Opinion: Bitcoin worth millions of dollars is not a dream?

This article has a total of 4344 words and is expected to read 12 minutes.

The original text was written on January 20, 2018, when the market value of digital currency fell from $820 billion to $420 billion in a month, a full 50% evaporation. Those media that are not optimistic about digital currency have been ridiculously ridiculed. Many new investors have regretted their intestines and have to bear the pain.

That is not the first time that a digital currency has experienced a plunge, and certainly not the last time.

However, unlike those investors who are rushing to sell, there is a group of people who are not motivated by it. This group of people claim to be “holders”. They hold digital currency such as bitcoin for a long time, and some of them have already experienced several market turmoil. Why did they buy digital currency so early? Why can they calm themselves in a panic market? Are they crazy? Still believe that the recharge is too much?

- Analysis of the market on May 28: Bitcoin fluctuated sideways, with an impact of 10,000 US dollars!

- Analysis of Ethereum GHOST Agreement

- Vote for new clothes, blockchain or subversion of traditional election mode

The reason is simple. The “holders” recognize the potential of the blockchain, so they look longer. Just like value investors, short-term price corrections don't make much sense to them. On the contrary, when the price of the currency falls, they will be excited to seize the opportunity to spend more on cheaper prices.

In this article, we will compare the blockchain with two reference objects so that everyone can look at the digital currency in the longer term.

Blockchain vs internet

In the 1990s, with the advent of the 32-bit (32-bit operating system) era, many Internet startups have sprung up and developed. Because the blockchain and the Internet are both digital and networked, and they will have a huge impact on human society, the supporters of digital currencies are convinced that the current blockchain is like the Internet of the year. A good blockchain startup recreates the brilliance of Internet companies such as Google, Amazon, and Facebook. If this is the case, then the price of the future digital currency is expected to grow tremendously, so investing in some potential token or project teams may be rewarding in the future.

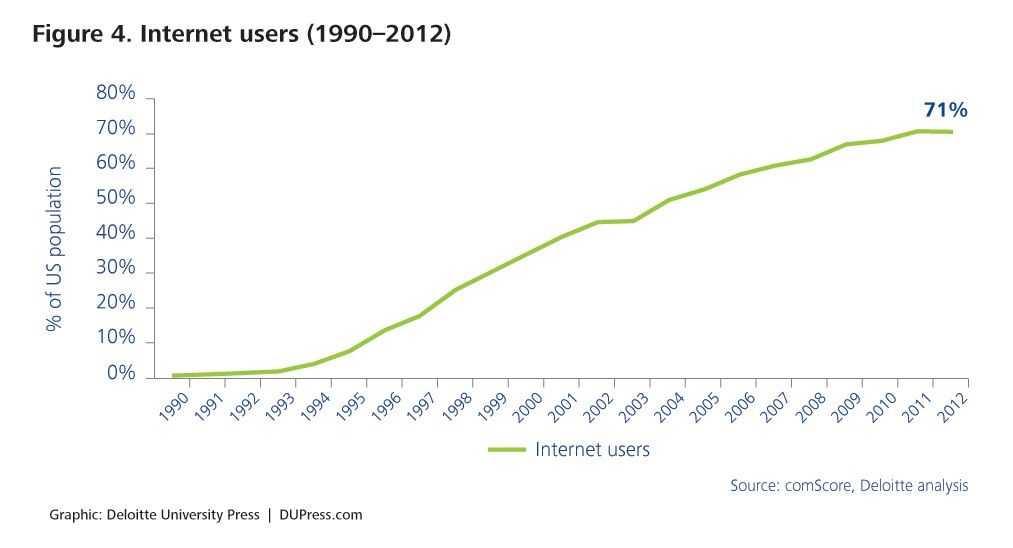

Internet user growth chart from 1990 to 2012

However, many people may have forgotten that most of the Internet startups that first emerged ended up failing, including some companies that have already completed large-scale financing. The opponents of the digital currency stated that the current blockchain is indeed like the Internet of the year – today's "bitcoin bubble" and people's enthusiasm for ICO, just as the Nasdaq market soared and collapsed. They feel that many blockchain projects will eventually decline like the companies Pets.com, Webvan, eToys and so on. Therefore, investing in digital currency or blockchain startups is very risky and must be rational and cautious.

But these two views are obviously wrong. In fact, comparing the blockchain with the Internet underestimates the final value of the blockchain industry and its impact on the future world.

