Valuing DeFi tokens? Look at the head DeFi token price-earnings ratio and future value analysis

Written by: Lucas Campbell at Fitzner, a blockchain consulting and DeFi rating company

Source: Chain News

In traditional finance, the price-to-earnings ratio (PE) is a simple formula used by investors to evaluate the relationship between a company's future growth expectations and its earnings.

By definition, a price-earnings ratio is the market willingness to pay $ x for every dollar a company makes. For example, Netflix's stock belongs to the high-tech sector and its price-earnings ratio is 84.2 times, which means that the market is willing to pay $ 84 for every $ 1 that Netflix makes.

- Will the addition of Canadian e-commerce Shopify bring new hope to Libra?

- CME Bitcoin futures trading volume plunges 89% in three days

- Free and Easy Week Review | Bitcoin Issuance? Ethereum determined to change the PoW algorithm? These rumors are not credible!

Generally speaking, the price-earnings ratio is an effective tool for evaluating capital assets. Capital assets, such as stocks, bonds, and real estate that generate rental income, bring investors cash flows based on future returns.

With the rise of DeFi in 2019, many new currency protocols have emerged on Ethereum. Many of these currency agreements generate cash flow by charging a small fee. These cash flows are used to allocate directly to participants in their ecosystem or to destroy their native tokens to increase scarcity.

Destroying native tokens does not seem to be the most effective mechanism to directly benefit holders. However, destroying tokens means that holders' share of the blockchain network or protocol increases, which is actually equivalent to dividends.

Since most of these license-free currency agreements are accumulating cash flow, then, as an effective tool, P / E ratios can also be valued for native tokens because they have similar properties to traditional capital assets.

Considering that crypto assets are still new, the price-earnings ratio is not a perfect tool or valuation method to measure its value, but it does provide a simple framework for examining the value gap between these tokens.

From the perspective of crypto assets, the price-earnings ratio formula can be written as follows: circulating market value / annual return

DeFi Token Revenue Analysis

Fortunately, friends of Token Terminal have already done most of the errands. They have collected cash flow data for many well-known currency protocols (Chain News Note: see tokenterminal.xyz).

Here's a bit of background on the currency protocols we've picked, and how they accrue costs in use.

- Synthetix: An issuance agreement for synthetic assets. SNX holders can pledge their token SNX and earn fees through Synth transactions.

- MakerDAO: In multi-collateral Dai, the spread between the Dai deposit rate and the stable rate is used to destroy MKR tokens.

- Kyber Network: KNC tokens are used to pay token transaction fees. A portion of KNC will be destroyed and removed from the circulation supply forever. The remaining portion will be allocated to the reserve manager who pledged KNC.

- 0x: The fee is denominated in ETH, generated from the token transaction, and distributed to the liquidity provider who has pledged ZRX in proportion.

- Nexus Mutual: The insurance amount (ETH and DAI) after the insurance expires will be placed in the fund pool, thereby increasing the value of NXM tokens.

- Augur: When REP holders honestly report the results of any of the forecast markets, they will earn fees denominated in ETH (daily settlement soon).

- Aave: loan origination Make assignments. The agreement fee is for the destruction of LEND tokens.

- Uniswap: All transactions on Uniswap will incur a fee, which will be allocated to each liquidity provider in each liquidity pool.

