Is an exchange losing $ 250 million in cryptocurrencies a Ponzi scheme: Quadriga Bizarre Story

Written by: Nathaniel Rich

Translator: Zhan Juan

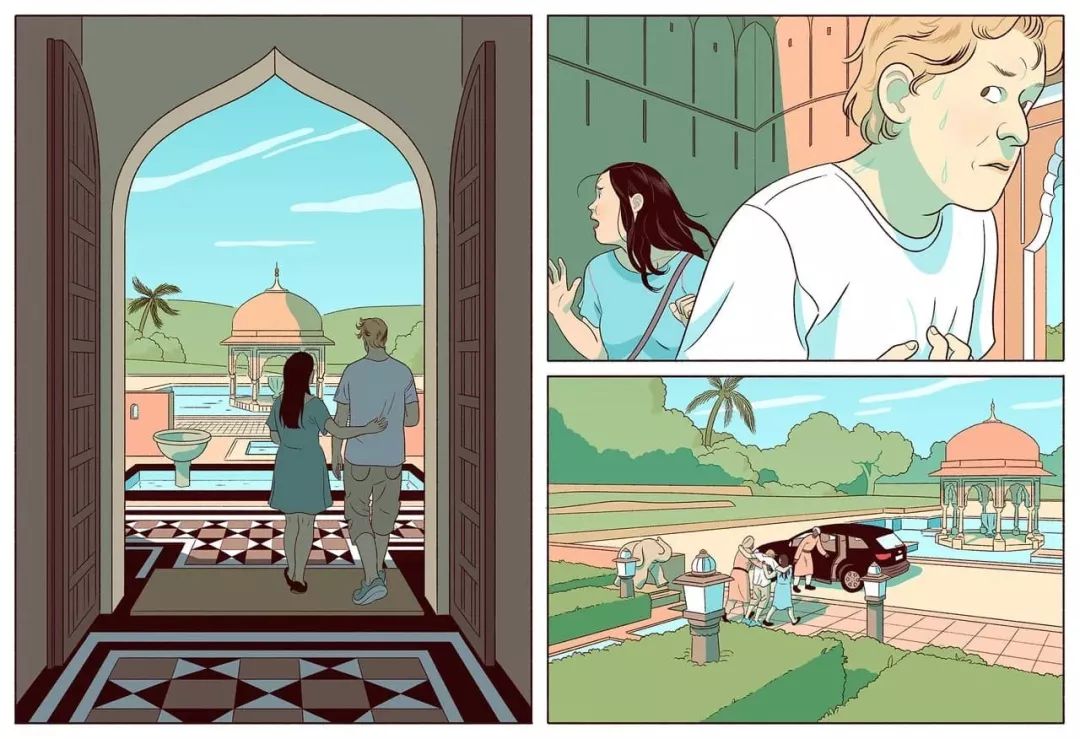

Illustrator: Bianca Bagnarelli

Original article published in Vanity Fair magazine

- Opinion: Excessive speculation that privacy coins will die

- Babbitt launches "strict selection platform for industrial blockchain", 3 major services help technology landing

- The impact of blockchain on China's macroeconomic future, Zhu Min answered me like this

Source: Chain News

Last year, when Canadian blockchain geek and founder Quadriga founder Gerald Cotten died unexpectedly, hundreds of millions of dollars of investor funds disappeared into the crypto world. But when banks, law, and the power of Reddit tried to track the cash, it turned out that the young tycoon might not be what he claimed.

"At the mercy of the waves"

In the summer of 2017, a smiling boy came to Sunnybrook Yachts, after the price of Bitcoin reached an all-time high and tripled in 5 months. Sunnybrook is the largest yacht brokerage company on the east coast of Canada. Its clients are mostly surgeons, litigation lawyers, and corporate executives who travel from Toronto, Paris, and Hawaii to Nova Scotia for the summer; their wives wear silk clothes and Manolo heels, and their nails are perfect-that ’s I just made $ 300 at the salon the day before.

This smiling boy is extraordinary. He was wearing a crumpled golf shirt, overalls, and worn open-toed sandals. He was appallingly young, with light brown hair, pale complexion, and seemed to have never seen the sun since adolescence. He took his girlfriend and the girl drove his own jeep. The impression they make on yacht salespeople is that you are more likely to see them in a Walmart parking lot than in an upscale restaurant.

The most striking and evil thing is that this young man always seems to be smiling. It was a gentle, calm smile. It reassures strangers; it also makes him carefree. It's hard to imagine that this trait was artificially designed, but then, when people found that almost everything on him was purely artificial, you had to be skeptical, and the smile he kept hanging on his mouth might just be this Part of the content.

However, he was very serious this summer. Smiling boy wants a big ship.

