Market Weekly | The market is in a consolidation period, and the exchange has picked up

Weekly summary

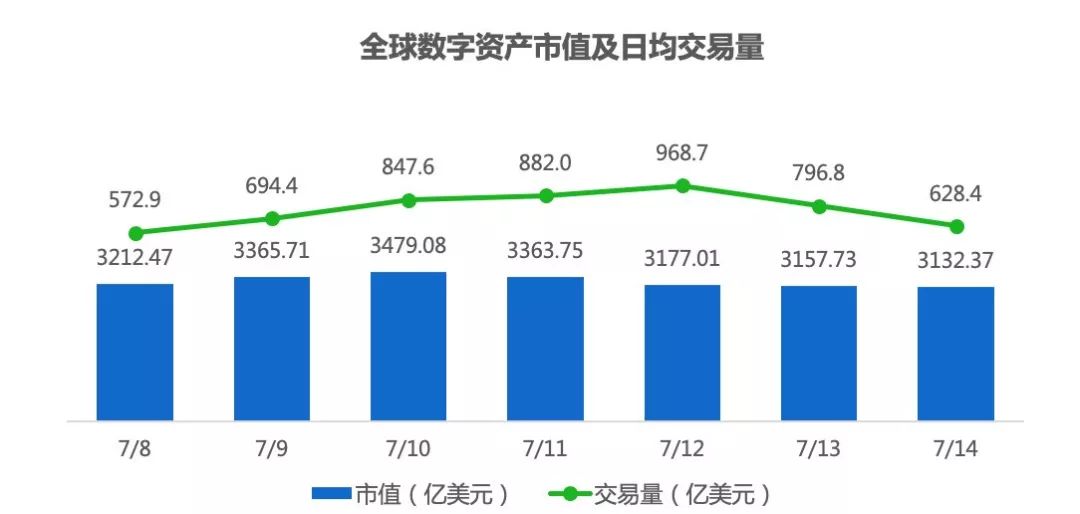

- Last week, the average daily market value of global digital currency assets was 326.973 billion US dollars, up 2.01%, and the average daily trading volume was 77.10 billion US dollars, down 1.93%.

- Last week's market value TOP200 assets fell 13.86% overall, all four areas fell.

- There are 18 new listings this week.

- A total of five projects were closed last week, and the total soft top of the project exceeded $200 million.

- The six blockchain projects received equity financing with a financing amount of more than $48.5 million.

- Xu Kun, Vice President of OK Strategy: The repurchase behavior of the secondary market is a way for enterprises to self-certify the truth of profit

Market overview

Last week, the average daily market value of global digital currency assets was 326.973 billion US dollars, up 2.01%, and the average daily trading volume was 77.10 billion US dollars, down 1.93%.

- People's Network: Libra drives the currency circle "incitement", you need to guard against the concept of stealing

- Hash pie: BTC 10,000 knife mark rebounded again, but the middle of the top may be shaped

- Is the draft bill issued by the US aimed at Facebook's Libra program?

Market value TOP5 (BTC, ETH, XRP, LTC and BCH), the average daily market value increased by 2.58% compared with the previous week; the average daily trading volume decreased by 0.43% from the previous week. From day to day, BCH's biggest drop was the highest, reaching 34.35%.

TOP200 market analysis

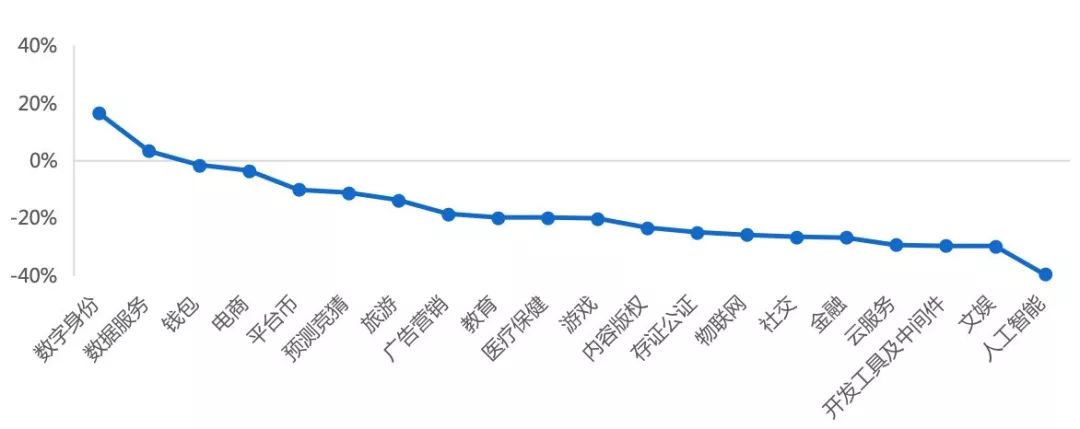

Last week, the market value of TOP200 assets fell by 13.86%, and all four major sectors fell. Among them, the industry's public chain fell the most, reaching 26.1%.

