Research Report | Blockchain Power Energy Application Industry Report

- Introduction to the power energy industry

1.1 Overview of the Power Energy Industry

Electricity is a secondary energy source that is clean, efficient, easy to use, safe, and has the widest range of applications. It can not only be easily converted into sound, light, heat, force and electrophysical, electrochemical effects through various electrical appliances, but also can be quickly transmitted in the wire, and can be divided indefinitely in the distribution system. These advantages of electricity make it the most widely used energy source in modern society and an important material basis for the production and life of modern society. With the development of industrialization in various countries, human demand for electricity has increased year by year. The ability to provide a large amount of cheap, high-quality, reliable electricity is directly related to the process of national economic development.

Electricity production can be divided into two broad categories: fossil fuel production electricity and clean energy (nuclear energy and renewable energy) to produce electricity. At present, it is the fossil fuel production power, especially coal-fired power generation and gas-fired power generation. As an important part of the global energy system, renewable energy, in addition to reducing greenhouse gas emissions, provides an important driving force for the social, political and economic development of all countries. It plays an important role in ensuring energy security, improving environmental protection and increasing employment in all countries. effect. At present, the proportion of electricity produced by renewable energy is not high, but it is obviously growing year by year.

1.2 Industry chain analysis

- Bitcoin Twitter user map: the most active in the United States, the most negative in Estonia

- Love to spray bitcoin and quietly hold the currency, this gold lover is a little fan

- Garbage classification – a practice of distributed computing for all people can learn from the blockchain

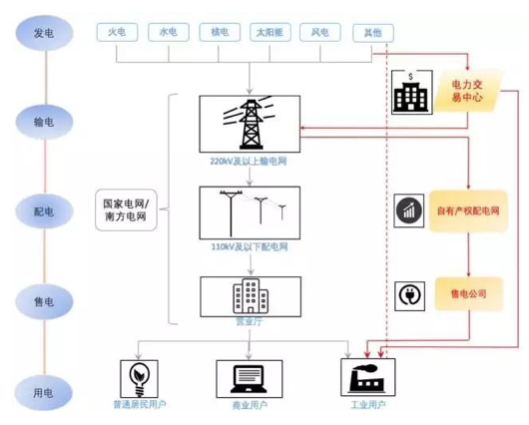

The power industry industry chain is as follows:

Power generation – transmission – distribution – sales – electricity

Image from Baidu Pictures

An electric power production and consumption system consisting of power generation, transmission, distribution, electricity sales and electricity consumption. The natural primary energy is converted into electricity through mechanical energy devices, and then the power is supplied to each user through transmission, transformation and distribution. . Power generation is the process of converting primary energy into production energy through production equipment; transmission is the process of boosting the power produced by the power plant through high-voltage transmission lines; power distribution is to reduce the energy on the high-voltage transmission line and distribute it to The process of users at different voltage levels; power supply, also known as power sales, is the process of ultimately supplying and selling power to users.

1.3 Characteristics of the power energy industry

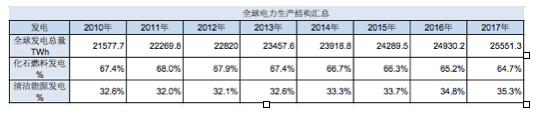

1. Fossil fuel power generation is the mainstay, and the proportion of renewable energy power generation is increasing year by year.

According to the 2018 Global Power Report data, fossil fuel power generation still dominates, with coal-fired power generation as the mainstay, followed by gas-fired power generation, and the share of fuel-fired power generation is small. In 2010, fossil fuel power generation accounted for 67.4% of the total global power generation, and remained at 64.7% in 2017, but it has declined. Clean energy is mainly renewable energy generation, which is increasing rapidly every year. As of 2017, global renewable energy generation accounted for 26.5% of total electricity, an increase of 2% over 2016, is also the year with the biggest increase. Among them, photovoltaic power generation and wind farms have the highest growth rate.

Data from the 2018 Global Power Report

2. Power transmission loss is large, and the share of international trade is relatively small.

Energy production determines the development layout of energy transmission to a certain extent, and transmission is a necessary condition for energy production and consumption. The conduction characteristics of electrical energy determine that it is inevitably accompanied by large losses during transmission. According to the report of "Natural Gas: The Energy for today and future 2017" released by the World Gas Association (IGU), compared with the loss of energy transmission, 100 natural gas users can get 92 copies, and 100 parts of electricity can only be obtained by users. 32 copies. Therefore, the international trade in electricity is much less than that of international oil trade. Compared with natural gas, the volume of international trade can reach 30%, and the trade between electricity is only between 1% and 2%, and most of the power lines are only connected to neighboring countries.

