Twitter Featured | A paper analysis of IEO speculation: "More than half of the bitcoin lost; the longer you take, the worse the loss"

According to Coindesk, LedgerX has officially launched the first physical bitcoin futures contract in the US, defeating Bakkt on the Intercontinental Exchange and ErisX supported by TD Ameritrade. (Note: Bakkt has started user testing on July 22, and it is only a matter of time to go online; Erisx has been approved by the regulatory authorities, and the launch time is not fixed.)

The contract will be settled in Bitcoin, not in US dollars, and will be open to both institutions and retail investors.

- Introduction to Blockchain | Exploring Zero Knowledge Proof Series (1): Initially Knowing "Zero Knowledge" and "Certificate"

- CSW v. Roger Ver failed, Judge: No damage to his reputation

- The public chain belongs to the grass roots, commenting on Algorand's "falling road"

Forbes commentator Joseph Young:

It’s interesting to see that big companies like the Kraken (a bitcoin exchange) and the blockchain (wallet and browser company) are expanding.

Just this week, Kraken acquired InterChange, a company that provides asset management services to institutional investors, and Blockchain launched a new exchange, The PIT.

The increase in industry activity is a good sign for the long-term growth of the industry.

The block analyst Larry Cermak's long analysis:

1. Just as ICO was quickly dying as a financing method, a stronger and more flexible financing method came back. It has a new abbreviation -IEO. IEO is not sustainable, but the current currency exchange (IEO) outperforms other exchanges.

2. In 2019, approximately 180 projects were financed through IEO, while at least 40 exchanges conducted at least one IEO.

Four little-known exchanges (ProBit, Coineal, Bitforex, Exmarkets) caught the trend and completed 45% of them.

3. Because of the poor qualifications of small exchanges, I analyzed IEO projects on more legal exchanges (Cuan, Bitfinex, Bittrex, Okex, Firecoin, etc.).

A total of 28 IEOs were conducted on these exchanges, of which 64% of the IEO projects were positively denominated in US dollars.

4. A more informative indicator is the return on bitcoin pricing. Only 12 projects (less than half) earn more than Bitcoin.