And I think that the best reference for the blockchain should not be the Internet, but the telegram! Why do you say that? Let us first review the invention of the telegraph.

Blockchain vs telegraph

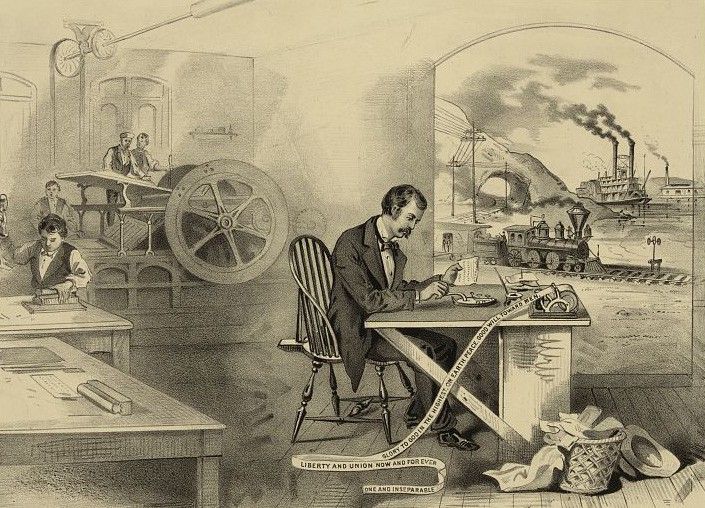

The telegraph was invented in the early 19th century and was the first to adopt telecommunications technology. Through electricity, people can use a private network to instantly transmit digitally encoded text messages over long distances. The invention of the telegraph accelerated the flow of information and opened up a new field of technology.

Telecommunications technology : Telegraph is the beginning of the telecommunications industry (temporarily not discussing the way to manually transmit information such as shooting, waving flags and flashing lights).

Digitally encoded information : Morse code can express different English letters, numbers and punctuation marks in different order, so that telegrams can send letters and digital information very conveniently and efficiently.

Long-distance instant transmission : At the time, the speed of data transmission via the telegraph line was very fast, so it was called “instant” (temporarily regardless of the time the operator spent at the relay station).

Private network : The telegraph network is a capital-intensive project with limited throughput, so private owners charge a fee.

The Internet is the pinnacle of the modern telecommunications industry and the inevitable outcome of the technological and social changes brought about by telegraphs since 1844.

