How to support dual offline payments for digital currencies: the central bank and ICBC have prepared three sets of plans

China's central bank digital currency is gradually approaching. Institutions including IDC and Business Insider have judged that the central bank's digital currency will be issued in 2020. On February 17, Li Lihui, former governor of the Bank of China, recently said in an interview with China Daily that "under the current situation of epidemic prevention and control, digital currencies should be able to be issued faster."

The release of the Libra White Paper last year has, to some extent, contributed to the accelerated research and development of central bank digital currencies. In the beginning of 2020, even the Federal Reserve, the Bank of Japan, and the European Central Bank are considering digital currencies, and mutual competition may accelerate the issuance of digital currencies between countries.

However, a technical problem in front of the central bank's digital currency is “dual offline payments”. Compared with digital currencies that Libra or other countries have issued and are developing, the Chinese central bank digital currency is the only one that explicitly requires “dual offline payments”. It was found that the patent of the interchain pulse query showed that the central bank had proposed a set of schemes. ICBC has also prepared two sets of schemes for the central bank's digital currency dual-offline payment, one using the blockchain and the other not.

Central bank's dual offline payments

Mu Changchun, deputy director of the Payment and Settlement Department of the People's Bank of China, mentioned in the course of "Science and Finance Frontiers: Libra and Digital Currency Prospects" that the central bank's digital currency can achieve "dual offline payments" like paper money, that is, when both income and expenditure are offline Payments can still be made in the future. In the future, as long as two people have installed the digital wallet of the central bank's digital currency, no network or signal is required. As long as the mobile phone has power, the two mobile phones can realize real-time transfer by touching each other.

- Coinbase: Cryptocurrency is a solution to racial inequality in the financial sector

- Forbes: Why use a fixed investment strategy to invest in Bitcoin

- Analysis of hard core technology | bZx protocol attacked by hackers

The current offline payment of Alipay and WeChat is “single offline”: offline to users and online to merchants. The method is to generate an identification code (usually a two-dimensional code) on the Alipay and WeChat clients to identify the Alipay user. After the merchant obtains the identification code, he applies to the Alipay backstage to debit the Alipay account corresponding to the identification code.

Alipay and WeChat Pay are single-offline payments. In order to ensure that the user's payment results are reliable, the merchant must obtain payment results from the payment company by his own terminal or system, and cannot use the consumer's payment result voucher as a conclusion. Taking the traditional POS business as an example, a merchant must see the POS machine to issue a successful payment document before they consider the payment valid.

This single offline payment still has a trusted institution (Alipay, WeChat Pay) for accounting calculations. This institution can understand the balance, credit, and real-time transaction behavior of the offline party through another connected party. Promote the completion of a transaction when it is safe.

The dual offline payment is a point-to-point payment. How to achieve trust between the two parties suddenly increases the difficulty.

In the era of banknotes, banknotes are constantly being forged. Compared to banknotes, digital currencies are a series of numbers that are easier to counterfeit. If the security of dual offline payments cannot be solved, the issue of digital currency issues by central banks will occur.

According to public information, the research on the central bank's digital currency began in 2016, and it also explored dual offline payment methods. In March 2016, the Institute of Printing Science and Technology of the People's Bank of China applied for a patent "method and system for offline payment using digital currency chip cards".

The central bank proposed the characteristics requirements of dual-offline of digital currency 4 years ago including:

1. Security: It can prevent any party in the business from changing or illegally using digital currency;

2. Non-repeatable spending: Digital currency can only be used once, and repetitive spending can be easily checked out;

3. Controllable anonymity: Banks and merchants collude with each other and it is impossible to track the use of digital currency, requiring the system to be unable to link the purchase behavior of users of electronic cash, thereby hiding the purchase history of digital currency users, but the issuance of digital currency To track the use of digital currencies;

4. Unforgeability: users cannot counterfeit digital currency;

5. Fairness: The payment process is fair to ensure that either the transaction is successful or that both parties have no losses, preventing a transaction party from suffering losses in the transaction;

6. Compatibility: The digital currency issuance process and circulation in the digital currency system of the central bank refer to the physical currency issuance and circulation as much as possible.