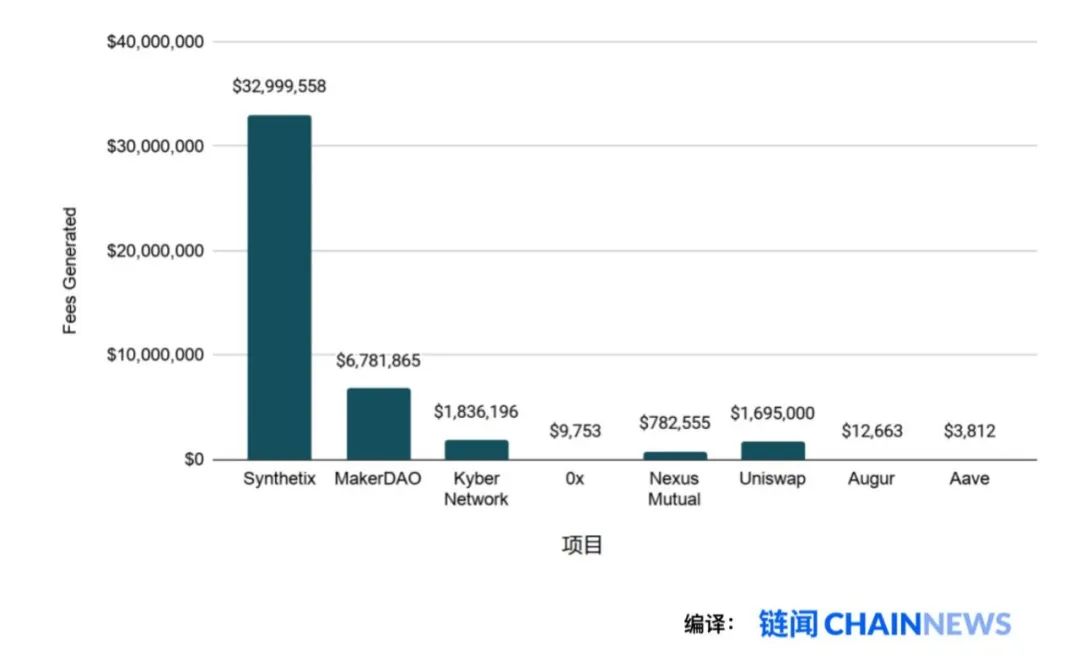

Annual revenue of each currency agreement, data source: Token Terminal

Snythetix

Looking at the annual cash flow of each major currency agreement, we will see that Synthetix is clearly ahead of the curve, with annual fees incurred through Synthetix.Exchange approaching $ 32 million. Simply put, Synthetix charges a fixed 0.30% fee for all Synth transactions. These fees are prorated to SNX holders, who provide collateral for the corresponding Synth.

Maker

Despite the highest market capitalization and the basis of other currency agreements, MakerDAO generates only $ 6.7 million in annual revenue through stabilization fees. After the recent shift from single mortgage Dai to multi-collateral Dai, the introduction of the Dai Deposit Rate (DSR) has also changed the MKR's destruction mechanism.

DSR allocates the stability fee accumulated by the system's outstanding debt to Dai holders, whose Dai is locked in a smart contract. There is a spread between the DSR and the stable rate, which is currently 0.25 and is about to increase to 0.5% (DSR is 7.5% and the stable rate is 8%).

The cash flow obtained from the spread is used to purchase and destroy MKR tokens, which is equivalent to bringing a general dividend to the governor of this important system, namely MKR holders.

Kyber and Uniswap

Kyber and Uniswap are the two largest DeFi license-free liquidity agreements and the other two that generate seven-figure annual revenue.

For Kyber, part of the fee is used to destroy Kyber's native token KNC, and the rest is allocated to the reserve manager. It's worth pointing out that Kyber's upcoming Katalyst upgrade will change the mechanism for cost accumulation, allocation, and destruction in the system.

Another well-known license-free liquidity agreement, Uniswap, is a tokenless system whose fees are allocated to liquidity providers that pledge ETH and other token pairs in a pool of funds.

Nexus

Another currency agreement that has performed fairly well in cash flow is Nexus Mutual, a decentralized insurance agreement. Nexus Mutual operates based on a binding curve, and users can purchase insurance for those well-known value storage smart contracts. Its insurance coverage covers a certain smart contract, and during the insurance period set by the user, it protects its losses due to hacking or system vulnerabilities. If the insurance expires without a claim, the ETH and DAI used to purchase the insurance will be put into the capital pool, which increases the value of the NXM token.

