Opinion: The financial industry explores the blockchain, and integrating resources is the key

On April 20th, Zinc Link held the third phase of “Zinc Huoyuan·Industry Blockchain Ecological Salon” in Shanghai. The theme of this issue is “Tomorrow World, Financial Digital Migration Guided by Blockchain”. The following is the sharing of the theme of " Joining the fullness and bones of finance" by Han Gen, co-founder of Jinqiu Technology.

In 2015, I began to invest in blockchain research. In the past few years, after changing the industry, I have also seen the problems. Perhaps more people only see the changes and benefits brought by the blockchain, but ignore the negative effects it brings. However, if the industry is to develop better, we should look at it more rationally and comprehensively, in order to know how to promote it practically.

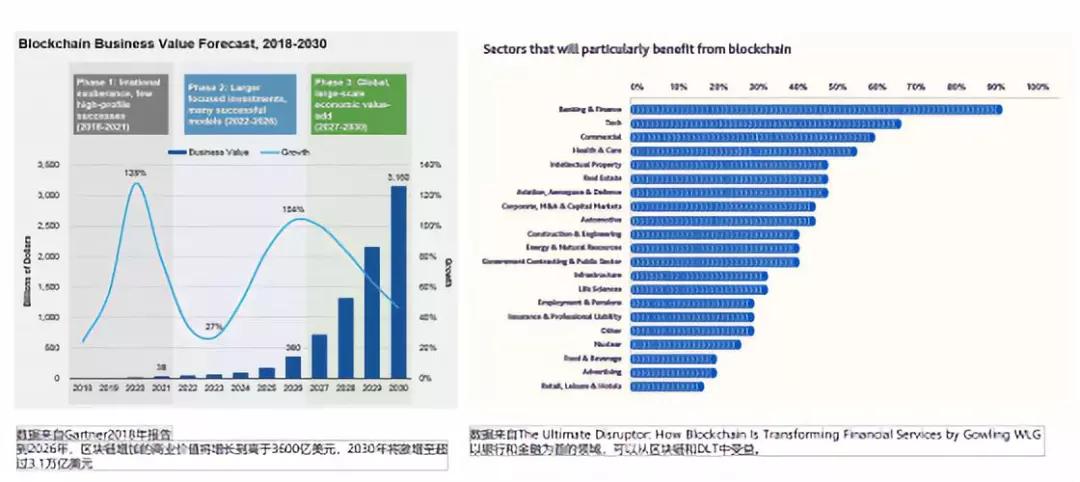

There are many full places in the blockchain industry. First of all, it is very popular. The report shows that by 2030, the entire blockchain commercial market will reach 3.16 trillion US dollars. The financial industry is ranked first in terms of which industry will benefit from the blockchain in the future. From the 13th Five-Year Plan of the country, the local government, to the strong support of the blockchain by various local departments, and the meetings of various places, we have seen a full side.

- Bit Continental in the DeFi field: read MakerDAO in a text

- Bibox and SKR staged the coin ring, and the IEO gambling nature became more intense.

- Meng Yan: Non-securities pass overseas financing? Singapore MAS or point out a clear road

On the other hand, so many countries, so many central banks and banks are studying the blockchain, and in fact we are also involved. Jinqi has been investing in the research and development of blockchain since 2015. It is also the first company in China to do blockchain technology research. It has participated in the formulation of domestic and international standards and has attended many international conferences. We have felt that not only China. Hot, the world is very hot.

However, three or four years have passed, and we look back, how many real business cases are there?

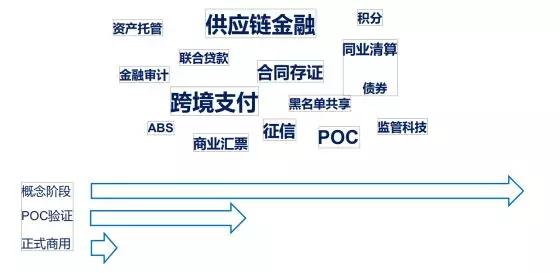

Most of the applications in the financial field are still in the concept stage, and only about 30% of the real landings, and most of them are POC verification. Really commercial, it may not be 5%.

We should think more about the fact that many businesses use technology to test and verify what they get. If it is very good, how can it be used? If there is no value, how can I revisit it?

To be frank, at the beginning, from the characteristics of the letter of credit, the blockchain is not suitable for the financial industry .

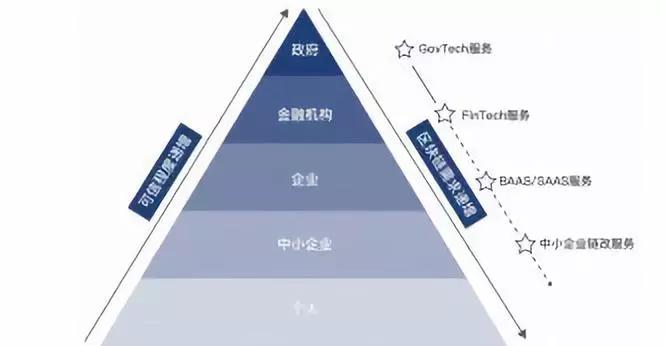

why? Economists have defined a blockchain: it is a machine of trust. But from our overall social structure, the government has the highest trust value, followed by financial institutions, enterprises, small and medium-sized enterprises, and then individuals. Need to be empowered by trust, in fact, more should be the middle and lower layers, not the upper middle layer.