In the industry's public chain and application, according to the industry's further subdivision, except for the digital identity and data services sector, all areas fell, with the artificial intelligence sector having the largest decline, reaching -39.47% .

Judging from the increase in the currency, the net market value of TOP200 last week, the net rose by 110.80% from the previous week.

New listing assets analysis

30 trading platforms including OKEx, Binance, HuobiGlobal, Bitfinex, Bitmumb, ZB.com, Upbit, HitBTC, Bittrex, and Poloniex, with 18 new listings.

Primary market financing

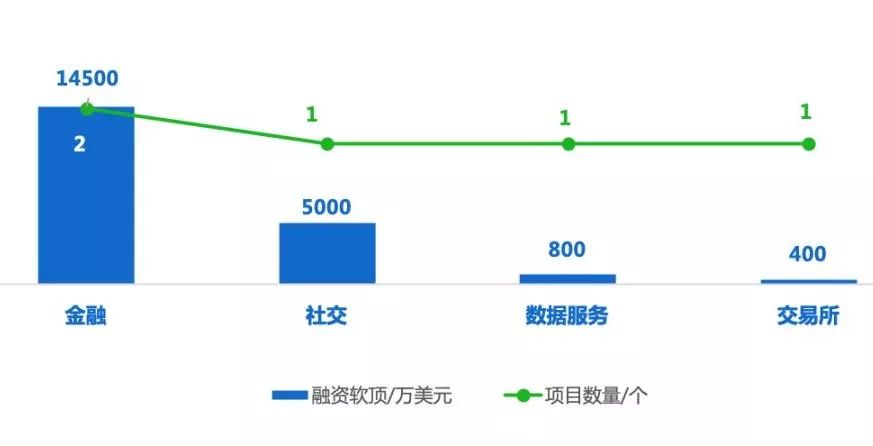

A total of five projects were closed last week, and the total soft top of the project exceeded $200 million. Among them, the total soft top of the financial sector projects reached a maximum of 140 million US dollars.

Last week, there were 6 blockchain projects that completed the completion of equity financing, and the financing amount exceeded US$48.5 million.

Last week, there were 6 blockchain projects that completed the completion of equity financing, and the financing amount exceeded US$48.5 million.

