Behind Alipay and WeChat Joint "Sniper" Coin: Competition in cryptocurrency stocks

Text | Mutual Chain Pulse · Liang Shan Hua Rong

Zhao Changpeng and He Yi did not expect that the road to returning to China was not as simple as imagined.

On the afternoon of October 9, Chanan announced that it will launch its P2P transaction service in China. Chan Changpeng CEO Zhao Changpeng subsequently confirmed on Twitter that it will add WeChat and Alipay payment channels. Just in the entire currency circle, when the currency security has found a legal way to open up the domestic OTC business, on the evening of the 10th, Alipay and WeChat issued a statement saying that it is forbidden to use its payment instruments for virtual currency transactions.

Although he was repeatedly "lifting the bar" on Sina Weibo, he still couldn't hide it. This is just a gimmick to promote the domestic market.

- "Gypsy" hoards bitcoin, holding more than 1,000 bitcoin addresses and growing at a record high

- [2019 CCF Blockchain Technology Conference] Topic: Focus on the frontier of blockchain technology, explore the application of industry

- Quote analysis: insufficient rebound power, the market has entered a downward trend

(Coin An Heyi "lifting bar" Alipay)

The United States is blocked

The so-called OTC business refers to OTC transactions, where both parties can directly trade encrypted assets. The transaction can be cryptocurrency versus cryptocurrency (such as Bitcoin and Ethereum), or French currency versus cryptocurrency (such as transactions between RMB and Bitcoin). ). Due to the low liquidity in orders on cryptocurrency exchanges, OTC is helping to drive block trade orders to find market liquidity.

In the Chinese market, both the head exchanges such as Firecoin and OKex, and the second and third-tier exchanges such as ZB, Gate.io, LBank, BiKi and Matcha have already opened OTC services. For digital currency exchanges, the OTC business has become standard.

Into the domestic OTC market, the currency security can grab more stock user market.

After September 4, 2017, the main business of the currency security business has been “going out to sea” for two years, but in September this year, the currency security has raised more emphasis on the Chinese market on many occasions.

Some analysts believe that with the continuous expansion of the domestic market share of the exchanges such as Firecoin and OKex, the currency security has always been unwilling.

Coupled with the strong regulatory policy in the United States since June this year, the currency has once "exited" the US market. Although on September 24, the company re-launched Binance.US, a new platform for US users, it can only trade 14 cryptocurrencies. Previously, 24.8% of the monthly traffic of the currency was from US customers. It can be said that the largest user market of the currency is in the United States.

It is difficult for the US market to “stagnate” to allow the currency to recover quickly in the short term, because Binance.US faces a series of problems such as the inability to trade all cryptocurrencies and the inability to conduct margin trading, which means that the currency has to face incremental User growth is under pressure from bottlenecks.

But the Chinese market is precisely a huge growth potential.

(Zhao Changpeng responds to the user currency security OTC to support Alipay channel)

China's incremental user growth point

For head exchanges, monopolistic market flows are key to their continued operation, whether bullish or bearish.

In the US market, the “blocked” currency security, relying on the limited-contained Binance.US trading platform, is difficult to fill the traffic and users lost in the original US market in the short term.

So where is the new user incremental market? China is undoubtedly a great option.