3. Centralized power generation transportation led by large enterprises

Most of the energy forms in the energy sector are affected by the scale effect. The initial power infrastructure construction and the continuous power supply transportation in the later period require huge capital investment. Therefore, the current power system is a centralized power generation transportation led by large enterprises. Centralized power generation and transportation not only ensure sufficient power supply, reduce transportation losses, but also provide professional operation management services to prevent system risks. Most of China's current power trading centers are controlled by large state-owned enterprises.

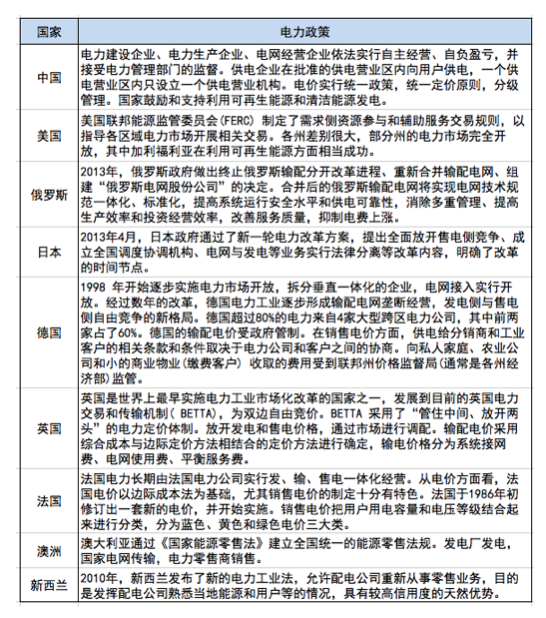

4. Affected by the policy

Electricity supply is part of the national infrastructure construction. In terms of policy, electricity is the basic industry with strong supervision and strong policies. Power projects need to be approved by policies or acquired qualifications, licenses, etc., and the impact of national policy on energy structure is significant. Power generation support policies mainly include on-grid tariffs, renewable energy quota systems, net metering tariffs, fiscal tax support policies, and green electricity prices. Among them, on-grid tariffs and quota systems are the most common. As of the beginning of 2013, 127 countries around the world have formulated or introduced renewable energy policies, with developing countries and emerging economies accounting for more than two-thirds.

1.4 Electricity prices and energy policies in some countries

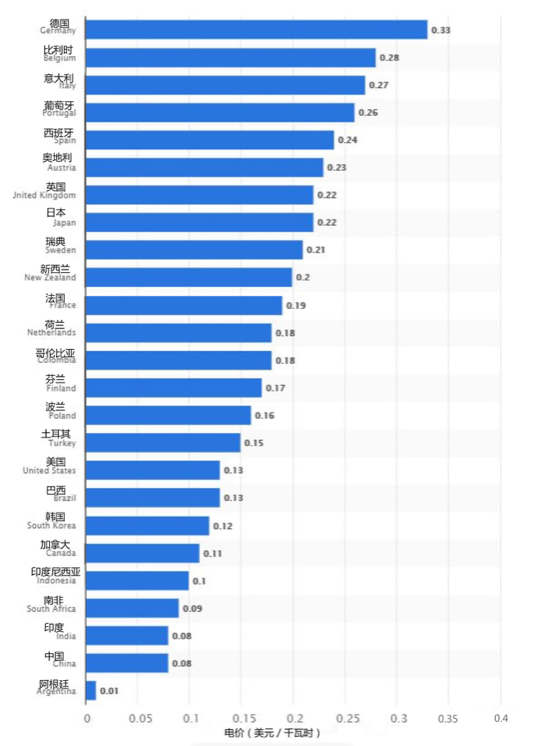

Electricity is one of the most important energy sources in the world and an indispensable element in modern life. Electricity prices not only reflect the level of power development in the country, but also the national economy and people's livelihood. It is an index that has a very significant impact. Different countries and regions often have different power market systems and electricity price systems. The power industry monopoly, semi-marketization or complete marketization affects the development and composition of electricity prices in the region, and also affects the local electricity price formation mechanism.

Image from "World Electric Power Encyclopedia"

From the perspective of electricity price distribution, among the 25 countries counted, Germany has the highest electricity price and Argentina has the lowest electricity price.

From the point of view of power policy, most of the nine countries in the statistics released the competition on the power-sale side, allowing distribution companies to retail.

