The biggest "coin difficulty" after 9 • 4 is happening, or it will pave the way for the central bank's digital currency

Text | Interchain Pulse · Black Pearl

"Coin difficulties" spread from first-tier cities to inland cities.

On November 28, a joint inspection team formed by the Chongqing Yuzhong District Finance Office in conjunction with the District Market Supervision Bureau, the District Public Security Branch and the Petrochemical Management Committee has issued a report on Chongqing Cangzhou Network Technology Co., Ltd. The host company) conducts surprise inspections. The inspection team verified that the company's behavior has become an inducement or fact to promote the Singapore Chain Trust International Foundation CCT virtual currency transaction, and there is a potential risk of using tokens for illegal fundraising.

From the first-tier cities to the inland, from the beginning of the mining industry to the issuance of coins, transactions, and publicity, various types of currency circle-related companies in various places have been included in the scope of remediation. This nationwide rectification is compared with the “94 ban” in 2017 There is nothing worse than that. After clearing the source, it may be time for the central bank's digital currency to be officially issued.

- European Central Bank: Central bank digital currency will be issued without efficient pan-European payment solution

- Long Baitao Recommendation | First Deputy Governor of the Bank of France: Financial Inclusion in the Digital Age-How to Change the Status Quo?

- Policy “ripens” blockchain application, China's number of landed projects increased by 110% in November

Strongly regulated in all aspects of virtual currency transactions

It is reported that the surprise inspection of Chongqing Cangzhou Technology has developed a quark chain letter APP using blockchain technology. During the cooperation and drainage process with Taobao e-commerce platform and game platform vendors, CCT virtual currency was introduced as a means of rewarding customers. , And guide investors in the nature of buying and selling.

At the same time, the Chongqing Finance Office issued a monitoring and supervision letter to the construction management committee of the major petrochemical new zone of Chongqing Cangzhou Network Technology Company, requesting to strengthen the risk monitoring and key prevention of the company, and report abnormal behaviors in a timely manner, and The rectification requires verification of the implementation of the rectification to ensure that it does not cause social risks.

The unannounced inspections and strict supervision measures of Chongqing Finance Office are just the tip of the "currency difficulty". Under strict supervision, most of the companies related to the currency cannot run away.

The industry in the eyes of the "currency circle"-the virtual currency mining enterprise-has also become a "high energy-consuming company" that needs to be remediated. In November, the mining industry just experienced a roller coaster-like ups and downs. On November 6, 2019, the Chinese government website formally released the "Industrial Structure Adjustment Guidance Catalogue (2019 Edition)". Compared to the previously released draft of comments, the elimination of the industry category in the official version removed the "virtual currency mining" "project.

The currency circle shouted that "mining industry" finally ushered in the spring. But within two days, Inner Mongolia took a strike against the mine. On November 11, the Ministry of Industry and Information Technology of the Inner Mongolia Autonomous Region issued a notice on the joint inspection of the cleanup and rectification of virtual currency "mining" enterprises. Focusing on finding out that the virtual currency “mining” companies that have nothing to do with the real economy, evade supervision, and consume a lot of energy, and use the “big data industry” as a package to enjoy preferential policies such as local electricity prices, land, and taxation, conduct this inspection. . On the 25th, Inner Mongolia issued a notice, asking all the cities to provide information on the work and applications of the blockchain in the region.

The mine is subject to remediation, and virtual currency transactions may be "powered off" from the source.

After the mining machine can be mass-produced in 2012, Inner Mongolia once attracted many mines to land due to low electricity charges, preferential land and tax policies. It was once a paradise for miners. In the "2019 Hurun Global Unicorn List", Bitmain, the number one blockchain company, is valued at 80 billion yuan. On September 26, 2018, the prospectus submitted by the Bitmain Port Exchange revealed that its largest mine is located in Inner Mongolia and can accommodate 60,000 mining machines with a total power capacity of approximately 90 MW. This time Inner Mongolia pointed out that it is important to find out the virtual currency "mining" enterprises, or it will seriously affect the "currency circle" trading market.

Observing the regulatory policies of the chain over the past month, compared with the previous rectification, there are two obvious changes this time, and the overall strike is unprecedented.

The first is the rectification of the entire "industry chain", ranging from mining companies and mines; to the issuers of coins; to the exchanges; and finally, the coin circle media for these people are within the scope of the crackdown. The second is that this rectification can be said to be batch processing. From the past crackdown on cases of reported cases or serious violations of laws and disciplines, to the inspection of all enterprises in the industry, there were many enterprises involved.

