In 2020, the top ten keywords look at crypto assets

The original text is selected from " Cryptocurrency Paper 2020" , source Messari, author Ryan Selkis, translation provided by First Class (www.First.VIP).

Keyword 1: "Bitcoin"

In 2020, for most people, the focus will still be "Bitcoin" rather than "Cryptocurrency". People outside the industry only care about Bitcoin, they don't care about things other than Bitcoin. The reason is that it's easy to explain Bitcoin to others, even to a five-year-old. I don't care about the complaints of the Ethereum crowd (the original author also loves ETH), there will be no "big turbulence" in prices this decade, because after a crash like 2018, people just want to invest in what they think is safe, reliable, and easy. Understand assets. Bitcoin has the lowest attack surface (because of poor functionality), has the longest history (founded the earliest), and the easiest to understand "simulated competitors" (gold).

- The death knell of the dollar, who is the savior?

- Bitmain launches personnel optimization, streamlines organization, cuts Bitcoin in half

- National Development Institute Li Guangqian: Beware of the "financial restraint" of the blockchain, the physical industry and financial attributes should develop in a balanced manner

In addition, Ethereum does not have as strong anti-government and anti-culture as Bitcoin (in fact, the Ethereum community is more "left-leaning", and BTC is "right-leaning"), so poor management of fiscal deficits will lead people's attention to Ethereum "A series of other statements are biased. In fact, they are focusing on Bitcoin first.

Keyword 2: Halving

Halving is only a prophecy of "self-fulfillment." The halving statement makes sense for high inflation assets because I don't think people really understand the impact of continued daily selling pressure on a given asset. Some analysts say that the impact of the halving event is already reflected in current prices because the information is known in advance, but assuming the cryptocurrency market is rational (but not). So the truth is at least somewhere in between.

In the early stages of Bitcoin's fixed issuance, people were just exposed to mining and were too excited to properly estimate the number of mining forces that would follow. It wasn't until later that earnings started to decrease. Intuitively, under other conditions being the same, the rate of Bitcoin issuance dropped from 3.7% to 1.8% within six months, compared with Zcash's issuance rate from 32% today to 12.5% in November next year. In other words, the former has less impact on the supply of the entire market, and even this will not have an impact on supply. Anyway, for the argument that halving the impact on the market, these two samples are not very scientific, and Bitcoin is also affected by more macro-level factors, not just a 2% increase in the issuance rate.

But from another perspective, the halving mechanism does ensure a limited supply of Bitcoin. Therefore, the discussion around this topic is likely to stimulate new demand for Bitcoin. According to previous reports, long-term cryptocurrency investors have stated that 50% of all newly mined bitcoin will be absorbed by the purchases of two corporate customers after the halving of bitcoin takes effect in 2020: Grayscale's BTC trust service And Square's BTC purchase service.

Keywords 3: uniqueness

There is only one Bitcoin. The author believes that the situation of Bitcoin Cash (BCH) should be more severe than alternative currencies such as Litecoin (LTC). For those who applaud BSV and some other junk coins, the reality is even worse. The chances of a meaningful Bitcoin fork are very low, unless 1) an excessively low fee clearly threatens the Bitcoin network or 2) a developer activates developers soft-fork and forces other members to support it. Hard fork.

However, according to current prices and an inflation rate of less than 2%, the annual output value of mining in May next year will fall to about 2 billion US dollars, while the annual transaction fee income will drop to about 7 million US dollars, which is similar to credit card companies. The method of charging fees is similar. I think this is more like an issue that needs attention in 2022 or 2023, that is, if transaction fees have not started to occupy a more meaningful percentage of block rewards, or BTC prices have stagnated (or even fallen further), " "Mining disasters" are more likely to occur.

Keyword 4: Lightning Network

It's hard not to be disappointed that Lightning Network's progress has stalled this year. Of course, Bitfinex's becoming the first major exchange to support LN is a major milestone. Of course, there may be many completely private transaction channels that are not counted in the channel number, and the number of Bitcoins locked in the Lightning Network channel may also be underestimated. Yes, the number of authorized active nodes has increased at least 5 times, and the channel capacity still seems to be $ 6 million. Compared to the DeFi application on Ethereum, Lightning Network can only rank eighth at most.

Having said that, the author still believes that from January 2020, Lightning Network will have an irrational moment of prosperity , and the channel capacity can reach $ 10 million. Considering that the Lightning Network has previously been favorable, Jack invested in Lightning Lab in 2018, and Matt Corallo, the core Bitcoin developer, joined in April this year, and the team expanded this fall. The Cash App does not release "some compelling features."