2. The point of convergence between the power energy industry and the blockchain

The current power transmission loss rate is high, and corporate financing is difficult. The scale of the industry is huge and the amount of funds is huge, and the transaction subject is very complicated, resulting in high transaction costs and settlement costs between the various links. And due to the lack of effective credit mechanism, the energy industry data sharing utilization rate is very low.

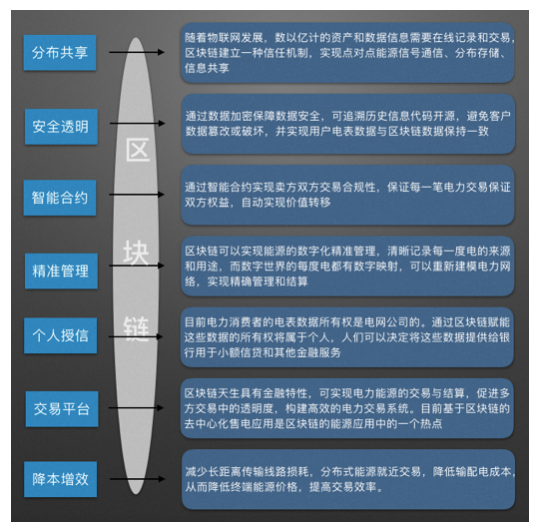

The energy Internet has gradually moved from concept to landing. It has strong internal consistency with the blockchain. Both of them are based on the IoT of smart devices, all of which emphasize decentralization, autonomy, marketization, and intelligence. The power Internet and blockchain mainly have the following seven points of convergence:

3. The main application scenarios of blockchain in the power energy industry

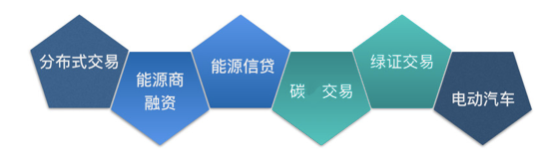

Blockchain technology will greatly change the energy system production and trading model. Energy trading entities can achieve energy product production, trading, and energy infrastructure sharing in a point-to-point manner. The energy blockchain can realize digital and precise management of energy, and the future will be extended to distribution. Energy trading scenarios such as microgrid, energy finance, carbon trading and green card issuance, and electric vehicles.

In point-to-point power transactions, especially for distributed energy, point-to-point transactions between users and generators can be achieved through blockchains. In the determination of online loss, the loss of conversion between different energy sources, the long-distance transmission of energy and the line loss caused by other operations can be notarized through the blockchain in the future, and the information will be more transparent. When there is a cross-energy type market, the transaction of multiple energy systems and its price information can be recorded, and on this basis, the marginal price of various types of energy in each region can be generated in real time.

In power finance, in the decentralized multi-energy system collaboration, the blockchain is used to record the real-time production information and cost of different energy systems, and at the same time, the direct securitization of power station revenue can be realized.

In the carbon emission certification, blockchain technology is used to build a carbon emission certification and trading platform, and each unit’s carbon emission rights exclusive ID is given, and the time stamp is stamped and recorded in the blockchain to record the generator set in real time. Carbon emissions, carbon trading behavior and fines for over-standard companies.

In the charging of electric vehicles, the blockchain distributed general ledger is used to realize the forced trust, the relevant parties interact point-to-point, the smart contracts automatically execute the power transactions, and the demand fluctuations automatically respond.

3.1 Distributed Trading

The centralized power supply method that we are accustomed to has shortcomings such as poor strainability, difficulty in coordinating energy storage, high power consumption due to transmission loss, and low energy utilization. Therefore, the decentralization of energy generation and storage is a good complement to centralized power supply. Although most of the world's regions are still focused on power supply by power companies, with the improvement of battery energy storage systems, more small energy suppliers will enter the market.

The use of photovoltaic power to generate electricity, stored in the battery for use at any time, surplus power sold to nearby households. At this stage, the single point of energy production and storage problems have actually been overcome, but how to link the scattered nodes, the emergence of blockchain solves the crucial part of decentralized energy supply. One of the essences of blockchain technology is distributed storage and distributed accounting, so one of the most common applications of blockchains in the energy industry is peer-to-peer power trading in distributed energy.

Blockchain can reduce the cost of distributed point-to-point power transactions, and smart contracts allow suppliers and consumers to automate sales by creating parameters based on price, time, location, and allowed energy types. If the technology is widely used, it will dramatically change the pattern of energy system production and trading, that is, the transaction entity can cross the current huge grid system, peer-to-peer to achieve energy product production transactions and infrastructure sharing.