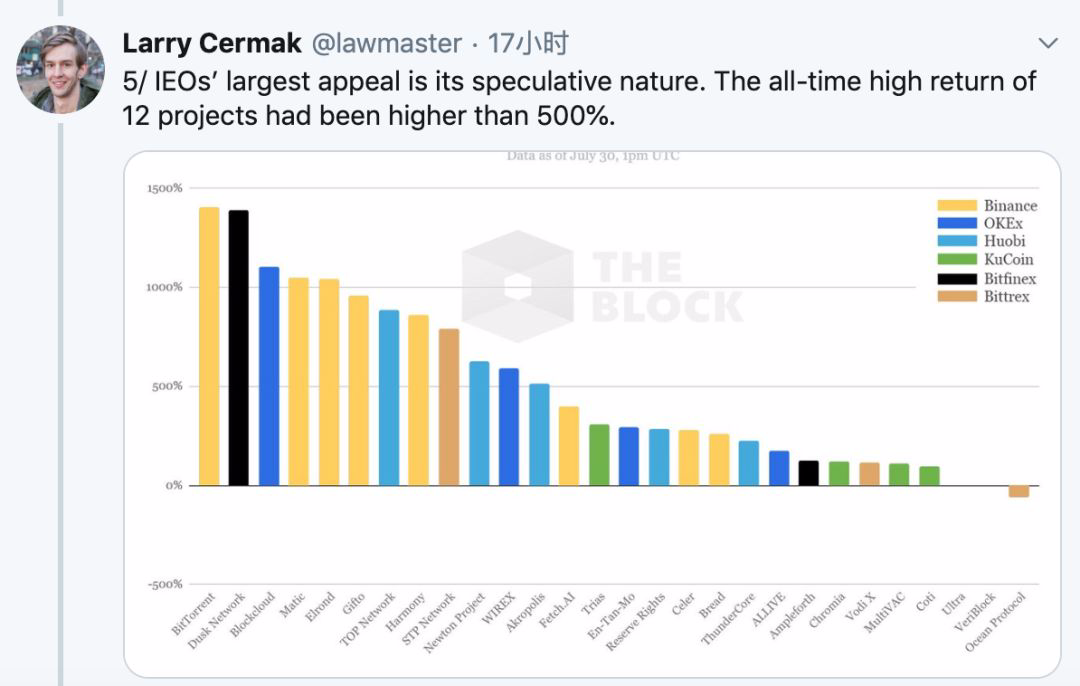

5. The biggest attraction of IEO is its speculative nature. The highest return of the 12 projects exceeded 500%.

6. Because many investors buy IEO tokens only to sell at a higher price in the next few months. 75% of the projects fell 50% from the highest point, and 39% of the projects fell 75% from the highest point.

7. Therefore, there seems to be a correlation between the price at the highest point and the time of the IEO. The longer IEO, the greater the price collapse compared to the highest point.

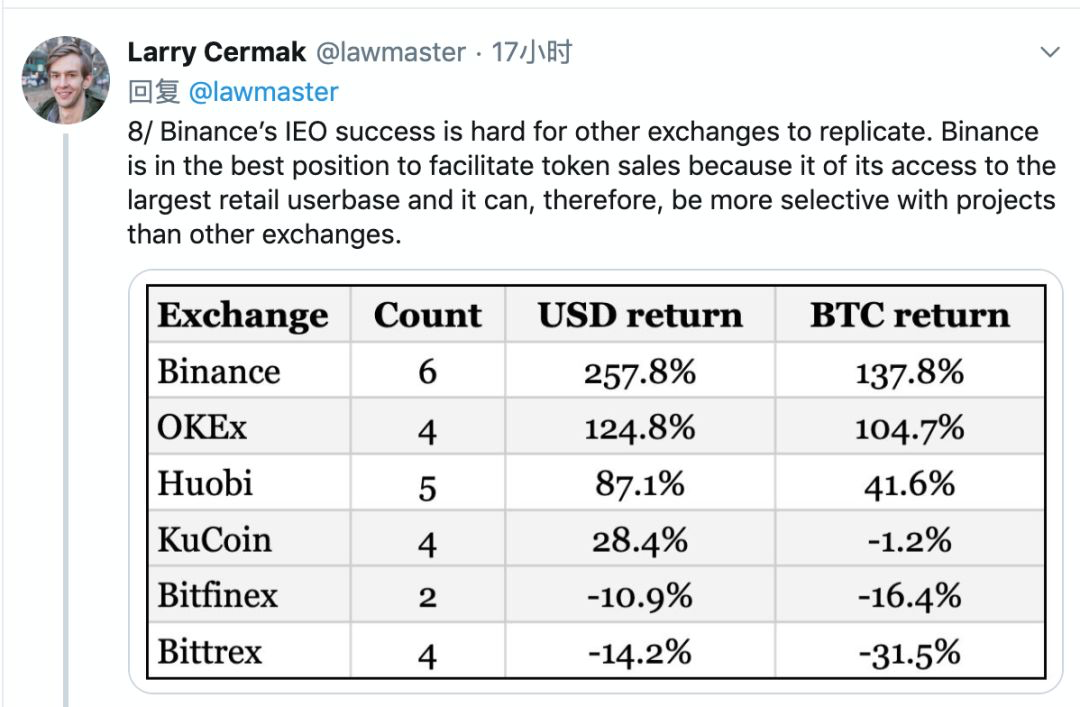

8, the success of the currency IEO, it is difficult to be copied by other exchanges. The currency is in the best position for token sales because it has access to the largest retail user base, so the currency has more options for projects than other exchanges.