0x, Augur, and Aave

Finally, there are several major currency agreements: 0x, Augur, and Aave. The three receive very few fees, which are more shabby compared to their market capitalization. Aave is new and we can ignore its accumulated costs. However, both 0x and Augur have been on the Ethereum mainnet for quite some time. 0x recently updated its token economic model, allowing liquidity providers to pledge ZRX to receive fees denominated in ETH. Augur is waiting for its upcoming v2 upgrade. At that time, it predicts that the market's capital pool will be denominated in DAI, and will no longer be a volatile asset like ETH. This transition, as well as several other improvements, should be able to Increase the use of this decentralized prediction market platform.

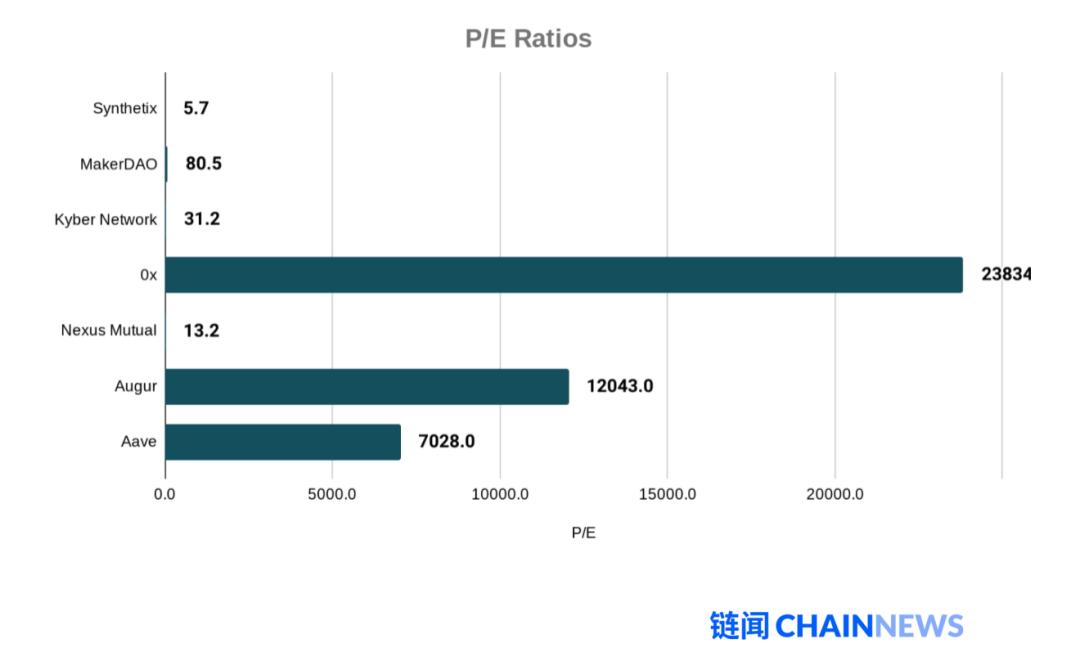

P / E ratio comparison

The above has explained how these protocols generate cash flow, and the following is the price-earnings ratio of these well-known DeFi tokens. (Please note that a high P / E ratio means it is overvalued!)

P / E ratios of various well-known currency agreements

It can be seen that, in terms of both traditional financial assets and crypto assets, Synthetix and Nexus Mutual have relatively low price-earnings ratios of 5.7 and 13.2, respectively. These two tokens are driving emerging open, license-free financial products (synthetic assets and insurance). Considering this, the future growth potential of these two currency protocols may be underestimated by the broad market.

Next is Kyber Network, whose 31.2 times price-earnings ratio is reasonable and worthy of praise, which is similar to Microsoft's 30.27 times price-earnings ratio. Kyber Network established its leading position in the DeFi license-free liquidity agreement in 2019, but this growth has not been fully reflected in its currency price. In the coming months, how the upcoming upgrade of the network (a reshaping of the token economy) of the network will affect its currency price is worth looking forward to, after all, it is one of the decentralized exchanges with the highest transaction volume.

