Forbes Binance’s Golden Touch, how did they turn failed ICO tokens into unexpected fortunes worth billions of dollars?

Forbes Binance's Golden Touch turns failed ICO tokens into billions of dollars.As its former competitor FTX founder Sam Bankman-Fried faces trial in New York for fraud and money laundering, the world’s largest cryptocurrency exchange Binance is facing a survival crisis.

The company has been hit with lawsuits from the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), accusing it of defrauding customers and deceiving regulatory agencies. According to Binance, payment processor LianGuaiysafe “suddenly decided” last week to stop processing euro transactions for Binance, and the exchange has also exited the European market, including the Netherlands. The company is also facing a significant loss of key employees globally.

Binance has not responded to multiple requests from Forbes for comment on these issues, but the company has dismissed the CFTC lawsuit, claiming it contains errors in multiple aspects and stating that the SEC’s actions are too broad.

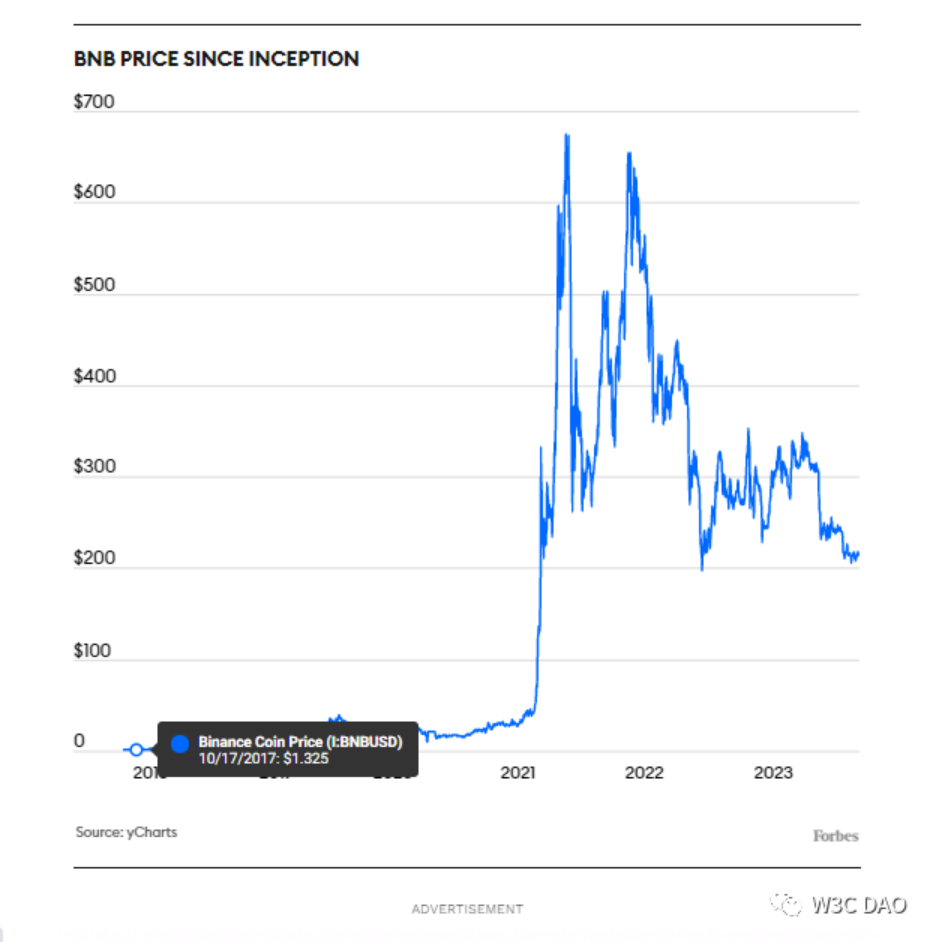

However, Binance’s biggest problem may be the decrease in trading volume, as the digital asset market continues to struggle through the cryptocurrency winter that began in 2022. This has put heavy pressure on its own cryptocurrency token, BNB, which has lost 68% of its trading volume.

- Web3 Legal Popularization丨Can GameFi Go Online Without a Game License and Constitute Illegal Operations?

- Crypto Race Weekly Report [10/9/2023] Decrease in ETH Staking Rewards, POW Track on the Rise

- Polkadot Q3 Development Summary Native USDC will enter the ecosystem, staking and independent account data continue to grow.

BNB is currently valued at $33 billion and has long been an important part of Binance’s operating model, but a closer look at its initial token offering in 2017 reveals that Binance’s early development was more turbulent than commonly believed.

Founder Changpeng Zhao said the idea of launching Binance’s own token came from a dinner on June 14, 2017, in Chengdu, Sichuan. On June 18, he distributed a 17-page whitepaper, which served as the foundational document for the project in the crypto world. It included a quick timeline for operation, detailing a new digital token called Binance Coin (BNB), which would be issued in a three-week auction.

