Staking has a wealth of money: an average of about 7% per year. There are many new ways to play.

The bear market, which began in the second half of 2018, brought "daytime" and "human harmony" to Staking. The depressed market reduced the enthusiasm of the currency traders, and investors turned to look for stable income, which is just the advantage of Staking. After accumulating in the bear market, Staking became an important outlet in the first half of this year. Its light assets, high returns and low competition made this business attract more and more big players to enter.

According to stakingrewards.com, as of July 25, Staking's total market size reached approximately $16.66 billion, accounting for 6.08% of the total cryptocurrency market. Staking's average annualized income is 12.06%, the average pledge rate is 37.98%, and the lock-up amount reaches approximately $6.444 billion. After half a year of rapid development, Staking is not limited to the public chain and additional rewards, new gameplay emerges endlessly.

Staking averages about 7% per year. Many factors affect earnings.

According to stakingrewards.com, the average annualized return of the currency of 86 Staking projects is about 7.03% (median). If investors operate properly, they may be higher than this number when they pay the legal currency. Of course, it may also be because of the currency. The decline in the price makes the French currency income lower than this expectation.

- Please ridicule our coins

- V God intends to let Ethereum marry BCH and is planning to enhance privacy. Will ETH sidechains and anonymous coins tremble?

- Node business, how to make multiple EOS super nodes

What is the average annualized income of 7%? According to the annual financial income of the bank's wealth management products sold on July 25, according to Sina Finance, the highest expected revenue of the “10th issue of ICBC's Tongli Private Equity Specialized Wealth Management Product SMGQ1931” is about 7% (the legal currency standard). Most are only about 4.5%. Staking's investment income is still considerable, of course, this is the return of the currency standard.

Among them, Livepeer's Staking expects the highest annualized income, reaching 156.34%, followed by Energi reaching 76.88%. The expected annualized returns of KuCoin Shares, Phore, BOScoin, Radium, Shift, Loki, Horizen and Pikciochain are also over 20%.

Some well-known public chain Staking expects annualized returns to be relatively low, such as EOS only 1.84%, Cardano only 3.70%, Tron only 4.21%.

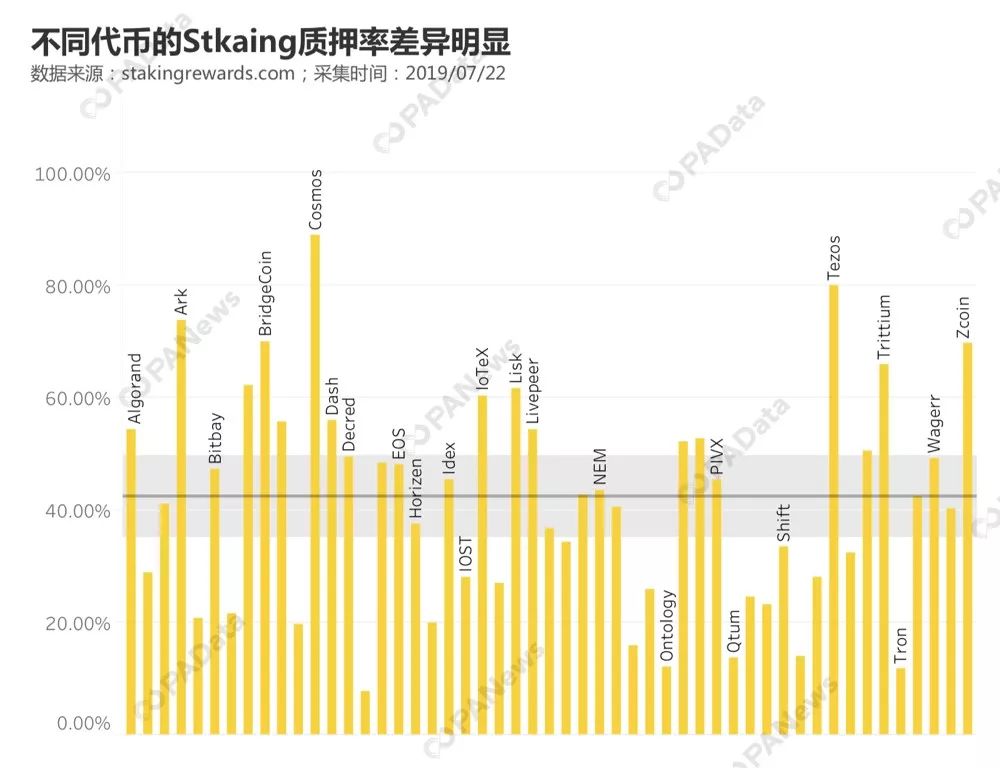

According to stakingrewards.com, the average pledge rate for 51 projects with pledge data is about 42.36% (median). In contrast, the pledge rates of the three major domestic public chain projects Ontology, QTUM and TRON are relatively low, about 11.90%, 12.15%, 13.88%, respectively, but the inflation rate of these projects is also very low, such as QTUM inflation rate. Only 1.03%, Ontology does not increase, and there is no inflation.

