Why is Facebook's GlobalCoin so important?

Why GlobalCoin is so important because it does a lot of things that people in the currency want to do but can't do it for the time being.

Since entering 2019, we seem to have become accustomed to the fact that more and more well-known Internet companies around us are starting – not already in the layout – but running into the blockchain era. From Ant's blockchain innovation contest 1 , Tencent's "Catch the demon together" 2 , then Amazon's Amazon Managed Blockchain 3 , Microsoft's ION 4 . Until last week, Chainlink announced a partnership with Google to bring BigQuery to Ethereum 5 …

But there is no doubt that the most far-reaching impact of all these events is Facebook's GlobalCoin. In this regard, Mr. Meng Yan's article has been very well discussed yesterday, and I will add some supplements here.

- The back of the Facebook Stabilization Coin program is actually Ruibo?

- Facebook cryptocurrency project Libra Chinese white paper (full text attached download)

- On the line for 16 days, the lock warehouse is 1.6 billion. Why is the ILO so bad?

(By the way, there is the Facebook Hackercup qualifier today.)

Internet company's Fintech Arms Race

The Internet company's Fintech layout has been around for a long time, but both domestic Internet companies 6 and Amazon, Microsoft, and Google mentioned above. But everyone seems to be at the stage of a tentative technical defense, building some infrastructure – and this time Facebook has clearly taken a step forward.

In this regard, I would like to first highlight two recent less noticeable details, and they are all directly related to Payment.

Apple Card

- With Apple Card, Apple is ready to transform into a "small bank"

- Design Analysis of Apple Credit Card Apple Card

- Apple redesigned the credit card. Can it redesign debt?

At the Q1 spring new product launch this year, Apple released a lesser-looking "hardware" product, the Apple Card. This is considered by many analysts to be a signal that Apple has entered the Fintech field. There are also a lot of articles here, and I have listed some of them at the beginning of this section.

The conclusion is that we have become accustomed to the fact that credit cards still have so many opportunities for disruption.

Uber

- This should be the most complete Uber "death" file in history, but the "hard" Uber still hasn't fallen down |

- Uber listing: an era in Silicon Valley is over

- CNBC, Uber is making a fintech push with a New York hiring spree

- After the high-level exchange of blood, Uber attacked financial technology! Wall Street shouts to buy

From 2017 onwards, Uber has been plagued by internal and external troubles. Next door, Google’s pro-son, Lyft, rushed to his former IPO. Although he has set the issue price at the bottom of the range, he still has not escaped the fate of breaking. Even some people shouted in Silicon Valley. An era is over.

But even in this situation, we still see Uber starting to layout like Fintech. Although there is no exact news yet, what Uber is going to do. However, from the 25-man roster 7 that The Block Crypto has released, we still see the names of Uber and Lyft.

Credits: Facebook's cryptocurrency partners revealed—we obtained the entire list of inaugural backers

Zuckerberg's big unification ambition

This time, Facebook, finally surpassed, directly on it's 3.0.

I started at the end of last year and said that the overall transformation of the big app will increase the number of digital currency users by 20 times from the district of 20 million, which will increase the market value of digital currency by 100 square meters (10000 times). Thanks to facebook! Unfortunately, there is no chance to be a node.

—— Kong Huawei, former director of the Institute of Computing Technology of the Chinese Academy of Sciences

Libra

According to the latest news, GlobalCoin is only the internal code of FBCoin, which was widely circulated in a report in the BBC last month. The final name is Libra.

Libra was the first goddess of justice in Greek mythology. Astraea used a balance for the good and evil referee for human beings. Astraya held a balance and held a sword in one hand. With the invasion of the Romans, this image gradually merged into Roman mythology and became the Lady Justice we now know. Since the 16th century, this image has begun to blindfold, but not as a demon hunter to perceive evil, but to be impartial.

A statue of the Lady of Justice in the 18th century in Malta.

In addition to the courts that often appear around the world, this image has also appeared in some French currency.

Cambridge analysis

Life springs from sorrow and calamity; death comes from ease and pleasure.

– "Under the Mencius

The motivation for Facebook to launch the digital currency program is relatively simple. It is a direct response from the Facebook decision-making layer to the 2018 privacy leak scandal.