At that time, it was a good time to enter the emerging cryptocurrency market, as hundreds of digital currencies were launching through initial coin offerings (ICOs), and most people could get rich by proposing dubious ideas in whitepapers. In the first six months of 2017, the cryptocurrency market grew fivefold, reaching over $100 billion.

The Birth of a Crypto Dynasty

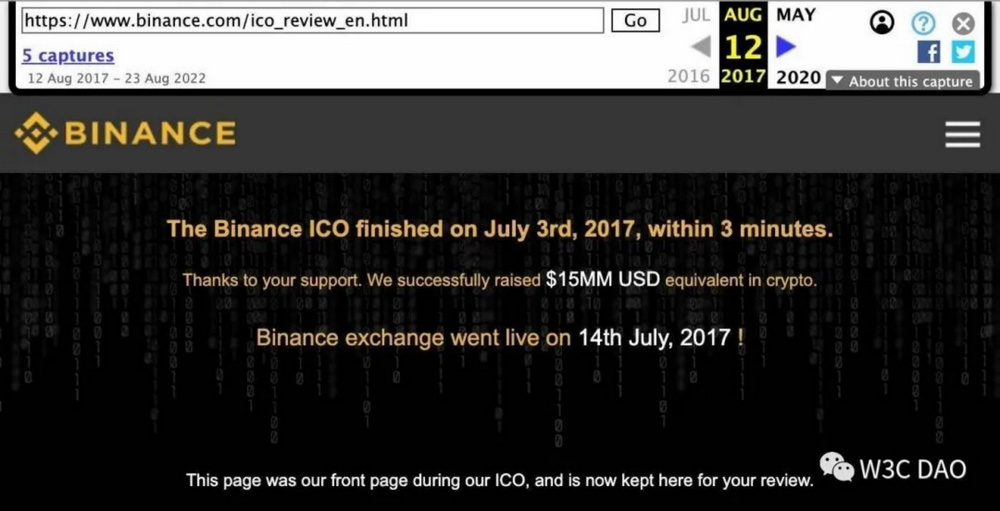

The Shanghai-based project progressed rapidly, starting implementation only in mid-June. According to a message posted by Changpeng Zhao on LinkedIn that day, the 100 million token ICO was completed on July 3, 2017.

Changpeng Zhao, now a billionaire, is widely known by his initials CZ. He claimed the auction was a “huge success” and wrote that $1.5 million had been raised, with an average price of 15 cents per BNB token. Some of the proceeds from the new token would be used to build the exchange platform, but most would be used for the Binance brand and marketing. The Ethereum-based BNB tokens could be traded like stocks, although they did not provide any ownership rights to the holders.

Exchange tokens are a peculiar creation, more like airline loyalty miles than company stocks. They are primarily used to reward customers with trading discounts or recruit new account holders. However, like stocks, they can also serve as a form of company currency. During last year’s cryptocurrency crisis, Binance used its holdings of BNB to pay for stakes in promising startups. According to the Binance whitepaper, a total of 200 million BNB were actually minted, but only 100 million were publicly issued during the ICO. Binance insiders will retain 80 million, with 20 million allocated to angel investors such as Bloq founder Matt Roszak, early Bitcoin investor Roger Ver, and NEO co-founder Da Hongfei. In addition, Binance has committed to gradually repurchasing and burning or destroying half of the initially minted 200 million tokens over time.

Zhao Changpeng said that more than 20,000 cryptocurrency enthusiasts signed up for the BNB auction, with many depositing funds in advance. At the time, CZ expected that some of the funds would be kept in Binance trading accounts. “We got a lot of PR in our core target markets,” Zhao wrote on LinkedIn in July 2017, “making the Binance brand well known and getting investment. What more could a new platform ask for?”

Zhao’s optimistic declaration of the ICO’s success was well received. The tokens initially traded at 15 cents each and are now priced at $213, but skyrocketed to $675 in 2021. Today, BNB coin is the fourth most valuable digital asset in the world, worth $33 billion. Forbes estimates Zhao’s net worth at $10 billion, but our calculation reflects the value of his business interests and does not include the substantial amount of BNB he may control.

An investigation conducted by Forbes with the assistance of two cryptocurrency forensics companies, Gray Wolf Analytics and Inca Digital, reveals that behind the scenes, Binance’s launch was actually a failure.