Interestingly, the three foreign public chain (including side chain) projects have the highest pledge rate. The pledge rates of Cosmos, Tezos and Ark have reached 88.84%, 80.06% and 73.90% respectively, but the inflation rate of these projects is still relatively high. Low, Cosmos is only 7.2%, Tezos is only 4.95%. There are also some projects with high pledge rates, high inflation rates, and high annualized yields. For example, Livepeer and Energi, the pledge rates reached 54.98% and 52.85%, respectively, and the inflation rates reached 74.89% and 64.22%, respectively.

According to Chain Capital's research, Staking expects annualized earnings/inflation/pledge rates. This means that a higher inflation rate and a lower pledge rate will result in a larger Staking benefit. In fact, the annualized income is also affected by more factors, such as the inflation model is fixed inflation or inflation adjustment, the original chip allocation plan, the commission rate paid by the project party to the node operator, and the currency price fluctuation. It can be said that the current Staking project on the market is different in mechanism design.

Service providers are fiercely competitive. Staking can also shop around.

There are already many companies offering Staking services on the market. stakingrewards.com lists 42 service providers, some of which provide node operations services, such as Staked.us, which announced earlier the completion of $4.5 million in seed round financing, while others are geared toward Ordinary investors provide PoS mining services, such as HashQuark under the HashKey Group in Hong Kong, Firecoin Wallet under the Coin, and Cobo Wallet.

PAData selected 11 of the larger service providers that officially disclosed the Staking currency, and analyzed their support currencies and expected annualized returns.

Among the 11 Staking service providers, MyCointainer supports the most currencies, reaching 25, but among them, there are few hot items, and most of the supported projects are not well known in China. Secondly, SNZ Pool, Everstake, Infinity Stones and HashQuark support more than 10 currencies, many of which are well-known hot items such as ATOM, ALGO, EOS, IOTX, IRIS, etc.

Judging from the business of Staking service providers, many service providers are engaged in business closely related to Staking. For example, the original wallet service providers are mostly involved in Staking, and Staking is classified as a fire coin wallet instead of a fire coin pool. The Cobo wallet is also connected to Staking.

In just six months, the competition of Staking service providers has been fierce. If investors want Staking to be more well-known projects, the choice is more adequate. So what is the expected annualized income between different service providers in the same currency?