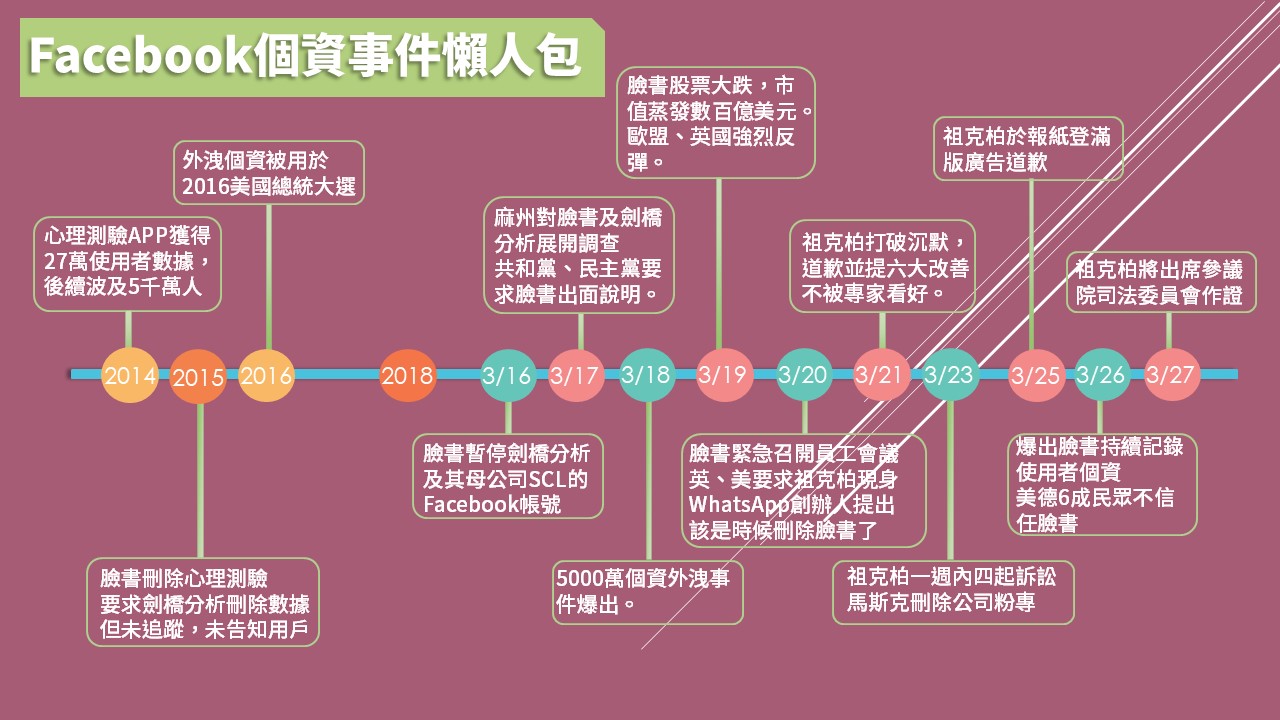

The scandal broke out in March 2018. At that time, internal lines were revealed to the US media. Facebook violated the user agreement and provided privacy data of more than 50 million users to a big data analysis company, which may affect public opinion and political voting. Due to the unique political climate in the United States under Trump, this incident has been repeatedly magnified, and the facts about Facebook's various violations of user privacy data have been exposed one by one. The arrogant Zuckerberg and his main assistant, Sandberg, were taken to the US Congress hearings in turn, and a large number of retired employees turned their backs, and the media fell into disarray. Even his former entrepreneurs also publicly suggested splitting. Facebook. In this case, Facebook's prospects have been cast a shadow for the first time since its creation in 2004.

The recent trip to Europe deepened Zuckerberg’s worries about Facebook’s future. In May 2018, the General Data Protection Act, the GDPR, entered into force in the EU. At the same time, Zuckerberg attended two hearings in the European Parliament and was questioned. The first was relatively mild, while the second was murderous. Subsequently, Zuckerberg was almost arrested for refusing to go to the UK for questioning, making him clearly aware that in the United States, especially in Europe, Facebook's current business model will face a fundamental threat.

—— Meng Yan, Facebook Digital Currency: Origin, Significance and Consequences

Zuckerberg’s past year has not been easy. The privacy leak scandal mentioned by Teacher Meng Yan is the famous Cambridge Analytica event. The entire Cambridge analysis event began in 2014 and was revealed in 2018, as the media directly accused Facebook because it directly influenced and manipulated the elections of Trump and Hillary in 2016, resulting in a large number of Democratic voters mapping their resentment on Facebook and Zuckerberg himself. This scandal directly caused the current market value of Facebook to evaporate tens of billions of dollars. Not only that, but Zuckerberg also had to face the blame of shareholders and the public directly, and he even had a hard time (when I visited Facebook that year, I saw a Hillary wearing a spacesuit on the table, To the Moon's hand…).