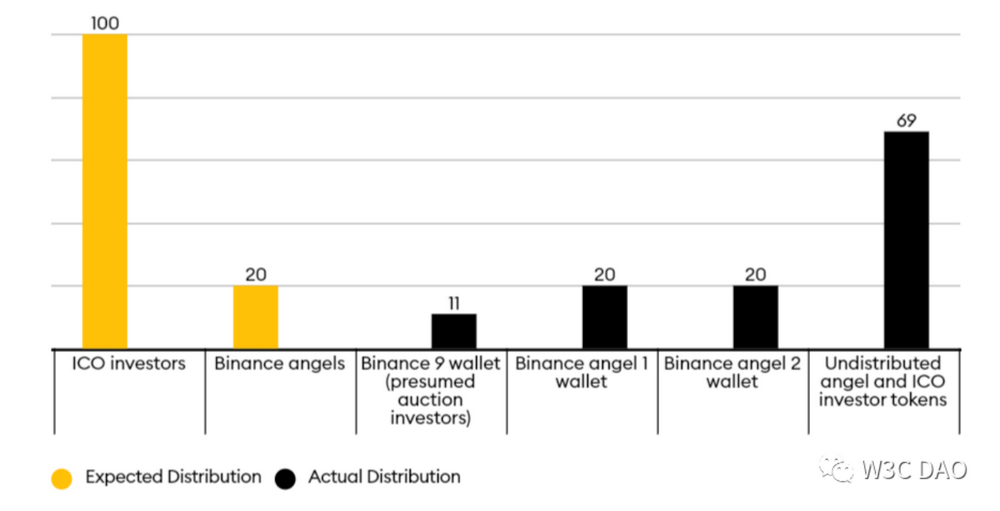

In fact, Binance did not sell all of the 100 million tokens during its initial issuance. Analysis of its cryptographic wallet shows that no more than 10.78 million BNB tokens were transferred to investors participating in its public ICO in the summer of 2017, although an additional 20 million tokens seemed to have quietly been transferred to angel investors, doubling their assets. A total of 40 million tokens were allocated.

All in all, Binance may have raised less than $5 million in funds during this issuance, while Zhao claimed to have raised $15 million at an implied price of 15 cents.

Despite repeated requests from Forbes, Binance has refused to respond to questions about its 2017 ICO and has declined to provide detailed accounts of its controlled BNB.

The issuer is not illegal to retain the remaining portion of the unsold auction as long as the company discloses that it is doing so, but Binance’s white paper does not mention what will happen if the ICO sales are insufficient.

This issue is not unique to Binance. According to a report from “Financial Markets and Portfolio Management” in 2020, which reviewed 306 ICOs from March 2016 to March 2018, 45% of issuers retained unsold tokens, while the rest either distributed them proportionally to investors or permanently removed them from circulation.

Few people know about the initial failure of BNB, partly because cryptocurrency ICOs are unregulated and have not submitted any type of disclosure to the SEC. But Binance’s ICO dilemma seems to have a glimmer of hope. As of September 2018, including Zhao, the founder of the exchange, left behind 145 million BNB tokens minted, instead of the originally planned 80 million. At the time of the ICO, the unsold 65 million tokens were worth less than $10 million, but are now worth about $14 billion.

According to forensic analysis of blockchain data (see Part II below), Binance controls many large cryptocurrency wallets that store millions of BNB tokens and occasionally transfer in and out. In addition, the CFTC filed a complaint against Binance in March 2023, alleging that Zhao directly or indirectly controls 300 different cryptocurrency trading accounts, including BNB. (Binance has taken action to dismiss the lawsuit filed by the U.S. Commodity Futures Trading Commission, claiming that the regulatory agency is overreaching.)

Price of BNB since its launch

As alleged by the SEC in the June lawsuit, can Binance use its BNB tokens to conduct so-called “wash trades” between accounts to help support the price of BNB? Trading of BNB has been active since 2019, especially during the two years when BNB tokens were moved to Binance’s own Beacon blockchain after being based on the Ethereum blockchain. In a court filing on September 21, Binance stated that the allegations of wash trades “lack factual basis.”

According to Pitchbook’s report, we also know that since its establishment in 2017, Binance has acquired stakes in at least 199 companies through its venture capital arm, Binance Labs, including well-known companies such as FTX, Trust Wallet, Coinmarket Cap, GOLianGuaiX, and Tokocrypto. BNB tokens have been used as sweeteners in some of these transactions. Binance also established a $1 billion fund on May 30, 2018, managed by Binance Labs using BNB.

How many BNB tokens are currently in circulation? According to Binance’s data tracking BNB circulation, there are currently 154 million BNB tokens not in circulation, so the exchange has destroyed 48 million tokens in the past six years. According to Grey Wolf’s forensic analysis, we have determined that as of August 31, 2023, Binance controls nearly 117 million tokens, accounting for 76% of the total circulation. We arrived at this number by combining the disclosed tokens issued to the founding team with proprietary probability analysis, which identified secret wallets previously used to store customer funds and serve other company purposes.

If tracking Binance’s BNB seems confusing, you’re not alone. However, one thing is clear. The BNB token has always been a key factor in Binance’s rise to become a major global cryptocurrency market, and maintaining a strong native currency is at the core of its success, just like FTX, where its FTT token has proven to be crucial to its ultimate solvency.

