Industry Research Report | Take USDT as an example to see stable currency: Although the positions are too concentrated, the role of “stability” is indispensable.

Overview Overview

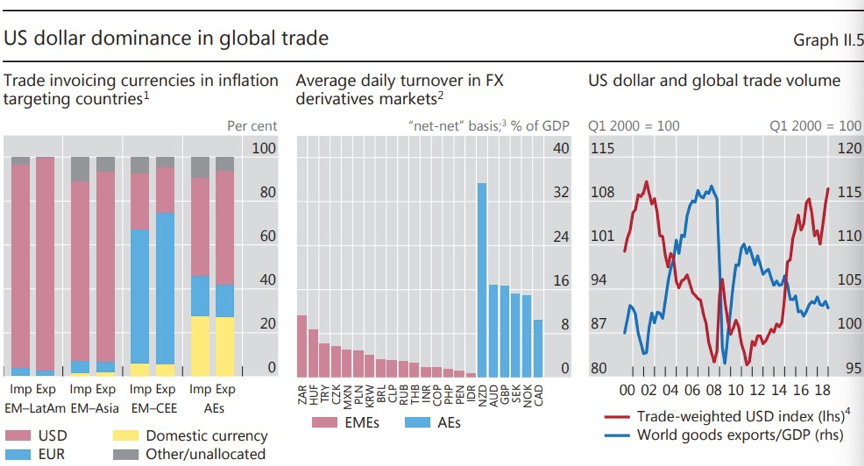

Since the establishment of the Bretton Woods system in July 1944, the center of the international monetary system has been the US dollar. With the deepening of foreign exchange liberalization, trade liberalization and capital liberalization, the dollar has continued to expand its influence with the wave of globalization. As of June 2019, the US dollar supply M2 reached 147.51 billion yuan, and the dollar-denominated settlement share accounted for 39.9% of the world. According to the Bank for International Settlements (BIS), more than 90% of Latin American trade and more than 85% of Asian import trade in global trade are settled in US dollars. As of the end of 2017, global interest rate futures options accounted for more than 70% of US dollar-denominated products. The exchange rates of 13 countries and regions are directly linked to the US dollar. From the US dollar to the oil dollar, the US central bank represents not only the world's most widely recognized clearing currency, but also stability and value. Therefore, in the face of fluctuating digital currency markets, stable currencies anchoring the US dollar came into being.

Fixed exchange rate currency anchored in US dollars

| Country | Region | Currency Name | Code | Peg Rate | Since |

|---|---|---|---|---|---|

| Bahrain | Middle East | Dollar | BHD | 0.376 | 2001 |

| Belize | Central America | Dollar | BZ$ | 2 | 1978 |

| Cuba | Central America | Conertible Peso | CUC | 1 | 2011 |

| Djibouti | Africa | Franc | DJF | 177.721 | 1973 |

| Eritrea | Africa | Nakfa | ERN | 10 | 2005 |

| Hong Kong | Asia | Dollar | HD | 7.75-7.85 | 1998 |

| Jordan | Middle East | Dinar | JOD | 0.709 | 1995 |

| Lebnon | Middle East | Pound | LBP | 1507.5 | 1997 |

| Oman | Middle East | Rial | OMR | 0.3845 | 1986 |

| Panama | Central America | Balboa | PAB | 1 | 1904 |

| Qatar | Middle East | Riyal | QAR | 3.64 | 2001 |

| Saudi Arabia | Middle East | Riyal | SAR | 3.75 | 2003 |

| UAE | Middle East | Dirham | AED | 3.6725 | 1997 |

US dollar imports and exports in all continents

Report text

What is a stable currency?

