Perspective | How to Assess and Reduce the Risk of Participating in Digital Asset Investment

Source of this article: Tokenin, there are deletions that do not affect the original intention, click to view the original

Author: TokenInsight founder Chen Yin

text:

My topic is "How to evaluate and reduce the risk of participating in digital asset investment". In fact, this topic is relatively large. There will be individual investors as well as institutional investors, which represent different investment styles. There will be configuration and investment and trading. The risk cannot be generalized. Today I want to discuss this issue from a methodological perspective.

- Was the plunge completely a whale? This person has completed a short sale and made a profit of $ 20 million

- From Bitcoin to Libra, a blockchain in the eyes of a financial man | Babbitt Industry Welcome Class

- South Korea's NH Bank and SK Telecom launch blockchain “mobile employee ID”, decentralized ID has become the general trend

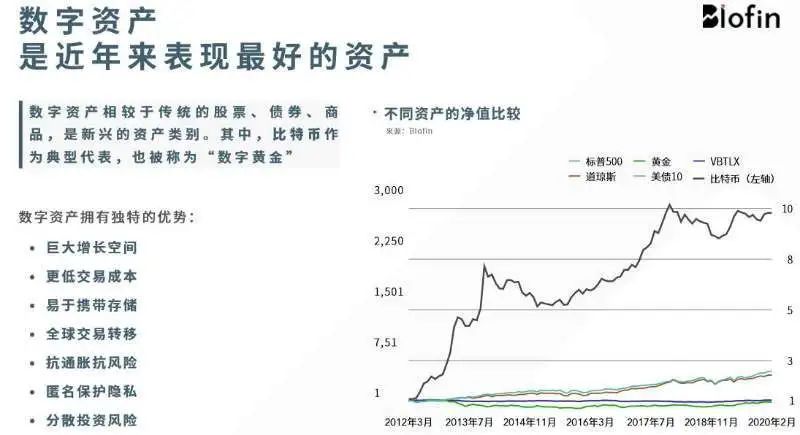

I just checked my phone and found a very interesting thing. Today (activity time: February 19, 2020) the Shanghai Stock Index closed at 2975. I took a look at the index around February 20, 2010, which is probably more than 2900 points. To tell the truth, the ten-year Nanke dream of A shares may have given everyone a deeper memory. Recently, the price of BTC has rushed to 10,000 $, which has increased by a factor of ten in ten years. As a result, there is a passage on the Internet: "BTC has increased by 1 million times, and everyone still thinks it is a scam; A-shares have not moved for ten years, and everyone thinks it can make a lot of money."

To this day, there are still many people who come to ask questions about the reliability of digital assets. I think there are two reasons for this question: one is that there are fewer tens of millions of people with digital assets around the world, and the vast majority of people don't know about this industry. When this number expands ten or even hundreds of times to billions of people, this question of digital assets will be greatly reduced.

The second is the popularity of 1C0 in 2017, so that investors including Chinese aunts and South Korean aunts rushed to the forefront of the market until they finally disappeared. After this incident, the attitude of public opinion on this field has also become somewhat too elusive. However, dialectically, some people's exits and each clean-up essentially promote the progress of the market. More than a year after the 1C0 blockade, we see that the market is actually developing in a healthy direction. A lot of quality projects and companies.

Just now I also mentioned the issue of the correlation between BTC and gold. After breaking away from the gold standard, gold has actually become such an asset that is determined by supply and demand. BTC is also moving in this direction, but after all, it is still in an early stage, which is why we have always been more optimistic about BTC.

So when BTC was relatively strong recently, many friends came to ask digital asset related questions. To sum up, there are a few questions:

3. Having certain investment experience in the industry, I will start looking for different tokens and ask which tokens will rise.

4. People with longer investment experience may ask some advanced questions, such as whether there are other assets to invest in except the Token industry.