Below you will find a detailed analysis by Forbes of BNB’s initial token offering and the token’s flow between wallets in the years after the ICO.

Binance ICO Deep Dive

ICOs were popular between 2017 and 2018, during which hundreds of projects (including many scams) raised billions of dollars from investors by selling tokens created out of thin air. They may have seemed similar to initial public offerings (IPOs) of stocks, but they couldn’t offer the same level of investor disclosure and protection.

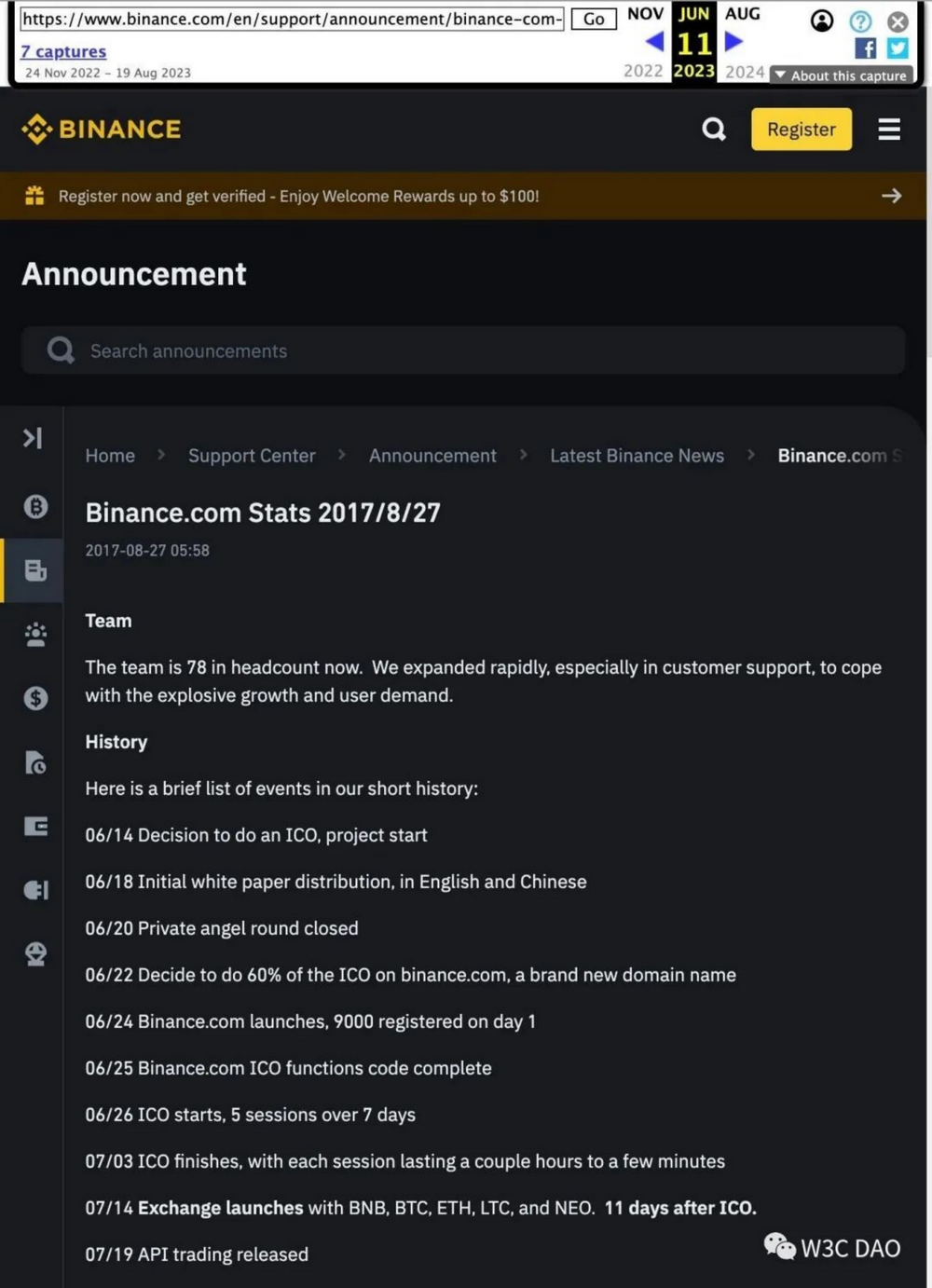

Binance announced its ICO on June 14, 2017, with the goal of raising $15 million from investors who could become active traders on its platform. The auction started 12 days later than the timeline specified in the whitepaper, launching on June 26 instead, which was 5 days earlier than originally planned, and ended 18 days earlier on July 3.

The Creation Myth of Binance

Archived posts from the Binance.com website show the rapid growth of the exchange and its BNB token in June and July 2017.

