Chinese digital currency vs. Swedish Krona: similar technology forks

Last week, the Bank of Sweden announced that it has begun testing e-krona and plans to conduct technical tests until next February. On January 10th, the WeChat public account of the central bank released “Inventory of fintechs for the central bank in 2019”, saying that the central bank basically completed the top-level design, standard formulation, functional R & D, and joint testing of legal digital currencies. ——This news shows that the technical problems of the central bank's digital currency have been resolved and are ready to go.

Different from the "petroleum coins" and "gold coins" issued by some countries in the past-digital currencies that are secured by property rights, China's digital currency and Swedish electronic krona are based on national credit, which is the specific digitalization of credit currency. In fact, their emergence is more significant.

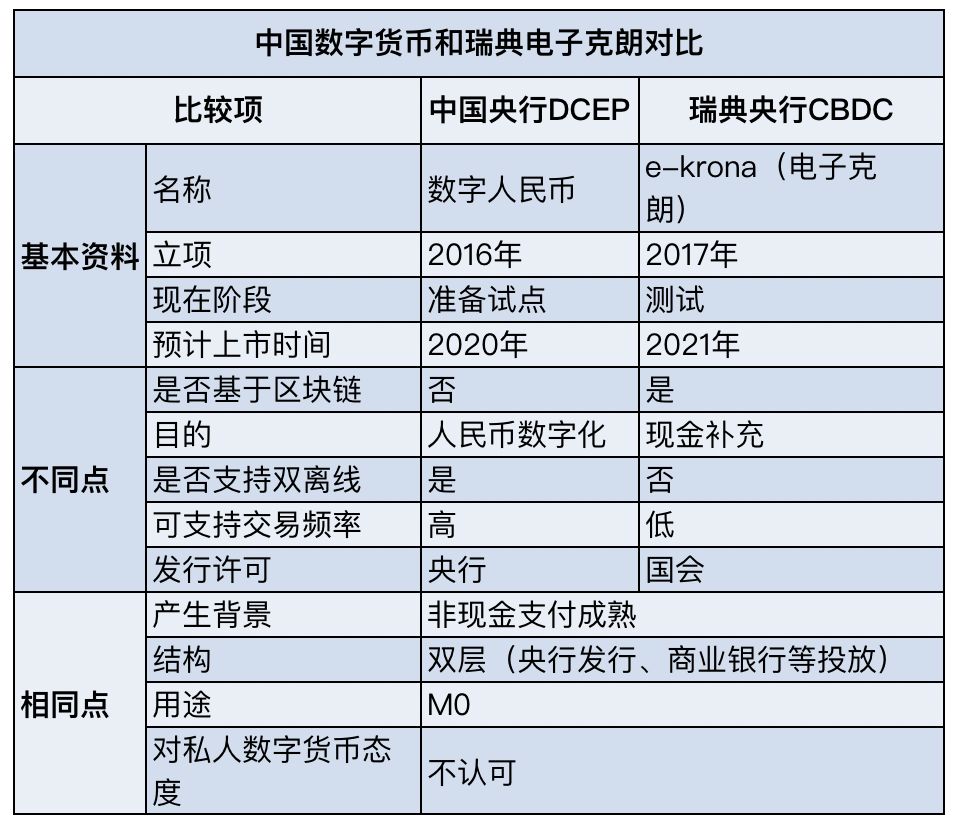

The Chinese digital currency and the Swedish electronic krona use two completely different technological routes, which provide different solutions for the future issuance of the global central bank CBDC.

- DeFi this year: There is not much time left for other public chains

- Daily trading volume of CME Bitcoin futures hits lows for the year, the market remains bullish

- Japan's Finance Minister: China's central bank's digital currency may pose great risks

Products of the times

In December 2016, the Digital Currency Research Institute of the People's Bank of China (the People's Bank of China) was established, marking that China's official digital currency is officially on track. Also in 2016, the United Kingdom, Canada, etc. also carried out specific research work on central bank digital currencies, but for various reasons, the United Kingdom, Canada, etc. have slowed down the development of digital currencies. On the contrary, the Swedish central bank, which initiated the project one year later, came later (in mid-March 2017, the Swedish central bank officially launched the digital currency project).

China and Sweden are currently the leading countries for central bank digital currencies. (Although Turkish President Recep Tayyip Erdogan directed at the end of last year that the government should complete the test of the national central bank's digital currency (CBDC) by 2020. From a technical perspective, there will be some difficulties.) This may be It is related to the stages of currency development in China and Sweden.

China and Sweden have become two benchmarks in global payments.

China leads the world in mobile payments. According to the "Global Consumer Insight Survey 2019" released by PricewaterhouseCoopers, in the global context, China uses 86% of mobile payments, ranking first in the world. Behind China are mostly neighboring countries of China, including Thailand, Hong Kong, Vietnam, Indonesia, Singapore, the Middle East, Philippines, Russia, Malaysia and so on.

Sweden is the number one in the world in terms of cashless usage. The World Payment Report 2018, compiled by consulting and technical services company Capgemini and BNP Paribas, shows (as of 2016) that Sweden ranks first in cashless use. Followed by all developed countries, including the United States, South Korea, Finland, Australia, Denmark, the Netherlands, the United Kingdom, Luxembourg and so on.

According to statistics, in 2018, only 2% of Sweden's consumption amount was in cash, which means that 98% were through other payment methods.

The above two statistics respectively represent the two camps of mobile payment and credit card payment. China and Sweden are leaders in the two camps. This provides the soil for the unremitting research and application of digital currencies in both countries. Imagine a society that still uses cash as the main means of payment. Tell users that these numbers on your mobile phone are your money. Can users be assured.

