R3, IBM, JP Morgan Chase grab Singapore, seize new fortress of blockchain trade finance

Text: Golden Walk

Source: Interchain Pulse

In Singapore, a battle for blockchain trade finance without smoke has begun.

Recently, several news related to Singapore have been announced one after another, delineating its important position in the global blockchain trade finance field, and the preemption of Singapore as a fertile land for trade by platforms such as R3, IBM, and JP Morgan Chase.

- Babbitt Live | Guo Yu: 3 minutes to understand zero-knowledge proof, why is it a double-edged sword?

- US SEC postpones ruling on another Bitcoin ETF proposal, how is this proposal different than in the past?

- Babbitt original 丨 First time! Shenzhen Stock Exchange released the Blockchain 50 Index, the total market value of constituent stocks is 1.3 trillion

On December 19, Gai Mei International Terminal in Ho Chi Minh City, Vietnam announced that it has joined TradeLens, a blockchain trading platform jointly launched by IBM and Maersk. Prior to that, Singapore was already the first ASEAN member country to use the platform.

On December 20, the Monetary Authority of Singapore announced that it will officially implement the Payment Services Act from January 28, 2020. This bill will make Singapore one of the few countries with clear regulation of digital currency business, and will further promote the compliance development of blockchain and digital currency in the country.

Interlink Pulse observes that recently Singapore is no longer just a compliant offshore node for blockchain projects. Depending on its own trade advantages, Singapore is gradually becoming a "regular army" to capture the "fortress" of the global trade payment field. From digital currency paradise to blockchain trade financial highland, its transformation is accompanied by the “snatch” of blockchain projects in various countries and the coordination of national policies.

Since 2017, the project of “grabbing” in Singapore has continued, with ambitious Libra listing Singapore dollars as the anchor currency; China, which has conducted a number of blockchain trade cooperation with Singapore; and cross-border with Singapore on the blockchain The Bank of Canada, which maintains close ties in the field of payments; the Philippine Bank, which has recently cooperated with digital currencies; and even Singapore itself.

The competition between projects is actually a competition between technology platforms. At present, Singapore has become the key to R3, IBM, JP Morgan and other platforms to seize the field of blockchain trade finance.

Singapore battle: seize the "fortress" of blockchain trade finance

The first to move were R3 and IBM. In November 2017, the Hong Kong Monetary Authority and the Monetary Authority of Singapore exchanged a memorandum of understanding to cooperate in the development of a "global trade connection network", the use of distributed ledger technology to build cross-border infrastructure construction, and to promote the trade between the two places and globally. Digitization of trade finance business. It is reported that the platform is the technical work involved in technology companies such as R3 and IBM.

Since then, China, as Singapore's most important trading partner, naturally will not be outdone.

In April 2018, China applied blockchain technology to all key players in the commodity trade process. One of China's four largest state-owned oil companies, a subsidiary of Sinochem Group, completed the task of relying on blockchain technology to transport gasoline from China to Singapore. Sinochem Energy Technology Company transported gasoline from Quanzhou, China to Singapore in the form of shipping. Ship.

Later in July, companies in Singapore also started relevant exploration and practice. CrimsonLogic, a Singapore-based e-government service provider, announced the launch of a blockchain platform focused on cross-border trade. The company is owned by a city-state government agency and port operator, and the platform is a licensed network run and verified as a node by a certified trade compliance company. It is reported that the platform was created by the Global Electronic Trade Services Corporation (GeTS).

Until this year, JPMorgan Chase has opened a more in-depth blockchain trade finance related layout in Singapore.

In May, the Monetary Authority of Singapore and the Bank of Canada issued a joint announcement saying that the two sides had conducted a successful payment experiment on cross-border and cross-currency payments of encrypted digital currencies. In this cross-border payment process, the Bank of Canada and the Monetary Authority of Singapore connected their respective blockchain projects Jasper and Ubin's networks by using hash time lock contract technology. It is reported that these two projects are based on Corda at R3 and Quorum at JP Morgan.

Later in November, foreign media reported that the Monetary Authority of Singapore and JP Morgan Chase developed a prototype blockchain for cross-border payments. The prototype allows users to pay in different currencies on the same network. Temasek, an investment company owned by the Singapore government, also participated in the development of this blockchain prototype. At the same time, it is reported that the prototype is part of the fifth phase of the Ubin project.

On the other side, the news of Libra's "offensive" to Singapore was reported in September this year.

