Understanding SAFT and Web3 Token Financing from the Perspective of Three-Generation Token Models

Understanding Token Financing using SAFT and Web3 from a Three-Generation Token Model PerspectiveWeb3 is a value network built on blockchain, where all value can be tokenized. Tokens are the digital form of value, and can be combined, circulated, and distributed freely and efficiently in the Web 3 value network. Dr. Xiao Feng of HashKey Group proposed the “Three Generations of Tokens” model, which clearly explains the various dimensions of value. Functional tokens (Utility Tokens), equity tokens (Security Tokens), and non-fungible tokens (NFTs) respectively represent usage rights, ownership, and digital certificates.

As the most common protocol for Web3 investment and financing, Simple Agreements for Future Tokens (SAFT) captures the value of Web3 projects in the form of tokens. This article will combine the HashKey Group’s white paper “Web3 New Economy and Tokenization” and the Cooley Law Firm’s SAFT white paper to understand SAFT, Web3 Token investment and financing, and the value capture of Token investment and financing from the perspective of the Three Generations of Tokens model.

(from: How to Invest in Web3: The Next Phase of the Internet)

- Relation Protocol announces its native token REL economic model

- With the rise of the APP Chains, what is its past life, present life and future?

- The ATOM 2.0 white paper is about to be released, can the value capture capability of Cosmos be improved?

TL; DR

Web3’s new economy is a stakeholder economy, with usage rights at its core;

The functional tokens, equity tokens, and NFTs in the Three Generations of Tokens model respectively represent usage rights, ownership, and digital certificates;

Usage rights cannot be securitized, but can be tokenized, that is, functional tokens are a value representation of usage rights, and their value comes from network effects;

SAFT itself is an investment agreement, which only applies to functional tokens. Through the two-step agreement mechanism, SAFT realizes the transformation of tokens from security tokens to functional tokens, thereby avoiding some of the securities regulation of the US SEC;

The purpose of Web3 project investment and financing is to capture the value of the project. The difference between equity investment and token investment lies in where the value is realized and how it is captured.

I. The Three Generations of Tokens Model in Web3’s New Economy

(from: 解析代币化,引领新经济! 《Web3新经济和代币化》白皮书在2023香港Web3嘉年华发布)

Understanding the essence of the Three Generations of Tokens model is very helpful for understanding the different forms of value capture in Web3 investment and financing.

Whether in the economic model of Web1 or Web2 (surveillance capitalism), the platform enjoys the ownership of the final information data, and generates huge commercial value through monetization, which has led to commercial giants at the platform level such as Facebook and Google, but this has nothing to do with ordinary user participants. Web3 based on the blockchain network is an economic model based on a value network (stakeholder capitalism), emphasizing data credibility, data sovereignty, and value interconnection. Under the premise that all values can be tokenized, value not only includes ownership, but more importantly, usage rights.

Ownership has exclusivity and is difficult to divide. The organizational form (usually a company) under the ownership system aims to maximize shareholder interests and is a manifestation of shareholder capitalism. Usage rights are non-exclusive, have multiple sharing, can be authorized and licensed many times, and even achieve unlimited circulation of open source and CC0. The core of the usage right system is stakeholder capitalism. The original organizational form may not be suitable. Decentralized autonomous organizations (DAO) based on open source organizations and non-profit organizations are naturally suitable for stakeholder capitalism and have become the main organizational form of the new economic model of Web3.

Under the usage right system, all participants in the organization collaborate on a large scale as stakeholders, make their own contributions, and share the value of the organization. In this context, the project shareholders represented by shareholder ownership are meaningless, and what is truly valuable is the project’s usage rights. Usage rights cannot be securitized, but can be tokenized. Combined with blockchain distributed ledger technology, usage rights can be standardized and shared in the form of tokens, which is related to the interests of every participant in the project network, that is, functional tokens (Utility Token).

(from: Web3 New Economy and Tokenization)

Based on the Web3 economic model, usage right system, and stakeholder capitalism, the three-generation token model constructed around the project-functional tokens (Utility Token), equity tokens (Security Token), and non-fungible tokens (NFT), will share value with all participating stakeholders according to their own value forms. For example, stakeholders only have the right to use the blockchain network, system, or application if they have the token of the network, system, or application; or tokens can be the voucher for voting rights, and can participate in community voting, voting and governance, etc., all of which are manifestations of usage rights.

Utility Tokens capture the network effects of the Web3 network, system, or application. The larger the ecosystem and user base, the higher the market demand for the token, and the token price relies on market value discovery.

Security Tokens capture the value of equity, debt, and other equity-like assets’ future cash flows.

Meanwhile, NFT is a digital asset form of the underlying asset of things and can be referred to as “digital tokens.” NFTs are related to the value of the underlying assets with various sources of value.

II. Legal Attributes of SAFT

SAFT (Simple Agreements for Future Tokens) is a type of investment agreement specifically designed for Web3 projects built on blockchain networks. The SAFT agreement stipulates that the project party will exchange investors’ current funds for the subscription rights of future tokens after the network goes live, which will be used for the current development of the project network.