There may be a negative correlation between the number of assets supported by the wallet / exchange and its likelihood of increasing Lightning Network support in the short term. So, start to separate "Bitcoin transactions" from "junk transactions"? Speaking of exchange support, BitMEX Research has a study on LN. If you want to learn more about Lightning Network, you can find and read.

Keyword 5: Privacy

Regarding Layer 1's privacy issues, last year, Messari co-founder Dan made the following predictions: "The Lightning Network may start to be used as a privacy layer for Bitcoin transactions. There will be more privacy solutions for Bitcoin Layer 1 Discussion of the plan, but it has not affected the progress of end users. "

I looked around the Bitcoin roadmap to see when the Bitcoin network can implement some privacy features, such as Dandelion (obfuscated the IP address of the first broadcast transaction node), Schnorr signature (in addition to multiple transaction signatures , "CoinJoin," or will make the Bitcoin transaction pool as elusive as Monero), Taproot, and more. If privacy can be achieved, it will bring more scalable private smart contracts to Bitcoin. When exactly these functions will be used as a soft fork of the protocol is unknown, but the author expects to launch a soft fork that supports Schnorr signatures in the third quarter , and it is almost certain that the upgrade will become a bitcoin developer studying A key part of the new features.

Keyword 6: Roadmap

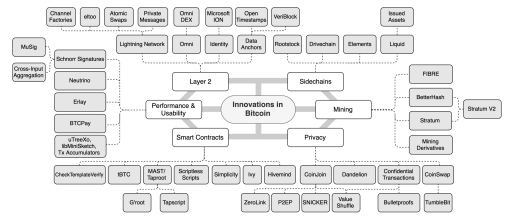

The roadmaps for Bitcoin and Ethereum are crazy. There is no real roadmap for Bitcoin, and Ethereum never completes the roadmap on time. Thanks to LucasI Nuzzi of Digital Asset Research for providing this excellent chart that helps organize the state of innovation and long-term roadmap within Bitcoin. (First Class: Originally called "Innovation in the Bitcoin Technology Stack: Today Is Not the Same" )

You can click here for a larger picture

In addition to the lightning network and privacy feature upgrades mentioned above, the author is most interested in some boring but important work in progress that will make Bitcoin as close to decentralization as possible.

Keyword 7: Bitmain

Bitmain will not be listed in 2020. Bitmain may make a comeback after a difficult period, but it may still not help. However, they have now submitted a confidential registration document to the SEC in preparation for listing in the United States. I would be surprised if they did pull the trigger in 2020. Bitmain's valuation in 2020 will be significantly lower than the $ 12 billion in 2018. Shares of their number one competitor, Creative Nan, fell 45% in the first two weeks after it went public last month. For Bitmain, the timing couldn't be worse. With the horizontal competition in the crypto market fiercer than ever, Bitmain's financial position fell by half in May. Readers may also have heard that they have recently had some dramatic events with their founders that may need to be resolved in court.

Keyword 8: Mining

The miners are moving back to the United States. Denver-based miner Crusoe Energy Systems will open a fourth Bitcoin mine in the Rockies. Many companies, including Bitmain and DCG-backed Layer1, have set up branches in the United States to take advantage of the recent shale gas boom (affordable energy). Interestingly, these data centers only use excess natural gas supplies, otherwise these natural gas supplies will be consumed by "natural gas burnout" because energy companies are actually burning capacity because they have too much inventory, storage or Shipping costs may be higher.

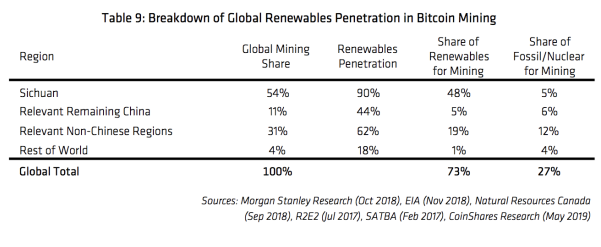

From a cyber risk perspective, it is a good trend for a country to have more diverse mining capabilities. If Bitmain's IPO is successful, I expect that it will drive the development of more mining facilities in the United States in 2020, even though Bitcoin is about to halve. CoinShares released its latest report on Bitcoin mining this month, which found that Sichuan Province accounts for 54% of global mining. This is geopolitical risky, but it is also good for the ecological environment, because 90% of production capacity there is provided by renewable energy.

