The next tipping point "DEFI" in the blockchain

Editor's note: DeFi, Decentralized Finance, is one of the fastest growing areas of blockchain applications in 2019, and its prospects are optimistic in the industry.

"We still have to go back to the old road of Nakamoto, DeFi is the direction of the crypto assets." Lipus, Ph.D., Ph.D., University of British Columbia, Canada, believes that if the road encounters heavy fog, we should return to the previous crossroads. .

On June 17, DAppTotal.com's DeFi feature page data shows that up to now, the 23 DeFi projects that have been counted have totaled $1.5 billion in lock-up funds. Overall, DeFi is growing faster, but it is still in its infancy.

Recently, the Nuclear Finance APP has submitted a draft to Lips. From the perspective of DeFi, the Universe blockchain applies the “vision” world to explain what is decentralized finance and the principle of decentralized finance.

- Zcash founder reward is about to be cancelled, the community is big due to funding problems

- Can regulations be "rolled back"? Blockchain is transforming traditional securities industry

- Like Nakamoto, the founder of Grin announced that he would leave the project temporarily.

Nuclear Finance APP Deep Core reported that Bitcoin is a decentralized economic system and value system, but it cannot be applied in the financial field. Decentralized finance can be close to people's lives, and the blockchain can be put to the ground, so that humans can really start to use "encrypted assets to make financial activities."

Crossroads of cryptocurrency

"If the front road encounters heavy fog, we should return to the previous intersection." Looking back at the cryptocurrency decade, people have witnessed the value of Bitcoin as a value storage network, and also saw the enormous energy of the Ethereum ICO contract. In addition, there has not been a particularly successful crypto asset project.

If we analyze it carefully, we will find that both Bitcoin and Ethereum are exploring around the two directions of economy and finance. The exploration of DApp's EOS and TRON did not change the world. Back at the crossroads of Nakamoto, we believe that the blockchain is born to serve the economic system and the financial system. In addition, there is little success.

Because, we have to understand the fact that a restaurant can introduce a mobile phone to order food, but also can introduce Internet to deliver food, but the Internet cannot produce a restaurant, and it is impossible to give birth to a bank. Blockchain as a technology can be used by many industries, but the blockchain itself cannot be born into other industries.

We can see that the taxi software introduced blockchain technology, but we can't see the "new format" of the taxi software on the blockchain. The field of encryption assets will eventually return to the old road of Satoshi Satoshi. It should focus on Value areas and financial areas, not others.

Therefore, starting from the crossroads of Nakamoto, adhering to the direction of decentralization, financialization of cryptographic assets is the evolution of cryptographic assets.

What is Encrypted Asset DeFi

We know that Fi means the abbreviation of Finance. When it comes to decentralized finance, many people naturally believe that decentralized finance is the purchase and holding of cryptographic assets such as bitcoin, which is a very common misinterpretation.

Currency is the research object of economics. The cryptocurrency represented by bitcoin tries to replace the legal currency and store value. These are the research scope of economics. And finance is the field to solve the problem of people configuring scarce resources across time. It is the economics with time parameters. To give a simple example, buying and holding a property is an economic act, and leasing a property is a financial act.

The relationship between economics and finance is like the relationship between probability theory and insurance, the relationship between aerodynamics and civil aviation. When you fly from Los Angeles to Beijing, you need to take a civil aircraft instead of aerodynamics.

Economics is the foundation, and finance is the application. Bitcoin is a decentralized economic value network. The blockchain technology represented by the public chain relies on the decentralized application “DApp”. The decentralized “coin” represented by bitcoin needs to go. Centralized financial market.

Why do you need DEFI?

As we all know, the global financial system has created enormous wealth, but the centralized management of traditional financial institutions often leads to the unfair distribution of resources, and those with resource advantages are more likely to obtain funds. Therefore, decentralized financial services are precisely to solve the shortcomings of traditional financial markets.

Since the beginning of this year, the "cryptocurrency" market has set sail, and giants such as JP Morgan and Facebook have entered the game one after another, making the industry realize that after so long, finance is the development direction of the blockchain.

According to Consensys, more than 100 cutting-edge blockchain projects are pioneering in decentralized finance, such as Ethereum's stable currency, DEX, investment, derivatives, payments, loans and insurance platforms.