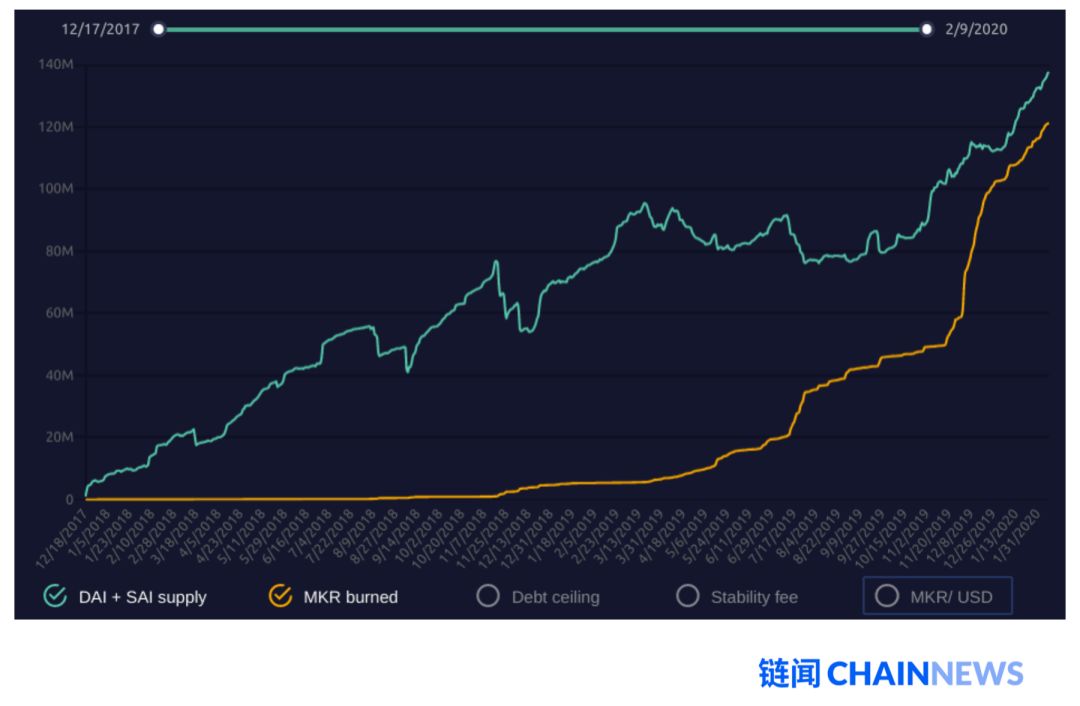

MakerDAO's price-earnings ratio is 80 times, which is comparable to the current price-earnings ratio of many high-growth stocks. With more than 12,000 MKRs destroyed and more than 100 million DAI in circulation, MakerDAO has grown vigorously over the past few years and continues to play the mainstay of DeFi development.

Charts from MakerBurn

MKR's dollar-denominated price has stagnated, mainly due to the bad trend of ETH over the past few years. However, if it is priced in ETH, MKR's performance is actually good, and since January 2018, the asset has increased by 124% in ETH.

Other token-based currency protocols, 0x, Aave, and Augur, have a price-earnings ratio that is too high to be incredible in traditional capital markets. We can think that these protocols either need to gather more users to generate higher cash flow, or they need to redesign their token economic mechanism to capture more value from their use and protocol fees.