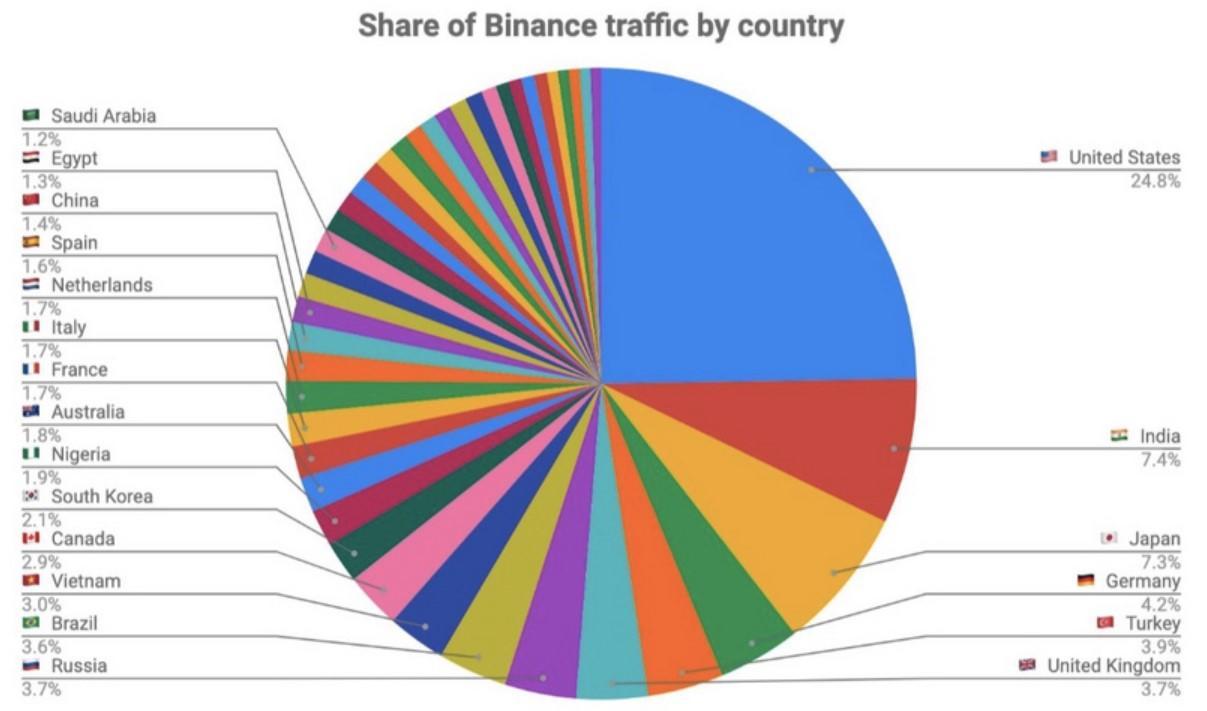

According to the block data, the largest share of the currency exchange country is the United States. In the first six months of this year, there were nearly 185 million visitors to the website, at least 30 million from the United States. 24.8% of the traffic came from US customers, but the traffic from China was only 1.4%, even less than 7.4% in India, 7.3% in Japan and 3.7% in the UK.

(The source of the currency exchange exchange source: the block)

In China's cryptocurrency market, users and traffic have long been monopolized by the two head exchanges of Firecoin and OKex. The “going out” of the currency security has caused it to lose a large market share.

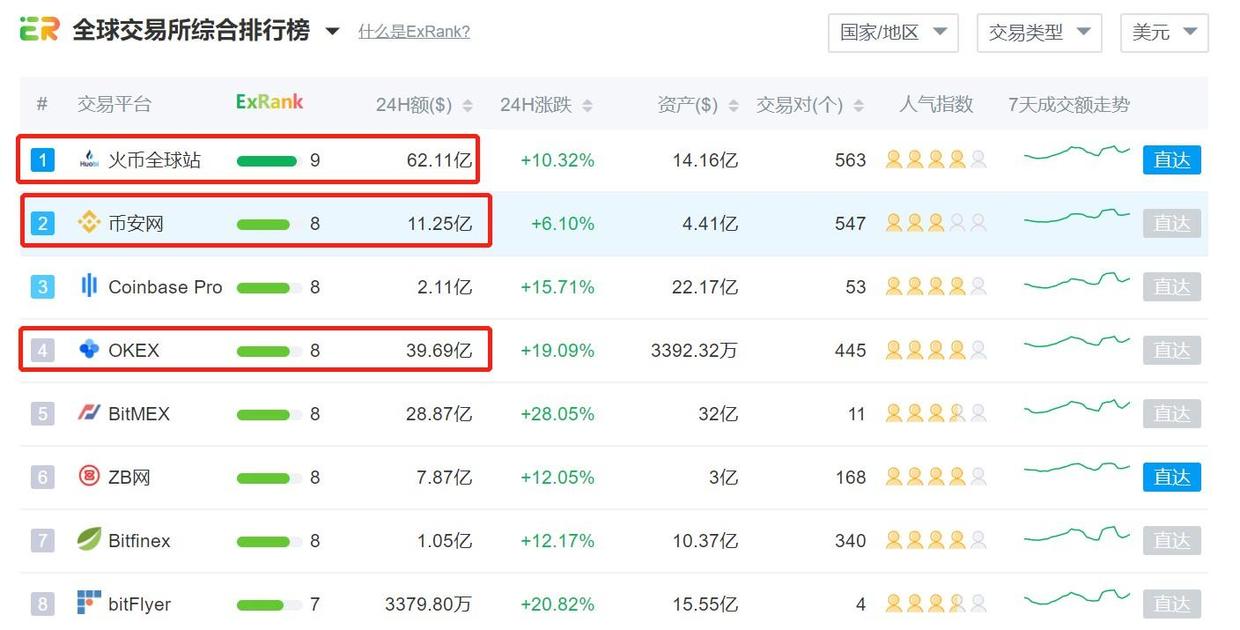

According to non-small statistics, as of October 12, the 24-hour trading volume of Firecoin and OKex was US$6.211 billion and US$3.969 billion, while the currency security was only US$1.125 billion.