There are currently many projects targeting the microgrid, such as:

1. Transactive Grid, a distributed photovoltaic power selling blockchain platform jointly established by US energy company LO3 and Bitcoin development company Consensus Systems, has developed the world's first energy blockchain market, combining blockchain technology with microgrid. To give users the right to return excess photovoltaic power to the grid.

2. The Energo project establishes a decentralized system of distributed energy independent communities and establishes an automatic energy trading platform based on Qtum quantum chain to realize clean energy measurement, registration, management, transaction and settlement of the microgrid.

3. Power Ledger is a P2P microgrid energy trading platform, and tries to build an application ecology of power trading. On this platform, it can graft multiple power scene applications, such as power port project to realize distributed storage of electricity; The operation of the power grid can allocate power energy more intelligently through power metering, big data analysis, fast transactions, etc., reducing energy losses.

4. ELONCITY adopts the model of distributed renewable energy supply + distributed intelligent energy storage equipment. By constructing community basic power facilities, it gradually completes the group-connected connection of micro-community smart grids and establishes a decentralized community power trading market.

3.2 Energy Finance

3.2.1 Energy supplier financing

The energy industry has great market potential. The development of new energy sources such as wind power and photovoltaics plays a vital role in achieving green and low-carbon energy transformation and energy security in various countries. However, due to the long investment cycle and high risk of the new energy power industry, its development is inseparable from funding and policy support.

At present, renewable energy faces the financing difficulties of high-quality green energy projects caused by the reduction of subsidies, the increase of developers, the increase of competition, and the establishment of higher credit conditions for banks to control risks. Ordinary investors can not participate in the high-growth investment and trading market in the green energy market. The liquidity and investment and financing efficiency and threshold of the green energy trading market need to be resolved.

According to Bloomberg New Energy Finance (BENF), the trend at the beginning of 2017 shows that compared with 2016, the investment in renewable energy in the first quarter fell from 64.25 billion to 50.84 billion, down 20.9%. The existing energy investment market is mainly from banks and private placements. Equity funds and hedge funds dominate. The system does not provide an appropriate capital access opportunity for renewable energy groups. Nor can it provide consumers with appropriate access to energy.

In order to solve this investment and financing problem, a blockchain project of the nature of energy financing platform emerged. E.g:

WePower is a green energy financing trading platform supported by blockchain and smart contracts. The platform allows renewable energy producers to issue certificates for their future production of energy, one of which will generate 1 kWh at some point in the future (usually within 4-6 months of the connection to the platform) Green energy, and pre-selling energy at prices below market prices, raises money, while energy buyers and investors can cut costs to buy energy. Helps reduce financing costs and increase project efficiency.

4NEW is the world's first environmentally friendly digital currency mine energy public chain that uses waste to generate electricity and use electricity for mining. The blockchain platform is built on top of the infrastructure, covering the entire supply chain: from waste collection to power generation and mining, and surplus energy units can be sold to the national grid. The project party raises funds for the construction of the factory through the sale of the certificate, currently. 4New's power plants are located in Middlesbrough and Hartlepool, England, and are fully operational.

3.2.2 Grid data collection

Each household has a meter that records the electricity consumption and contributions of a household and can be used as a reference for credit. Incorporating enterprise power consumption into the credit information system is conducive to enriching the credit information of enterprises, understanding the credit financing situation of enterprises in advance, and helping to gradually improve the use of electricity and payment of electricity by customers, and provide guarantee for the preservation and appreciation of state-owned assets. In addition, timely sharing of the company's electricity payment information through the credit information system can also help financial institutions to fully grasp the business operation and credit repayment ability, reduce the cost of reviewing loans, and improve the ability to prevent risks.

For individuals and families, their application in power crediting still stays on the punishment of dishonesty, that is, when the family steals electricity, defaults on electricity, or maliciously defaults on electricity charges, the power supply company will report the loss record. To the credit information service platform system, as a punishment. But for those who use electricity in good faith, electricity data is not very useful in terms of credit.

The blockchain energy project Bitluments provides renewable energy power and microfinance services to low-income users in Latin America through IoT and blockchain technologies. The platform hopes to connect microfinance to users without grid connections, and to facilitate users who are often unable to enjoy microfinance and assisted finance. These devices can form a microgrid where the infrastructure is inadequate. The solar kit is connected to smart meters and user phones, and each user will have their own ID and credit history. The software collects the data and sends it to the blockchain, giving users complete control over their data. One can decide to provide this data to banks for microfinance and other financial services. When the user defaults on monthly instalments, the power supply can be locked, which provides the necessary guarantee for the issuance of microfinance.

