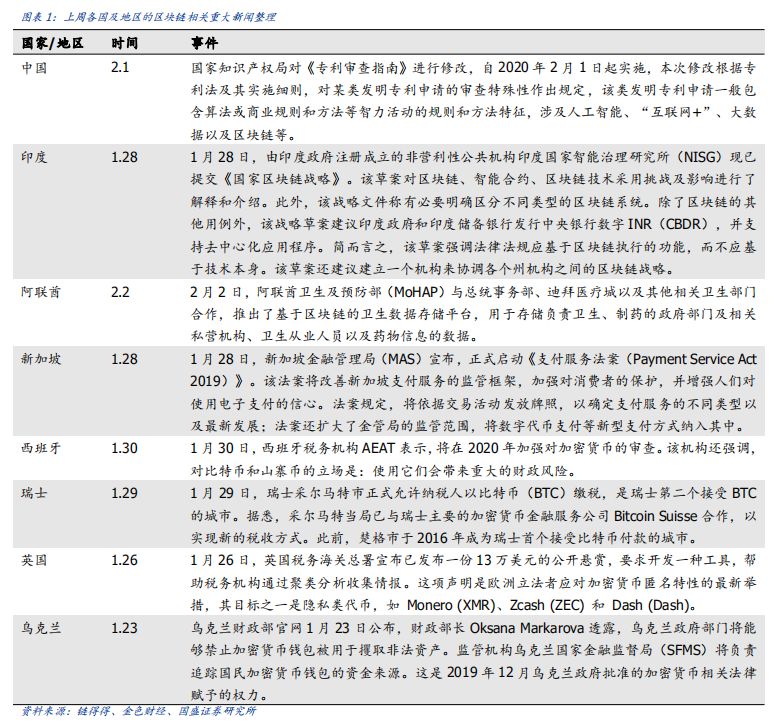

Nasdaq Research launches Bitcoin futures, fierce competition on digital currency track

Summary

Singapore's cryptocurrency regulatory law came into effect, opened license applications to global companies, and actively built a new digital asset center. On January 28, Singapore introduced new payment legislation, the Payment Services Act, which for the first time provided a global cryptocurrency company with the opportunity to apply for an operating license to conduct its business in the country. The bill is the first comprehensive regulatory requirement for businesses engaging in digital payment token transactions such as Bitcoin and Ethereum. With the active promotion of Singapore's legislation and regulation, it will continue to provide a more ideal environment for blockchain entrepreneurship and actively build a new digital asset center.

The current international situation is constantly changing, especially with signs of escalation in the Middle East conflict. Bitcoin has maintained an upward momentum in the past and is currently returning to the level of $ 9,300. But cryptocurrency financing and cross-border anonymous transactions have also caused caution in some national regulators. The Indian central bank has said it will restrict domestic banks from engaging in cryptocurrency-related businesses, but does not ban the use of cryptocurrencies. The Reserve Bank of India (RBI), the central bank of India, said it has banned financial institutions from engaging in cryptocurrency-related businesses given a range of known risks. With the changes in the international situation, the investment activities of cryptocurrencies such as Bitcoin have been increasingly restricted.

- Technology Sharing | "Junk Input and Junk Output" of Blockchain Technology

- Crypto assets regulatory rules updated in the UK: up to £ 10,000 is required to apply for a license and registration fees are non-refundable

- MasterCard CEO: Libra's financial inclusion fails to meet expectations, and compliance is too vague