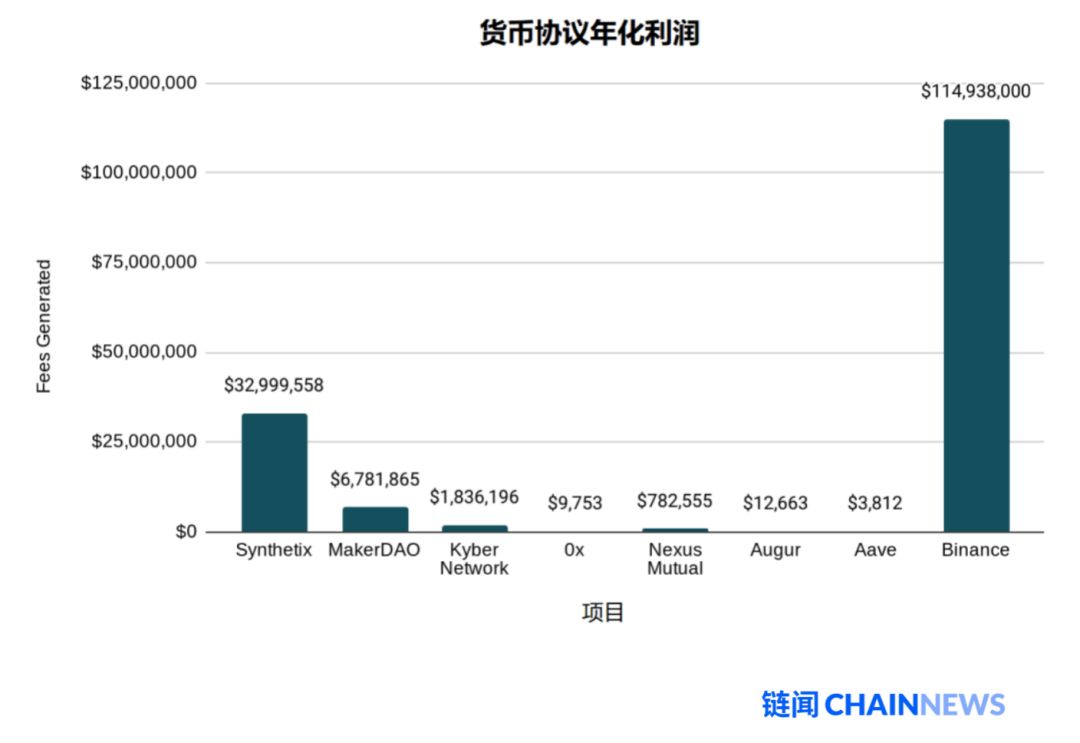

Compared with centralized finance

Although various open and license-free currency agreements are exciting, we also see token strategies such as Binance Coin (BNB) initiated by major “crypto banks” such as Binance.

Each quarter, Binance will use a portion of the profits generated by its operations to destroy BNB, which provides BNB holders with a dividend based on their quarterly profits. There are some controversies in the community regarding the implementation of BNB destruction (not buying and destroying BNB from the open market, but buying and destroying from the ICO reserve that is not in circulation). Nevertheless, this approach does provide some clues, allowing us to compare a centralized, licensed crypto bank with those decentralized, license-free currency agreements, such as annual revenue. In this regard, Binance has left those DeFi protocols far behind.

Over the past four quarters, Binance has taken approximately $ 115 million from its profits to destroy BNB.

Its annual income of 115 million US dollars is allocated to BNB tokens, and the circulating market value of BNB is 2.83 billion US dollars. From this calculation, the price-to-earnings ratio of BNB is 17 times. As one of the most highly valued tokens in this field, this multiple is quite reasonable.

Although the amount of income is impressive, it is worth noting that BNB holders do not enjoy the same legal protection as securities holders, and the right to maintain the value of BNB by destroying tokens is not protected by law. As the provisions of the Binance White Paper on token destruction have changed, we have seen problems in this regard. Therefore, investors should always be alert to the centralization risks of these token systems.

Few people noticed that Binance revised its white paper last summer to no longer destroy BNB based on profit. Research reports made by agencies such as Arca and Messari were inaccurate, but Zhao Changpeng happily retweeted and interacted with them. They are now destroying BNB based on the transaction value.

Larry Cermak @lawmaster

Welfare: Two Thought Experiments

What if the market value of DAI reaches $ 400 billion?

I explored the possibilities of Dai in a variety of hypothetical scenarios in Bankless's newbie article, "Possibility of ETH to be worth a trillion dollars." If Dai can capture a small share of the global money supply, Dai in circulation needs to reach billions (if not trillions).

