should the central bank manage it?

Fan Yifei, the deputy governor of the central bank, issued a document in 2018 that the central bank's digital currency can adopt a two-tier system, which is further deepened on the basis of the traditional “central bank-commercial bank” dual model.

The two-tier system refers to the digital currency wallet and the account secondary issuance system.

Meng Yan introduced the zinc link. The digital currency in the central bank's digital currency wallet is equivalent to cash and is issued by the central bank. The digital currency in the central bank's digital currency account is only a number. As long as the demand for extraction is met, it may not be necessary to prepare adequately.

At present, many details of China's CBDC have not yet been determined. For example, can an individual open a digital currency account in the central bank or open a digital currency account in a commercial bank, and run the CBDC business on his behalf? If an individual opens a digital currency account directly in the central bank, the necessity of a commercial bank will be greatly weakened, which will lead to the consequences of a narrow bank.

Meng Yan told Zinc Link: "The secondary system has at least opened a digital currency account for commercial banks, protecting the existing banking system and reducing the impact of interests."

He believes that the value of CBDC has three points:

In the landing, CBDC has a lot to be perfected. For example, the central bank digital currency placed in a wallet is an interest-free asset that exists in electronic form and is equivalent to a commercial bank deposit, while the latter is an interest-bearing asset that generates arbitrage risk. As another example, the specification of privacy protection for digital currencies has not yet been established.

As Goldman Sachs CEO Solomon said earlier, the future of the payment system must depend on the blockchain, and the global payment system is moving toward a stable currency.

At present, the most important thing is that some central banks that are willing to launch CBDC can design a feasible and safe digital currency solution to achieve the landing, and at the same time, they can introduce perfect laws and regulations, maintain stable financial operations, and protect the interests of investors.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Getting started with blockchain | From ordinary computers to ASIC mining machines, are ordinary people still suitable for mining?

- Grayscale tells you: How do traditional investors who buy stocks and bonds look at bitcoin?

- EU advisory body: vigilant blockchain is monopolized by elites

- Ready to participate in Ethereum Staking? How to get the benefits in the Ethereum 2.0 system?

- Predicting the trend of Bitcoin? Tom Lee: The Fed’s interest rate cut has boosted bitcoin’s rise and is expected to record a new high by the end of the year.

- ChainNode evaluation: sharp grid hardware wallet

- Who is the ambition of the Telegram blockchain and Libra that will be launched on the main network?