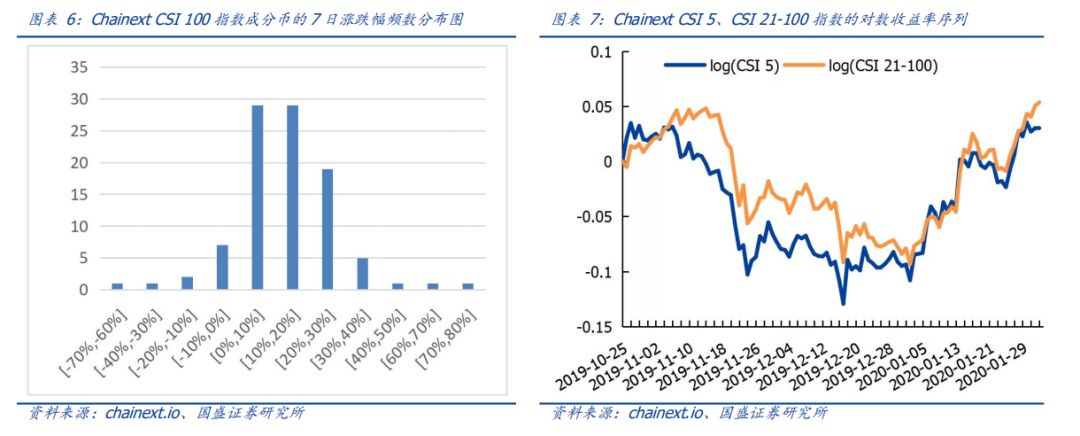

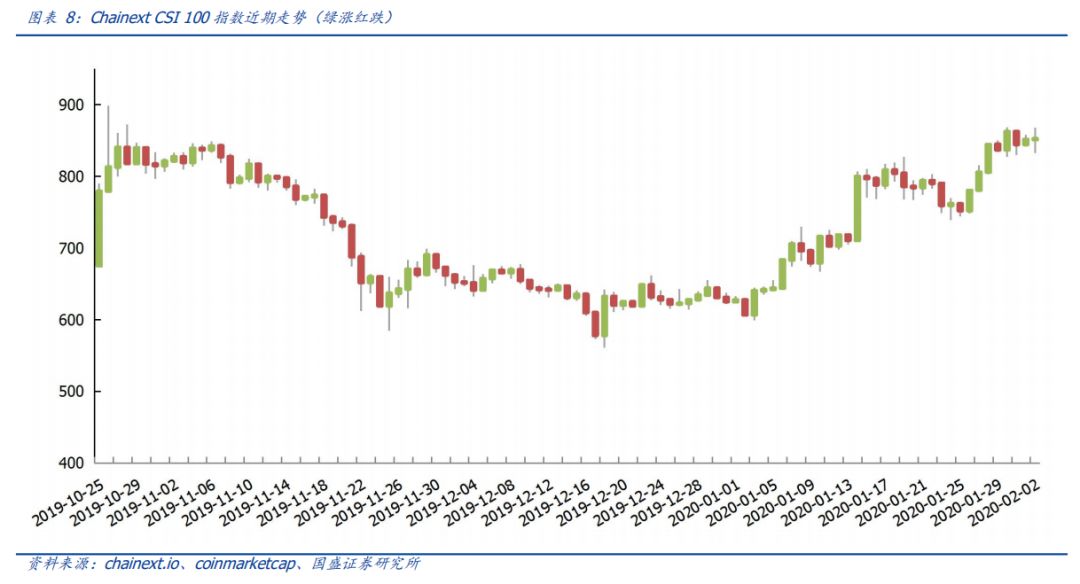

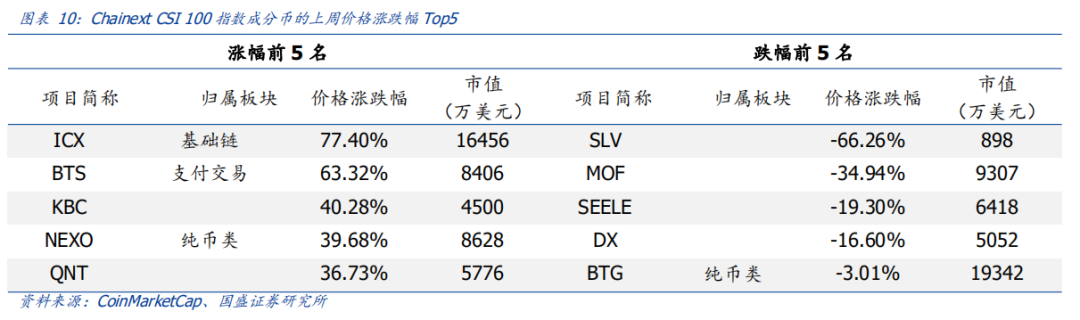

Last week's market review: Chainext CSI 100 rose 9.20%, and the storage & computing performance in the segment was the best. From the perspective of subdivisions, payment transactions, entertainment and social media, business finance, infrastructure enhancement, infrastructure chain, and storage & computing performance all outperformed the Chainext CSI 100 average levels of 9.34%, 12.74%, 17.96%, 16.31%, and 14.52 respectively. %, 27.55%; the performance of IoT & traceability, pure currency, and AI were all lower than the average level of Chainext CSI 100, which were 9.1%, 8.6%, -1.58%, respectively.

Risk Warning : Uncertainty in regulatory policies, and the development of blockchain infrastructure is not up to expectations.

Singapore's cryptocurrency regulatory law came into effect, opened license applications to global companies, and actively built a new digital asset center. On January 28, Singapore introduced new payment legislation, the Payment Services Act, which for the first time provided a global cryptocurrency company with the opportunity to apply for an operating license to conduct its business in the country. The bill is the first comprehensive regulatory requirement for businesses engaging in digital payment token transactions such as Bitcoin and Ethereum. In addition to bringing cryptocurrency companies into the regulatory sphere, the law will also grant the Singapore Monetary Authority (MAS) formal regulatory powers to regulate cybersecurity risks and control money laundering and terrorist financing activities. At present, Japan is the main cryptocurrency trading center in Asia. Since 2017, 22 exchanges have obtained trading licenses in Japan. Increasing interest from global investors in digital tokens has prompted multiple regulators to review relevant platforms, especially for money laundering and other illegal activities. With the active promotion of Singapore's legislation and regulation, it will continue to provide a more ideal environment for blockchain entrepreneurship and actively build a new digital asset center.