"What is your use?" With a sense of subtlety unique to this industry, the yacht salesman asked. Yacht salespeople never ask customers "how much do you want to spend", nor do they ask if they have ever been on a yacht, let alone whether they would sail a yacht. He sketched the future: the customer was already a proud captain, and he sat across a luxury yacht and swam in the turquoise sea.

"I want a boat. I can drive it locally," said the smiling boy. "Then sail south." He hoped that he would sail directly to the Caribbean without stopping in Canada or the United States.

The salesman explained that in this case, the yacht would be equipped with a fuel tank and a desalination system for drinking water. They selected a custom Jeanneau 51 with pink and cream interiors, three cabins, an area for six people, a dishwasher, a gas stove, a washer and dryer, The master bedroom has a shower and a pool with teak wood. The salesman asked if he wanted to equip the life raft with an electric motor. The smiling boy reached out to his Tesla on the dock parking lot and said, "Of course it is fine. I like electricity."

The entire ship cost $ 600,000, but he didn't mention money at all-all he cared about was safety. He named his ship "Gulliver", and the hero in the novel gave himself to the arrangement of fate, leaving the waves to follow the flow.

After dozens of hours of sailing lessons, the yacht salesman learned something about his customers. His name was Gerald Cotton, but everyone called him Gerry; his girlfriend, Jennifer Robertson, was a property manager; when the Gulliver passed through Ma Hong On the islands and shoals of the Bay, her two Chihuahua dogs enjoy sunbathing on the deck.

Corton bought a nearby four-acre island that was surrounded by black sand that summer. He asked someone to cut down the trees and build a house, but he didn't reveal his intention to move to the island for a longer stay. The couple live in a three-bedroom unit in the Fall River north of Halifax. The Fall River is a wealthy suburb just recently developed, near a long black lake surrounded by a dense forest. In addition, Corton owns a third property in Kelowna, British Columbia's wine region; his fourth home is in Calgary; and 14 other rental properties in Nova Scotia, including Bedford Every house on a one-way street. He also has a Lexus, a powerful single-engine Cessna 400, but he has never tried to fly it himself. The couple often travels abroad, and they plan to donate a house for 12 children in an orphanage in India. Corton said that in India, the Canadian dollar exchange rate is a good deal.

Corton rarely mentioned his work, but details slowly surfaced.

He is the founder and CEO of Quadriga, Canada's leading bitcoin exchange-a status similar to TD Ameritrade in the cryptocurrency space. His MacBook Pro never leaves, this is the guy he eats. Once he landed it on the Gulliver and waited until the yacht had left the dock to remember it, which made him hysterical for a while. He had Crohn's disease and seemed to live on hummus; when others were drinking beer, he drank a few bottles of apple cider to make fun. He likes flying: airplanes, helicopters, drones. He seems to be the kind who might retire early and live quietly on an island.

In the summer of the next year, Coton returned to sailing class, but he was not as diligent as before. He is very busy. Then, in December, Robertson called Sunnybrook Yachts and explained that Gree died suddenly while they were on their honeymoon in Jaipur. She wants to sell the Gulliver. A month later, the Canadian national media began to report on this matter, and the article emphasized another detail: Corton is the only person holding the password for the Quadriga Fund account-including cryptocurrencies and cash, with a total value of about $ 250 million. No one knows how to find that money.

The yacht salesman has many questions, although his job is not to ask questions. More than 75,000 Quadriga users also have questions.

The Nova Scotia Supreme Court declared the company bankrupt and chose Ernst & Young as a third-party regulator to protect Quadriga creditors' lost funds. The Royal Canadian Mounted Police, the FBI, and at least two other law enforcement agencies that have not disclosed their identity, one of which may be a Japanese national agency, have begun further investigations. However, the most effective and thorough surveys to date have been conducted by anonymous accounts on Twitter, Reddit, Pastebin, and Telegram. Although their findings are quite technical and tortuous, they can be reduced to four words:

Gerry wasn't dead.

"He is not an evil guy"

The earliest description of Corton appeared in February 2018, when Quadriga announced his death through a Facebook post, and the description here is in line with the impression of the yacht salesman.

Cotton is a computer enthusiast. He entered the right industry at the right time and achieved even more success than his wildest imagination. His experience is generally bland, at least if his interest in a decentralized currency system is taken away, that is indeed the case. They live in a suburb of Belleville and own a large brick house on a quiet street.

Known as the "Friendly City", Belleville is a seaside community between Toronto and Montreal, known for cheddar cheese. In 2010, he graduated with a honours degree from the Schulich School of business of the University of York in Toronto with a bachelor's degree in business administration. His parents own an antique store; Cotton has decided to enter the cryptocurrency space.