Although the bank has landed many trust projects, in fact, it does not use the "trust machine" attribute, but more is data sharing, efficiency improvement and so on.

Is the blockchain so much that everyone thinks so much? If the blockchain is to be integrated with the financial business, it must integrate resources. It should bring changes to the entire business structure and governance structure, thus generating value, not just the technology itself.

We did a credit reporting project with a financial office in a certain place. As we all know, the credit information of banks and enterprises is in the central bank. Through the central bank's centralized credit information platform, as long as one bank has defaulted and overdue, all banks will know.

However, it is difficult for the local financial supervision bureau to establish a huge credit information platform like the central bank. We work with regulators to build a new governance model using blockchain.

Financial institutions such as small loans establish blockchain nodes and conduct data reporting and credit reporting. All actions are tracked and recorded on the blockchain. Smart contracts control data query permissions, without the customer providing corresponding information for authorization. Technically, financial institutions cannot access customer credit information.

Even if financial institutions obtain data through certain channels and complete the credit inquiry operation, the behavior is recorded in the blockchain, effectively eliminating the problem of customer data being abused by data. By providing self-crediting access to customers, it is possible to prevent financial institutions from smearing high-quality customers for competitive customers. Through blockchain-assisted governance, regulators only need to pay attention to rulemaking and violation penalties.

From this case, the financial office does not need to use a large number of manuals to manage a large number of systems. These systems are distributed in various organizations. It only makes a governance structure and realizes a business similar to the central bank's credit information.

At present, since 2017, the project has already had more than 20 small loan companies and financial institutions in the local area. At the same time, we are also in contact with other local governments to promote this model to other regions, which will help enrich the management of local regulators and improve the financing of local small businesses.

From this point of view, I believe that the blockchain can bring about changes in the governance structure in order to truly empower the business.

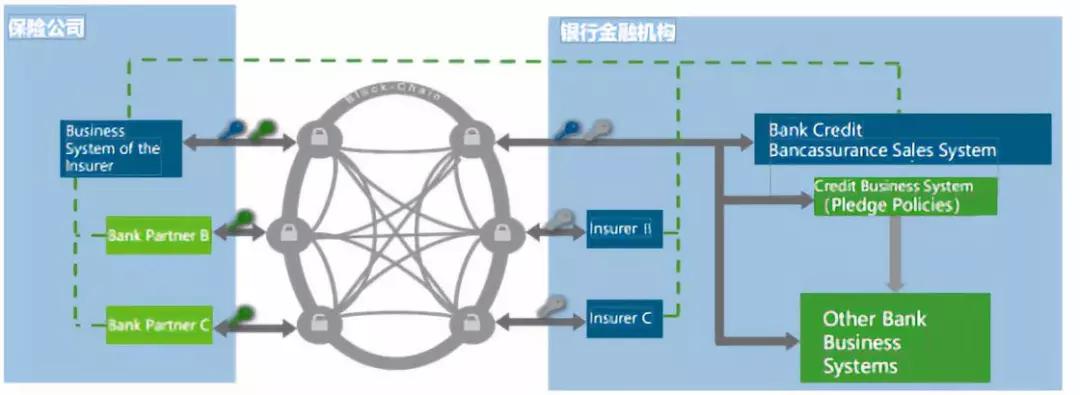

In the second case, this is a private banking business. Because the bank does not have an insurance license, it has to work with the insurance company. When doing comprehensive financial planning for the customer, the insurance business must be part of it, so find a cooperative insurance company.

When the bank interacts with customers and insurance companies and customers, it will find that the entire business process has many steps, including submitting materials, paying fees, etc., and the bank can not complete these steps through cooperation or system integration, because the policy The state bank is unaware that the status of the payment is unknown to the insurance company and there is a lot of information asymmetry.

Based on the blockchain, Jinqi constructed a module for the life cycle of the bank's business and built a collaboration platform. Why is a blockchain, not a system?

Because an insurance company wants to work with many banks, a bank will also cooperate with many insurance companies. Among them, the biggest trouble is that the interface and the standard are not uniform. The maintenance cost of the bank is very high in this piece every year, and the blockchain gives them a unified standard.

From these collaborative cases, we can see that the “standard” of the blockchain is critical.

The promotion of blockchain applications requires a broad consensus first, and the current obstacle is that interfaces and standards are not uniform. Second, the blockchain is more used for collaborative scenarios, and collaboration is to be of a certain size. This is also why blockchains can be problematic in the use of many financial institutions because they are used only within financial institutions. In addition, if there is so much institutional synergy, the core of the core is governance.

So how should the financial industry iterate and innovate based on blockchain? In fact, my personal opinion is not as positive and optimistic as everyone is, because finance is a highly regulated industry. The national regulators clearly stipulate that the financial business is a license business, so its innovation is not easy to break through.

Innovation in the financial industry is actually better suited to improved innovation than to transformative innovation. Progressive, improved innovations can make blockchains healthier in the financial sector.

Text: Chen Haining

Editor: Wang Qiao

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why did DeFi suddenly rise? Is the new model that relies on technology really reliable?

- The "TongRumen" report was announced, and the bitcoin was closed?

- Dry goods | Understanding BLS signature algorithm

- A big inventory of privacy technology, there are so many choices in Bitcoin.

- The BSV incident observation shouted for 10 years of "decentralization" slogan, and the encryption community went back to liberation overnight?

- What is the mentality of those who have announced their withdrawal but insist that they are still optimistic about Bitcoin?

- Before the second crowdfunding of Pokka Polkadot, talk about why Poca is so hot!