Opinion: The biggest opportunity for blockchain 2.0 is "regulatory technology"

By Liu Mingrui

Editor / Wang Qiao

- Viewpoint: Bitcoin gold has been attacked by double spending again, and nearly 7,500 coins have been lost. Is Bitcoin still safe?

- Assisting Wuhan, what can the blockchain do for public welfare?

- U.S. ambassador to Iraq hit, bitcoin surges over 4%

Peter Drucker said: The greatest danger in an turbulent age is not the turmoil itself, but still doing things with the logic of the past.

The subversive nature of blockchain 2.0

Last September, I proposed the concept of Blockchain 2.0 in the Jinqiu Blockchain Research Report. The illusion that Blockchain 1.0 gives us is that there is nothing magic about blockchain technology, but it is so. However, do not underestimate the fundamental subversive nature of Blockchain 2.0.

I understand what blockchain 2.0 is, and a few words from the article at the time can try to express:

The blockchain industry has created a lot of big concepts, DAPP, De-Fi, Web3.0 … most of them are pure concepts.

Has the blockchain product improved the customer experience?

Does the blockchain solution reduce the operating costs of enterprises?

Can blockchain technology build a new business model?

The essence of technological innovation is to improve business efficiency. A blockchain that can improve overall business efficiency is considered industrial blockchain 2.0.

2. "Pre-Requirements" for Technology Development

The explosive development of any technology needs to meet "pre-requirements".

For example, to achieve flight, an airplane needs to solve these three major problems: the source of lift, the source of power, and maneuverability. These three major flight problems are to meet the "pre-requirements" of flight, and these three problems are not solved by any inventor at one time.

Aerodynamic theory, light weight and high power engine, and control system are the three "pre-requirements" of the invention of the aircraft. The Wright brothers invented the joystick that controls the wing of the aircraft, which fundamentally solves the last problem of flight: the problem of aircraft control. Successfully invented the airplane.

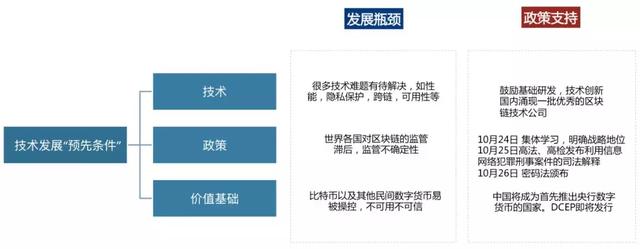

The explosive development of blockchain technology also needs to meet three major requirements: technological breakthroughs, policy certainty, and value foundation. In 2020, we observed that these three “pre-requirements” were basically met, and an outbreak of the industry was imperative.

In terms of "technology", the technical bottlenecks of blockchain technology in areas such as privacy protection, performance, scalability, and cross-chain are gradually overcome;

In terms of "policy", a series of policies such as the development of the blockchain as a national strategy, the promulgation of the cryptographic law, and cracking down on the chaos of virtual currencies have removed policy uncertainty in the development of the blockchain industry;

In terms of "value base", China will become the first country in the world to issue central bank digital currencies, and digital currencies will become a unified, compliant, and stable value rotation infrastructure.

With the blessing of blockchain technology dividends, policy dividends, and digital currency dividends, the explosive growth of blockchain 2.0 has become unstoppable.

Which industries will benefit first? Government, justice, medical, logistics? It's all possible, but we see a very clear opportunity in "regulating technology."

Blockchain + regulatory technology

1) Regulatory technology

Global financial institutions spend more than $ 100 billion annually on non-compliance issues. And Bloomberg predicts that the global regulatory technology market size will reach $ 55 billion by 2025, with an average annual growth of 52.8%.

Regulation Technology, abbreviated as RegTech. The Financial Conduct Authority (FCA) in the UK first proposed the concept of regulatory technology. But the Institute of International Finance (IIF) has a clearer and simpler definition, and regulatory technology is a new technology used more effectively and efficiently to meet regulatory and compliance requirements.

China attaches great importance to the application of regulatory technology and has defined regulatory technology from a higher perspective and position. The Financial Technology Committee of the People's Bank of China put forward: "Strengthening the application of supervised science and technology, actively use technologies such as big data, artificial intelligence, and cloud computing to enrich financial supervision methods, and improve the ability to identify, prevent and resolve cross-industry and cross-market cross-border financial risks. "