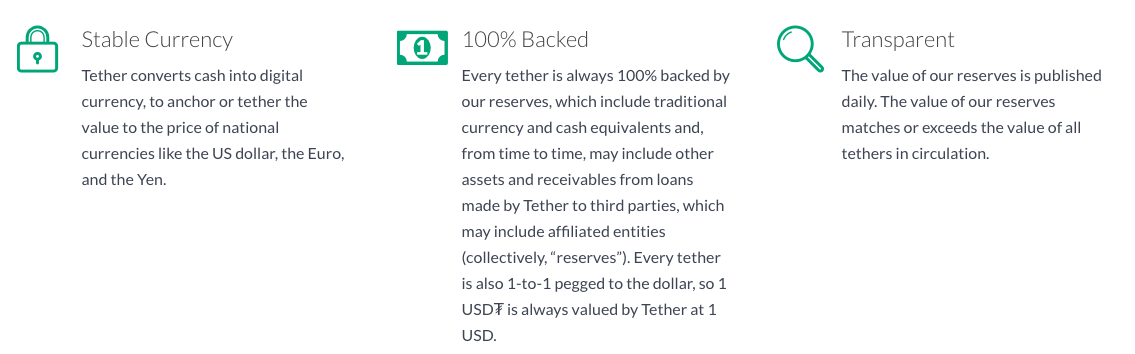

Stabilized currency is a new cryptocurrency, because it has the support of reserve assets, so it can guarantee a stable currency. The stable currency originated from the USDT issued by Tether Limited, which was formed by Bitfinex in 2014. Thether Limited wrote in its white paper on tokens: Tethers, a currency-linked digital currency, all Tethers are first issued in tokens on the Bitcoin blockchain via the Omni Layer protocol, each issuing Tethers They are all linked to the US dollar one by one, and the corresponding total US dollar is stored in Hong Kong Tether Co., Ltd. (that is, one Tether is one US dollar). With Tether Limited's Terms of Service, holders can redeem/exchange Tethers with their legal currency or convert them to Bitcoin. The price of Tether is always linked to the price of legal tender, and the amount of money linked to it is always greater than or equal to the amount of currency in circulation.

- 50% of the assets are bitcoin, is it crazy?

- User information is not guaranteed? UK Customs and Excise Department asks cryptocurrency exchanges for transaction data

- Deep understanding of the "Oolong incident" of LedgerX futures: media misreading, LedgerX or suing CFTC

Tether Limited official website for the description of USDT and currency

Why do you need a stable currency?

As a new currency that has only been developed for a few years, it has received a lot of attention because Stabilization Coin attempts to combine the advantages of legal and digital currencies – namely, the instant processing and payment security of cryptocurrencies, and the stability of legal tenders. value.

Bitcoin's Achilles' heel

Although Bitcoin is still the most popular cryptocurrency, its valuation is highly volatile, which greatly increases its investment properties, but weakens its currency attributes. For example, the price of bitcoin rose from about $5,950 in November 2017 to more than $19,700 in December, and then fell by about two-thirds to $6,900 in early February. Even the price fluctuations in the bitcoin are fierce – in just a few hours, bitcoin fluctuates more than 10% in either direction.

Bitcoin trend

This short-term fluctuation makes Bitcoin and other popular cryptocurrencies unsuitable for the daily use of the public. In essence, money should be used as a medium for the storage of financial transactions and value, and its value should remain relatively stable over a longer period of time. If the purchasing power of a currency cannot be kept relatively stable, then he loses the meaning of the existence of the currency itself.

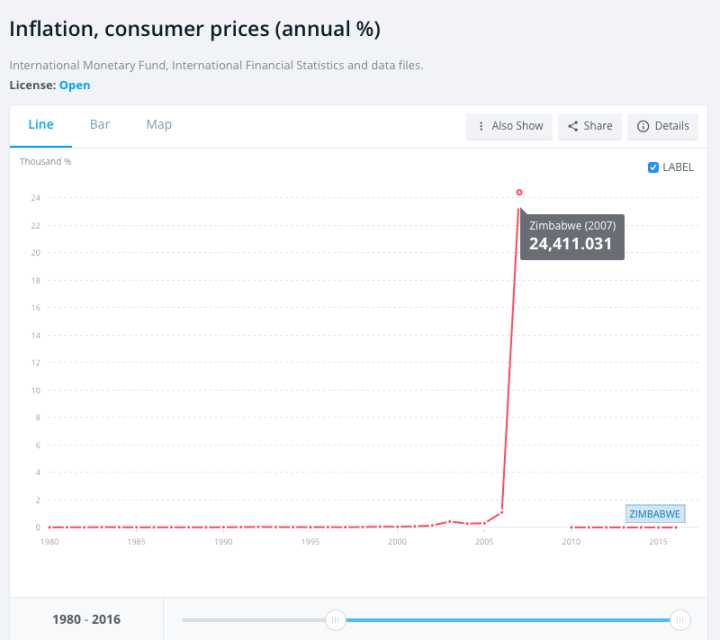

For example, in 2006-2008, Zimbabwe broke out the most serious hyperinflation in human history, domestic prices soared, and social problems appeared. The officially announced inflation rate for June 2008 is estimated to exceed 11,200,000%. By December 2008, the Zimbabwean government issued a new banknote of 100 trillion denominations, which was actually worth only $25. Super inflation has stagnate the economy, not only scares away foreign investors, but also destroys the purchase value of deposits and household income, thus undermining long-term economic growth.