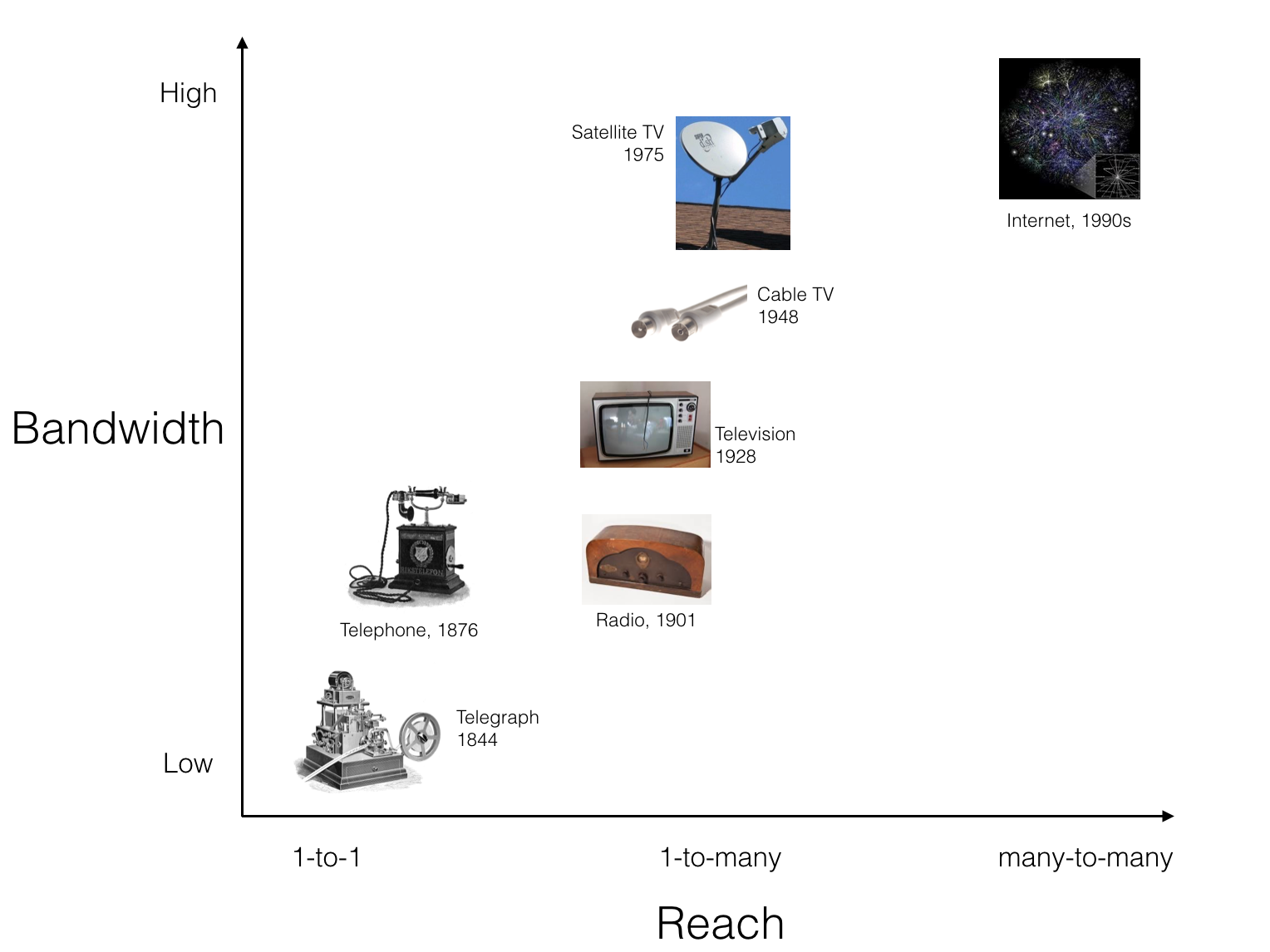

In 1876, the invention of the telephone brought telecommunication technology to thousands of households, realizing the transmission of audio data outside the text.

In 1901, the invention of radio allowed people to transmit information over the wireless electromagnetic spectrum, no longer limited to physical wires, and the radio also implemented a one-to-many transmission.

In 1928, the invention of television allowed viewers to watch video information other than text and audio.

Cable TV in 1948 and satellite TV in 1975 used more bandwidth and faster speeds, and supported a wide variety of content.

In the 1990s, the Internet integrated all of these technologies, and the form of transmission expanded from one-to-one, one-to-many, to many-to-many.

The rapid development of science and technology and the rapid advancement of society. In 1844, in the Federal Supreme Court Chamber of the Washington Capitol, American scientist Morse sent the first telegram to Baltimore, 64 kilometers away. People at that time would have difficulty imagining that the future world would have the Internet, and people around the world could use light instead of wires to transmit information.

No technology is isolated

Telegraphers in the 1840s can hardly imagine today's Internet boom. The development of telecommunications technology is not isolated from technological and social changes. It is inseparable from the joint promotion of other industries (especially the energy, transportation and computer industries), which were formed as early as the mid-19th century. For example, if there is no globally popular energy source, humans cannot invent satellites and mobile phones.

The invention of the telegraph applies to electromagnetism, crude oil materials need to be refined from paraffin, and internal combustion engines require industrial production. The cooperation of various technologies has created a globalized world of high-speed operation and interconnection.

In the early days of telegraph development, the specific technical details may be vague, but the future is clear: smaller, more connected, and more focused, that is what the future looks like.