Credit: Facebook's personal event is a complete reunion lazy package

The regulatory and legal environment for Internet-based services and applications has changed considerably over the past decade. When large-scale social networking platforms first became popular in the 2000s, the general attitude toward massive data collection was basically "why not?" This is what Mark Zuckerberg said, "The era of privacy is over," Eric Schmidt argues: "If you have something that you don't want anyone to know." Maybe you shouldn't do it from the beginning." They argue that this is personal: the data you get about every bit of other people is a potential potential for machine learning. And each limit is a weakness. If there is any problem with the data, the cost is relatively small. Ten years later, the situation has changed a lot.

Some trends are particularly worth focusing on.

– Privacy In the past decade, a large number of bills on privacy have been passed, not only in Europe but also in some other places, and the most recent is GDPR. The GDPR contains many components, the most prominent being: (i) the requirements for explicit consent, (ii) the legal basis for processing the data, (iii) the right for users to download all of their data, and (iv) the user requesting the deletion of all their The right to data. Other jurisdictions are also exploring similar norms.

- Data Localization Rules Russia and many other jurisdictions are increasingly developing or are exploring rules that require domestic user data to be stored domestically. Even if there is no clear law, people are increasingly worried (for example, 1 2 ) that data is being transferred to countries that do not adequately protect data.

- Shared economic regulation Uber and other sharing economies have long struggled to convince courts that their applications control and direct the extent of driver activity, and they should not be legally classified as employers.

- Cryptographic Monetary Regulation The recent FINCEN Guide attempts to clarify which categories of cryptocurrency-related activities are subject to US regulatory approval requirements and which activities are not subject to this restriction. Is it a managed wallet? This is regulated. Do you have a wallet for users to control their own funds? Unregulated. Running an anonymous transaction obfuscated service? If you are operating, you are regulated. If you are just writing code… it is not regulated. —— Vitalik, Control as Liability

Https://www.facebook.com/photo.php?fbid=10104969495512951&set=a.529237706231&type=3&theater

The ensuing trip to Europe exacerbated Zuckerberg’s sense of crisis, and two days after Zuckberg issued this status, GDPR came into effect. Facebook's business model has begun to face unprecedented challenges.

As Mencius said, "born in sorrow and succumb to happiness." "The most effective way to inspire major change and innovation is to push a person who has great resources and vision and courage to desperate." So we started to see Facebook start to build its own blockchain team on a larger scale, and saw Zuckerberg’s 2019 personal goal, but to my surprise, Zuckerberg’s plan turned out to be A stable currency.

The specific decision-making process has not yet been known to the outside world, but Zuckerberg made this decision, on the one hand, the situation, and on the other hand, it also highlights its personality and courage. In all fairness, digital currency is not the natural choice for Facebook, and it is not the safest and most reasonable choice. In 2018, Facebook's net profit reached $25 billion, with more than 2.6 billion users and a market capitalization of more than $500 billion. He stood in the industry's commanding heights with the world's largest user base and endless cash. If it's safe, Facebook can go with other giants in e-commerce, cloud computing and even search. Even if you want to do financial technology, there are a lot of traditional mature models to choose from. It can be said that Zuckerberg finally chose blockchain encryption digital currency as the main direction, which is extraordinary. It has surpassed the simple meaning of “finding the road” and must have higher strategic goals.

—— Meng Yan, Facebook Digital Currency: Origin, Significance and Consequences Zuckerberg once again educated us about what is "Move Fast and Break Things".

Non-state predictions about currency

We envisage that abolishing the government's currency monopoly will prevent the repeated episodes of severe inflation and deflation that have plagued the world for more than 60 years. After exhaustive investigations, it is also a powerful medicine for treating a more ingrained disease: periodic depression and unemployment, which was once considered to be the inherent and fatal flaw of capitalism.

– Hayek, "Non-State of Money", Ch25

It is generally believed that a country must provide its own unique and proprietary currency by its government. Once we successfully liberate ourselves from this dogma that people generally and unconsciously accept, there will be countless emerges immediately. The most interesting question that has not been examined before.

– Hayek, "Non-State of Money", Preface

Just as many amazing discoveries in the history of mathematics begin with a re-recognition of an inherent concept (rational, imaginary, non-Euclidean etcs), and so is our understanding of money. In Hayek’s last economic monograph, “Non-State of Money – An Analysis of the Theory and Practice of Multi-Currency,” it reads: “Since the free competition in the general commodity and service markets is most efficient. So why can't we introduce free competition in the currency field?" Hayek then proposed a revolutionary proposal: "Abolition of the central bank system, allowing private money to be issued, and free competition, this competitive process will find the best currency."

For us, is this world not strange? Today's Crypto world is constantly engaged in this kind of competition.

However, soon opponents will think that one of the big problems that today's bitcoin can't be popularized on a large scale is the violent fluctuation of its currency price. From this perspective, it is clear that this FBCoin is closer to the "non-state currency" described by Hayek in the book.