Zimbabwe inflation rate

Stabilizing coins provide solutions

Ideally, cryptocurrencies should maintain their purchasing power and should have as low an inflation rate as possible to encourage consumption of tokens rather than savings tokens. Stabilizing coins provides a solution to achieve this ideal state.

Two main reasons for the stability of fiat currency prices:

- The foreign exchange reserves that support them are linked to the underlying assets such as gold or foreign exchange reserves as collateral, so their valuations will not fluctuate drastically.

- The central bank's market behavior, even under certain extreme circumstances, when the valuation of legal tenders may fluctuate significantly, the authorities controlling the currency will intervene to manage the supply and demand of the currency to maintain price stability.

Most cryptocurrencies lack these two key characteristics—they have no reserves to support valuations, and there is no central authority to control prices when necessary.

The USDT provides a solution to the first problem: using a dollar-denominated currency and specifying a 1:1 exchange rate, and providing proof of assets to ensure that the price of Tether is always linked to the price of legal tender, which is linked to the stock of the currency. It is also always greater than or equal to the amount of currency in circulation, making the USDT price more stable than Bitcoin. The inflation rate of the USDT is also the same as the US dollar because it is pegged to the US dollar.

Is the stable currency really stable?

Although it is called stable currency, but the value and price of stable currency is really stable, this article will qualitatively and quantitatively analyze whether the USDT itself is stable from three aspects: the degree of decentralization of USDT, the exchange rate stability of USDT, and The inflation resistance of the USDT.

USDT is not decentralized like Bitcoin

Regarding the degree of decentralization, USDT's publishing company Tether Limited made it clear in its white paper: We recognize that our implementation isn't perfectly decentralized since Tether Limited must act as a centralized custodian of reserve assets (albeit tethers in circulation) Exist as a decentralized digital currency) (We recognize that our application is not completely decentralized, because Tether Limited must act as a central custodian of reserve assets (although Tether in circulation is a decentralized digital currency) ).

This also means the following risks:

- Tether Limited may go bankrupt

- Banks serving Tether limited may go bankrupt

- Bank may freeze Tether Limited's assets

- The company may use reserves for high-risk investment activities

Therefore, from the perspective of decentralization, the stable currency is not stable.

Exchange rate stability of USDT

First of all, in order to facilitate understanding, first introduce the research methods and formulas used in this paper. Since USDT is a 1:1 benchmark relationship for USD, the offset formula is as follows:

Deviation = Max (price high – $1.00, $1.00 – price low)

We chose USD/JPY as a comparison to test the offset risk of a constant exchange rate compared to a non-constant exchange rate currency pair.

By comparing the exchange rate USD/JPY between USDT and French currency, the USDT of the annualized average offset point is significantly smaller than USD/JPY. However, due to the large base of USD/JPY, it is found that the USDT offset is significantly larger than USD/JPY after comparing the adjusted annualized offset. The adjustment formula is as follows:

Annualized Deviation (adjusted) = Deviation / Close Price

At the maximum offset rate, the USDT is much larger than USD/JPY, and even in 2017, two years after the release, the maximum offset rate of 21% still appears.

Although the volatility of the USDT has steadily decreased year by year, it is still higher than USD/JPY 0.48% in 2019.

The only thing worth mentioning about USDT is that USDT's downside risk is less than USD/JPY according to historical data. The maximum retracement since listing is -10.496%, while USD/JPY's five-year maximum retracement is -20.48%. The formula for calculating the maximum retracement is as follows:

Maximum Drawdown = ( max ( 1-date value of the account / maximum value of the account before the current day) * 100%

In summary, in terms of volatility and offset, in the framework of the stable currency USDT, the stability of the stable currency and the legal currency is not as stable as the non-linked relationship between the legal currencies. Although this test is not representative, such as the existence of high-volatility non-developed countries, one of the purposes of the existence of the USDT is to stabilize. As can be seen from the test, the stability of the USDT is not convincing.