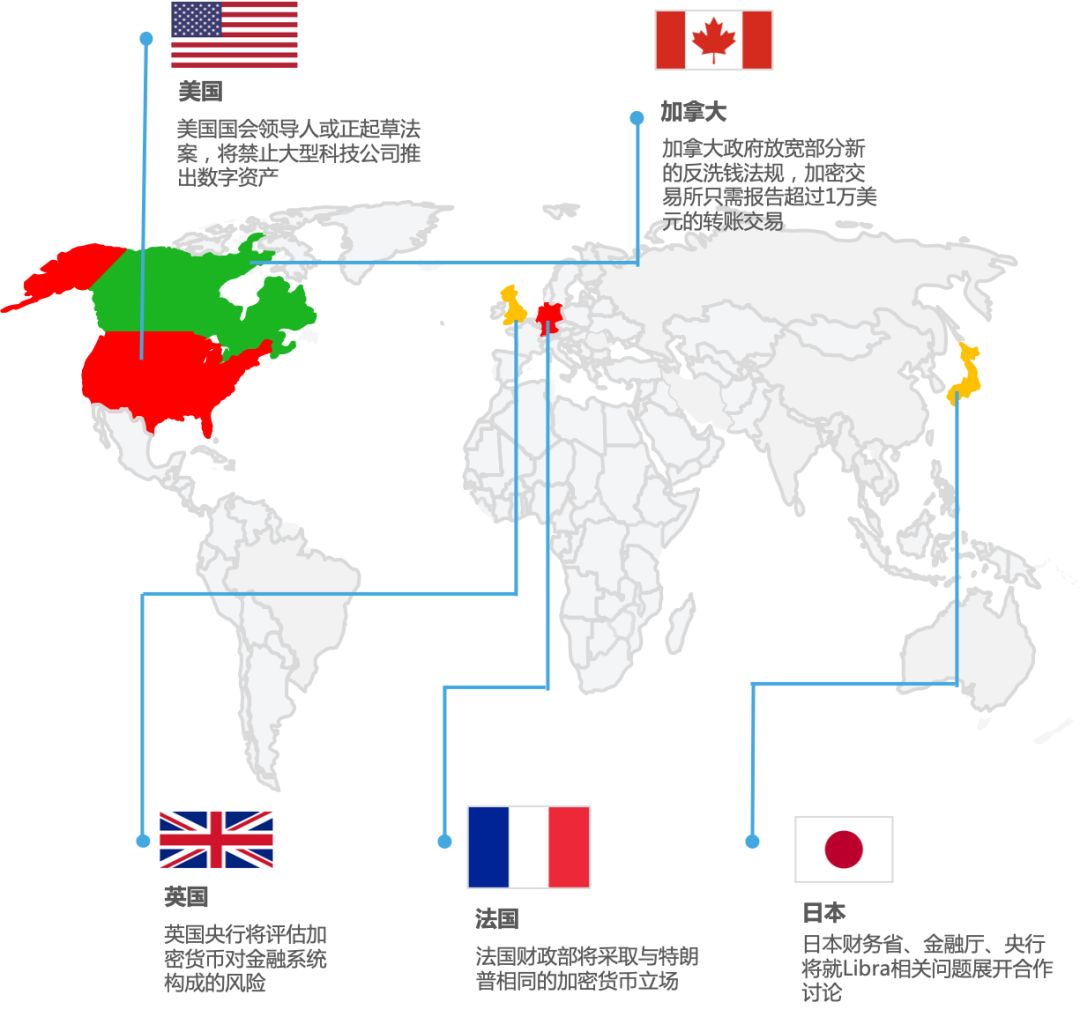

List of regulatory policies

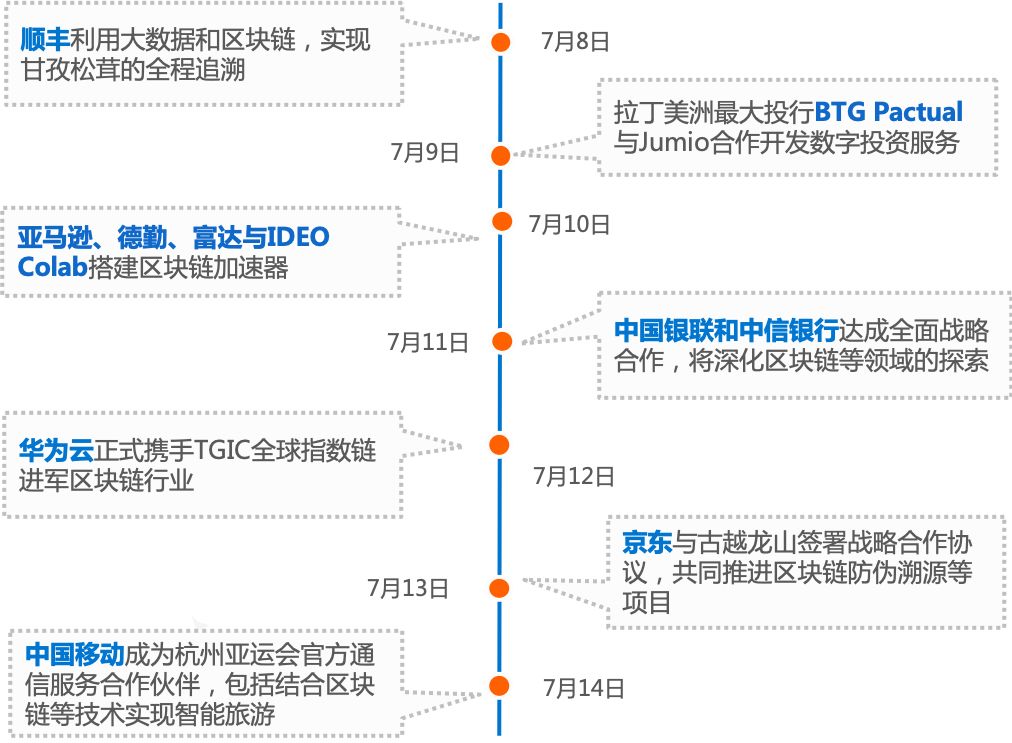

Giant layout

Big coffee said

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The US will open the USDT, will Chinese investors become the biggest "taker"?

- Research: Lightning network disposal as a bad node, has been confiscated 2.22 BTC

- After Vitalik proposed the blockchain “marriage plan”, what do people in the industry think?

- What can Ethereum learn from Libra?

- The US Treasury Secretary said that Libra’s timing was “uncomfortable” and the encryption community saw a positive side.

- Bitcoin's soaring population: the mining giant ushered in the spring exchange to die in the cold winter

- What will be the martyrdom of David Marcus at the upcoming two Libra hearings?