According to Bloomberg, Facebook wrote in a letter to the U.S. Senator on the crypto project Libra that the fiat currency supporting the stablecoin may also include the Singapore dollar. Because Libra's main scenario is the cross-border payment field. Its choice of Singapore is not only to ensure the smooth selection of the Asian market when the Chinese market cannot be guaranteed, but also to use the background of the Singapore Trade Center to realize its ambition of currency globalization through trade circulation.

In addition, Philippine Union Bank, a large domestic commercial bank in the Philippines, has also explored blockchain trade finance with Singapore. At the end of July this year, the United Bank of the Philippines launched a stablecoin called PHX, linked to the country's legal currency "peso", backed by the bank's reserves, and focused on the payment business. Later, the bank reached a cooperation with Singapore's second-largest bank, OCBC Bank, to remit the tokenized fiat currency from Singapore to Cantilla Bank in the Philippines, successfully implementing the Philippines' use of blockchain technology for cross-border remittances. First try.

To sum up, the war around Singapore and platforms around the world, focusing on blockchain trade finance, has intensified.

"Knowledge of the Times" is Singapore: Policies complement each other

The reason why Singapore has become the focus of competition for platforms such as R3, IBM, and JP Morgan is mainly due to its own openness and strong trading position.

Singapore is an export-oriented economy that is highly dependent on international trade and has a high degree of openness. According to the 1981 Economic Development Index, Singapore's economic openness reached 61% -68%, compared with 9% in the United States and 11% in Japan. At present, its opening is further in the field of blockchain, and with the opening is advanced and progressive.

Observing the pulse of each other, the Zero One think tank has calculated the performance of blockchain investment since 2018. China and the United States have led the world in the number and amount of financing, followed by Singapore and the United Kingdom. At the same time, Robert W. Greene, a researcher at the University of Social Science of Singapore, said that more than 40% of the smart contract platform projects for token sales from 2017 to 2018 were conducted in Singapore.

Singapore's blockchain development market is huge, and regulation is relatively liberal. Originally, Libra's primary goal in the Asian market was China, but subject to regulation, its final choice was Singapore, which is also the "Four Little Dragons of Asia".

On the other hand, Singapore has a strong international financial and trade status.

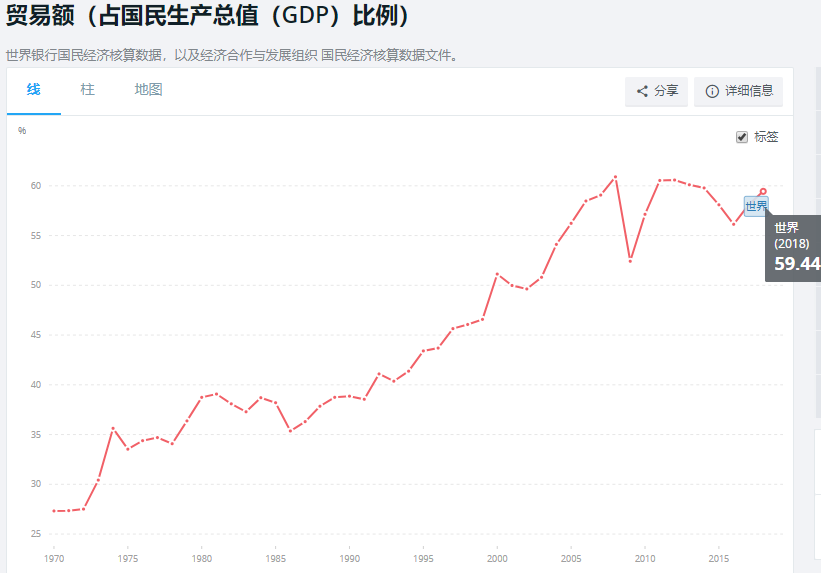

Interlink Pulse observes the data from the World Bank's official website. In 2018, total global GDP was 85.91 trillion, and trade accounted for 59.443% of it. And from the perspective of development trends, the total amount has accounted for an increasing proportion of global GDP in the past ten years of development. Trade is already the world's largest industry, which means that whoever controls global trade is equivalent to having the right to speak internationally.