The Internet Archive’s Wayback Machine

More confusing is the exchange’s statement on Binance.com, which has been deleted but can still be viewed on the Internet Archive’s Wayback Machine, claiming that the ICO was completed “within 3 minutes.” Binance, in small print, stated, “This page is our homepage during our ICO, and it is now kept here for your review.” Most, if not all, ICO-related pages have been removed from Binance.com, including the original whitepaper.

Three-Minute Hero

The archived Binance.com post claims that its BNB initial token offering sold out in a three-minute meeting.

ICO Process

Tokens issued in initial token offerings (ICOs) usually come from what’s called a deployer wallet, a common term in computer code for minting new tokens and then sending them to digital wallets, each with a unique alphanumeric identifier.

With the tokens in the deployer wallet, the next step of the ICO is for Binance to distribute the tokens won in the auction to buyers. Forbes used blockchain records to track receiving wallets and analyzed their profiles. Gray Wolf and Inca Digital reviewed and validated Forbes’ audit methodology and individual wallet data.

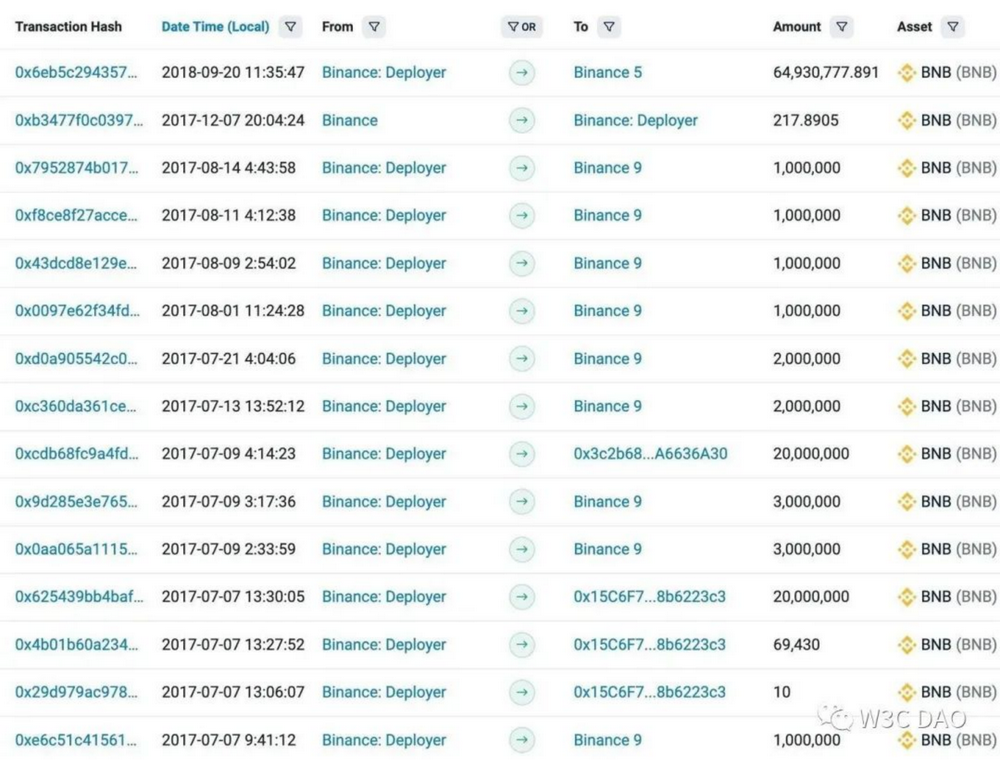

According to the white paper, Forbes predicts that shortly after the ICO, 100 million tokens will flow to ICO participants, with 20 million going to Binance angel investors, for a total of 120 million tokens. Binance started token issuance on July 7th, but only 55 million out of the expected 120 million tokens were issued, with the rest being distributed and frozen for over a year.

“The 55 million USD was paid through 13 transactions between July 6th, 2017 and August 14th, 2017,” said Grey Wolf. “These transactions were the only ones in which Binance Deployer sent BNB between July 2017 and August 2018, during which about 145 million BNB were controlled by the Binance Deployer address.”

Although Forbes and Grey Wolf believe it’s unlikely, the undistributed tokens could represent buyers who stored their tokens on Binance exchange (which started operating on July 14th, 2017). The usual practice is to send tokens to external wallets because investors usually don’t want to keep tokens on an exchange that hasn’t established security yet. Alternatively, Binance may have issued non-blockchain receipts for the tokens, which is an extremely unusual practice and cannot be verified by third parties.

Which wallets received the tokens

The following is an analysis of the main wallets that received BNB directly from the deployer. Other than the alphanumeric strings identifying each wallet, there is no other blockchain information about the owner, although sometimes facts are known through other means. Therefore, linking owners to specific wallets is often a combination of art and science. The size of the wallet, transfer frequency, transfer dates, and the source and destination of tokens can tell a story indicating the owner.