USDT stability test results

| USDT | Annualized Deviation | %Annualized Deviation | Max Deviation | Min Devitaion | Annualized Volatility | Max Drawdown |

|---|---|---|---|---|---|---|

| 2015 | 0.004 | 0.57% | 71% | 0% | 5.70% | -0.020% |

| 2016 | 0.000 | 0.04% | 4% | 0% | 0.38% | -3.794% |

| 2017 | 0.020 | 2.05% | twenty one% | 0% | 2.56% | -8.641% |

| 2018 | 0.016 | 1.59% | 8% | 0% | 1.07% | -10.496% |

| 2019 | 0.014 | 1.41% | 5% | 0% | 0.77% | -10.496% |

USD/JPY stability test results

| USD/JPY | Annualized Deviation | %Annualized Deviation | Max Deviation | Min Devitaion | Annualized Volatility | Max Drawdown |

|---|---|---|---|---|---|---|

| 2015 | 0.677 | 0.56% | 3% | 0% | 0.34% | -5.73% |

| 2016 | 0.953 | 0.88% | 5% | 0% | 0.58% | -20.48% |

| 2017 | 0.698 | 0.62% | 2% | 0% | 0.32% | -14.15% |

| 2018 | 0.497 | 0.45% | 1% | 0% | 0.25% | -16.62% |

| 2019 | 0.405 | 0.37% | 3% | 0% | 0.29% | -15.93% |

Correlation with inflation

Because the volatility of the USDT is weakly correlated with inflation, the issue of the impact of inflation on the USDT is not discussed here.

Pearson correlation coefficient

| Pearson related | Numerical value |

|---|---|

| USDT, Inflation | 0.295121985 |

| USD/JPY,Inflation | 0.335673447 |

| USDT, USD/JPY | -0.61757705 |

The significance of stabilizing coins to investors

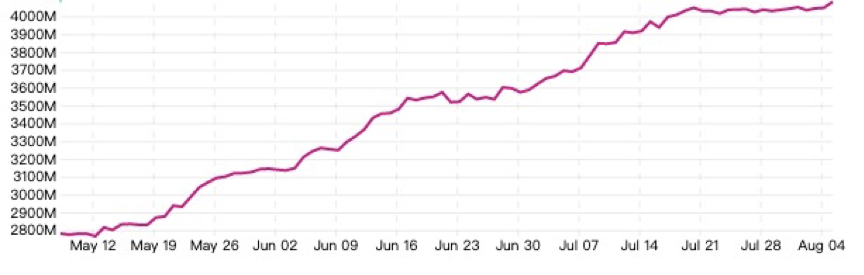

Although USDT has various risks, it has successfully solved the doubts of some investors and digital money users, and provided a strong support for the concept of digital currency in the air. Therefore, since its listing in 2015, the market value has soared. The market value has exceeded 4 billion US dollars so far, and the growth rate in 2017 has reached 13816%.

Market value growth rate

| USDT | Market Cap |

|---|---|

| 2015 | 212% |

| 2016 | 946% |

| 2017 | 13816% |

| 2018 | 37% |

| 2019 | 116% |

USDT market value

Storage means

In the current cryptocurrency ecosystem, the ICO financing process creates the risk of price volatility in encrypted assets. The project side usually raises a certain amount of ETH to use the resources to achieve the previous commitments. Because of the high fees for converting crypto assets to fiat money, the project's founding team tends to store most of the assets in ETH, but as cryptocurrency prices rise, investors pay opportunity costs. However, in the bear market, the price of crypto assets fell sharply. In the face of a sharp drop in assets, the founding team still had to meet investors' expectations for IRR. In the long run, stable coins can help the founding team of the ICO project save assets more securely.

Payment means

As a payment tool, stabilizing currency can effectively eliminate the risk of price volatility, providing a better user experience and significant efficiency gains through cryptocurrency trading than current banking tools. Current international bank transfers take 3 days, while cryptocurrencies can quickly confirm transactions.

At present, the use of stable currency is mainly concentrated in Tether (USDT), Tether is the second-largest cryptocurrency in trading volume, accounting for about 60% of BTC daily trading volume. At the beginning of this year, Tether's market capitalization ranked in the top ten of the cryptocurrency, and now the market capitalization accounts for 93% of all stable currency market capitalization. Although new stable currencies such as USDC have successfully entered the exchange, Tether continues to dominate, accounting for approximately 98% of all stable currency transactions.

Circulation means

Derivatives can effectively hedge risky assets. For example, the cost of fuel used by commercial airlines is calculated in gallons per dollar, and airlines generally use Forward Contract to hedge their exposure to the US dollar.

