South Korea launches the Bank of Korea digital currency pilot program, launched in 2021

The Bank of Korea announced on April 6 that it will conduct a pilot test of the Bank of Korea ’s digital currency in 2021.

Bank of Korea Digital Currency Plan

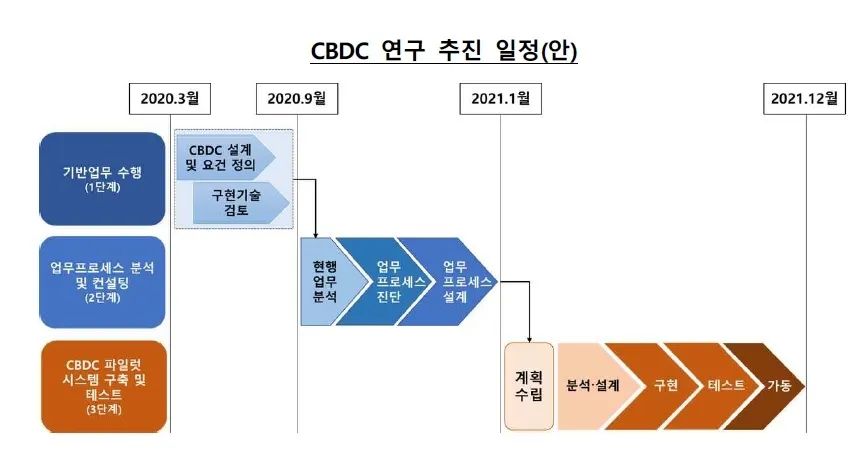

The purpose of this pilot test of CBDC is to create a virtual environment and check the operation process of the central bank's digital currency. According to the plan of the Bank of Korea, the test will first be prepared for the design, technical review, business process analysis and consultation of the central bank's digital currency CBDC at the end of December 2020. If the technical preparation is sufficient, it will be carried out from January to December next year Small-scale pilot test.

The Bank of Korea said: "There is no need to issue central bank digital currency in the near future, but if internal and external conditions change, you must respond quickly."

- The Baite mining pool under the universal computing power was withdrawn, and the computing power was ranked in the top ten

- Zou Chuanwei: The logic and mechanism of the blockchain applied in the post-processing of financial transactions

- Analyst: From the perspective of the development mode of the Bitcoin mining ecosystem, the market has bottomed out in March

South Korea has always been a popular global cryptocurrency investment and trading market. In 2019, the South Korean National Assembly passed a resolution to formally define cryptocurrencies as digital assets, requiring strict financial supervision of all cryptocurrency exchanges.

For example, cryptocurrency exchanges must register with the Korea Financial Services Commission (FSC), provide periodic reports, and strictly comply with KYC and anti-money laundering regulations.

South Korea's digital currency market and blockchain market are developing very rapidly. For example, Samsung Group has enabled Samsung Pay, a digital asset function, to keep pace with leading mobile-based payment services. KakaoPay goes one step further, launching an ICO in 2018 and generating KLAY digital tokens for in-app payments. It can support older digital payment assets such as Litecoin and Dogecoin. But the use of digital assets is still limited, even in the market segment activity of KakaoPay distributed applications.

By 2019, with the release of the Libra white paper, central bank digital currencies in various countries are also accelerating. Bank of Korea has released research results on central bank digital currency CBDC, simulating the impact of central bank digital currency on commercial bank liquidity. The Bank of Korea said that this new currency model may reduce bank deposits and reserves, plunge the latter into a cash shortage and affect financial stability.

But this is limited to research. The Korean government has always been cautious about issuing CBDC digital currency CBDC. Some South Korean officials have said that South Korea already has a perfect electronic payment system, and there is no urgent need to establish CBDC. In fact, Korea ’s demand for digital asset payments is realized by private companies.

Therefore, the Central Bank of Korea, Bank of Korea (BOK), said that it has a wait-and-see attitude towards the central bank's digital currency and has no plans to issue it. However, the Bank of Korea will pay close attention to the issuance of digital currencies of the central banks of other countries and actively participate in international discussions in related fields. According to "AsiaNews", the bank recently established a dedicated research department. Through this move, the Bank of Korea joined the global central bank's team of investing resources in the potential development of blockchain assets.

This shows that the Bank of Korea has been paying close attention to the research on the issuance of central bank digital currency. Until today, South Korea ’s central bank ’s digital currency plan has surfaced, saying it will conduct a pilot test of CBDC next year.

Digital currency plans and processes in other countries

In major overseas countries, the central bank is also issuing pre-issued digital currency.

The Swedish Central Bank announced that it will cooperate with Accenture, an Irish professional services company, to create a pilot platform for the digital currency of eKrona to enhance its understanding of the potential of digital currency. The bank said: "The pilot project of the electronic krona is mainly to strengthen the bank's understanding of the possibility of krona's digital currency technology."

As of February 19, 2020, the Swedish Central Bank has put this announcement into practice. The Swedish National Bank said the day before that Sweden has begun testing electronic kronor, which indicates that Sweden is about to create and use the world's first central bank digital currency, the Swedish kronor.

In fact, as early as 2019, central banks around the world, such as the United Kingdom, the European Union, China, France, Japan, and other countries began to pay close attention to central bank digital currencies. The People ’s Bank of China is faster. From September to December last year, The bank then spoke closely about the central bank's digital currency DCEP, and announced that it will start small-scale tests in 2020 in Shenzhen, Suzhou, and other places in China.

Other countries are no exception. Christine Lagarde, the new European Central Bank President and former Chairman and Managing Director of the International Monetary Fund, said publicly in early December that one of her tasks during her tenure will be focused For the development of Euro stablecoins.

The central bank's digital currency CBDC is still a traditional currency, only in digital form, issued and managed by a country's central bank. In contrast, cryptocurrencies such as Bitcoin are generated by solving complex mathematical problems and are managed by a decentralized online community rather than a central agency, and cannot be mainstream recognized.

Therefore, the issuance of a digital currency developed and issued by the central bank is currently a problem faced by all central banks. The issuance of this new central bank digital currency can not only improve the country's means of coping with the digital crisis, but also further accelerate the process of digitizing the national currency.

The South Korean pilot will help people understand the central bank's digital currency and accelerate the landing of central bank digital currencies in various countries.

If you need to reprint, please indicate the original article URL (52cbdc.com)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The 10 most noteworthy DeFi projects in 2020

- Opinion: Bitcoin halving is actually a reward for efficient miners

- Market analysis | The market is suspected of stabilizing, can it break through the $ 7,000 mark?

- Ripple co-founder confirmed to be infected with new coronary pneumonia and is now fully recovered

- Ethereum 2.0 is not yet online, and fraudsters began to defraud users' funds

- How does Ruixing's employees commit fraud of 2.2 billion, and how to use technology to prevent financial fraud?

- The Fed's current rate cut is fundamentally different from the 2008 financial crisis, or may trigger a new round of global central bank interest rate cuts