3.3 Carbon trading and green certificate

3.3.1 Carbon trading

Carbon trading is a market mechanism used to promote global greenhouse gas emissions reductions and reduce global carbon dioxide emissions. On May 9, 1992, the UN Intergovernmental Panel on Climate Change adopted the UN Framework Convention on Climate Change through difficult negotiations, and in December 1997 passed its additional agreement, the Kyoto Protocol, to treat carbon dioxide emissions as a commodity. Under the premise of reasonable environmental capacity, international regulations on greenhouse gas emissions including carbon dioxide should be restricted. The agreement countries promise to achieve certain carbon emission reduction targets within a certain period of time, and countries will allocate their own emission reduction targets to Different domestic companies. As a result, carbon emission rights and emission reduction quotas began to scarce, and the emissions trading market was formed. They became a valuable product called carbon assets.

Each of the technical and policy approaches to carbon emissions relies on methods for accurately measuring and recording carbon content in global markets. However, these methods have limited transparency, inconsistent standards, inconsistent regulatory regimes, and serious trust issues.

In the carbon market, the most important thing is the carbon emission data of various controlled enterprises, the quantity and price of quotas and certified voluntary emission reductions (CCERs), and the authenticity and transparency of the data. The central server cannot do data security. To absolute protection, the opacity of information also prevents many organizations and individuals from actually participating. These problems can be solved by blockchain technology. With this technology, every ton of carbon and every transaction information can be traced to avoid tampering and information asymmetry.

At the same time, the traditional carbon asset development process takes a long time, involving control companies, government regulatory agencies, carbon asset exchanges, third-party verification and certification bodies, etc., with an average development time of more than one year. Moreover, each participating node will have a large number of file transfers, which are prone to errors and affect the accuracy of the final structure. The blockchain can solve this problem. Through the multi-node network, records can be shared, which not only improves timeliness but also ensures accuracy.

In addition, if the carbon asset development method is compiled into a smart contract, the carbon asset quota of each controlled enterprise can be automatically calculated, and the whole process becomes transparent and accurate, which not only reduces the carbon asset development time, but also reduces the carbon assets. Production and management costs.

In response to this, blockchain projects targeting carbon trading have emerged on the market. E.g:

1. US blockchain startup Nori is exploring ways to optimize the carbon emissions market and use blockchain as a proven method of capturing carbon dioxide to facilitate transactions between suppliers and buyers.

In May 2002, IBM announced a partnership with Veridium Labs to enable carbon credits to be creditized, enabling companies to track their carbon footprint through blockchain technology. Veridium converts carbon credits into a new, alternative digital asset, CRB, that can be exchanged and traded on the Stellar public network, eliminating friction and opacity in the carbon credit supply chain.

3. Zero Carbon is also a blockchain project that supports the consumption and trading of carbon credits and other natural capital assets. A Carbon Pass (NRG) represents a carbon-protected credit from a diverse basket of internationally certified carbon-protected credit lines. Environmental assets are not “outdated” or irreplaceable risks. Investors can reduce risk and optimize investment as a long-term hedge. Because these hedges are backed by related assets, Carbon Pass is a current asset that can be placed on the corporate balance sheet and borrowed.

3.3.2 Green certificate issued

From the history of international green card development, the green card trading system is usually a supporting policy for the renewable energy quota system to ensure that the green card can be purchased by market participants with renewable energy consumption indicators. The core of the system is that the government or the regulatory authorities can enforce regulations that require the power supply company to have a certain minimum quota or a fixed percentage of the electricity sold before a certain time must come from renewable energy.

Under this system, renewable energy power is sold at market prices just like conventional electricity, and the cost of producing renewable energy is higher than that of traditional fossil energy. Offset. In order to meet regulatory requirements, power companies can use their own renewable energy to generate electricity and hold relevant credits or certificates, or by purchasing renewable energy sources with quotas or certificates from other companies, or to purchase renewable energy separately. Amount or certificate.

Just like the carbon certification, the green certificate is facing the same pain point at this stage. Most of the current green certificates are based on the valuation of power generation, and then issued to the energy companies through the issuing authority of the issuing authority. The actual electricity generated is not necessarily equal to the electricity calculated by the green card. Moreover, most of the existing green certificates and carbon certificates are issued by authoritative organizations. The process is long, and there are more relevant interest groups involved in the process. The corresponding costs are also increased, and most of them are paper-based. Conducive to the market trading of the green card.