The last strong regulation of the currency circle was the "94 ban."

On September 4, 2017, seven ministries and commissions, including the People's Bank of China, issued the Announcement on Preventing Financing Risks of Token Issuance. The announcement pointed out that ICO is an illegal financial activity, which severely disrupted the financial order and suspended all domestic token financing projects. Later, people in the "currency circle" mentioned the ban, calling it the "94 currency disaster."

However, if the "94 ban" is compared with the regulatory developments since the New Deal, it is still a bit of a witch. The "94 ban" is directed at ICO behavior, and the exchanges and the media circle involved are also companies that frequently support or announce ICOs. After the ban, the overall ecology of the currency circle, including mines, project parties, exchanges, and the media, has not been destroyed as a whole. For example, the three major miners of Bitmain, Jianan Yunzhi, and Yibang Technology have successively tried to list in 2018; the operations of head exchanges such as Binance and Huobi continue to develop overseas or domestically. Matcha recently said that users have developed To 3 million …

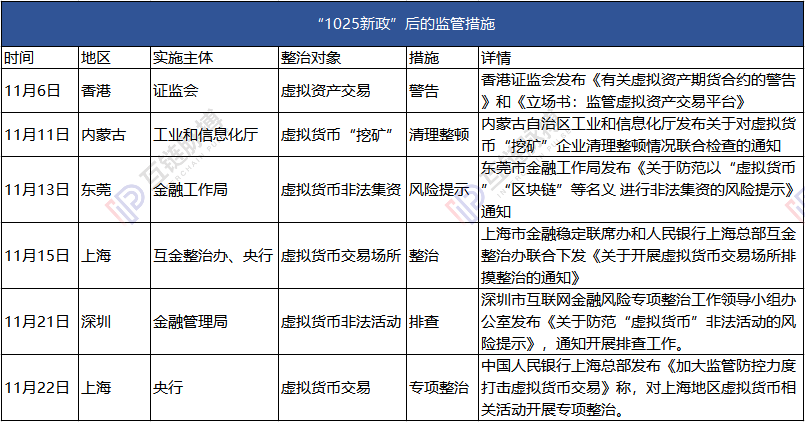

After the "1025 New Deal", although seven ministries and commissions, such as the central bank, have not taken the lead in rectifying actions, relevant institutions in various places, especially the Financial Bureau, have started to rectify related companies in the "currency circle" and have achieved certain results.

After Inner Mongolia, Dongguan and Shenzhen issued a reminder to prevent the illegal activities of virtual currencies and illegal fund-raising; Beijing issued a risk alert for the exchange, and Shanghai has launched an exchange remediation operation.

(Drawing: Interchain Pulse)

On November 29, a media article stated that ChainUP's Beijing office had been evacuated. Sources said that the sudden move away was to avoid suspicion, and ChainUp CEO Zhong Geng was rumored to have been sidelined. On November 25th, the Beijing police recently cracked the BISS (Coin Market) exchange, which was identified as illegal fund-raising fraud. This is also the first case where a virtual currency exchange was directly blocked in China. The Shenzhen Municipal Financial Supervision Bureau stated on November 21 that it has eliminated 39 illegal activities that are suspected of developing virtual currencies.

In addition, the "currency circle" public opinion field in late November was also full of a sense of crisis. "Coin circle" media——Deepchain, coin circle bond, one coin, coin speculation school have been blocked; TRON and Binance official Weibo have been blocked; BiKi exchange has been blocked by Securities Times, Caijing, etc. The official media named "cut leek", causing a large number of users to return coins.

The mines were inspected; virtual currency-related companies were excluded in batches; the exchanges were passively blocked or actively withdrew from the Chinese market; the currency circle media were banned … a series of incidents or are welcoming the "regular army" to enter the market.

Comprehensive rectification or the way for the central bank's digital fiat currency

The comprehensive reorganization of the "currency circle" is considered to be paving the way for the central bank's digital fiat currency.

On December 1, at the "Hainan International Offshore Innovation and Demonstration Demonstration Zone Construction and Blockchain • Digital Asset Trading Technology Innovation High-end Forum" in Sanya, Mutual Chain Pulse participated as a co-organizer. The former Institute of Financial Information Technology of the People's Bank of China Mr. Li Xiaofeng expressed his opinion: Digital currency will bring about the construction of financial infrastructure and corresponding legal issues. The state is cleaning up the portal. It is necessary to clear all exchanges and issuers, and the central bank (digital currency) Will be officially unveiled, and then the currency is issued to be issued by the state monopoly.