So, how will MKR be affected in these scenarios? If you keep the Maker's current P / E ratio, spread rate, and Dai's liquidity unchanged, you can calculate the price of MKR in these scenarios with just a little arithmetic.

The formula for calculating the MKR price is: circulating market value = return × P / E ratio

If Dai captures …

1. 51% of Argentina's M1 money supply = $ 13 billion

2. 1% of US M1 money supply = $ 40.3 billion

3. 10% of US M1 money supply = $ 403.4 billion

If we assume …

- Spread: 0.25%

- Price-earnings ratio: 80

- MKR supply: 1,000,000

So, the result is …

If 10% of US M1 currency circulation is captured, it means that the price of MKR will exceed $ 80,000. (MKR is currently at $ 609)

In my last article, these numbers only gave you the impression that MKR may be valued in the future and also suggested that this should be cautiously skeptical. The predicted price of this MKR does not take into account the MKR tokens destroyed in the past, but simply calculates the fully diluted MKR supply. In addition, Dai's deposit interest rate, stable fee rate, and corresponding spreads may change.

And, if these numbers mature, the P / E ratio will change. If Dai's share of the current money supply continues to grow (the share that may be captured in the future will also become smaller), as future growth expectations decline, investors' price-earnings ratio for MKR may decline.

Of course, the opposite may also happen-if Dai's image as a global license-free stable value storage tool is successfully established, the market will think that its growth opportunities are still considerable, and investors may give MKR a higher price-earnings ratio.

What if Uniswap issues tokens?

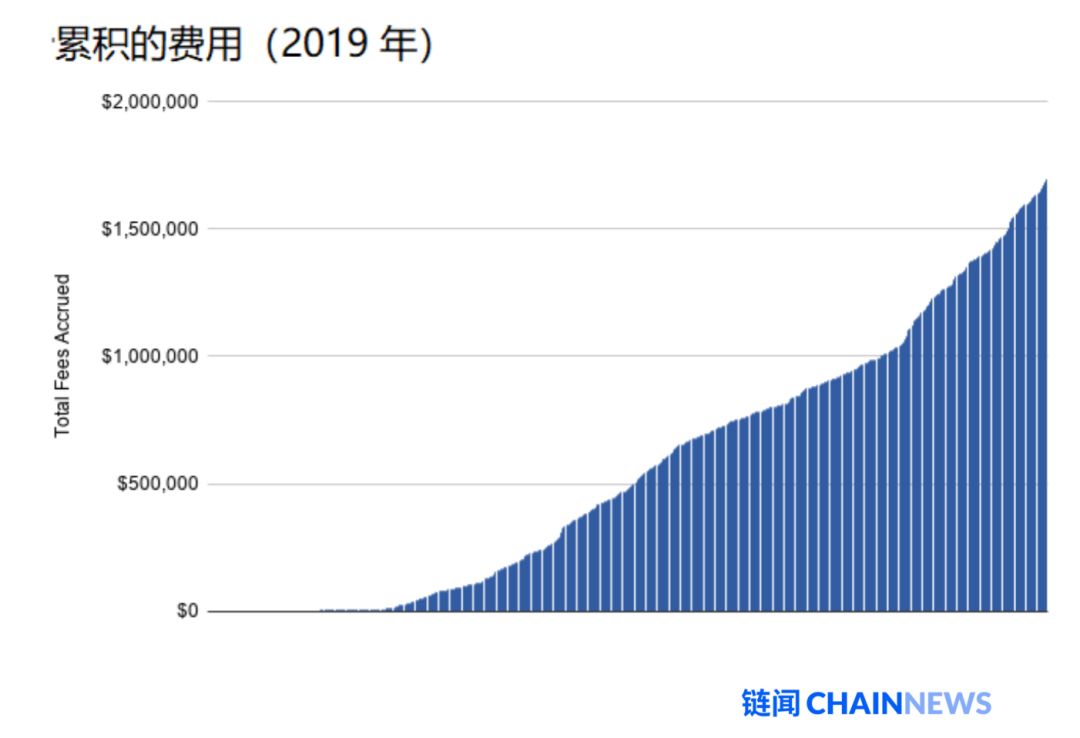

Uniswap quickly became one of the leading license-free liquidity agreements on Ethereum. In 2019 alone, Uniswap has accumulated $ 1.69 million in fees. Uniswap has allocated millions of dollars to its liquidity provider, and despite this, it currently does not have its own native token.