(Source: non-small)

A large part of the trading volume of Firecoin and OKex comes from domestic users. For the currency, the potential of the Chinese market is very tempting.

On the other hand, this year, the rise of a number of emerging exchanges, including Biki and Matcha, has forced Coin to re-examine the opportunities in the Chinese market.

"There are many uncertainties in the past in China, and the policies are conservative…but we have noticed that our peers are very high-profile in China. From sales, marketing activities and offline activities, we feel that the domestic environment has relatively released some goodwill. More positive." Coin founder He Yi recently said in an interview with a blockchain media that we are also self-reflecting for this, and that the currency security is not radical enough when doing market strategy.

“In China, they (exchangers in the exchange) may have their own big account managers in every major province or city, and they can always meet the needs of their customers. There may be dozens or even hundreds of sales in China. He said that this is very radical, but it is also very effective.

China's strategic layout of the currency

The start of the return of the currency to the Chinese market was in September, and it was attacked on all sides.

On the "absent" long-term futures contract business, the currency announced on September 2 the acquisition of the cryptocurrency derivatives trading platform JEX, and on the evening of September 24 due to intentional contract pin, has been connected with OKex.

In the OTC business of OTC, Qian’an officially disclosed that the currency security OTC business will be officially launched in October and the recharge channel of C2C business will be launched at the “Three Body Coin Security” media meeting on September 17. Previously, the currency has not had a legal currency channel in China, and this has solved the problem of domestic users' capital in and out.

In addition to its own business level layout, Coin Safety also strategically invested in the domestic blockchain media Mars Finance in September to open up the public voice channel of the domestic market.

“There is a big shortcoming in the currency, which is in a state of relatively aphasia in China, which makes the difference between the currency and the real currency in the impression of the public. In addition, in terms of public opinion, there are fewer coin security personnel. I hope to take the time to fight against the critics." He recently said in an interview with Mars Finance that there are many misreadings on the currency in the market. This misunderstanding is related to the aphasia of the media environment in China.

From the futures contract, to the opening of OTC, C2C business, to the investment blockchain media, the strategic layout of China's currency seems to be blooming in all directions, but flowering may not be “results”. At present, the situation of China's cryptocurrency trading market and the establishment of the currency security have become a world of difference. Whether the currency security can recapture the Chinese market is still full of uncertainty. After all, as the OTC business to open the domestic market capital, the OTC business has just been announced. Already encountered the "union strangle" of Alipay and WeChat.

In fact, due to the rapid exchange of funds and short return on investment, more and more funds have poured into cryptocurrency exchanges this year. On the other hand, the current growth of cryptocurrency trading users has been weak, resulting in exchanges. The competition between the stock market and the user market has become increasingly fierce. Since the second half of this year, there have been many incidents in the small exchanges in China.

At present, Firecoin, OKex, Matcha, ZB, Biki, etc. are killing the murderers in the domestic market. The strength of the currency is “returning”, and it is bound to set off another storm. The reshuffle of the Chinese cryptocurrency exchange is already on the line.

This article is [inter-chain pulse] original, the original link: https://www.blockob.com/posts/info/25429 , please indicate the source!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- A week of review | Libra received 5 "good guys card", and Telegram wants to receive a certificate

- Joe Lubin's full presentation from Devcon 5: How do we implement a decentralized world wide web?

- Litecoin Foundation "funds exhausted", Li Qiwei: Most of the losses are attributed to the collapse of LTC and BTC prices

- Mind Reading: Extracting "Knowledge" from Zero Knowledge Proof

- Academician Zhou Zhongyi of the Chinese Academy of Engineering: Blockchain application must first distinguish user-centric classification

- Financial giant Fidelity executives: In order to protect investors, we have not yet provided cryptocurrency trading services on retail trading platforms.

- Will the quantitative fund industry break out? Global mainstream investors will participate in 5 years