Beginning in 2019, the characteristics of the central bank's digital currency have been gradually disclosed to the outside world, which is nothing more than the above requirements. It is worth noting that the lead of the invention of this patent is "Yao Qian", who later served as the director of the Digital Currency Research Institute of the Central Bank and is currently the director of the Science and Technology Supervision Bureau of the CSRC.

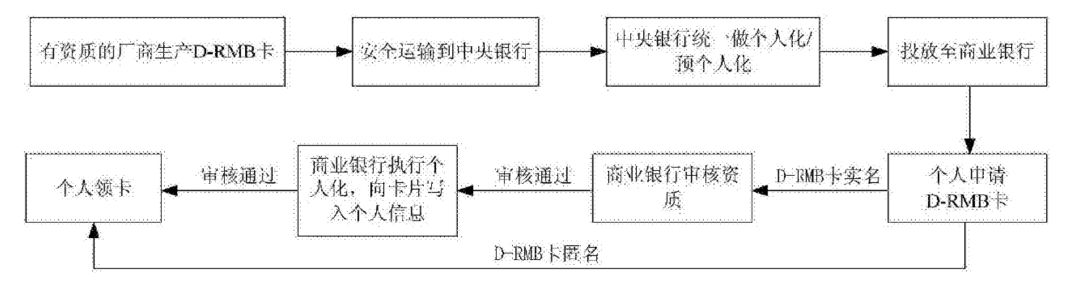

But in this patent, the "dual offline" payment is realized through a "chip card". According to the description in the patent, the offline payment between the two parties of the transaction is realized by near-field communication means such as NFC, infrared or Bluetooth. The transaction terminal requires a digital currency chip card. The form of the chip card includes a visible Bluetooth IC card, an IC card, a mobile phone-eSE card, a mobile phone-secure SD card, and a mobile phone-SIM card.

This chip card has the functions of verifying the authenticity of digital currency and the legality of transactions. It should be an encrypted chip card with strong resistance to cracking. According to the patent, a qualified manufacturer is required to produce this chip card, and then put it into commercial banks and personal terminals.

(The central bank's offline payment card collection process source: the patent application)

In other words, the central bank has set up an offline payment system through a unified chip. But this cost is also huge, that is, all payment nodes are required to install this chip. This may be the reason why this method is not adopted now.

But the principles of central bank digital currencies have not changed.

Two sets of ICBC's dual offline payments

At present, the central bank's digital currency is about to "sword out of its sheath". According to the mutual chain pulse, ICBC has participated in the construction of the central bank's digital currency system.

In order to support the dual-offline payment of the central bank's digital currency, ICBC has prepared two plans. In October 2018, ICBC applied for a patent "Cryptocurrency-Based Offline Payment Method, Terminal, and Agent Delivery Device".

According to the description of this patent, the background of its invention is: "The People's Bank of China vigorously promotes the research and development of digital currency to accelerate the entry of digital currency into the circulation field. As a new force in future payment methods, digital currency needs to support network-based online Payments, but also need to support offline payments where both the receiving and paying parties are offline and not connected to the network. "

This ICBC patent builds a complete dual-offline payment solution, which mainly implements more software modules, and its hardware more uses existing trusted hardware such as SIM cards. This can be rolled out on a large scale without upgrading the hardware.