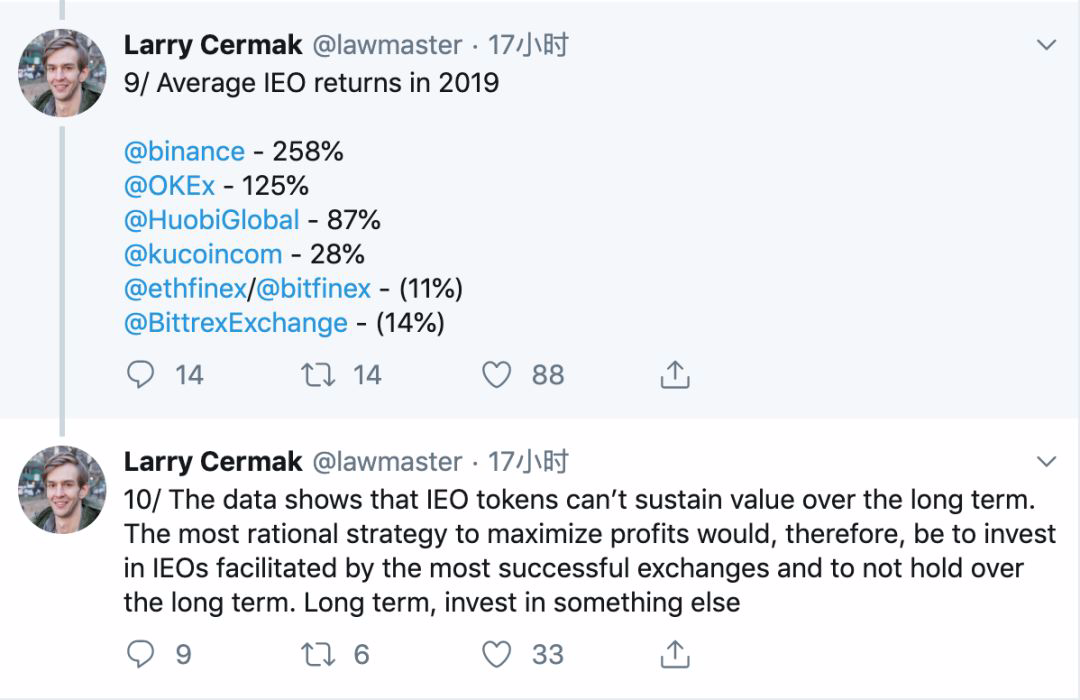

9. The average return of IEO in 2019: 25% for coins, 125% for Okex, 87% for fire coins, 28% for Kucoin, 9% for Bitfinex, and 14% for Bittrex.

10, the reality of data, IEO tokens in the long run, can not maintain value. The most rational strategy for maximizing profits is to invest in the IEOs that are most successful in trading, and not to take long. In the long run, invest in other things.

1. According to CoinDesk, developers of NBA and CryptoKitties and Dapper Lab are collaborating to launch a blockchain-based collection encryption platform, the NBA Top Shot.

Fans can buy and sell, trade digital collections of the season, such as "Kevin Durant's three-pointer or Joeln Bide's dunk." Digital collections can be used for chain games or tournaments.

2. According to Cointelegraph, the judges of the High Court of England and Wales dismissed the embarrassing lawsuit of Stanford Cong (CSW) on Bitcoin cash supporters and Bitcoin.com CEO Roger Ver.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- QKL123 market analysis | good times but the upswing is weak, why? (0801)

- Germany's largest blockchain company financing, Bitwala received Sony's lead of $14.5 million

- Google launches new secure multi-party computing open source library to collaborate with data in a privacy-safe manner

- Trading volume in the bitcoin chain soared to the highest level in history, with a single-day transaction of over $6.3 billion on July 29

- Does the US ban bitcoin? Senator: Will not succeed

- LTC cut production and led the gains, the broader market to start?

- Bitcoin returned to $10,000, and the Fed cut interest rates to help!