How terrible is the IEO? 62% of 87 projects broke, with a maximum loss of 99%

87 IEO projects, raising more than 2 billion, 62% broken

"Bitcoin is about to plummet to $5,000." "Cryptographic currency is a scam."

With the collapse of Bitcoin at the end of September, there has been such an argument.

It is difficult to predict whether Bitcoin will fall to $5,000, but what investors say is that "cryptocurrency is a scam" is based on the fact that the IEO project in the first half of 2019 has broken, smashed and ran away.

- The “blockchain scam”, which has been repeatedly subject to regulatory investigations, has been officially opened.

- Can incentive model adjustment improve EOS online voting? BM release new ideas for governance

- Is the blockchain anonymity compatible with the real business world?

I know that IEO is crazy and tragic, but the truth may be more terrible than most people think.

According to deep chain financial (ID: deepchainvip) statistics, as of October 10, 2019, 17 exchanges, including currency security and fire coins, launched a total of 87 IEO projects, raising more than 295 million US dollars, or a contract worth 2.09 billion yuan. .

According to the highest rate of return, the fund reached a maximum of 1.359 billion US dollars, and now only 325 million US dollars, shrinking 76.09%.

Among the 87 projects, 3 projects lost 99%, close to zero, 41 with losses exceeding 50%, and 33 without losses. The median return on investment is -45%, which means that the vast majority of investors are losing money.

This is only the data purchased at the issue price. If it is bought at a high price in the secondary market, the loss will be more serious.

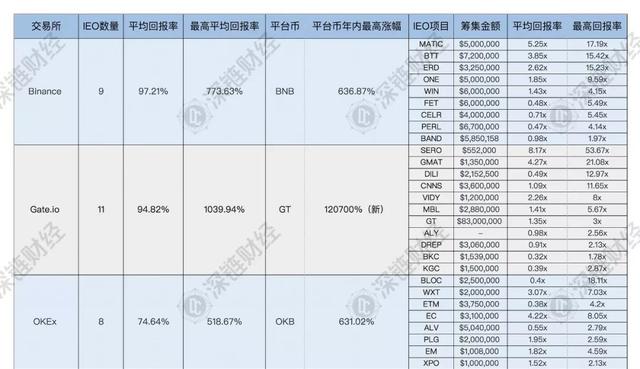

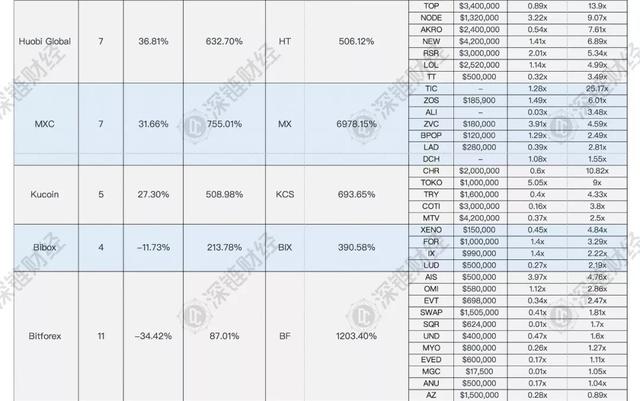

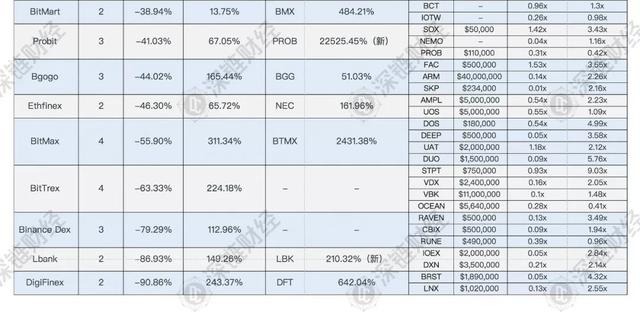

The average return rate of coins is up to 97.21%, and DigiFinex is at least -90.86%.