Uniswap leads to $ 1 billion? Source: DeFi Rate

We assume that Uniswap decides to integrate a native token into its protocol in the future. So, what is its "fair price", and where can it stand in terms of market capitalization?

First, let's design a fast token economic model for Uniswap, accumulating value from its transaction fees, such as:

To become a Uniswap liquidity provider and have the right to benefit from the cash flow of the agreement, users must hold a certain amount (assuming x) of UNI tokens.

This design is not elegant, but simple enough. UNI stands for the right to receive Uniswap's accumulated transaction fees.

Based on the current annual revenue of 1.69 million US dollars, what level can UNI's circulating market value reach?

Its most direct competitor, Kyber Network, has a price-earnings ratio of 31 times. Based on this price-earnings ratio, Uniswap's tokenized circulating market value will reach $ 52.39 million. Due to the explosive growth of Uniswap in the past year, investors are optimistic about its future prospects, and its price-earnings ratio can be higher. Let's jump up to 50 times.

Calculated at a price-earnings ratio of 50 times, Uniswap's circulating market value will reach $ 84.5 million, exceeding Kyber's current market value of $ 76 million.

Just to be happy, let's mention the P / E ratio of 100 times (this is less than half of Tesla's P / E ratio). Uniswap's circulating market value will reach US $ 169 million, which is close to the levels of other DeFi protocols such as Auguste (approximately US $ 158 million) and Synthetix (approximately US $ 185 million).

in conclusion

Most currency agreements generate cash flow and have similar characteristics to traditional capital assets. Therefore, for DeFi tokens, the price-earnings ratio is a meaningful indicator.

The point is that it is impossible for DeFi tokens to accumulate currency premiums (maybe SNX can), as they are mainly used to promote related agreements and are not used as reserve assets or value storage.

Therefore, it should be fair to evaluate these DeFi tokens using the lens of traditional capital assets. Tokens like Synthetix and Nexus Mutual have fairly low P / E ratios, which means that their usefulness is higher than their market value. This shows that either they are generally undervalued by the market or their future growth expectations are very low (this is unlikely, after all, DeFi is still in its infancy and has great potential).

On the other hand, tokens like Augur and 0x have ridiculously high P / E ratios, which means that these currency protocols need to go through a difficult time to accumulate a large amount of cash flow before they can match their market value. Crypto investors either overestimate these assets or have extremely high expectations for their future growth.

In any case, looking at various DeFi tokens from the perspective of price-earnings ratio can give investors a clearer understanding of the utilization rate of these protocols and potential investment opportunities.

It is also obvious that we have a long way to go in terms of cash flow to compete with crypto-licensing banks that need permission, and even further against traditional financial companies.

Original link: https://bankless.substack.com/p/are-defi-tokens-worth-buying

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion | Bitcoin price bull market could last 1,000 days

- Bank of England: Central banks should consider developing CBDC to counter the tech giant ’s lead in digital payments

- DeFi Trust Crisis: Rethinking the bZx Incident

- Compared to Nielsen's ten possibilities, what impact does a blockchain product have on the experience?

- Eliminate voting fraud, Seoul, South Korea will launch blockchain voting system on March 1

- 24 U.S. companies and the U.S. Food and Drug Administration have completed a blockchain pilot in favor of using blockchain to track prescription drugs

- Research: Over the past ten years, 24 crypto networks have processed more than 3.1 billion transactions and transferred funds of $ 4.6 trillion