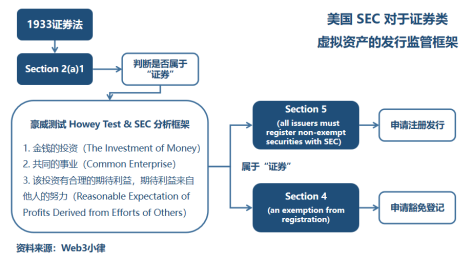

As Security Tokens are the key regulatory objects in various jurisdictions, SAFT establishes a set of protocol mechanisms to achieve the effect of the Utility Token network’s launch, avoiding the US Securities and Exchange Commission and related laws’ regulation of Web3 project token financing activities.

(from: https://saft-project.org/)

The SAFT white paper (The SAFT Project: Toward a Compliant Token Sale Framework), mainly handled by the US law firm Cooly, was published on October 2, 2017, proposing the SAFT transaction model for the first time, aiming to provide Web3 projects with a compliant Token issuance path based on the US securities law system, mainly divided into two steps:

(1) Project Development Stage: For Web3 projects that are still in development, investors’ profit expectations after monetary investment depend on the project development team’s management and development of the network. As the tokens do not have any actual utility, the nature of the tokens in this stage is more like a value representation of equity, capturing the ability of Web3 projects’ future cash flows.

This investment behavior may meet the standards of the Howey Test and be classified as an “investment contract,” which will be subject to strict securities regulation by the US Securities and Exchange Commission. However, it can be exempted from securities registration by applying for Regulation D Rule 506 of the US securities law and restricting investors to Qualified Investors.

(2) Project development completion and online stage: For the already developed and online project network, the issued token (Already-functional Utility Token) has many functionalities that allow users to access the Web3 project ecosystem (use, consume, govern, etc.). The token nature in this stage is a representation of the value of usage rights and is defined as a utility token (Utility Token).

As the token already has practical attributes, in general, the main purpose of investors buying tokens is to obtain the practical value of the project network, not just to make a profit. Moreover, for a decentralized token economic system or governance system, the price of the token in the secondary market is completely affected by the market supply and demand relationship, not dominated by the contribution of the project development team. This is a significant difference from the role of tokens in the project development stage. Therefore, the SAFT white paper believes that such Utility Tokens do not have the attribute of “securities” and are generally not subject to strict supervision by the US Securities and Exchange Commission (SEC). However, the purpose of SAFT is to meet the requirements of SEC regulations, strictly speaking, it is only suitable for professional investors (Accredited Investment), and it is not suitable for most small and medium investors.

(from: Kraken’s Legal Chief Has No Time to Educate Firms About Crypto)

Although we see that the SEC has issued many challenges to SAFT in recent Kik and Telegram cases, it always feels that there are flaws in the design and issuance pace of utility tokens (Utility Token). As one of the drafters of the SAFT white paper, Marco Santori, one of the lawyers who knows the most about Crypto and US securities law, currently serving as Kraken’s general legal counsel, was overthrown by the SEC in February 2023 due to Kraken’s Staking as a Service business, not to mention SAFT agreements for projects with different network, token function design, token economic design, and different investors.

There are many legal ways for Web3 investment and financing, such as SBlocking (Share Purchase Agreement) involving equity, SAFE (Simple Agreement for Future Equity), TBlocking (Token Purchase Agreement) involving tokens, SAFT (Simple Agreement for Future Tokens), or a combination of SAFE + Token Warrant/Side Letter. The specific form to be adopted needs to be based on the essence of Web3 investment and financing.

Three, the essence of Web3 investment and financing

When investing in Web3 projects, the most important thing is to determine where the value is realized. When valuing equity-based projects, the focus is more on the company’s ability to generate future cash flows, as shareholders have a legitimate right to share in the company’s profit distribution. When valuing token-based projects, the traditional cash flow valuation model is not applicable. Instead, the focus is on the network effects of the project, the demand between the network and the token, and the functionality of the token. Therefore, compared to token financing projects, the token economy is very important.

(from: Connecting Web3 Wallet to Twitter Account)

(1) Twitter’s Web3 Hypothetical

Currently, the Web2 Internet giant Twitter in the creator ecosystem is run through the corporate organizational form, with the goal of maximizing shareholder interests, reflecting shareholder capitalism, and investment value in the company’s ability to obtain future cash flows. The stock price reflects the value of future cash flows. But imagine a Twitter based on the Web3 new economic model, which incentivizes all participants in the network ecology (content creators, developers, validators, other market participants, etc.) with its tokens to jointly maintain the Twitter ecological network and promote governance. The utility of the token is not only as a medium of exchange, but also to provide users with access to the Twitter ecological network, consume products/services on the Twitter ecological network, and govern decisions on the Twitter ecological network.

