Viewpoint | The market is just around the corner, the bear market is coming to an end?

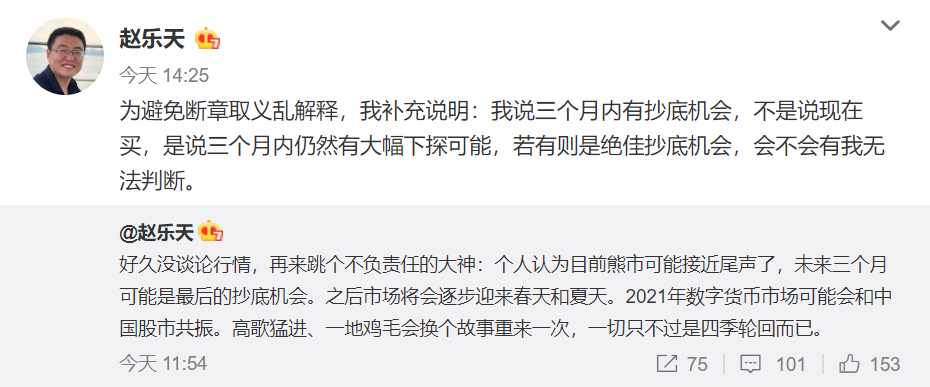

The currency circle big V Zhao Dong released Weibo said that the bear market may be coming to an end. Before discussing this issue, we should review the August issue from different aspects and understand the development of the industry from the details, which may help to make more accurate judgments.

The market continued to fall this summer. As Bitcoin fluctuates repeatedly under the $10,000 mark, the altcoin has been struggling to keep its position. It is encouraging to see that most people do not see it as a catastrophic blow, which may be a sign of an expected increase in the second half of 2019.

First, the market

- Interview with FISCO BCOS Zhao Zhenhua: Meeting the distributed business with open mind

- ConsenSys Announces Decentralized Financial Project "Codefi" to Promote Ethereum Enterprise Adoption

- Cryptographic currency lending: Innovation or emulation?

As the market continues to fall, the dominance of Bitcoin has risen, hovering around 70%. The demand for altcoin has been low, prompting investors to re-examine the main markets.

Despite this, due to the active development of DApp, we are more likely to start seeing the adoption of products in the near future. So, this may be a good time to gold in the top 200 of Coinmarketcap's market capitalization.

The market value of the entire cryptocurrency market peaked at the beginning of August, just below $320 billion, and then fell back to its lowest level since June 10 this year, at a level of about $245 billion.

After a very strong start in August, Bitcoin buying began to disappear above $12,200, and Bitcoin subsequently fell, with the decline ending on August 28, when the dollar fell to $9,300 for bitcoin.

In September, a major technological breakthrough is brewing, which may form a long-term trend in the coming months. At present, there is no attractive content in the mid-term technical aspects of Bitcoin, which allows many traders to exit the transaction until a breakthrough is confirmed.

In the past month, the performance of the altcoin is also very heavy, and no one has survived the bearish market. Litecoin, Ripple and Ethereum may have been verified in the July monthly report, which makes the possibility of a recovery this month very much expected.

Litecoin suffered an expected decline and the price fell to the $60 area, which led to its short selling and unpopularity.

Ripple also has room for a rebound, although technical analysis suggests it may fall further before a clear recovery.

Since the market was in a bear market last month, the top 100 cryptocurrencies have undergone many changes and new currencies have entered.

If we consider bitcoin price changes as a breakthrough, volatility may also improve, which is likely to translate into increased market activity and increased participation in the entire digital currency industry.

Second, the super currency

Facebook Libra this summer triggered a lot of discussion. Every aspect of the legal and business world is full of excitement, fear and strong opposition.

It seems that the project may be losing support. Nonetheless, this super-money concept, which will serve as a medium of communication in everyday life, continues to attract companies around the world.

Telegram was quiet for a long time after hyping its ICO. Recently, it has once again become the focus of news. It seems that investors may start receiving tokens in the near future, which may change the cryptocurrency market. Its main network is expected to start on October 31, which will stimulate a round of FOMO and FUD.

The catching news so far is that its token TON will be compatible with Ethereum. The founder of Telegram has a good entrepreneurial experience in social media projects, so it may not be wise to exclude TON from competition, although it seems that it is late.

On the other hand is the cryptocurrency supported by the government. Although the attention brought by the Petro experiment in Venezuela may have subsided, the rumors about the introduction of cryptocurrency in China have caused widespread concern.

Forbes reported that it is expected to distribute the digital currency through seven major institutions including Alibaba and Tencent in the coming months. However, the People's Bank of China has refuted this.

Whether in the capital and mining participation and the potential to adopt cryptocurrencies, China has an important position in the cryptocurrency industry. However, state-backed cryptocurrencies will run counter to the core idea of cryptocurrency supporters.

Many in this field believe that there will be many successful cryptocurrencies in the future, not just one. Initiatives like Libra and state-backed cryptocurrencies may pose a threat to this vision.

Third, the macro side

As the encryption market matures, it will inevitably be linked to other global markets. As the Sino-US trade war situation becomes severe, investors are once again looking for a safe haven for their capital.