The current international situation is constantly changing, especially with signs of escalation in the Middle East conflict. Bitcoin has maintained an upward momentum in the past and is currently returning to the level of $ 9,300. But cryptocurrency financing and cross-border anonymous transactions have also caused caution in some national regulators. The Indian central bank has said it will restrict domestic banks from engaging in cryptocurrency-related businesses, but does not ban the use of cryptocurrencies. The Reserve Bank of India (RBI), the central bank of India, said it has banned financial institutions from engaging in cryptocurrency-related businesses given a range of known risks. The Internet and Mobile Association of India (IAMAI) is currently appealing to the Supreme Court on behalf of companies affected by the April 2018 ban. In its response to the association's complaint, the Reserve Bank of India further stated that the ban only restricted banks in India from entering the cryptocurrency field and did not completely prohibit the use of cryptocurrencies. The Economic Times reported that it had seen a 30-page copy of the affidavit filed by the Reserve Bank of India to the Supreme Court in September, citing a response: "First, the Reserve Bank of India and the Virtual currency (VC) has not been banned in India. The Reserve Bank of India has issued instructions to entities under its supervision and may not provide services to individuals and entities engaged in virtual currency trading or settlement … The Reserve Bank of India can prohibit Entity participation in activities that constitute reputational or financial risks, as well as other legal and operational risks. "The Reserve Bank of India is particularly concerned about the use of cryptocurrencies for illegal financing and has stated that" anonymous cross-border transactions must be dealt with promptly and seriously " . With the changes in the international situation, the investment activities of cryptocurrencies such as Bitcoin have been increasingly restricted.

United Arab Emirates : On February 2, the UAE Ministry of Health and Prevention (MoHAP) cooperated with the Presidential Affairs Department, Dubai Medical City and other relevant health departments to launch a blockchain-based health data storage platform for storing health and pharmaceutical products. Data from government agencies and related private agencies, health professionals, and drug information.