But of course I don't think it's necessary to be so pessimistic. After all, we can see more things than the predecessors today. Using smart contracts to build stable coins on an encrypted asset is actually not difficult to achieve from a technical point of view. Things, Currency is just an application built on Crypto. Of course, monetization is the most important battlefield of the old and new world.

Impact on the world of Crypto

At the end of the article, Mr. Meng Yan discussed the impact of FBCoin on China. Here, let's discuss the impact of FBCoin on the Crypto world.

A war for adoption?

- Will Facebook's "Libra" cryptocurrency outcompete Bitcoin?

First of all, I think it's really not the target user of FBCoin – unless there is any decent killer application this year – otherwise I think we can't migrate it for a while. This part of the user was not yours now, and War couldn't talk about it.

However, users who are first attracted to FBCoin will be more easily absorbed by the Crypto world. From this perspective, FBCoin will have a huge boost to the entire industry, which is almost certain, and the angle of view should be extended, and ultimately it should be Crypto.

Facebook's cryptocurrency will turn out, in the end, to be a Trojan horse that benefits bitcoin. — What Facebook's Cryptocurrency Means: 6 Predictions

Regulatory && Compliance

FBCoin has done a lot of demining work in terms of regulatory compliance. Once successful, I believe that many multinational Internet companies will start to join this wave. Moreover, this "TrustCoin" obviously has a greater impact on national currency than Crypto. Revisit the industry and accelerate the construction of laws and regulations. Over time, the Regulatory threshold will become lower and more standardized.

Openmind && Diversity

All existing blockchain technologies are basically implemented in this game, except that it is a private chain. This is one of the most successful blockchain applications, but it is not "politically correct." In this game, when users play, they can't feel the blockchain, and Tencent will not make this thing a gimmick.

Therefore, if the future blockchain wants to really push into the public, you can't just stand on the concept of "political correctness", but to meet some universal needs. This demand may be very tacky. For example, I want to drive a very cheap but full-powered sports car. For example, if I want to make money, this is a very simple demand. You can't rely on an idea to make this thing the world.

—— X-Order founder Tony Tao: The monetization of digital assets is very important

This is the process that Jobs was questioned after returning to Apple at the Apple Global Developers Conference a few years after he was expelled from Apple.

– the fragment that Jobs was questioned

A few days ago, I saw on Facebook that some netizens shared the fragments that Jobs was questioned. I think it is worth every entrepreneur to read it again. After I saw it, I felt so excited.

Gavin Wood previously gave a speech at a conference in Berlin introducing TheDAO fork, citing an English proverb, "if all you have is a hammer, everything looks like a nail.", although in a different context. But I think it is also very suitable here.

Of course, I know that Lightning Network and Plasma are very good, but relying on this technology alone is difficult to achieve user growth. So we saw that there are 21 super nodes EOS – at least it's Develop Friendly… but it seems that it can't grow. Now we have seen FBCoin with 100 "super nodes", each with a face and a face, and people are still a stable currency, and then bring billions of traffic…

Yesterday I was on the push and saw that Bitcoiner said:

Bitcoin's killer feature is moon. Libra won't have this. Moon is a product of the unique supply/demand dynamics of the first perfectly scare asset.

We'll drink from Libra's milkshake

— https://twitter.com/parabolictrav/status/1140141080794423296

I don't think so. The currency that no one uses will degenerate into gold (and possibly degenerate into a shell). Imagine why Steam was going to get off the Bitcoin payment at the time. Probably this is the Toxic Culture described by @TheBlueMatt, but there are still people who are soberly pointing out these problems. Chairman Mao once said that we should pay attention to the enemy in "strategic contempt for enemy tactics", which is probably what I want to express.

Freemarket of Currency

In the end, the entire "money industry" players have become more, now in addition to the French currency, Crypto, joined the multinational company TrustCoin in between. All currencies will be pulled into a unified free market to compete, and fierce competition means faster evolution.

The revolution is bottom-up, and the non-stateization of money will be realized in this century.

(Source: Andromeda Technology)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 40 crypto-securities companies are blocked in applying for licenses in the US. What is behind the delay in FINRA?

- Depth | Viewing blockchain governance from the rights pledge mechanism of Polkadot and Cosmos

- Babbitt column | Bank is just the beginning: blockchain will transform these 55 industries

- Research Report | The main currency calculations have hit record highs, and the trading volume is expected to hit the peak again during the year.

- Market Analysis: BTC is only a stone's throw from the million mark

- 7 things we need to know before the Facebook cryptocurrency white paper is released

- Market Analysis: Bitcoin is high, short-term risks and opportunities coexist