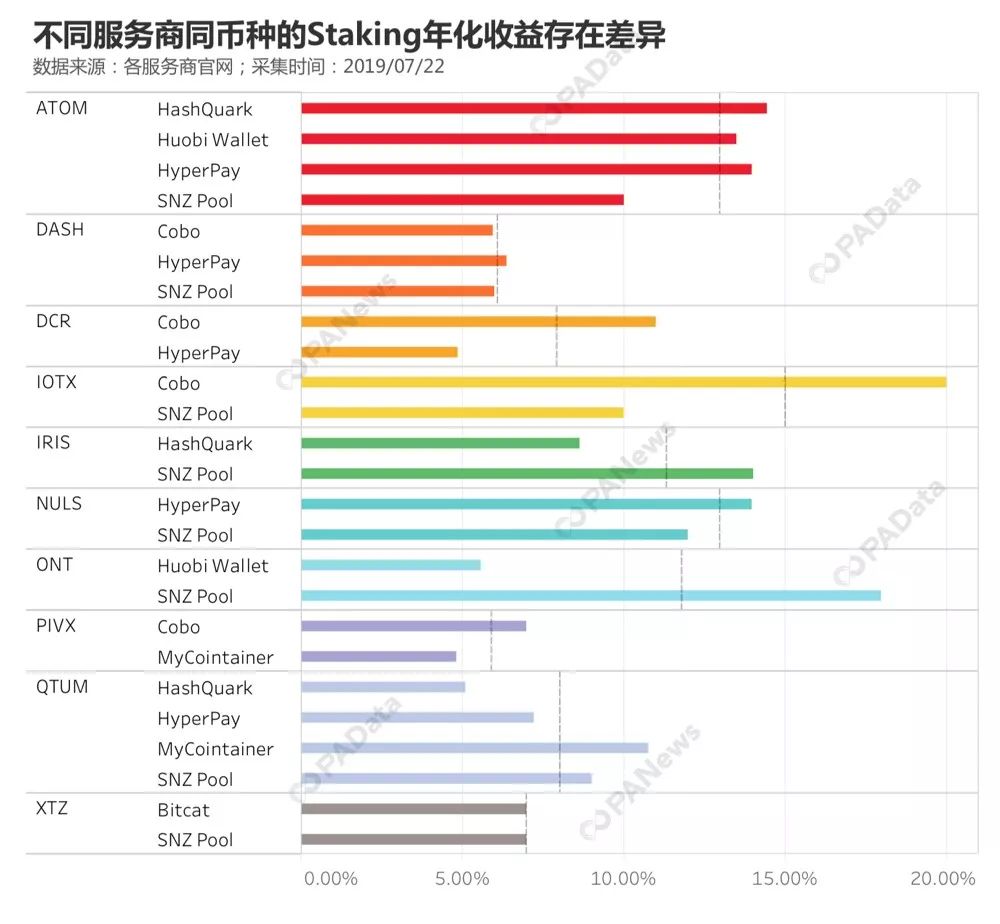

The expected annualized income difference provided by different service providers in different currencies is different. In some currencies, almost all service providers have similar annualized returns, such as DASH, three annual offerings provided by DASH Staking service providers Cobo, Hyper Pay and SNZ Pool. The revenue is around 6%. In some currencies, there are significant differences in the annualized returns provided by different service providers. For example, ATOM, SNZ Pool provides annualized revenue of about 10%, which is 4 points less than the average of the other three. Like QTUM, the highest annual revenue of My Cointainer can reach about 10.75%, and the lowest HashQuark is only 5.11%. In addition, the annualized income gap between ONT, IOTX and IRIS on different service providers is also very significant.

The annualized income gap between different service providers may be related to many factors. For example, Li Chen, CEO of HashQuark, said in an interview with PANews that they have their own set of algorithms to optimize annualized returns. Others may also be related to channel factors under certain DPoS consensus. For example, the high-ranking super nodes in EOS can get more rewards. Staking gives these super nodes a higher benefit. In the process, super There is a game relationship between the node and the Staking service provider, which may generate a polarization reaction. That is to say, the higher the ranked super node and the large Staking service provider form a stable cooperative relationship and thus affect the node pattern change, which is also It will be passed to the ecological construction of the entire public chain.

Staking's new gameplay

When discussing Staking at the beginning of the year, it is generally considered that under the consensus mechanism of PoS (Proof of Stake), the node is responsible for packaging transaction information, maintaining network operation, and participating in community governance to get rewards. This kind of reward mainly comes from system issuance. Tokens, the way of this kind of income is Staking, which is essentially rewarded by the exercise of power.

Under this narrow understanding, there are several keywords, one is the PoS or PoS-like consensus mechanism, one is the public chain, and the other is the reward from the issuance. However, after more than half a year of development, Staking has been widely defined, and many new ways of playing have appeared on the market.