We have seen that gold has withdrawn from the physical trading market and withdrawn from the monetary function. However, it has not lost the function of financial risk hedging and has not lost the function of value savings. The financialization of encrypted assets will also reproduce this process. But there are some differences. The biggest difference is the “decentralization”. The decentralization ability of the encrypted assets makes the finance of the encrypted assets also have the decentralization feature.

To this end, by separating the economy from the financial sector, the holding and trading of the currency as the subject matter has become the decentralized financing scheme for the crypto assets, thus carrying out more complicated financial market transactions on the subject matter.

It should be pointed out that the main problem of decentralized finance is not the issue of cryptocurrency issuance, purchase, and possession, but the solution is “resource allocation under time scale”, which is typically REX on the EOS blockchain.

According to my judgment, the separation of ownership and use rights, the misallocation of resources, the faster flow of resources, the more needed places, the promotion of productivity, the efficiency of the use of funds, and the reduction of financial costs are decentralized. The mission of finance.

What elements does DeFi contain?

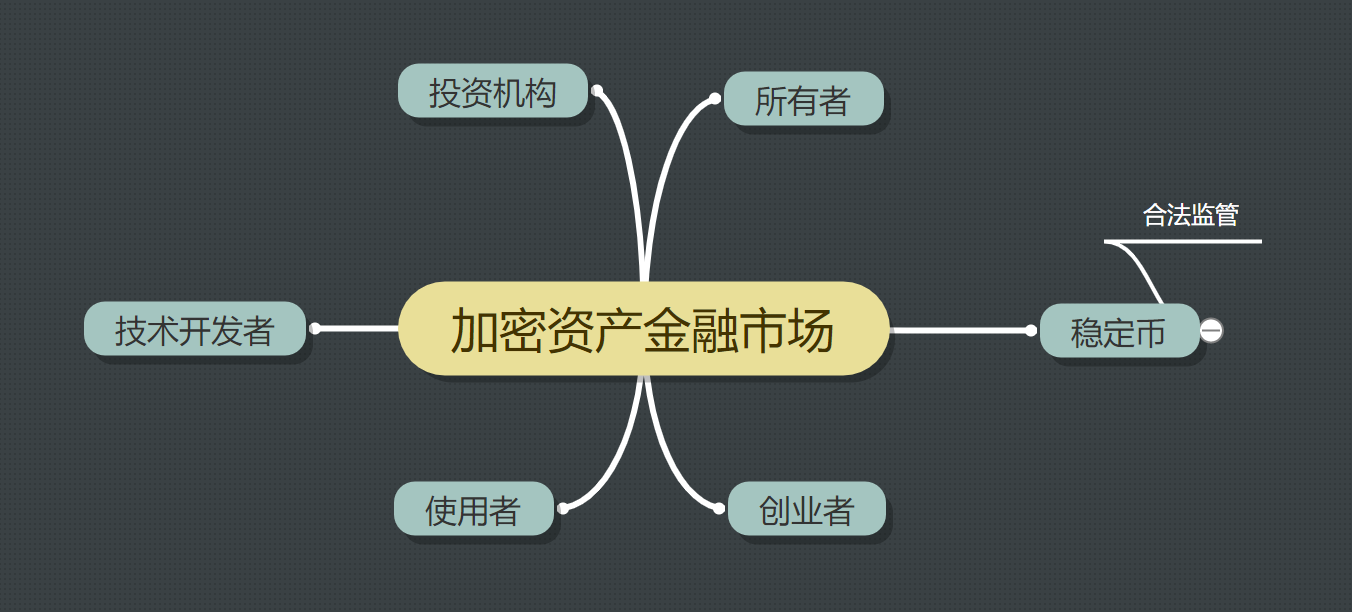

Decentralized finance includes decentralized financial markets, decentralized financial institutions, asset holders and users. Their relationship is shown in the figure below:

Encrypted assets flow between the holder and the user through decentralized financial markets. One of the most typical examples is REX on the EOS network. People with surplus EOS don't fully use EOS, and it can be leased to “resource-poor organizations and individuals” who need to use it.

In order to fully release the market vitality, connect the crypto-asset holders and the crypto-equity users. The two parties complete the mis-period allocation of resources around the price of “interest”. This is a problem to be solved in the financial market.

DeFi product type

Adding decentralized attributes to traditional financial products will bring about decentralized finance. Financial products that run well in traditional markets can be decentralized and transplanted into decentralized financial markets, mainly including Insurance and hedging business, mortgage financing business, leasing business.