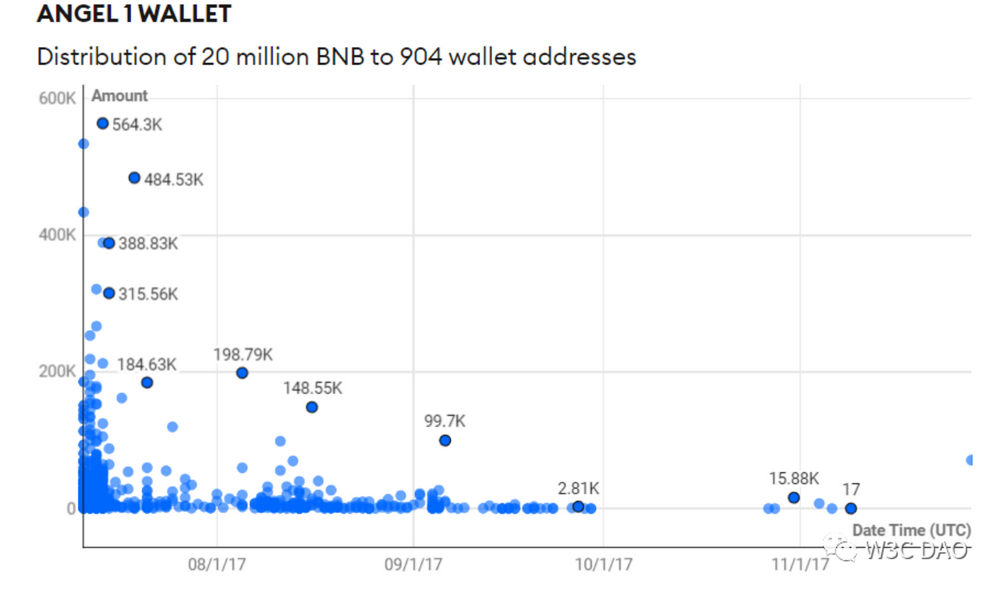

Angel Wallet 1 (20 million). Forbes, Grey Wolf, and Inca Digital have identified this wallet as the source of tokens allocated to early investors, as the received amounts and subsequent transactions are mostly high-value transfers. During the ICO month (July 2017), Binance distributed 17.84 million BNB tokens to 678 different addresses from this wallet. From August to November 2017, the exchange distributed an additional 2.15 million to 226 different addresses.

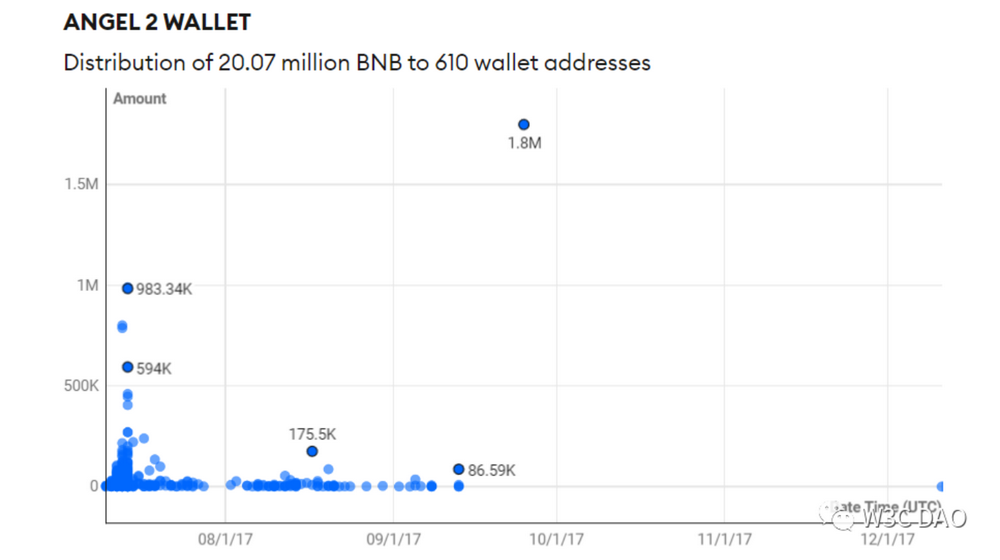

Angel Wallet 2 (20.07 million). This wallet is referred to as Angel Wallet 2. Within the first two days after the launch of the exchange in mid-July, it received 20,069,440 tokens through three transfers (20 million + 69,420 + 20) from the deployer. Although the amount received by this wallet is slightly more than the 20 million sent to Angel Wallet 1, based on similar numbers and subsequent distribution patterns detailed in the following chart, we speculate that these tokens are also for the angels. It’s worth noting for crypto detectives that there is an intermediate wallet between Angel Wallet 2 and the token receivers, but for simplicity’s sake, we will retain the reference to Wallet 2. Out of the 20.07 million BNB transferred to Angel Wallet 2, Binance distributed 17.4 million BNB to 531 wallets in July 2017. From August to December 2017, 2.66 million BNB was added to 79 wallets.