Keywords 9: side chain

What about Bitcoin's sidechains? Similar to the Lightning Network, the Bitcoin sidechain has not received much attention since the blockbuster white paper that Blockstream advertised in 2014. We seem to have a long way to go to achieve "trust minimization" sidechains, but "affiliate sidechains" (ie, managed by the alliance) like Liquid and RSK are starting to show some improvement.

As one of the 23 initial launch partners of the Liqud network, BTSE plans to issue tokens and raise $ 50 million through the Liquid network. The token functions similarly to existing exchange tokens, and BTSE uses 30% of all revenue to buy back and burn the token. In the crypto community on Twitter, critics gritted their teeth to accuse the bitcoin community of hypocrisy-they have been criticizing ICOs and token projects for years. However, the author believes that exchange tokens, as a quasi-secure securities with actual company income support, are much more interesting than the "practical" tokens in the ICO boom of 2017. But I still agree that BTSE is skeptical of token issuance, and they cannot raise the $ 50 million they want.

DeFi startup Money on Chain recently revealed that it is launching the Bitcoin DeFi platform on RSK , which will provide a Bitcoin mortgage loan system similar to MakerDAO on the RSK sidechain. The good thing is that DeFi on Bitcoin can use Bitcoin's liquidity and stability to become an alternative to the Ethereum-based DeFi project. In the worst case, it will be difficult to start the DeFi ecosystem on Bitcoin from scratch using the "Union sidechain". Builders may not only be skeptical of relying on the alliance's "trust" model, but they may also be anxious about abandoning Ethereum's rapidly growing DeFi ecosystem.

Keyword 10: Privacy contention

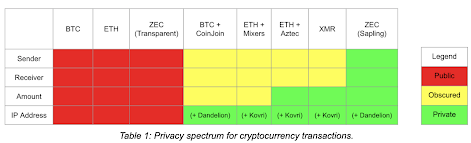

A battle for privacy is about to erupt in 2020, and Monero and Zcash are at the front when it comes to privacy and encryption. In theory, Monero should be the most difficult asset to be supported by the exchange, because all their transactions are anonymized by the protocol's ring signature scheme by default.

But Zcash will eventually become the most noteworthy "Canary" project in the privacy field. In addition to its weird "z-address" (fully anonymous), Zcash also provides a non-anonymous "t-address". Because exchanges can support t addresses by default and verify the sender (theoretically), Zcash should be less risky of being delisted by most major exchanges. If assets are struggling with the support of the exchange, it means that Bitcoin privacy upgrades will also bring huge compliance risks.

The Multicoin team provides excellent introductory knowledge for privacy, and the author recommends reading the full text to better understand (especially in 2020) important trends that need attention. Multicoin came to a different conclusion from this article-"The privacy chain itself is worthless because privacy is an important feature in any network." This team apparently underestimated the power of privacy, and because of ZEC's poor performance, misunderstood that high inflation would permanently affect the attractiveness of ZCash as an asset (does not constitute investment advice).

(First-class warehouse note: The above figure evaluates the privacy of major cryptocurrencies, and evaluates the privacy of "sender", "receiver", "quantity", and "IP address". Red indicates full publicity and yellow indicates partial privacy , Green means full privacy)

From the technical point of view shown above, even Multicoin has to admit that Zcash is the most competitive in the field of privacy. But their argument is that first assume that Bitcoin's obscurity is good enough, "We will see. If you have to make a series of unspeakable transactions, wouldn't you choose to trade in the green zone? If Your answer involves a cryptocurrency other than Bitcoin, so this cryptocurrency has investment value. "

Other privacy coins that rely on proof of work face a tough battle. If you look at the pressure that Zcash faced in the first three years before the first halving in the fourth quarter of 2020, you can't be excited about Grin because it will take twice as long to bring inflation down to Zcash's Level. This puts too much pressure on the "seller" and lasts too long. (The original author will not repeat them here. Regarding the viewpoint of "privacy contention", see also the key word 5 of this article.)

original:

https://messari.io/article/bitcoin-trends-for-2020 manuscript source (translation): https://first.vip/shareNews?id=2675&uid=1

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DeFi vs. Apple / Google App Store: Unsolvable battle?

- Blockchain coffee: the road to exploration of blockchain landing

- What misconceptions do people have about the security of Bitcoin?

- Chairman of Nanan Zhang Nanxun addressed the New Year: the first disclosure of new highlights of the second-generation chip self-research support 5G

- Summary of the latest cryptocurrency supervision by countries at the end of 2019

- Hashing Duck! Outlook for the Bitcoin mining industry in 2020

- The first on-chain finance in 2019: how does blockchain technology land in "bank guarantee"?