(Data: World Bank official website)

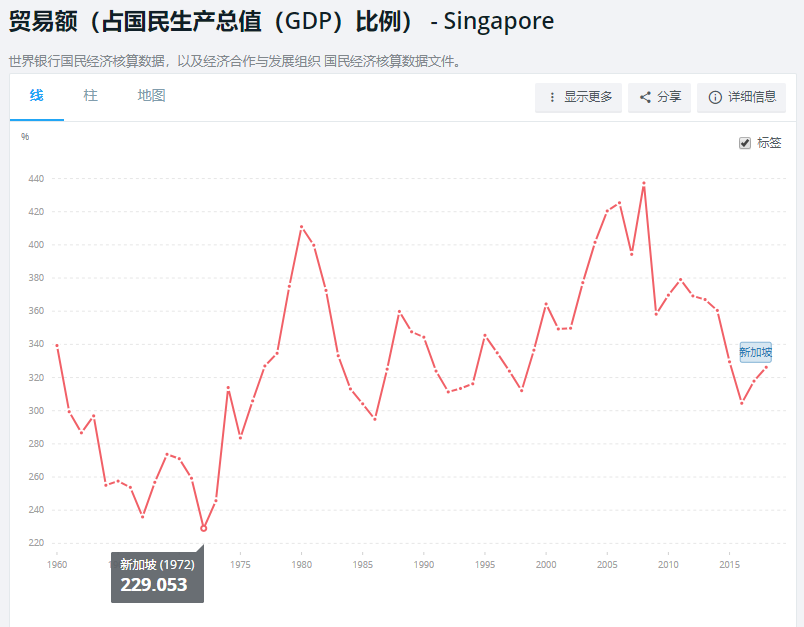

Similarly, according to data from the World Bank's official website, Singapore's trade accounted for 32.1955% of GDP in 2018, and its lowest percentage in history was 229.053%. Based on its unique geographical location and development background, Singapore has become a natural port for trade and enjoys a high international trade status.

(Data: World Bank official website)

At the same time, Singapore is complemented by a highly open free trade policy. If most goods are imported and exported with zero tariffs, import duties will be levied on only a few products; Singapore promises to keep the number of import licenses to a minimum and strictly restricts the number of exported goods; 8 "free trade zones".

In addition, Singapore's e-government construction has a very high level, and many links related to customs clearance have been paperless, automated and networked. Based on this development, combining trade and blockchain has become the key to countries and platforms that value Singapore's blockchain trade market.

And Singapore is also quite "knowing the current affairs as a handsome man" and timely launching corresponding policies to create good conditions for the development of blockchain trade finance projects in the local area.

As early as June 2016, MAS launched a “regulatory sandbox” system, which aims to provide a good institutional environment for financial enterprise innovation. And Singapore has always been known for its highly enlightened policies on blockchain and digital currencies.

Since then, it has become a key location for cryptocurrency exchanges and blockchain projects that evade regulation and seek a living space. But in fact, Singapore's policy encourages more quality projects, and the exchanges are also strictly regulated. For example, in May 2018, the Monetary Authority of Singapore issued a "warning for digital currency exchanges and issuers of ICOs". And continue to strengthen public financial education to ensure that the public is aware of the risks of the first coin offering.

Recently, the Monetary Authority of Singapore has continued to promote the regulation of payment services.

From December 2018, the new regulatory framework for payment services, including digital currencies, is not expected to be licensed under the new regulatory framework, and cryptocurrency service providers that are not part of the prior regulatory framework are expected. As of November 2019, the Payment Services Regulatory Framework was formally legislated and named the Payment Services Act. More recently, the Monetary Authority of Singapore announced that it will officially implement the Payment Services Act in 2020.

The policy clarifies the regulation of digital currencies, and promotes the development of Singapore's blockchain-based trade finance and cross-border payment fields from the institutional level.

With the dual role of the blockchain platform and the promotion of domestic policies, Singapore has become a high place for blockchain trade finance, and it is also a stronghold for the development of blockchain trade finance by countries and platforms.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analyze the consensus mechanism from an economic perspective: PoW is a diesel car and PoS is an electric car

- Bitcoin Core developers share Bitcoin roadmap for 2020, these four major improvements are worth looking forward to

- The official blockchain stock selection list is here! Shenzhen Stock Exchange released the first blockchain index in the two cities, the most beef stocks rose 310% during the year

- Digital currency silent smoke: Alipay RMB and Libra USD

- 4 days countdown! Ling listening to the 2020 New Year's Eve speech exploration class, 5 core views invite you to think New Year's Eve

- Only sell coins but not buy coins. One year later, the country ’s attitude towards cryptocurrencies has completely changed.

- Former Bakkt CEO becomes U.S. Congressman, Chief Product Officer takes over