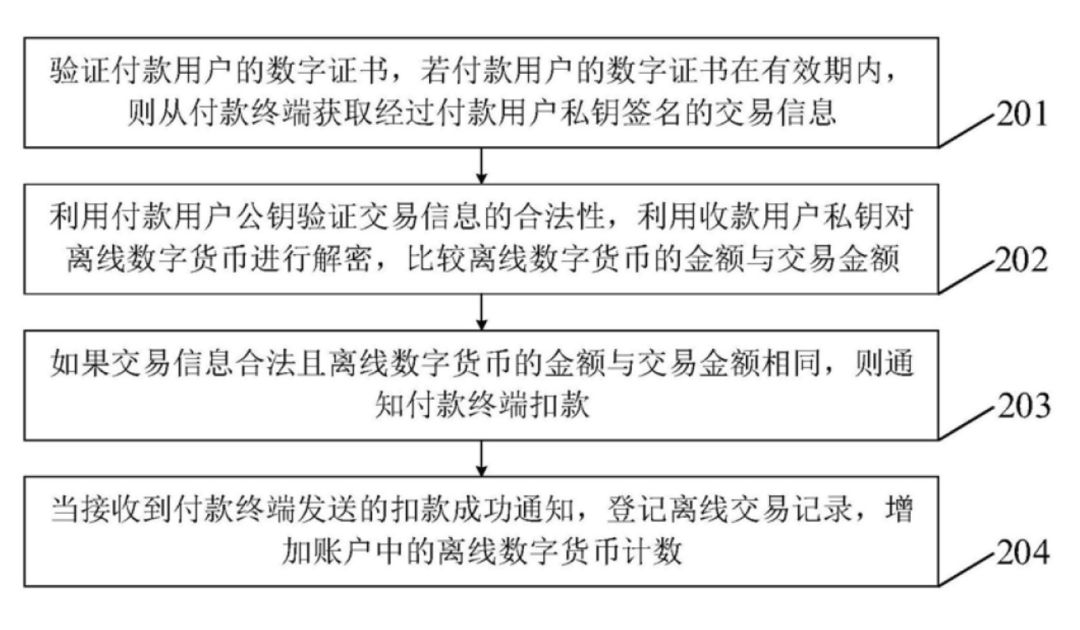

According to the patent, its implementation is to send the payment user ID, the payment user public key, and the digital certificate of the payment user to the payment terminal, and receive the payment user ID, payment user public key, and payment user's Digital certificate; if the digital certificate is within the validity period, receiving transaction information signed by the payment user ’s private key sent by the payment terminal, the transaction information includes offline digital currency paid by the payment user, and the offline digital currency passes the receiving The user's public key is encrypted; the payment user's public key is used to verify the legitimacy of the transaction information, and the recipient user's private key is used to verify the validity of the offline digital currency; if the transaction information is legal and the When the offline digital currency is valid, the payment terminal is notified to debit; when a notification of the successful debit sent by the payment terminal is received, an offline transaction record is registered, and the offline digital currency count in the account is increased.

(A flowchart of the patent offline payment method)

It is worth noting that the patent "discloses" the information to be included in the digital currency. The patent description states that the digital currency agent will be responsible for generating the coin number, face value, currency type, unit, version number, previous currency number, agency issuing agency identification, digital signature and other elements to assemble, and generate digital currency encrypted characters through encryption. String is digital currency.

In addition to this solution, in August 2019, ICBC applied for another offline payment patent, "Blockchain-based offline payment system and method".