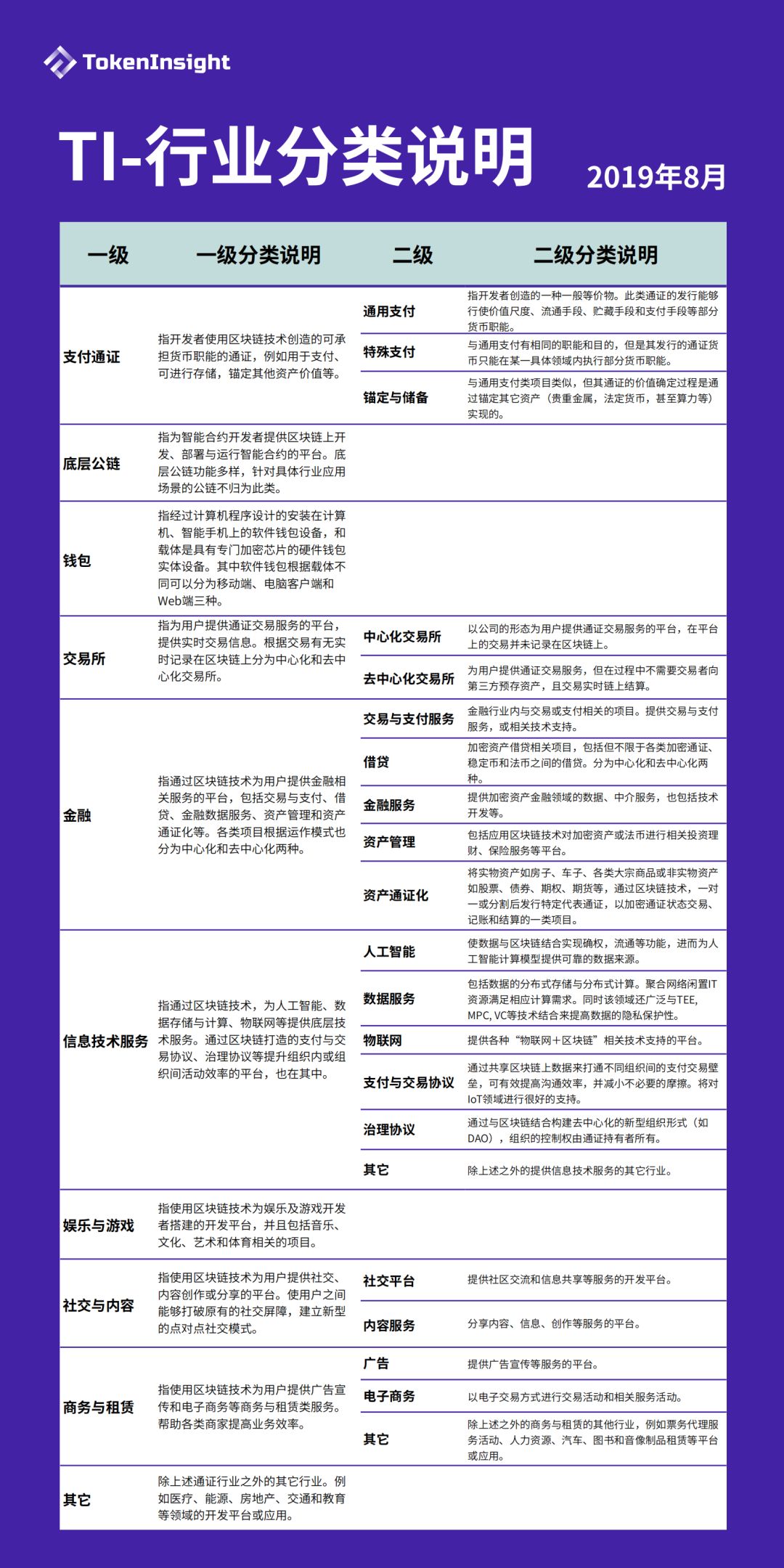

First of all, in terms of methodology, let's talk about the risks of digital assets. Before talking about investment risks, I want to raise a point that everyone is very concerned about. Where is the token safe? Generally speaking, tokens are placed in wallets, whether they are exchange wallets, special hot wallets or hardware cold wallets. As for how to reduce risks, there are two main ways: one is to rely on technological progress, but this requires a cycle. So in the current state, how to choose a wallet? Here I send a picture to everyone. It is TokenInsight's evaluation of various types of wallets in the industry. There are evaluations in different dimensions. If you are interested, you can go to the website to see the details.

But as of now, specialized wallets are more of a storage tool. It is not very convenient for some people who want to invest or trade on their own. So what is the other path? From my perspective, I understand that I have the ability to pay. Next, let me talk about what are the risks of investment?

First, the risk of any investment is divided into systemic risk and non-systemic risk. Systemic risk refers to the entire system engaged in investment or exchanges, due to external shocks or internal factors, resulting in drastic fluctuations, crises, and even the entire system is paralyzed. No organization can escape this kind of risk and suffer losses. Traditional markets include policy risks, fluctuation risks in the economic cycle, and interest rate risks. This kind of risk cannot be eliminated by diversifying investment, but this kind of risk has a measurement index, called β, and many friends who make investments may also know that β is a very important risk index.