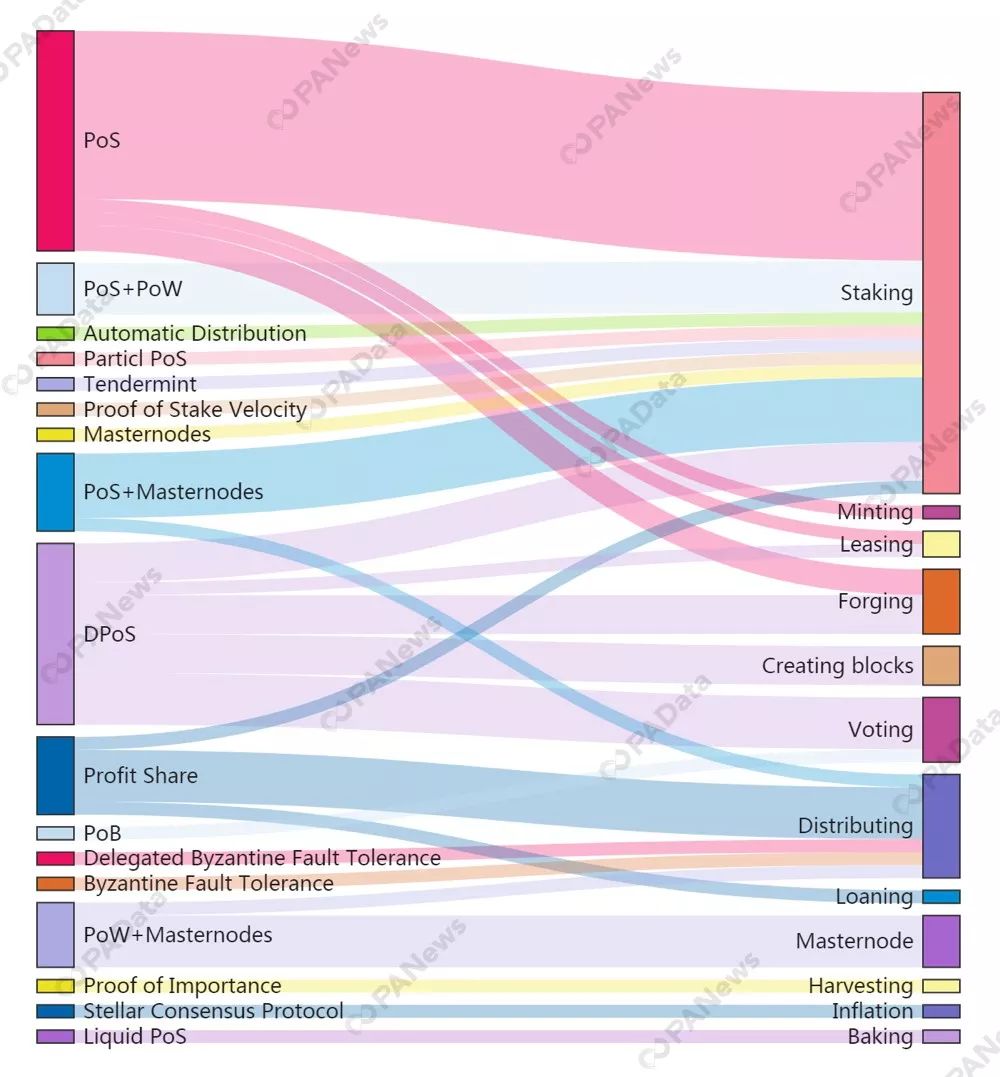

According to the incomplete statistics of stakingrewards.com (here the Consenseus Type and Processing Type are all complete 63 project data), PoS and PoS-like (including DPoS, LPoS, etc.) are the most mainstream Staking consensus mechanism, and the other four consensus mechanisms. It almost divided the remaining markets, including the PoS+PoW hybrid mechanism with Ethereum as the main representative, the PoS+Masternodes mechanism with VeChain and NULS as the typical, the Profit Share dividend mechanism with KuCoin as the typical, and the representative of Zcoin. PoW+Masternodes mechanism. There are also individual projects that use their own consensus mechanisms, such as NEO's use of the Delegated BFT mechanism.

Among them, Masternodes is widely used in Staking with PoS and PoW mechanisms. Under this mechanism, each user can participate in protecting the network and generating blocks. However, companies that invest heavily and target a large number of tokens will receive further masternode rewards, often with some governance voting weights, which are essentially more like an additional bonus.

From the perspective of profit distribution, Staking is the most mainstream distribution method, which is rewarded by packaging transaction information, maintaining network operation, and participating in community governance. This kind of reward mainly comes from system issuance, but now there are some projects that do not adopt the incremental inflation model, but reserve a portion of the original chip allocation as a Staking reward, such as Loom.

In addition, the main distribution methods are Distributing, Voting, Forging, Leasing and Loaing. Voting is mainly related to the DPoS consensus mechanism, which can be shared by voting, such as Cosmos and IOST. Forging is a relatively new concept, but its essence is very similar to Staing's super node, except that the name of the node here is "forge", and the income comes from the block, or "forged block", but here is the new The trick is that some projects will group forgeters, and the grouping and revenue will be reallocated after forging a block. In addition, the project using the two distribution methods of Leasing and Loaing is either DeFi application or ILO (Initial Lock-up Offering). The basic mode is that the user locks the position with a coin, and can not only redeem the lock after expiration. Tokens, you can also get ILO tokens, which can be considered rewards.

From the combination of consensus mechanism and distribution method, it can be seen that in the past six months, Staking's new gameplay has emerged in an endless stream. It has long been no longer restricted to public chains and additional awards. DApp, DeFi and other industry hotspots have also been integrated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market analysis: long-term confidence lost, BTC will soon bottom out again

- ErisX Chief Strategy Officer explains how cryptocurrency transactions benefit from algorithmic trading

- Three men set a bitcoin scam to get a profit of more than 150,000 yuan was sentenced

- Can garbage trading mess up blockchains? They are eyeing XRP

- Fear of being dominated by the US Internal Revenue Service: Users with more than 10,000 cryptocurrencies will receive a tax "warning"

- The US Internal Revenue Service warns that bitcoin causes a fall in the price of 7/27

- Bitcoin is still expected to reach $42,000 by the end of the year? Hedge fund CEO also believes that it can reach $356,000 in 2021.