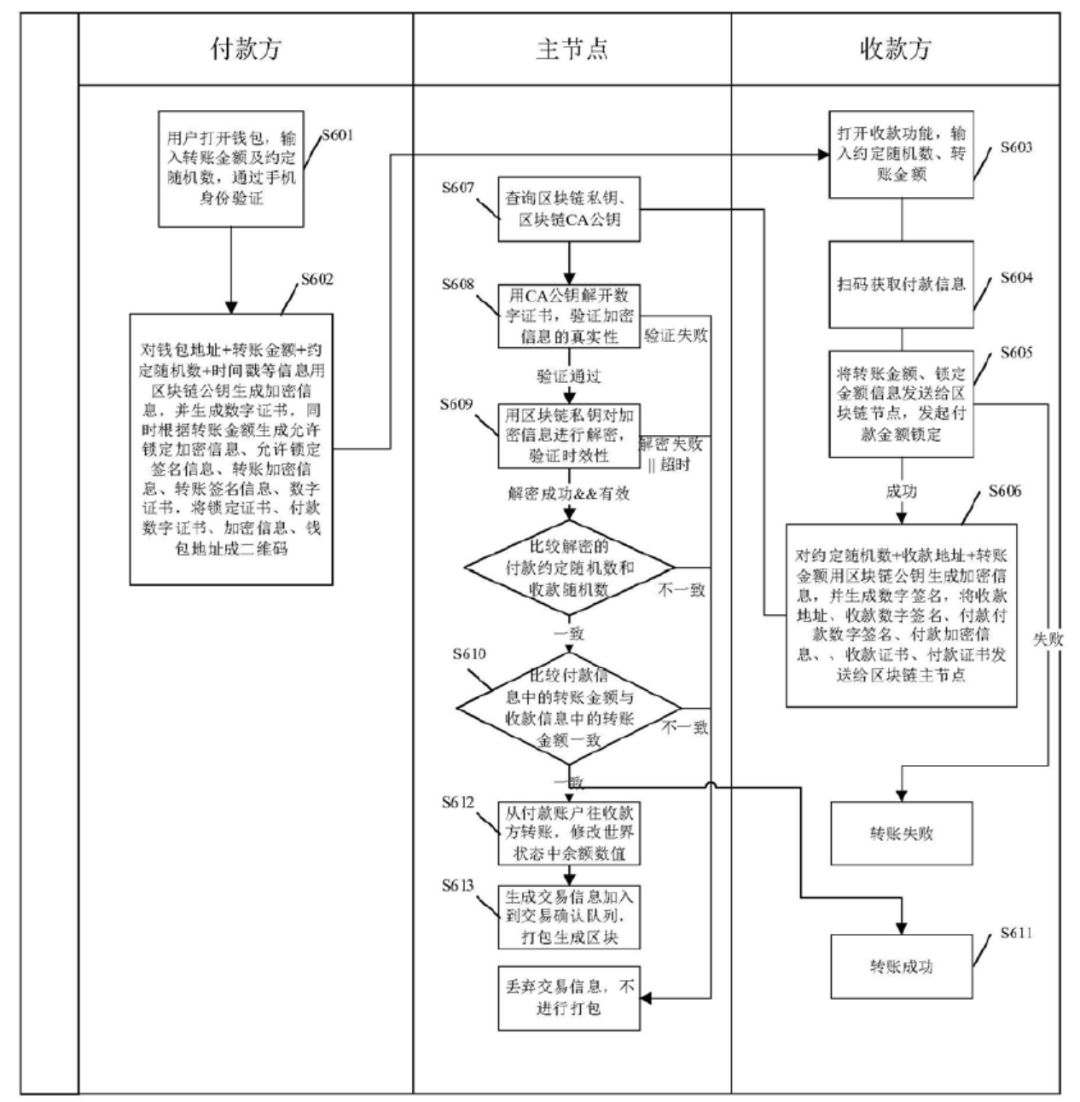

The biggest difference between this solution and the previous solution is the use of a blockchain. The method is as follows: the main chain of each bank constitutes the main chain of the blockchain, and the user's light nodes access the main chain of the block chain. The asymmetric encryption technology is used to encrypt the transfer information of the sender to ensure the security of funds and communication. Enter the transfer amount, the user wallet asymmetrically encrypts and signs the user information, the transfer amount and other information and sends it to the backbone network for transaction verification. After verification, the transaction information is packaged and added to the blockchain. Several subsequent areas After the block is generated, the transaction is completed, which can achieve the goal of anti-tampering, thereby achieving offline and fast payment in the real world.

Specifically, information such as wallet address, transfer amount, agreed random number, and time error are used to generate encrypted information and digital certificates through the blockchain public key. At the same time, you can lock signature information, transfer encryption information, transfer signature information, and generate payment using these information. QR code. The payee can then scan the code to generate a digital signature on the above information. When there is a network, upload it to the blockchain master node.

(A flowchart of the patent offline payment method)

However, this scheme is mostly based on two-dimensional codes, and its use range is narrower than the previous scheme. And this scheme needs to cooperate with each bank node to join a blockchain network, and its system complexity is also higher than scheme one.

The digital currency dual-offline payment of the People's Bank of China can benefit a wider range of people and be applicable to more scenarios. No matter what the final solution is chosen, its technological exploration is also unprecedented and is likely to become a global benchmark.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Kraken January Crypto Market Fluctuation Report: Earthquake Level Transformation?

- In a year, 27 items of landing applications were disclosed. The IBM blockchain is only for nurturing cloud services?

- Vitalik: Uniswap v2 Price Predictor Can Withstand Lightning Loan Attacks

- Take Mentougou as an example: Do investors in FCoin have a future?

- Coin price soared, 51% attack, "destruction" and "reputation" on the way of reducing Bitcoin Cash (BCH) production

- Don't blame "Lightning Loan", bZx is attacked by it

- Five countries are strengthening cryptocurrency regulation