Just as this pneumonia outbreak is a systemic risk, we can see that many assets performed differently during this period. After decades of development of the traditional market, finally from the 1980s and 1990s of the last century, between the passive investment and the active investment, to find a way to defeat the market, is the so-called Smart-β.

Smart-β is a method that adjusts the weighting of various factors (such as momentum, volatility, etc.) of different assets in its portfolio, that is, a multi-factor quantitative model to adjust the combination coefficient, allowing investment to reorganize, ultimately defeating the market and reducing the system Sexual risk. Such a factor is actually a basis for quantitative investment, and it can be said that it is a hybrid investment strategy in which both active and passive coexist.

In the current digital asset market, I think it is still at an early stage, and the concentration of Tokens is relatively high. Especially, a single BTC accounts for more than 50% of the total market value of Tokens. But I want to share a trend with you here. Starting this year, we see that the market is actually setting off a new round of ETFs.

Why is there an ETF in the blockchain industry? Because ETFs are one of the largest asset models in traditional markets. What kind of result will the ETF have? I think if the ETF is implemented on a large scale this year, it will promote the further development of the index in the industry. So I believe that after the launch of this round of ETFs, similar products of Smart-β will soon appear in the market.

Let's talk about non-systemic risks. This is about the risks caused by individual projects or company-specific events. Because of individual factors that cause changes in prices and returns, such risks can actually be spread out through investment diversification. Like investing in traditional markets such as the stock market, you can choose to invest in individual stocks or you can choose to invest in funds. So we take this as an analogy and talk about investment tokens.

This brings us to the second part, how do we look at digital assets? Many people ask me what is the blockchain market like? What I want to say is that there is no way to answer this question. After several years of development in the blockchain industry, this different industry has been derived. There are not only subdivisions similar to traditional industries such as games, data services, etc., but also some unique subdivisions like payment tokens, wallets, and so on. For a single token, we must first observe the industry segmentation, and then look at the development prospects and ecology of the industry segmentation, in order to analyze whether the token has investment value.

If it is an individual or purely for the purpose of configuring digital assets, I think the first choice is BTC, because it represents more than 50% of the digital assets. As part of the asset portfolio, I also think that BTC has a relatively large allocation value. In addition, I believe that the market will launch more typical index funds and ETF funds this year, and the width of allocation will also expand accordingly.

In addition, this market has a feature that is different from the traditional market. You can either look at the exchange rate of more tokens and fiat currencies, or increase the number of tokens through investment transactions. If you want to do the same operation in the traditional market, for stocks, you first need to sell the stocks and convert them into fiat currencies. Then use fiat currency to buy other stocks. It is difficult to complete the stock-to-stock transaction directly, and you need a medium to do this.

However, in the blockchain trading market, many Tokens can be directly traded. For example, BTC can be directly exchanged for ETH, and ETH can be directly exchanged for LTC. There is no need to complete it through a medium similar to legal currency. This situation will lead to more arbitrage opportunities in this market, so we see that there are a large number of quantified funds operating in investment institutions in this market. TokenInsight has a large amount of fund data in the digital asset market. It can be seen that these funds have achieved better performance in this market. Compared to the traditional market, the overall alpha will be higher. Therefore, in this market, it is also a better choice to choose fund products from excellent fund management teams.

I think that the development of the digital asset market to this day has produced more asset classes. Not just in the form of Tokens. For example, mining and mining power and other products, such as Token and fiat-based lending products, the types of products in this industry are constantly being enriched. So back to what we said at the beginning, according to each person's different investment style, choose the corresponding investment product.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- When all Bitcoins were mined in 2140, what is the final value of Bitcoins purchased today 120 years later?

- If 21 million bitcoins were evenly distributed to the world's 7.8 billion people, how much would each person get?

- Non-contact is more comfortable, new experience of Shenzhen blockchain electronic invoice during the epidemic prevention period

- Data sharing empowers AI-driven networks based on blockchain technology, taking mobile network operator MNO as an example

- Microsoft: All in blockchain, BaaS services overpowering tech giants such as Alibaba Cloud and Amazon

- Will the NFT that has tripled in three years become the meme in 2020?

- Hong Kong wants to increase cryptocurrency laundering supervision, the world will act in concert to impact the value of cryptocurrency "black market circulation"