Most of these derivatives are settled in cash, and stable coins can be transferred at a fair price. Today, the infrastructure of modern banks such as the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE) relies heavily on costly intermediaries such as Clearing House and the use of currency settlement contracts. When these complex operations are performed through smart contracts, all require dollar asset settlement.

For the foreseeable future, these derivatives can be settled on the chain by stabilizing the currency, reducing transaction costs and eliminating the need for central institutions. In the current financial market framework, these centralized institutions provide trust between market participants.

Stabilized coins are not perfect

Although the USDT solves the problem of stable exchange rate, its currency attribute makes it still not escape the ternary paradox.

Trilemma, also known as the trilemma, is a principle in international finance, which means that a country cannot simultaneously complete the following three:

- Capital mobility

- Fixed exchange rate (Exchange rate)

- Independent monetary policy

What the USDT did was to ensure that capital freely entered and exited, and linked to the US dollar 1:1, completely abandoning the independent monetary policy, so that any resolution of the Fed will affect the value of the USDT, deviating from the original intention of the original digital currency. The lessons of history prove that violation of the rules of the ternary paradox will lead to a large-scale financial crisis.

The exchange rate policy actually adopted by East Asian countries is linked to the US dollar (fixed exchange rate) to promote free capital flows, while at the same time formulating an independent monetary policy. First, because of the fact that it is pegged to the US dollar, foreign investors can invest in Asian countries without worrying about the risk of exchange rate fluctuations. Second, the free flow of capital allows foreign investors to invest without barriers. Moreover, between 1990 and 1999, the short-term interest rates of East Asian countries were higher than the short-term interest rates of the United States. For these reasons, many foreign investors have invested huge sums of money in Asian countries and have made huge profits. But when the trade balance of East Asian countries changed, investors quickly withdrew funds, triggering the Asian financial crisis.

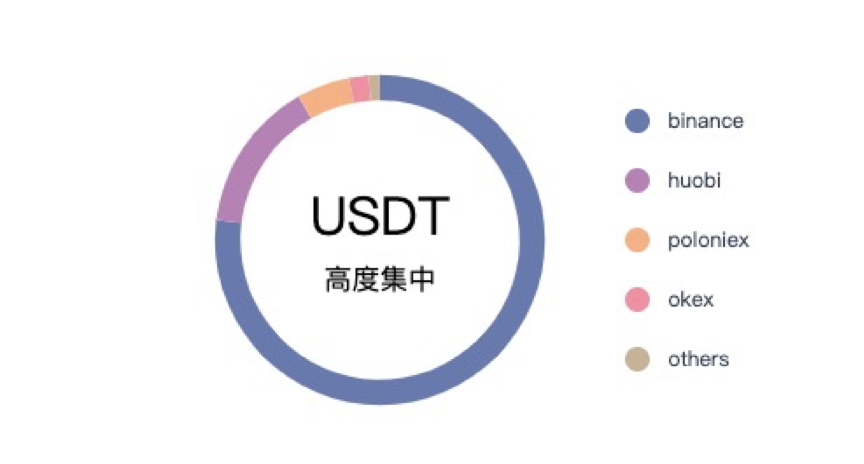

At the same time, although USDT is pegged to the US dollar, it is not a US dollar. For a currency with a market capitalization of only US$4 billion, its position is too concentrated. According to longhash, 76.95% of USDT's transactions are concentrated on one Binance exchange. The number of active addresses is only 15,000-20000, and the chips are highly concentrated.

Longhash position analysis

Conclusion

The emergence of stable currency mainly solves the volatility problem faced by Bitcoin, and effectively functions as a means of storage, means of payment and means of circulation. Although the volatility is still higher than the legal currency and the legal currency, and there are risks such as excessive concentration of positions and insufficient decentralization, the gaps filled in it still play an indispensable "stability" in the digital currency market. The role.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Getting started with blockchain | Multi-signature is safe but not private enough? Ring signature and blind signature

- The user information of the currency circle has been leaked on a large scale, and the fire currency and the currency security have issued risk warnings one after another.

- The Grin mining machine has a 20,000 US dollar, earning thousands of dollars a day, and the Asic mining machine is about to start.

- Babbitt exclusive | From the central bank 74 patents, on the core points of the legal digital currency

- BCH has been on the line for two years, and Coinbase still can't hide this lawsuit.

- Embracing the blockchain revolutionary sentiment, but there are still many risks and challenges in terms of law and security.

- Bitcoin mining or welcoming 3.0 era, Stratum V2 will return power to miners