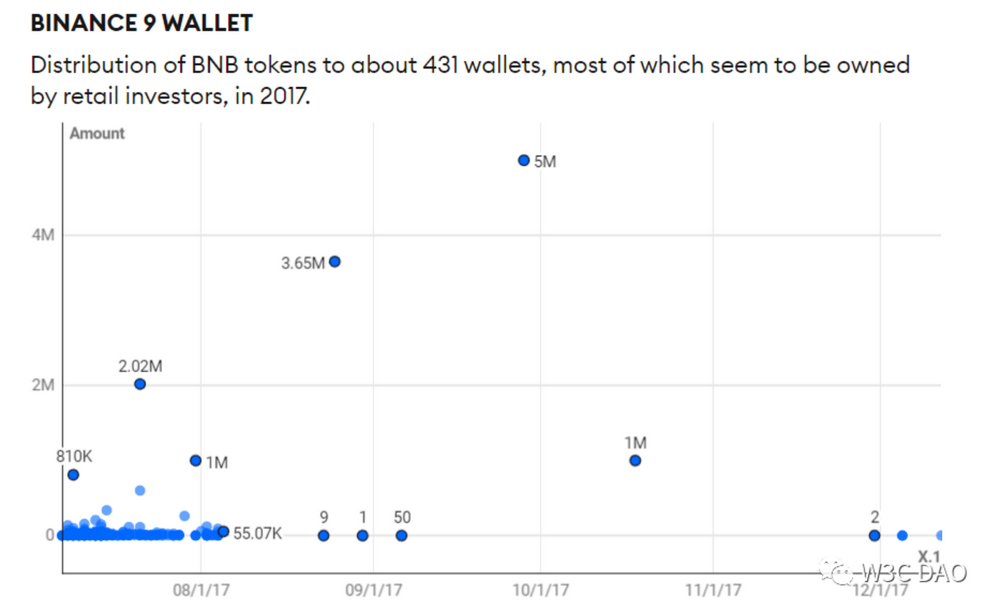

Binance 9. The name of this wallet appeared on the Etherscan blockchain analysis service and gradually received the remaining 15 million tokens from the deployer. As of the end of July, Binance only provided 11 million tokens to Binance 9. Among these 11 million BNB tokens, we believe that Binance sent 10.78 million BNB to as many as 400 assumed retail wallets, as the payment amounts were mostly small. Then, the exchange sent the remaining tokens to 31 wallets from August 2017 to July 2022.

We estimate that there were less than 2,000 addresses for angel investors and individual investors in the first month after the ICO, which is about 10% of the 20,000 users CZ claimed to have registered on the exchange.

In 2017, BNB tokens were distributed to about 431 wallets, most of which seemed to be owned by individual investors.

BNB Spaghetti

Although the maximum number of participants from Binance angels and investors in the ICO seems to be less than 2,000 people, there is significant overlap, wallet-to-wallet transfers, and mixing between individual wallets, making it difficult to determine the exact number of participants in each group.

For example, in July 2017, there were 56 recipients who received a total of 3.98 million tokens from Binance angel wallets. When Binance 9 is included, all three wallets sent tokens to 22 recipients, totaling 2.94 million BNB. In addition, angel wallet 2 sent nearly 1 million tokens to Binance 9, and Binance burned these tokens in the first-quarter burn operation according to the plan, ultimately reducing the supply to 100 million.

The transfer of 1 million tokens to Binance 9 is one of dozens of events indicating that the wallet was used for multiple purposes. For example, we found that through a separate intermediary wallet, Binance 9 transferred 5 million BNB tokens to Binance 5 in three transactions, and Binance 5 is a wallet whose beneficiary is the exchange itself. Binance also sent a total of 4.1 million tokens to another exchange, Binance 5 and Binance 6, to stop circulation. This practice makes it difficult for external observers to differentiate between tokens owned by users and the exchange.

The Fate of Unsold ICO Tokens

The table below shows that from September 2017 to August 2018, there were no expenses from the deployer’s wallet. The table also shows that in 2018, Binance had its deployer wallet send nearly 65 million BNB tokens to Binance 5, which seems to be unsold in the ICO. This wallet now holds 99.4 million BNB, accounting for half of the total supply. According to the terms of the whitepaper, Binance and its executives hold an additional 80 million tokens.

Deployer Wallet

The BNB transaction list in the Binance deployer wallet includes nearly 65 million tokens transferred in September 2018 (over a year after the ICO).