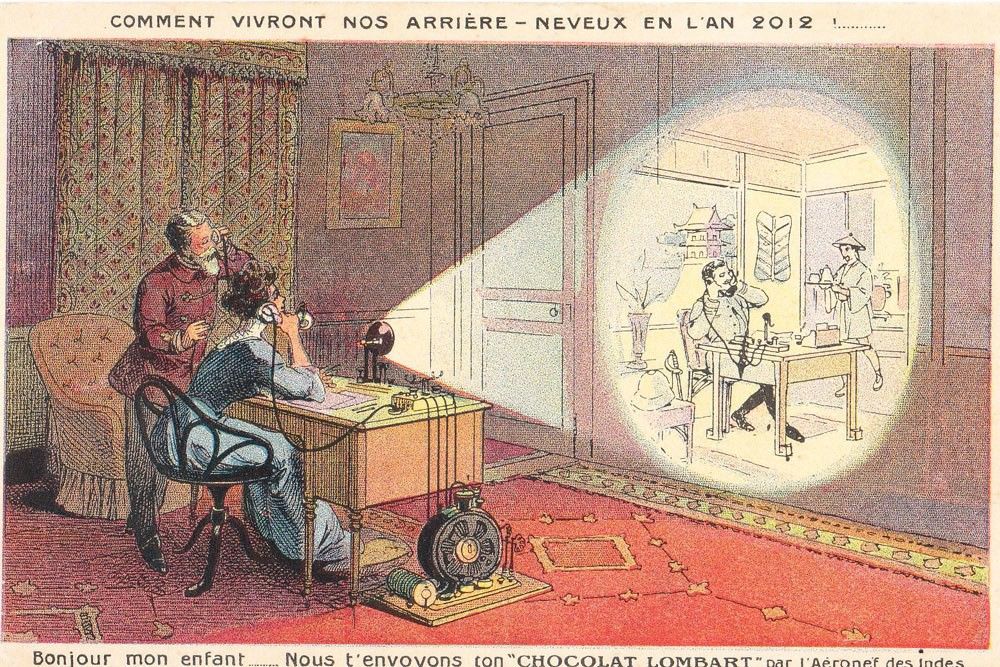

1899 painter's work to predict future video calls

Why is the telegram the best reference for the blockchain?

Because the blockchain uses a distributed consensus mechanism for the first time, cryptography is used to achieve decentralized collaboration. Like the telegraph, it has also opened up a new field of technology.

Distributed Consensus Mechanism : For the first time, Bitcoin adopts a consensus mechanism for workload proofing. Through distributed ledgers, transaction accounting is done by multiple nodes distributed in different places to prevent transactions from being tampered with.

Cryptography : Using cryptographic techniques such as key pairs, hash functions, and Merkel trees to secure data transmission and access, balancing power between attackers and defenders, spammers and verifiers, governments, and citizens relationship.

Decentralization : Use valuable tokens as incentives, without centralized management or third-party agencies.

So, where does the blockchain evolve? When one day in the future, the blockchain is as old as today's telegraph, what will our world look like?

Decentralized future vs centralized past/present

The telecommunications industry needs to coexist with the energy, transportation and computer industries. These are democratized industries that create many opportunities for ordinary people. But at the same time, because they are all capital-intensive industries, the rights are concentrated and it is easy to go to monopoly.

Telecom industry map before 2005

The blockchain is a distributed ledger with robustness, trustworthiness, anti-fragility and independence. Like the telecommunications industry, the blockchain is also not isolated. If we want to predict the future of the blockchain, we need to consider the following industries as influencing factors:

Green energy enables energy to be regenerated and recycled, while also facilitating distributed management. From a thermodynamic point of view, the transmission of energy is very expensive, so try to make the energy production and consumption close to each other. The energy industry has evolved from highly concentrated electrical energy to solar, wind and geothermal energy, not only for environmental protection, but also for achieving unit economic benefits. Once energy is fully allocated, future energy systems will evolve into distribution networks and instant supply markets.

3D printing is still in its infancy, but I believe it will fly into the homes of ordinary people in the near future. 3D printing technology subverts existing industrial production models and supply chain sequencing, moving the manufacturing process to the final stage of the supply chain. By transporting raw materials, you can produce industrial finished products on site, especially small consumer goods.

A mesh network can be seen as a peer-to-peer architecture. The current centralized telecommunications infrastructure is too easy to be manipulated, and the future Internet needs to be built on a globally distributed point-to-point mesh network to ensure efficiency and security.

Today, you use the Internet to buy goods from around the world on Amazon. Internet and purchase records are monitored. The transportation of goods is inefficient and consumes a lot of resources, and these costs need to be borne by consumers.

In the future, you will use digital currency to purchase product designs on a distributed Internet, and then use 3D printers to produce finished products. The entire transaction process will not be acquired by any company. Moreover, the resources needed to produce finished products come from local green energy, which saves a lot of transportation resources and is environmentally friendly.

By then, global markets like Amazon may exist on the blockchain and do not need a centralized company to operate. Although there may still be a large number of economies dominated by centralized multinational companies, the structure of these companies will be distributed.