In order to simplify the green card accounting process and reduce the power error, IDEOCoLab, Nazdaq and Internet of Things equipment company Filament have jointly developed a system based on blockchain that can automatically create a renewable energy certificate (REC). For example, photovoltaic power generation, by collecting sensors on the photovoltaic panel to collect the electricity data produced and stored, it can accurately calculate the amount of energy produced by it and transmit the data to the system in time. The system then automatically issues the corresponding green certificate to these. Energy producers have made it easier for them to get economic incentives. The system labels each 1kW·h of clean power, and the node will also receive a green certificate when purchasing clean power. The certificate indicates the source of the specific power purchased, which is convenient for traceability.

3.4 electric car

According to the latest report of the 2018 Global Electric Vehicles, published by the International Energy Agency (IEA), the total number of electric vehicles on the global roads (including pure electric vehicles and plug-in hybrid vehicles) exceeded 300 in 2017. Ten thousand vehicles. In the future, the continued growth of electric vehicles will depend to a large extent on cost reduction, improved car performance, faster charging speeds, and availability, speed, ease of use and cost of the charging infrastructure.

In the P2P electric vehicle charging market, traditional transaction establishment relies on centralized organizations, and there is a risk of information leakage and single point of failure. At present, the pain points of the charging end of electric vehicles are: the number of charging facilities is small, the charging protocol and the metering mode are diverse, the charging and discharging interaction is poor, the charging process is opaque, and the charging protocol is not flexible. There are currently about 1.68 million private charging devices worldwide, but most chargers are idle for most of the day. If the user of an electric car can use the charging facility in the charging station in any place, then the widespread acceptance of the electric car will certainly become a reality.

Blockchain technology can be used to build a simple blockchain-based billing model that subsidizes incentives for providers of private charging devices so that they can be shared with the public. The electricity owner can set the charging price itself. Blockchain to handle all billing, payment, and authentication issues. Electric car drivers can park their car at any charging station at will, the electric car will automatically connect to the charging station, and then automatically charge, the charging station will automatically charge them the electricity fee on the blockchain. In addition, blockchain data can help utilities and operators manage power quality and system sufficiency issues associated with EV growth, and interact with smart meters to enhance their management and charger speed, location and usage. The role of data and so on.

At present, many blockchain project roadmaps targeting distributed transactions have made electric vehicle charging an important part of later development. E.g:

1.JuiceNet is a P2P charging network based on blockchain technology. This blockchain platform combines the two characteristics of sharing and charging, allowing the charging pile owner to share with other users and charging the application area when other electric car drivers use it. After the blockchain, not only can the shared charging pile be realized, but also the built-in charging pile can be promoted.

2. Innogy and IBM are developing a blockchain platform that automates and integrates a range of mobile services, including electric vehicle charging, billing, parking fees, highway tolls, and car sharing services.

3. Power Ledger is a P2P microgrid energy trading platform and attempts to build an application ecosystem for power trading. On this platform, electric vehicle projects can realize new energy vehicles and charging piles through digital identity setting and blockchain technology. , secure transactions between robots and other chargers.

4. Distribution of data in blockchain projects in the power and energy industry

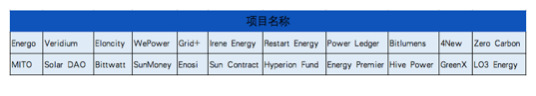

OK collected a large number of white papers on energy blockchain projects and compiled the progress of the most complete and accurate energy blockchain project to date. Twenty-two energy blockchain projects were selected to analyze their data distribution, and six core points were summarized to provide readers with a quick and accurate understanding of the current status and future of the entire energy blockchain project.

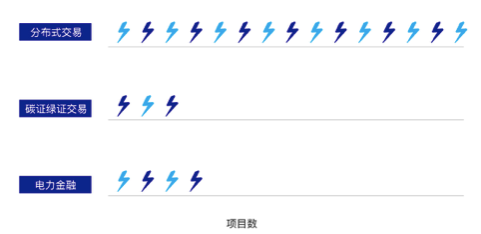

4.1 Project category distribution

The decentralization of the blockchain precisely matches the characteristics of distributed energy, which can greatly reduce the transaction cost of distributed power and improve transaction efficiency. Therefore, distributed power trading is the main application scenario of blockchain in the energy industry. There are 15 such projects in the project. There are three projects that target carbon trading or green card trading, namely Veridium, Zero Carbon, MITO, and four projects are located in power finance, namely WePower, 4New, Hyperion Fund and GreenX.