Blockchain technology is not to be used for virtual currency transactions. Xinhua News Agency reported on October 25 that the Political Bureau of the CPC Central Committee conducted the eighteenth collective study on the current status and trends of blockchain technology development on the afternoon of October 24. Xi Jinping delivered a speech while chairing the study. He pointed out that the application of blockchain technology has extended to many fields such as digital finance, the Internet of Things, intelligent manufacturing, supply chain management, and digital asset trading.

Blockchain technology can be used to develop digital asset transactions, but it must be legal and compliant. The development of blockchain digital asset transactions can be through stablecoins, rather than the "air currency" that is flooded in the current trading market, and virtual currencies ≠ stablecoins.

People's Daily published an article on November 12 "The Original Version of the Source: The Difference Between Stable and Virtual Currency". The article clearly mentioned that recently the country has raised blockchain technology to a national strategic level, which has caused concern. However, the current virtual currency in the transaction respects that it will eventually replace the fiat currencies of various countries, but it is not actually a physical currency. Its attributes are investment financial products and are highly speculative. The possibility of becoming a universal currency is basically zero.

At present, scams under the brand names of "blockchain" and "virtual currency trading" are not uncommon. The exchange has launched "Air Coin", "MLM Coin", and "Zero Coin", and the project parties have played a lot of money games and cheated A lot of money in the district has triggered social unrest many times.

According to reports, in mid-October, more than 150 MBI victims were crying on their knees to defend their rights, and more investors entered the home of the son of the chairman of the MBI Group and threatened with a knife. In August this year, the "Huaden Block Dog" completely collapsed. Incomplete statistics showed that the amount involved in the case was as high as several hundred million yuan. Individual investors invested up to several hundred thousand, which caused investors to jump off the building and defend their rights. The MGEX exchange was established in June this year and was exposed in early November. Many people have lost hundreds of thousands of dollars.

(Data source: Money chart ranking chart: Mutual chain pulse)

Recently, the official media's report on the blockchain has also shifted from popular science in early November to anti-counterfeiting supervision. The Securities Times reported on November 10 that Biki's listing projects are basically "air coins" with no underlying technical team and no actual value. The focus interview criticized BEEBANK's blockchain wallet project by name, and used the blockchain concept to engage in capital disks, and then ran for money.

But returning to the blockchain technology itself, digital currencies using blockchain technology can complete instant payments, be more secure, and help build a digital economy in the future. Currently, several countries are developing and piloting stablecoins, anchoring the national or multinational fiat currency, making digital currencies truly have monetary attributes.

For example, Libra anchors a basket of currencies such as the US dollar; Wal-Mart Coin, JPM Coin, USDT anchors the US dollar; the Central Bank of Brazil's block chain instant payment system will be launched in November next year, and users can directly transfer funds through QR codes, etc., its design The mechanism is similar to China's central bank digital currency.

China's central bank currency is on the horizon. On December 2, Zhou Xiaochuan, the former governor of the People's Bank of China, said that digital currencies may initially try to solve the global financial infrastructure, hoping to improve efficiency through new technology, but also raised some regulatory issues.

The chaos of virtual currency scams in the past has caused a certain degree of stigma to digital currencies. New rules for the use of digital currencies need to be formulated. Therefore, the central bank needs to clear obstacles and prevent risks before digital currency issuance. Recently, the People ’s Bank of China Governor Yi Gang publicly stated that before the central bank ’s digital currency is officially launched, there should be a series of research, testing, piloting, evaluation and risk prevention, especially in cross-border scenarios. A series of regulatory issues such as anti-terrorist financing and anti-tax havens.

After this round of strong supervision, the digital currency is mentioned as the central bank's digital currency.

This article is the original [Interlink Pulse], please indicate the source when reproduced!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Research Report | The Status Quo of the Application of Blockchain in the Logistics Industry and the Three Challenges Facing the Landing

- Viewpoint | Rather than technological breakthroughs, asset chaining requires more institutional building

- IMF Liu Yan: Legal definition of digital currency is the basis of regulation

- 4D long text explains the latest development of Ethereum

- The Revolutionary Potential of the Bitcoin Lightning Network from the Internet

- Can the data be used as collateral in DeFi?

- Blockchain international patent TOP 20: 5 Chinese companies including Ali, Huawei entered the list