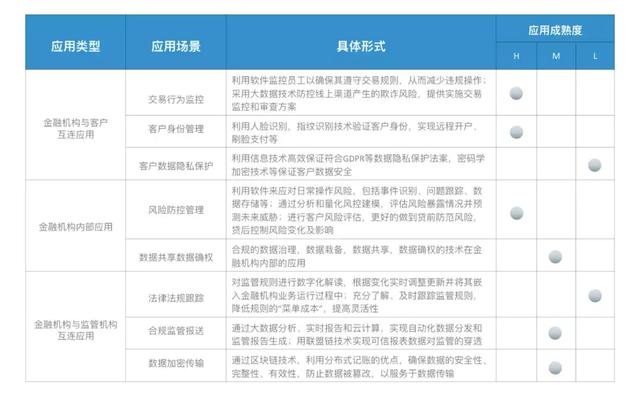

Due to the different subjects of using technology, supervising technology is divided into two aspects: SuperTech (Technology + Supervision) and Compliance CompTech (Technology + Compliance). Regulatory technology application scenarios include three main categories, financial institution and customer interconnection applications, financial institution internal applications, and financial institution and regulatory institution interconnection applications. The following table lists the main application scenarios of regulatory technology:

2) Supervision technology and blockchain, born a pair

The blockchain has the characteristics of distributed storage, multi-centralization, and data cannot be tampered with, which naturally fits into the supervision. Blockchain technology can ensure the security and transparency of regulatory data, as well as improve the efficiency of regulation and compliance. Achieving accurate risk assessment and rating, eliminating information asymmetry and other issues, improving transparency and regulatory efficiency, supervisors can monitor the behavior of the supervised in real time, and find suspicious risks. The supervisory authority can automatically take corresponding measures, while reducing the compliance cost of the institution and reducing The cost of repeated reporting and repeated verification of data.

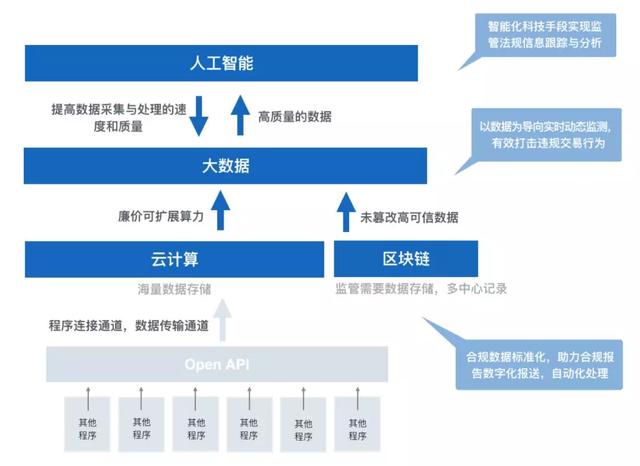

The five core technologies of Supervision Technology are ABCD + API, artificial intelligence, blockchain, cloud computing, big data and API. The five major technologies are integrated with each other and run through the entire supervision process. The relationship between the five major regulatory technologies is as follows:

Application of Blockchain Supervision Technology

1) Application of Blockchain in Regulatory Data Reporting

The Shanghai People's Bank Headquarters issued the "Guiding Opinions on Promoting the Development of Fintech and Supporting the Construction of Shanghai's Fintech Center" on October 30, 2019. The opinion mentioned that "in exploring the establishment of a digital supervision system, we should study and explore the development of unified standards and regulatory rules Reporting data requirements, with the help of blockchain and application programming interfaces, to achieve data and information interconnection, reduce agency operating costs, reduce multiple submissions, improve the timeliness of regulatory supervision, and promote risk prevention and control change."

Compliance data reporting is one of the important means for regulators to conduct off-site supervision. Regulatory data needs to be reported to multiple regulatory authorities, and the data capacity and data dimensions continue to expand and increase. When processing compliance reporting based on the blockchain and constructing a distributed trusted environment, both the regulatory agency and the regulated agency serve as on-chain nodes, and the regulated agency reports compliance data on the blockchain. Participate in data integrity verification and governance together. Complete real-time data interaction, reduce manual intervention, improve the ability of financial institutions to report data, and reduce compliance costs for financial institutions.

Jinqiu Technology's EAST regulatory reporting platform based on the underlying blockchain has been successfully applied to banks such as HSBC, Morgan Stanley, BNP Paribas, and Bank of East Asia. In the fields of KYC, AML, MBT, FAL and other fields, they are also actively promoting the underlying reporting system of the blockchain.

2) Application of blockchain in contract certificate

The CBRC issued the "Interim Measures for the Management of Business Activities of Internet Loan Information Intermediaries", which proposed to financial institutions that electronic signatures and electronic certifications used in transactions should comply with the provisions of laws and regulations to ensure the authenticity and integrity of data and electronic certification of electronic signatures Legal effect.