4.2 Project area distribution

Twenty of the 22 projects can be found in the official website, and most of their distribution areas are in regions and countries where the market price has been realized in Europe and the United States.

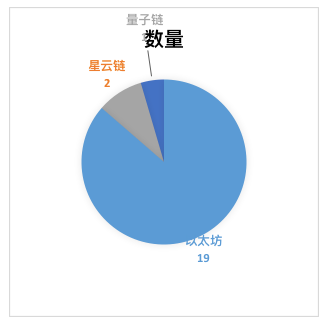

4.3 Project Development Platform

Most of these 22 projects are based on the Ethereum platform, which is ERP20 compliant. Supporting this standard ensures compatibility of tokens with third-party services and is easy to integrate. 19 of these 22 projects are based on Ethereum development. Veridium and Irene Energy are based on a nebula chain and Energo is based on a quantum chain.

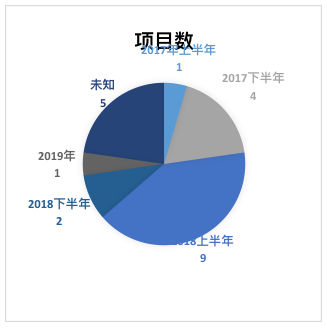

4.4 Project fundraising time distribution

It can be seen from the distribution of project fundraising time that there are five power blockchain projects in 2017. With the 1CO heat, there are 9 in the first half of the year, and there are 2 in the second half, and only one in 19 years. This is consistent with the overall fundraising performance of the blockchain project.

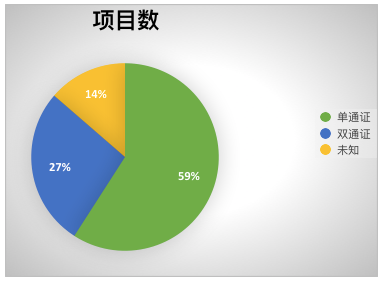

4.5 pass system

Among the 22 blockchain projects with energy peer-to-peer trading as the core application scenario, 13 projects use the single pass system, 6 projects use the dual pass system, and 3 project passes constitute unknown. Single pass certificates accounted for the majority, and the number of double pass certificates accounted for 27%, which is higher than that of other industries. The core logic behind the dual-pass system of these projects is similar, one of which is used as a redemption power, and the other is used as a stable currency within the ecology.

5. Challenges and prospects

The emergence of a new energy industry chain requires new technologies to be realized, and new systems and business models are needed to support them. However, at present, these are still unable to keep up with technological changes. Blockchain as a solution empowers power, innovation and challenges.

5.1 Challenges for Power Energy Blockchain Projects

(1) Profit model

The introduction of blockchain technology into the power industry is fundamentally profitable in the future. Therefore, after decentralization, after peer-to-peer self-organization, what profit the company relies on becomes the primary issue at the moment. At present, most of the blockchain projects in the world rely on issuing certificates and financing through the value-added of the certificate, but the certificate is not compatible with the monetary management policies and financial management policies of most countries, especially in China. The clearing exchange has been explicitly banned, as well as various business models based on the circulation of certificates. If companies wish to profit from the decentralization of electricity sales through the blockchain, they must also consider legal and specific profit plans.

(2) Project landing

The energy industry, especially renewable energy, smart grid and other new business scenarios, the need for distributed transactions, power certification, security and reliability, and the characteristics of blockchain and smart contracts. However, it should also be considered that the landing of the power and energy blockchain project requires a high degree of coordination among the industry and may be hindered by traditional interests. Due to unclear policies and difficult landing of policies, distributed energy power projects have encountered challenges in terms of spare capacity, power access methods, and government fund reductions and exemptions. Limited by infrastructure and national power policies, in the short term, energy and power blockchain projects may only be implemented in small areas in developed regions, and it will take a long time to reach the public.

(3) Centralized competition

At present, a strong characteristic of electric energy is scale effect. The larger the scale and the lower the cost, so it is a natural scale economy and requires low cost. Therefore, from the perspective of consumers, there is no particularly large demand for decentralization of energy. Unlike data transactions and financial transactions, electricity must meet the physical constraints of power networks, while blockchain sales emphasize decentralization in the design of mechanisms, emphasizing self-coordination and self-combination among users, but distributed power generation. There are problems such as large peaks and valleys, large uncertainty, user homogeneity, irrational trading, and excessive market power. Therefore, it is very easy to cause the problem of point-to-point power trading on the blockchain to surge or decrease. Moreover, if there is no exquisitely designed power price schedule mechanism as a support, it is easy to cause systemic risks in the system.