This Web3 new economic model releases economic benefits and governance power from centralized entities to the entire decentralized ecological network, and all stakeholders who participate can share the value they create, reflecting stakeholder capitalism. Under this model, Twitter’s equity may not be meaningful, and Twitter’s token will replace equity to capture greater value on the Twitter ecological network. The token price reflects the supply and demand relationship between the ecological network and the token.

(from: https://dune.com/hildobby/NFTs)

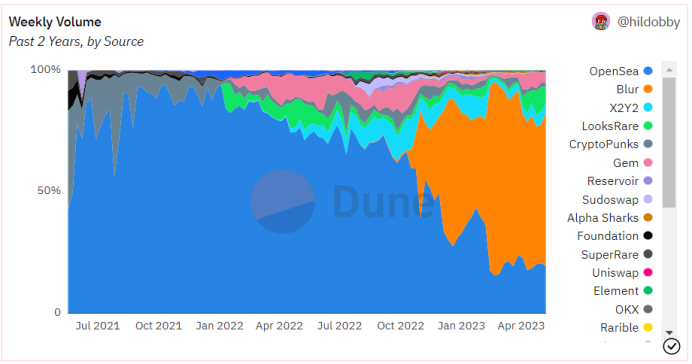

(2) Opensea and Blur

Opensea, once the world’s largest NFT trading platform, raised $300 million in funding from Blockingradigm and Coatue in January 2022, with a valuation of $13.3 billion. Opensea’s cash flow is mainly supported by its transaction fees. These types of projects can be understood as typical equity financing projects in Web3, and in many ways, traditional business models can be applied to them. Investors capture the value of the company’s future cash flows, and equity investment is more desirable.

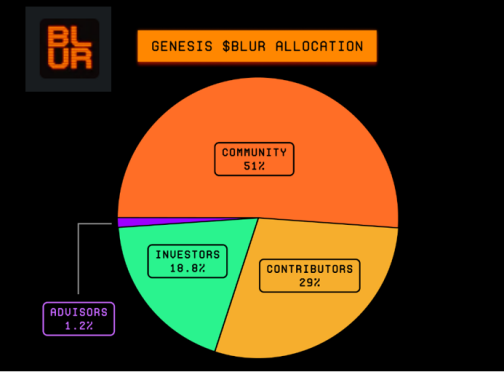

In March 2022, Blur secured funding of $11 million from Blockingradigm. In the face of Opensea, Blur activated its community a year later (by airdropping tokens to community participants) and started the liquidity feast of the NFT market, achieving a bend overtaking of the network effect of Opensea. Projects like Blur can be understood as typical token investment and financing projects in Web3, where investors capture the network effect of the Blur ecosystem. The larger the ecological application and user volume, the higher the market demand for the functional token, and the price of the token depends on the value discovery of the market.

However, considering the stagnation of the Blur token after listing and the limitations of the Token function, it can be seen that designing the token function and token economic model well is the key to the long-term operation of the project .

(from: https://docs.blur.foundation/tokenomics)

Therefore, it can be seen that the purpose of Web3 project investment and financing is to capture the value of the project, and the difference lies in where to determine the value and how to capture it.

IV. Conclusion

The significant improvement of the value liquidity of Web3 projects has raised higher requirements for the project party. They need to be able to describe the future model and token economy of the project relatively clearly in the white paper financing stage, otherwise it will be difficult to connect with the subsequent SAFT and development plan.

Therefore, in the early stage of the project when the model has not yet been determined, equity financing + token clauses (SAFE + Token Warrant/Side Letter) can also be used to solve the purpose of SAFT avoiding US securities regulation, and provide a way for the project to obtain equity financing, while retaining the possibility of token financing.

There are many ways, but Web3 projects must generate value, otherwise it is all just empty talk.

——END——

This article is for learning and reference only, and I hope it will be helpful to you. It does not constitute any legal or investment advice, not your lawyer, DYOR.

Reference:

[1] HashKey Group, Web3 New Economy and Tokenization White Paper

https://www.hashkey.com/cn/insights/web3-new-economy-and-tokenization-whitepaper

[2] Cooly, The SAFT Project: Toward a Compliant Token Sale Framework

https://www.cooley.com/news/insight/2017/2017-10-24-saft-project-whitepaper

[3] Beita Research | Equity vs Token: Investment Model and Value Capture

https://mp.weixin.qq.com/s/TqgqIon3Ijq77yCe1wx5ZA

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Technical Guide | Teach you how to build a commercial DAO without a bank

- LikeCoin wait 21 days to cancel the delegation? Talk about Cosmos's proof of bound equity BPoS

- Bitcoin Technology Weekly: Statechain, Schnorr signature and BIP322

- Technical Guide | IPFS Relationship Genealogy, Technical Framework and Working Principle

- Technical Primer | GHAST Rule Upgrade (Part 1)

- Why is Filecoin different? IPFS founder talks about its proof system

- Technical direction: Bandwidth optimization in transaction forwarding (1)