By endorsing the IEO project exchange, the project party can more easily raise funds, and investors can more easily participate in the speculation of the secondary currency market of the project.

Deep Chain Finance (ID: deepchainvip) counts the highest gains of the platform exchanges in 17 exchanges, the IEO projects on the line, the average return rate of the projects and the highest rate of return.

A total of 87 IEO projects have been launched on 17 exchanges. The highest exchange rate on the highest exchanges is as high as 1039.94%, and the lowest is only 13.75%. Overall, the rate of return is still positive.

However, specific to the project itself, there are Sero with a maximum return on investment of 53.67 times, and there is also an Ocean Protocol with a high return on investment of -59%.

87 IEO projects raised more than $295 million in funding, and according to lCObench, lCO raised $425 million in September. From the point of view of the amount of funds, the channel for the project party to obtain funds is mainly lCO.

It can be seen from the data that if each IEO project is involved in the purchase price and only 33 projects are still profitable, only 37.93%. If you buy at a high price in the secondary market, then this ratio will be lower. The three projects with the lowest rate of return, SKP, SQR and MGC, are both -99%. If you buy these items for 100 yuan, you can only get back 1 yuan.

Of the 17 exchanges, only 6 exchanges have an average return that is still positive. The average return rate of the currency is up to 97.21%. DigiFinex has a minimum of -90.86%, which is equivalent to investing 100 yuan, and finally only 9.14 yuan.

Most IEO projects often require a certain amount of platform currency to purchase, which also makes the platform currency a huge increase. This year's new Gate.io platform coin GT and Probit platform coin PROB are the two currencies with the largest increase. However, at present, GT has fallen by 56.47% compared with the highest point, and PROB has fallen by 74.60%.

As of October 10, the IEO projects on the BitMart, Ethfinex, BitTrex, Binance DEX, LBank, and DigiFinex exchanges all fell below the issue price.

Among them, the project without Bitcoex platform is broken on the line, and the average yield of all IEO projects is -63.3%.

BitTrex IEO project price trend

IX, DXN and other projects after the cash out of "death"

After an in-depth investigation of some projects, Deep Chain Finance (ID: deepchainvip) found that multiple IEO projects have been "dead."

Bibox launched X-block (IX) on April 25, and raised a total of 990,000 US dollars. After the launch of Bibox, IX began to plunge all the way. Today, the price is maintained at 0.0001 (the lowest price of Bibox), which has been more than a month, and there is almost no volume.

The last tweet of IX is still in May, and the content is about the online bb.vip exchange. However, the announcement of the official website of the bb.vip transaction indicated that “the X-Block was delayed due to the progress adjustment of the project” and there was no following.

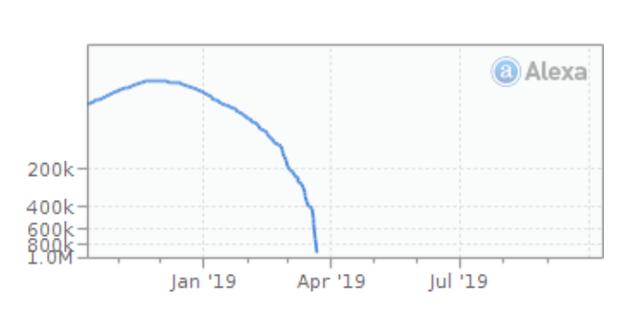

Upon inquiry, its official website x-block.io has been unable to log in, and the website ranking has fallen from a cliff in mid-April. In the Ethereum browser, you can see that only 537 addresses are held by IX, and the top ten addresses hold 66.42% of tokens.

X-block.io Alexa ranking

X-block.io Alexa ranking

DEXON (DXN) launched LBank on April 25 and raised $3.5 million. LBank's copywriting said that DEXON is the most advanced distributed ledger technology, which perfectly balances the impossible triangle of traditional blockchain systems: decentralization, security, and scalability.

In fact, DEXON did not do publicity, and after May, DEXON's Facebook and blockchain were never updated.