There are many similarities between the digital currencies of the two countries. For example, they are designed as a two-tier structure, that is, the central bank issues and commercial banks put in place. This will not change the current currency placement path and system, which will fully motivate the market, and it is also the path where digital currency can smoothly produce resistance .

Digital currencies in both countries are used for M0, replacing some cash, and will not replace M1 or the broad currency M2. This is because M1 and M2 in both countries have been digitized, and the ins and outs can be tracked.

The central banks of the two countries also have stereotypes about privately issued digital currencies such as Bitcoin and Ethereum. For example, the Swedish central bank believes that the concentration of digital currencies in private institutions will affect social development in the long run, and the social payment system is vulnerable to shocks.

The People's Bank of China believes that due to the characteristics of anonymity, low cost, cross-regional, decentralization, high proliferation and high volatility of privately issued digital currency solutions, it is very easy to impact the payment system, economic operation and financial stability. And influence.

Currency fork

From the perspective of human history, currency technology tends to be unified. From a variety of natural currencies (shell, bone, stone), to metal building currencies (bronze, iron, gold, silver), and then to printed banknotes today, the "unification" of global currencies has been completed.

However, the Chinese digital currency and the Swedish electronic krona use different technologies, which are likely to form a big fork of global digital currency technology.

According to the information learned so far, the central bank's digital currency does not use blockchain. The article "Development and Management of Blockchain Technology" published in "China Finance" on February 21 at the Digital Currency Research Institute of the Central Bank clearly stated: "Blockchains sacrifice at the cost of simultaneous storage and co-calculation of a large amount of redundant data. Because of the system's processing efficiency and some of the customer's privacy, it is not yet suitable for high-concurrency scenarios such as traditional retail payment. "And many scenarios of M0 are used for retail payment. From the perspective of digital currency related patents issued by the central bank, it is still a centralized system.

The Swedish electronic krona explicitly uses a distributed ledger (blockchain). According to the February report of the Bank of Sweden, the country's digital currency project was led by Accenture and built on Corda, the blockchain alliance R3. (At present, the market is still divided on the relationship between distributed ledgers and blockchains, but the Swedish central bank believes that they are the same thing. as block-chain technology. ")

In 2017, the Swedish central bank also doubted whether the blockchain could be used for digital currencies. In 2017, the first report of the Swedish central bank on electronic kronor pointed out that blockchain is "a weak, troublesome and untried technology. -Central bankers worldwide considering the issuance of digital currencies have not yet determined whether to use this technology. "

In that year, the blockchain technology did encounter Waterloo in the digital currency field of the central bank. The Bank of Canada did experiments, and the digital currency based on the blockchain was not easy to use. The Bank of Canada published its report "Central Bank Digital Currency: Motivations and Implications". The report concludes that the central bank's digital currency based on blockchain has been slammed, including that the system is not as good as a centralized system, without cost savings and high security risks.

The Swedish central bank's final choice to use blockchain may be related to the emergence of Corda and meeting financial needs. Corda is "most bank-like" of all distributed ledger platforms. It is from the hands of banking businessmen. The architecture design has fully considered the complex requirements of interoperability and interoperability between commercial banks and commercial banks, and between commercial banks and their commercial customers, especially for banks. There is a deep understanding of the requirements for legal compliance and sound operations within an organization. For example, Corda can realize regulatory intervention, which is reflected in Corda's following technical links: (1) Licensing, which can propose real name system requirements, set access conditions, and implement regulatory requirements through certificates and name services; (2) Operational links, which can Give the supervisory node access to the local database on all nodes and obtain all transaction data to achieve a "see-through" effect; (3) In the emergency treatment link, specific nodes can be given the privilege of emergency treatment operations, including but not limited to suspending transactions and correcting Error trading, etc.

In terms of performance, Corda also has advantages. The financial clearing center in the United States has performed performance tests on various major blockchains. Corda and Digital Assets can be expanded to 6000 TPS in 5-6 hours. The other two projects, Fabric and Quorum, have crashed directly.

However, compared with Chinese digital currencies, the electronic krona may still lag behind in terms of large-scale transaction performance.

Another significant difference between the digital currency of the People ’s Bank of China and the electronic krona is that the digital currency of the Chinese central bank supports dual offline payments. The electronic krona does not seem to consider this at all. This means that in a transaction environment with no network and network congestion, China's digital currency technology has an advantage.

It is worth noting that in January this year, the Bank of Sweden, the European Central Bank, and the Bank of England formed a Central Bank Digital Currency (CBDC) group to jointly evaluate the possibility of CBDC. The group also includes the Bank of Japan, the Bank of Canada, the Swiss National Bank and the Bank for International Settlements (BIS). If the electronic krone test works well, it is likely to be used by the developed countries.

It remains to be seen whether China's digital currency technology standards can be exported globally and whether two major digital currency technology camps will form.

references:

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Jiang Zhuoer: Why is Core persisting in trying to issue additional BTC?

- Viewpoint | Using Blockchain Technology to Improve Infectious Disease Early Warning System

- G20 Finance Ministers' Summit: Reiterating Regulation and Review of Global Stablecoin

- How is the blockchain landing? Global experts from Asia, Africa, and the United States answer your questions

- If Bitcoin does not take off as expected, what should miners do after halving?

- Decentraland first experience: virtual world based on Ethereum

- Viewpoint | Historical data inventory, see the evolution of Ethereum