Singapore : On January 28, the Monetary Authority of Singapore (MAS) announced the formal launch of the Payment Service Act 2019. The bill will improve the regulatory framework for payment services in Singapore, strengthen consumer protection, and increase confidence in the use of electronic payments. The bill stipulates that licenses will be issued based on transaction activities to determine different types of payment services and the latest developments; the bill also expands the scope of the HKMA to include new payment methods such as digital token payments.

Spain : On January 30, the Spanish tax agency AEAT said it would strengthen its review of cryptocurrencies in 2020. The agency also emphasized its position on Bitcoin and altcoins: using them poses significant financial risks.

Switzerland : On January 29, Zermatt, Switzerland officially allowed taxpayers to pay taxes in Bitcoin (BTC), which is the second city in Switzerland to accept BTC. It is reported that Zermatt authorities have cooperated with Bitcoin Suisse, Switzerland's main cryptocurrency financial services company, to implement a new taxation approach. Previously, Zug became the first city in Switzerland to accept Bitcoin payments in 2016.

United Kingdom : On January 26, the UK Revenue and Customs Authority announced that it has issued a public reward of $ 130,000, requesting the development of a tool to help tax agencies collect intelligence through cluster analysis. This statement is the latest move by European lawmakers to respond to the anonymous nature of cryptocurrencies, and one of its goals is privacy tokens such as Monero (XMR), Zcash (ZEC), and Dash (Dash).

Ukraine : The official website of the Ministry of Finance of Ukraine announced on January 23 that Finance Minister Oksana Markarova revealed that Ukrainian government departments will be able to prohibit cryptocurrency wallets from being used to seize illegal assets. The regulator, the State Financial Supervision Agency of Ukraine (SFMS), will be responsible for tracking the source of funds for the national cryptocurrency wallet. This is the power conferred by crypto-related laws approved by the Ukrainian government in December 2019.

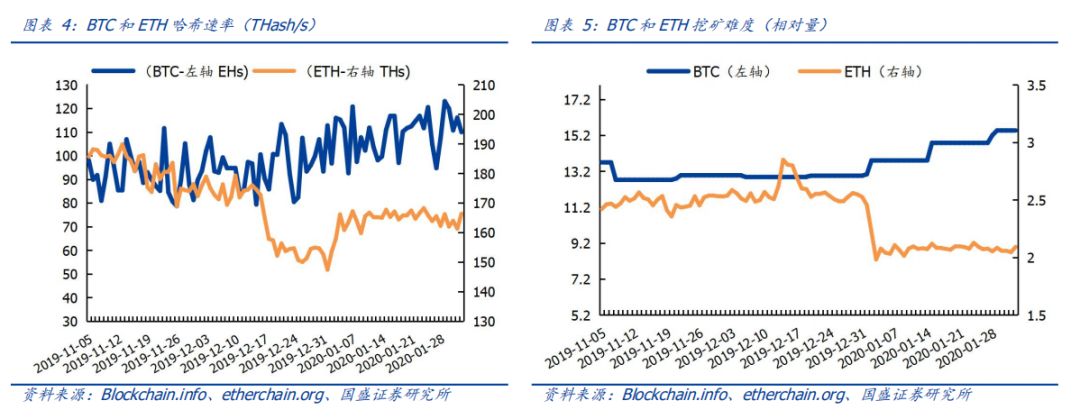

Last week, the average daily income of BTC miners was 17.16 million US dollars, an increase of 3.4% from the previous month; the average daily income of ETH miners was 1.97 million US dollars, a decrease of 8.9% from the previous month.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Want to buy Bitcoin? Understand these 4 points first

- Should a single anchor and a basket of currencies be more imaginative?

- Babbitt Column | Can blockchain help food companies such as Sibe to survive?

- MIT shot! Researchers open "spider" routing solution to increase blockchain speed by 4 times

- Blockchain Weekly Report | Blockchain companies' aid in Ecuador has successively arrived in Europe and the United States to introduce new policies related to cryptocurrencies

- China's blockchain industry under the shadow of the epidemic: conference postponed, mining machines suspended

- Forbes: Fear of New Crown Virus May Make Bitcoin Break $ 10,000