DEXONSCAN blockchain browser

Huang Weining, the founder of DEXON, was also disclosed to create the exchange Cobinhood and raised 400 million Taiwan dollars through the platform currency COB. The team was disbanded due to internal chaos.

When questioned by the DEXON open source foundation, Huang Weining denied it. However, it is hard to deny that DEXON's GitHub was only updated once in 2019, and the test network has been shut down.

DEXON was taken down by LBank in July and survived for less than three months.

In addition to X-block and DEXON, there are a number of projects that only maintain social network updates, ensuring that they are “alive” in the eyes of investors.

The break rate of fire coins is 42.86%, and the break rate of OKEx is 37.5%.

Because of the above mentioned, the reason why the IEO project can easily raise funds is due to the endorsement of the exchange. But how does the exchange benefit from it? The first is to lock in the liquidity of the exchange platform currency, reduce the supply in the market, and thus raise the price of the currency. The second is to charge a certain amount of the currency fee from the process of depositing the currency.

If the exchange does not raise the demand for platform currency prices, then there is no strict requirement for the “quality” of the IEO project. For example, the only cost of BitTrex's IEO project is the currency fee.

Similarly, there is no platform currency for Bince DEX (non-Binance). As long as 1000BNB, the project side costs are low, so the IEO project on Binance DEX has a low increase and all breaks.

So, is it necessary to choose an IEO project that is launched on a big exchange?

Unreliable, the current highest average yield of the currency is on the line of 9 projects, of which 4 breaks, breaking rate of 44.44%. The average yield of the second highest rate of Gate.io 11 projects have 5 breaks, breaking rate of 45.45%. 3 items of 7 coins were broken, the breaking rate was 42.86%; 3 out of 8 items of OKEx broke, the breaking rate was 37.5%.

In fact, not only is it unreliable, but the exchange may still be an accomplice.

For example, Huobi Prime Lite's first project, ThunderCore (TT), on May 9th, immediately went up from 0.015 to 0.048, and then plummeted all the way. On the 11th, there were rumors that the team had loaded 50 million and 30 million TTs respectively into Upbit and Firecoin before the transaction.

Immediately after TT's earliest unofficial community, ThunderFans issued a message stating that it ceased operations and publicly broke with the project side. The TT price was hit hard by the departure of chief scientist Elaine. At this point, TT has fallen by 90.04% compared to the highest point.

TT price trend

In addition to TT, the second phase of the Huobi Prime project, the Newton Project of Fire Coin, was also revealed as “cutting leeks”. Today, it has fallen by 79.84% compared to the highest point.

Of course, there are also direct exchanges between the exchange and the project side. Bibox announced that it would suspend the Staking (SKR) project two hours before the launch of the Bibox Stellar, and then SKR issued a message indicating that the real fuse is that Bibox is asking for a margin.

After the farce, the Bibox platform BIX has fallen 72.57% from its highest price. SKR moved to the BiKi exchange, and it immediately jumped 10 times on the line, then immediately plunged back to the original point, and now it has plunged 99.59% at the highest point.

In the opinion of analysts, it is precisely because the interests exist in every aspect of the IEO, so there are motives for evil in both the project side and the exchange. From the data point of view, IEO is only suitable for speculation rather than investment.

After the fiery IEO, there may be an IXO, and the speculative wind will not stop. For investors, always remember that before the speculation, the currency market is risky and speculation should be cautious.

Author

Editor's door

Operating a hundred small stones

This article is original for Deep Chain Finance (ID: deepchainvip). Unauthorized reproduction is prohibited.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Jiang Zhuoer: Will it come if the halving of the bull market will come?

- Following the Telegram, we believe that the SEC will start with these two projects.

- Libra has become a catalyst for the reform of the mothers? The central bank governor told the reality

- Getting started with blockchain | Block heights and bookkeeping

- Howe Test: SEC hangs the sword of Damocles on the head of the encryption company

- CME Group Q3 Report: Bitcoin futures grew 61% year-on-year despite the market volatility

- Two times to prevent the ASIC from failing, Monroe will completely change the algorithm at the end of October.