1. Insurance and hedging business. The mature decentralized financial market will solve the bitcoin price volatility. By issuing Bitcoin warrants, both long and short sides will trade in the warrants field. In the event of super fluctuations, only the warrants are lost without threatening the price of Bitcoin.

At the same time, warrants are typical financial market products, leaving the “entity” bitcoin and entering the pure warrant trading model. If a person expects the price of an encrypted asset to rise, he should buy a warrant, which can enjoy the profit brought by the price increase, and can also avoid the loss caused by the price of the currency, that is, the price and income of the warrant reflect the cryptocurrency market. Value added, not the doubling of the price of the currency itself.

The essence of hedging is price insurance. Decentralized finance will provide a sound risk hedging market. Through the competition of transaction costs, it eventually replaced the position of gold in the financial hedging market.

2. Mortgage financing and discounting business. If a person holds 10 bitcoins, but he needs funds now, he is not willing to sell bitcoin, then the financial market needs to provide discounting ability. If he thinks that the increase of bitcoin can cover the discount loss, he can choose to discount. Solve the current funding needs. If it believes that discounting is still not cost-effective, decentralized financial markets can provide mortgage financing services.

In the perfect decentralized financial market, anyone can launch investment products and futures products. For example, the project party mortgaged 100 bitcoins to issue FIT at an opening price of 1 USDT. After three months of commitment, it was automatically reclaimed at a price of 1.1 USDT, or other organizations helped him complete the mortgage. This is a well-established lending market, and its USDT, which does not use the USDT bourgeoisie, can lend to those who need financing. The project party holding the collateral does not want to sell the collateral. The two parties can complete the fund allocation through the market based on the decentralized trust mechanism.

3. Lease business. Decentralized finance provides a decentralized “financial market” in which fund holders lend their own funds to fund lenders, and both parties reach the price of time. Pay the full interest first, then use the resources, the ownership and use rights of the resources are separated, and the lender gets the right to use, just like renting a property.

DeFi participants and business implementation

Market participants include financial market technology developers (they provide financial market instruments for everyone), institutional participants in financial markets (typically, such as Facebook provides stable currency), and financial market counterparts.

1. Financial market technology developers. The decentralized financial system is a series of smart contracts running on the high-performance public chain. These smart contracts are open, and the parameters of the contract operation are determined by the parties to the transaction. It is somewhat similar to Gongxinbao, but the scene business is more open. Such a financial market is designated by technology developers as a loose standard, either a corporate entity or a DAC organization. They only make technical implementations and cannot agree on how the market trades.

2. Institutional participants. Financial institutions provide offline mapping of assets such as physical mortgages/preparations, just like Facebook's stable currency, which is strongly regulated and introduced in decentralized contracts as value anchoring and currency intermediation.

3. Both parties to the transaction. Both parties to the transaction need to describe the business and, after reaching an agreement, implement it through a decentralized smart contract.

In some scenarios, there are no pre-visible trading participants. This requires the financial market to pre-set a general contract, and then the auction model is sold in the market, just like an IPO.

In fact, in the traditional VC field, entrepreneurs have become accustomed to let the employers share the risks and benefits. A team designed a project that may or may not fail. The startup team allocates 50% of the risk to the employer and also sells 50% of the proceeds to the employer. This is a typical angel contract.

In the capital lending market, the design of financial products will be more flexible. Due to the unpredictable currency price, an entrepreneurial team with 100 bitcoins can mortgage a portion of Bitcoin for financing while not selling Bitcoin, and mortgage Bitcoin into the contract to publicly sell funds for these maturity assets. Raise.

In short, DeFi contracts have automatic delivery, non-tamperable, high-throughput, open and fair operating rules, which will lead to the birth of decentralized inclusive finance, leading to the application of encrypted assets.

Text: Lips

Source: Nuclear Finance

(This article is dictated by Lips, slightly abridged)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Introduction to Blockchain | Bitcoin: A Currency Innovation Mechanism

- Market Analysis: Mainstream currencies are retreating as scheduled, but BTC is still stable above $10,000

- Blockchain Weekly | Interpreting Algorand: A Crowdfunding for Five Years

- The 4 major catalysts have caused Bitcoin to rise. Will this break out like 2017?

- Really big short! 4 traders hold 70% of BTC short positions

- Talking about Huo Ju, Mikko, Katt | Facebook Libra's original sin

- Market Analysis: Will the adjustment be close, will it be deep?