The China Securities Regulatory Commission announced the "Administrative Measures on the Appropriateness of Securities and Futures Investors" and "Regulations on Implementation", which will be implemented as of July 1, 2017. Article 25 of the Measures clearly stipulates that if a securities company conducts its business through off-site methods such as the Internet, the operating agency shall improve the supporting mark-retaining arrangements, and ordinary investors shall confirm them through electronic means that meet the requirements of laws and administrative regulations. Article 34 of the Measures provides that if a fund sales agency has a dispute with an ordinary investor, the fund sales agency shall provide relevant information to prove that it has fulfilled the corresponding obligations to the investor.

The blockchain-based electronic contract certification scheme provides credible and reliable public services such as registration, certification, storage, and verification for electronic contracts, while taking into account user experience and privacy protection requirements. Jinqiu Technology's large state-owned securities companies in two countries have successfully deployed blockchain electronic contract depository platforms.

V. Prospect of Blockchain Supervision Technology Application

1) Blockchain is conducive to the realization of simultaneous online collaborative interaction supervision by multiple parties

Blockchain technology builds a way of data sharing between regulatory agencies, ensuring fast data rights, data privacy protection, and data invisible. The regulatory-led compliance blockchain moves government regulatory agencies such as the central bank, the two associations, public security, industry and commerce from the entity to the blockchain, and goes online at the same time to coordinate joint supervision across time and space.

At the same time, open interfaces to various licensed and unlicensed financial institutions, as well as consumer organizations, urge financial institutions to upload data and transaction operation information to the network, and broadcast to the entire network after review and confirmation by the main chain node of the regulatory department. Reduce multiple submissions, improve the timeliness of regulatory agency supervision, and reduce agency operating costs.

2) Blockchain smart contract promotes regulatory flexibility

The smart contract of the blockchain has played a great role in the specification of the data structure. The smart contract of the blockchain can perform centralized verification and processing analysis on databases of different dimensions and types to achieve the universality of data between audited institutions. .

The smart contract of the blockchain brings rules to the regulatory policy. With the code agreed in advance, an efficient and trusted closed loop from compliance to supervision is formed. At the same time, smart contracts have good compatibility and flexibility, and can be adjusted and iterated according to actual conditions.

The efficiency of the adjustment and optimization of regulatory rules is improved. The cost of modifying the code of the logic layer and the application layer will be lower than the cost of formulating laws and regulations from scratch and adding, deleting, and modifying existing regulations. Reduced regulatory policies and regulatory costs.

3) Blockchain promotes international regulatory cooperation

The supervision of each country is very independent, data sharing, and supervision coordination are very difficult. Blockchain technology can promote international cooperation between regulators, effectively improve the prevention and governance of cross-border risks, and have a huge inhibitory effect on dark web transactions such as AML (anti-money laundering) and anti-terrorist financing; regulatory agencies in various countries have established compliance The blockchain partnership is conducive to coordinated interaction, information sharing, and jointly promote the development of regulatory technology.

6. Dongfeng has arrived and set sail against the wind

On October 24, 2019, the Political Bureau of the Central Committee of the Communist Party of China collectively studied blockchain technology, and clarified a national strategy to accelerate the development of blockchain technology and industrial innovation. On October 30, 2019, the People's Bank of China's Shanghai headquarters issued the "Guiding Opinions on Promoting the Development of Fintech and Supporting the Construction of a Fintech Center in Shanghai", which further clarified the application exploration direction of the combination of regulatory technology and blockchain.

With the development of technology, the agreement between blockchain and regulatory technology will become higher and higher, and many new application scenarios will be spawned. From the practice of China's existing blockchain application in supervision and foreign exploration, the market and the government should provide them with a loose and testable environment, optimize the regulatory technology governance model, and upgrade finance through a simultaneous online and interactive model of multiple parties. Regulatory concept.

In the intelligent regulatory ecosystem formed by regulatory technology, blockchain and distributed ledger (DLT) often play the role of the underlying structure. The new financial regulatory paradigm of "blockchain + regulatory technology" has a broad blue ocean in the future regulatory field. Blockchain has opened a new path in the regulatory field and has a significant impact on traditional regulatory thinking and regulatory paradigms.

Blockchain makes regulation more efficient, makes enterprises more compliant, and makes the system more transparent.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Chengdu has 35 companies with blockchain technology research as the core and 298 related companies

- Financial institutions join the stablecoin trend: 2020 will be the year of the real stablecoin

- What can the blockchain do? What can't you do? | Back to common sense

- Deutsche Bank: Digital RMB will weaken US dollar's dominance in global financial system

- The largest Ponzi fraud in history-the so-called institutional entry is not as mysterious as imagined

- Understanding Blockchain from Scratch: The Basics of Blockchain Technology

- Bright flags! French central bank governor opposes privatization of digital currency, affirming its usefulness