If you think that a distributed autonomous organization (DAO) sounds ridiculous, think about it, in fact, bitcoin has already been realized. The Bitcoin network is a distributed autonomous organization. Miner mining as a proof of workload guarantees the security of tokens (bitcoin) on the network, and at the same time obtains tokens as mining gains, thus forming a balanced incentive system.

In addition to storage and payment services, many financial services can also be provided by distributed autonomous organizations (DAOs), such as ICO projects, decentralized exchanges, and so on. “World Computers” like Ethereum are trying to distribute computing power, others focus on storage, bandwidth and data, and some of the budding projects are dedicated to identity, social media, news, property ownership. Distribution of insurance and other industries. Supply chain-oriented blockchains are transforming today's transportation, manufacturing and logistics industries.

It is impossible for humans in 1844 to predict all the details of our modern world, so it is impossible to predict the details of the future world today. But we can look into a more distributed world where a centralized supply chain, social media, and energy networks will be replaced. Blockchain and distributed technology form a self-reinforcing mechanism that changes the world.

After centuries of technological integration and development, we have the great Internet today. The blockchain represented by Bitcoin is just getting started. Comparing it with the telegraph can help you to establish a longer-term perspective and understand the future development trend of the blockchain.

Amara's law is more applicable to blockchain technology:

“People always overestimate the short-term benefits of a technology, but underestimate its long-term impact.”

– Roy Amara

If you bought some ICO tokens yesterday, you think that you will be rich tomorrow, then you are "overestimating the short-term benefits of a technology." If you think that our country, global supply chain, multinational banks, oil pipelines, etc. will not fundamentally change in the next century, then you are "underestimating the long-term impact of a technology." Blockchain may not fix many of the world's problems, but it will definitely change the world.

Ok, let's talk about the price of bitcoin (I believe this is what everyone cares most)

The positioning of Bitcoin should be the global reserve currency. Although bitcoin is not perfect, the design is exquisite. Bitcoin has proven to be a great way to hedge your wealth. The emergence of a second-tier solution, such as Lightning Networks, enables Bitcoin to be traded more easily and quickly. Blockchains will eventually be applied in areas such as energy markets, social networks, the Internet, and offline payments.

According to Nakamoto's vision, holding Bitcoin is equivalent to holding a future global economic share. This plan inspired early participants to buy Bitcoin. However, it is not enough to have a single idea. The development of Bitcoin in the past ten years has been inseparable from the efforts and beliefs of countless blockchain evangelists and investors. If Bitcoin can develop healthily under the joint efforts of everyone, break people's prejudice, solve its own scalability and governance problems, and interact with other successful blockchain projects, the price of Bitcoin will be today's price. Many times.

If you feel that the prices of mainstream digital currencies such as Bitcoin and Ethereum have not much room for appreciation, and blockchain technology is nearing maturity, then you are wrong. Blockchain technology is still in its early stages and there is still much room for development.

If you are worried that you will fall when you enter the market, or you will see more short-term appreciation, then you are wrong, and you will miss out on future growth.

The fact is that $5,000, $10,000, $20,000 in bitcoin, or $100, $500, and $1,000 in Ethereum are all bargains. If the blockchain is really like a telegraph, then the technological and social revolution sweeping the world is about to happen, and it has already begun!

So, don't feel that it is too late to enter the blockchain industry. Now is a good time to understand and invest in digital currencies such as Bitcoin. Of course, in addition to investment, we have a lot of other things to do, such as specializing in blockchain technology, establishing regulation, and exploring new business models. Let's do it.

(The currency market is risky, investment needs to be cautious)

original:

Https://blog.unchained-capital.com/stop-comparing-bitcoin-to-the-internet-b6cb995e8364

The author Dhruv Bansal, compiled by Cobo, does not represent Cobo's point of view.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Microsoft hides bitcoin in your Excel: BTC is included in the currency option

- Twitter Featured: Performance bottlenecks in the world's largest exchange, the bull market is coming?

- PoS Mine HashQuark Announces Joining Wanchain Galaxy Consensus PoS Node Plan

- Hacker Reproduction = Bull Market Horn? Their judgment is more accurate than the analyst

- DAO's ultimate question: Who owns the decentralized organization?

- The story of the flock: the cryptocurrency market system risk that must be circumvented

- Ernst & Young: Blockchain solutions for wine traceability platforms