(4) Professional service restrictions

The decentralization of blockchain technology can only solve the decentralization of transactions, the decentralization of trust, and the supporting services of electricity still need to be provided by professional service agencies. A large part of the special nature of electricity relative to other commodities lies in its professionalism. In addition to providing supply and demand intermediary services, the power sales companies also provide power quality management and power security services to users, and even many power sales companies. Providing equipment operation and maintenance services, as well as professional energy-saving emission reduction and efficiency optimization programs, these professional services are temporarily unable to decentralize through the blockchain.

5.2 Prospects for Power Energy Blockchain Project

(1) The power generation end gradually develops into distributed

The energy Internet is now being promoted, and the background of the energy Internet is that the future of the energy industry will undergo tremendous changes in the areas of development, transmission, use, storage and financial transactions. With the demand for energy and the transformation of energy production patterns, the direction of energy production is likely to gradually shift from a centralized production model to a distributed production model. It is foreseeable that in the future, it will transition from a single centralized large-scale power supply to a mode in which centralized power and distributed power supply are in harmony. The power generation will gradually evolve from distributed to distributed, and the topology of the power grid will change with the distribution of the power generation end.

(2) Consumers will become the value chain of industry chain

Energy consumption will be the most important sector in the energy Internet. Consumers will not only be pure consumers in the energy Internet era, but will emerge in another new form, both producers and consumers. With the popularity of distributed power grids, consumers will have greater autonomy in purchasing energy services, and will prefer energy services with high flexibility and economy. User energy custody and energy efficiency custody may become new profit models. . Consumers can actively participate in the community demand side response project through the demand side response plan. They can also join the virtual power plant project as a virtual power plant member. At the same time, they can also resell electricity to the power grid through electric vehicles and energy storage facilities. Consumers will become more and more valuable in the industry chain and become the value chain of the industry chain.

(3) Combine artificial intelligence, Internet of Things and other technologies to jointly develop electricity

Applying emerging technologies to the power industry is the future development trend, and blockchain technology can work synergistically with technologies such as artificial intelligence and Internet of Things. With the development of the Internet of Things, hundreds of millions of assets and data information need to be recorded and traded online.

Energy and power companies can obtain customer energy usage data in real time through the Internet of Things. Based on this, big data and cloud computing are used to analyze and predict customer energy demand, and provide energy efficiency management services for customers. Automatically reading smart meters through decentralized, autonomous, and efficient systems, automatically reading smart meters, and combining artificial intelligence to predict energy demand can make future energy consumption smarter. Through real-time connection and real-time interaction with customers through intelligent hardware, we can explore the needs of customers in a variety of work and life scenarios, and grasp the business opportunities of consumption upgrade.

references:

1. Blockchain in the energy field

2. Analysis of the development status of China's power industry in 2017

3.Power Ledger, WePower, Veridium, eloncity white papers

4. Judging the application of blockchain in the energy industry

5. Overview of the development of foreign power market

6. "Overview of Power Markets in Countries Around the World" Alberta, Canada

7. "Overview of Power Markets in Countries Around the World"

8. "The world's electricity prices encyclopedia"

9. How will the fourth industrial revolution affect the power and energy industry?

10.The New Era of Green Energy Begins Now

11. "2018 Global Power Report"

Risk Warning: All articles in OKEx Research do not constitute investment recommendations. Investment is risky. Investment should consider individual risk tolerance. It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

Written by: Zhang Xiuxiu, Senior Investment Analyst, OKEx

Welcome to reprint, please indicate the article from OKEx

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Encrypted currency and class crossing (3): After the layout is over, where do you expect the bull market?

- CoinEx Chain's wild vision is born for financial freedom and is reserved for the DEX ecosystem.

- Getting started with blockchain | How is the blockchain anti-counterfeiting traceability application implemented?

- Facebook Interview: Facebook has gradually lost credibility in recent years, will Libra succeed?

- The bull market is coming, do you want to wait and see if you want to buy a mining machine?

- The market value of GUSD has shrunk by more than 80%, and the market circulation accounted for less than 0.1%.

- BlueChain, the winner of the original development contest, brings sustainable development to a new era with blockchain