Bitcoin has long been likened to gold, so its investors naturally exhibit a pattern of behavior like gold. Some studies have even shown that Bitcoin has a better risk-adjusted return than gold. As the stock market is under pressure, investors may be adding cryptocurrency assets to their diversified investments.

However, it should be noted that the use of gold as a hedging instrument (especially against inflation) has been reviewed, and even bitcoin may face similar criticism.

In addition, in August, the performance of the S&P 500 actually exceeded Bitcoin, so it is important to be cautious. Bitcoin may be an interesting attempt in diversified investments, but it should be cautious.

Fourth, the institutional and retail side Bakkt was finally approved by the US Commodity Futures Commission, and the officially delivered BTC contract is expected to be launched on September 23. Given the expectations of what the platform is doing this summer, this may ultimately be disappointing in terms of recent price changes.

Every cryptocurrency investor is looking for signs of institutional funding, but it seems unlikely that there will be many follow-up situations alone. As regulatory and trading solutions improve, it is more likely that the organization will gradually enter the market over time.

On the retail side, Monolith is developing a new Visa debit card that allows users to pay with DAI where they accept Visa payments. Making password currency easy to use is critical to its popularity, and bank cards can be a user-friendly way. V. Security incidents

Some notable events occurred last month. The KYC data of the currency was leaked. Although it is not clear whether the legality of the data is still available, Coin has already provided a lifetime VIP membership as compensation for the victim.

This is not the first security issue encountered by the currency security, but it is worth noting that the exchange seems to be able to deal with problems quickly and protect the interests of customers.

Coinbase, the US competitor of the currency, also encountered security problems. An error caused the customer registration data to be stored in clear text in the internal web server log. Coinbase contacts the affected customer to make a password change. Again, they quickly took action to correct the mistake.

However, this further increases opposition to centralized exchanges and hosting schemes. If more events continue to occur, decentralized exchanges may begin to attract more attention.

Bitcoin's lightning network may also contain security holes. Developer Rusty Russell reported the vulnerability, but the details of the problem and the scope of the impact are uncertain.

There is also a drop in bitcoin and Ethereum prices on BitMax.

Events such as this highlight the fragility of the cryptocurrency market because it is susceptible to liquidity and manipulation problems.

Sixth , the funding side

August witnessed some large inflows of capital inflows or preparations for investment. Coinbase acquired Xapo's hosting business to strengthen its position as a leader in the industry. Coinbase has been actively preparing to defend its territory and expand as Coinbase is going to offer 30 tokens in the US.

Circle is looking for a $100 million venture capital fund for its crowdfunding platform, SeedInvest. Alan Howard and his investment firm Elwood Asset Management are launching a $1 billion fund dedicated to investing in cryptocurrency hedge funds.

This may be a good sign. In a weak market, institutional investors may not be able to invest easily. Therefore, the fact that major players in the market are adjusting funds to support institutional investors may mean that they expect significant events in the second half of 2019.

It is worth noting that despite the market downturn in 2018, many projects still have large sums of money. These funds will need to be invested in the project's ecosystem sooner or later. When the market starts to improve, these projects can make full use of their funds and better development. Seven Outlook

After a bullish spring, this summer witnessed the horizontal and downward changes in the market. But unlike 2018, this did not affect the development progress of infrastructure participants and project parties. Therefore, there are indications that this is the integration period of the industry.

This industry needs new players and new capital to continue to move forward. This won't happen overnight, but how quickly this process will happen, the industry seems to have broken its expectations. This shows the growth and maturity of the market.

In the short term, the second half of this year can prove to be very important to this industry.

District Brother Comments:

The recent market bitcoin solo dance, the market value accounted for 70% of the total market value of cryptocurrency, the cottage currency fell, and constantly create a new low for bitcoin, this wave of market alone favors bitcoin.

After Bitcoin reached a high of $14,000, it oscillated back and forth, falling below $100 million several times, but it was once again tenaciously breaking through $100 million and oscillating at the key position of $10,000.

Since September, the voices of the media and the media have thought that there will be major events happening, but the short-term market is unpredictable. The district brother does not encourage you to buy coins. Investment is an important matter and should be treated with caution.

The currency circle big V Zhao Dongfa Weibo said that the bear market may be coming to an end. What do you think of this? Do you think the bear market is coming to an end?

-END-

Source: SIMETRI.

Translator: Chuan, special author of the Blockchain Learning Society.

Disclaimer: This article is the author's independent point of view, does not represent the position of the Blockchain Institute (Public Number), and does not constitute any investment advice or suggestion , the image source network .

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Defeat the dry season: Will the miners' northward move be smooth in 2019?

- Wu Jihan's latest speech: Analysis of the market, space and time factors affecting the marketability of Bitcoin

- The overlord of the bank blockchain! JPMorgan blockchain network IIN will absorb 400 banks worldwide by the end of the year

- The oversold rebound is not strong, BTC is about to face the direction

- Non-serious discussion on blockchain finance from "self-tearing" (1): ideal and reality

- Clone coin or anchor coin: look at the stable currency classification from another perspective

- Switzerland publishes official guide to stable coins, what does this mean for Libra