Gray Wolf Analysis summed it up: “The disparity between what is described in the white paper and the actual on-chain transaction volume, coupled with the conflicting documents of the ICO timeline, paints a confusing picture. Stakeholders and the wider cryptocurrency community cannot help but wonder about the true nature of the progress of the ICO, the accuracy of reported transaction volume, and the adequacy of consumer protection. These lingering questions highlight the crucial role of blockchain technology in enhancing transparency and accountability in the cryptocurrency ecosystem, where trust is absolutely necessary.”

Adam Zarazinski, CEO of Inca Digital, added: “Binance claims to have achieved all the goals set in the ICO, but in reality, on-chain data shows that less than half of the 120 million tokens have been distributed, and then in multiple wallets that are presumably controlled by Binance. The dissemination of misleading information about the actual results of the ICO has led BNB investors to have overly optimistic expectations for the future success of the token, potentially allowing Binance to artificially maintain a high price for BNB.”

Expectations

Data in the millions of tokens suggests that the token issuance this time is far lower than the quantity outlined in the Binance white paper.

Binance claims to have raised $15 million in July 2017, which is incredible. If Binance only sold about 11 million BNB tokens at a listing price of 15 cents, it would have raised $1.65 million from retail investors in the ICO.

If Binance angels purchased $40 million worth of tokens at the same price, Binance would have raised $6 million from them, still less than $15 million. The result of all this is that the additional 65 million tokens obtained from the sold ICO provide Binance with a dark and freely disposable asset pool, worth over $40 billion at its peak.

Total Holdings of Binance BNB

There is little verifiable information about the BNB held by Binance. As of September 1st, the company claimed a net balance of 30.3 million tokens held by customers, supported by 34.5 million tokens held by the exchange, which is a moderate over-collateralization. The company’s reserve proof webpage shows that these amounts do not include the BNB held by Binance.

Forbes and Gray Wolf have developed a method to identify all wallets on Binance that contain BNB, calculate customer and exchange funds, and verify these numbers. The method involves tracking BNB creation and movement on three blockchains within the Binance ecosystem, quantifying token flows, identifying wallets, determining wallet functions and possible ownership based on unique characteristics.

It is worth noting that our analysis below involves wallets on Binance’s proprietary blockchain, including the BNB beacon chain and the BNB smart chain. BNB was migrated to these two chains in 2019 and 2020, respectively. We classify BNB wallets on Binance into disclosed wallets, which are claimed to be fully owned by the company and its founder, and a series of hot wallets and cold wallets on the platform, which may mix customer and exchange tokens. For example, in the figure below, CZ publicly disclosed four Binance team wallets in November 2022 as part of the transparency initiative after the collapse of the FTX cryptocurrency empire. He said that these people collectively control 22 million tokens. As of October 1, known Binance wallets hold 53.8 million units of BNB, worth $11.6 billion.

The wallets at the bottom of the table have not been disclosed by the exchange, but our collaboration with Grey Wolf has identified that they may be located on the Binance platform. Based on probability analysis, we considered wallets on Ethereum that have a direct connection to Genesis wallets (the successors of deployment programs) in terms of holding scale, transaction patterns, main wallets of interaction, and other factors. Binance cold wallets 1-3 collectively hold 51.5 million tokens, worth $11.5 billion. In cryptocurrency terms, wallets are usually either hot or cold. Cold wallets are typically more secure because they are not directly connected to the internet. They are used to hold more assets and have lower usage frequency. Hot wallets are connected to the internet and are usually used for more frequent and smaller transfers.

Exchanges like Binance typically cycle assets between hot and cold wallets. Customer deposits usually go into hot wallets first and can then be transferred to cold wallets for long-term storage. On the other hand, exchanges may move funds from cold wallets to hot wallets to meet increased withdrawal demands. Best practice is for exchanges to keep funds in hot wallets no more than what is needed for daily liquidity. At the bottom of the chart, we found multiple hot wallets, with the top 20 being the largest, holding 11 million BNB. Some hot wallets had no assets on the day we took the snapshot.

All the suspicious Binance wallets listed hold a total of 63.1 million units of BNB, worth $15.7 billion. Combined with the assets held in known wallets, Binance controls 1.169 billion tokens, worth $27.3 billion.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Financing Weekly Report | 14 public financing events; Web3 restaurant loyalty application Blackbird completes $24 million Series A financing, led by a16z Crypto.

- In the past month, about 270,000 RNDR tokens have been destroyed. How big is the future space for the distributed rendering network Render Network?

- Q3 Crypto Dapp Report Daily active wallet count increased by 15% compared to the previous quarter, NFT transaction volume hits a new low in the past year.

- LayerZero’s Full-Chain Narrative Security Prospects and Ecological Opportunities

- What happened during the first week of the SBF case in a comprehensive article?

- Layoffs, restructuring, strategic adjustments, Yuga Labs, the Web3 Disney wakes up from its dream

- Not getting rich by speculating on coins, this user received a multimillion-dollar reward from the tax authorities for paying taxes on a trading platform.