A few years after graduating, Corton moved to Vancouver and joined a club community of entrepreneurs obsessed with Bitcoin. At that time, more than a dozen individuals formed a core group called the Vancouver Bitcoin Co-op, organizing gatherings in coffee shops and dormitories. Coton was a frequent visitor at these gatherings. For most of Bitcoin's early followers, what attracted them most to this digital currency was the spirit of libertarianism and its commitment to decentralization, transparency, speed, and independence from governments and financial institutions. Bitcoin will enable more than 2 billion people without access to banking services to send and receive money; it will bring stability to citizens in countries with currency chaos; and it will eliminate all bank fees.

Cotton knows these buzzwords and talking points, but he seems most interested in the speculative possibilities of Bitcoin. The first Bitcoin block was born on January 3, 2009, and on May 22, 2010, Bitcoin gained economic value. This day is called "Bitcoin Pizza Day." On that day, a man in Florida A person in the UK was paid 10,000 bitcoins, who helped him order two pizzas from the Papa John store. This kind of pizza sells for about $ 25 each, so the price of a bitcoin is set at a quarter of a cent. (As of press time, this pizza is worth $ 82,373,500.) As a result, Bitcoin, like any other currency, has become a huge illusion: its value comes from the belief that it has value.

In April 2013, when Corton appeared in Vancouver, the price of Bitcoin had risen to $ 266. But if you lack the corresponding technical reserves and sufficient patience, it will be difficult to buy and sell. 70% of global Bitcoin transactions are conducted through Tokyo's Mt. Gox exchange, so to trade, you must first send a bank wire transfer to Japan. Because Canadian banks do not want to be involved in Bitcoin, users have to transfer money through a series of intermediaries, which will cost a lot of transaction fees. "It's hard to buy bitcoin in Canada," Cotton said in a 2014 interview in his cool, vivid, and curious tone. "You can't connect your bank account anywhere. This is really a challenge."

In November 2013, Corton co-founded the Quadriga Token Exchange (QuadrigaCX) with his older business partner Michael Patryn, who later explained that the name was taken from the Roman Empire with four Horse-drawn chariot). Patrin is an expert in currency trading and is passionate about Brazilian Jiu-Jitsu and luxury cars.

In a small and inefficient market, Quadriga quickly stood out. It is the cheapest, fastest, and seemingly most secure Bitcoin trading platform, and it was the first to obtain a currency service business license from Canadian anti-money laundering agency FinTRAC. Quadriga installed a Bitcoin ATM in its office, the second Bitcoin ATM in Canada, which can accept gold paid by users and is priced in ounces. Investing through Quadriga is even a patriotic act: "People are very satisfied with our headquarters in Canada, and they know where their money goes." Corton emphasized this in several interviews. Quadriga went live on December 26 of the year.

Through his reputation in Vancouver, Cotton has earned the trust of Bitcoin enthusiasts, where he became the head of the Bitcoin Cooperative. He started hosting weekly meetings in Quadriga's office. Quadriga sponsors local Bitcoin conferences and education events, and an investment of $ 500 or $ 1,000 can generate immeasurable goodwill. Generally, Quadriga is the only Bitcoin company willing to pay for sponsorship. "From our perspective, we need Quadriga," said Andrew Wagner, then director of public relations for the cooperative. "Without them, our activities cannot be continued. But it also puts us in a particularly vulnerable position."

Although Cotton is always quick to live, he always feels alienated in social situations, making it difficult for him to establish close relationships with others. He seems to prefer people to keep close acquaintances instead of becoming friends. Fortunately, his generosity to some extent compensated for this alienation.

"He's always smiling and very friendly, bringing tea and water to everyone," said Alex Salkeld, a member of Vancouver's original Bitcoin circle. In January 2014, Salkard posted a video on YouTube in which Coton gently taught his young daughter to operate a Bitcoin ATM machine; Salkard was convinced that his two-year-old daughter is to date By far the youngest buyer of Bitcoin. Cotton said he had a helicopter license and was willing to take Sokeld on a lap. But he never cashed in.

In February 2014, six weeks after Quadriga launched, Mt. Gox suddenly suspended operations, claiming that hackers had stolen $ 473 million from customer accounts. A year later, CaVirTex, Canada's largest exchange, announced the closure, also for hacking reasons; the second largest exchange, Vault of Satoshi, also closed the same week. Overnight, Quadriga became the dominant Bitcoin market in Canada. The following year, the company launched a bid for listing on the Canadian Stock Exchange and submitted a complete financial audit report. "We were excited to be able to provide unparalleled transparency," Corton said at the time.

Quadriga raised nearly $ 850,000 in private capital, but after arguing with one of its major investors, Cotton eventually abandoned the effort. Quadriga's entire board resigned, and Cotton became the only full-time employee at Quadriga. Despite some additional pains — a software failure that resulted in a $ 14 million loss, after Cotton failed to file an audit report, the British Columbia Securities Commission issued a trading halt, and CIBC failed to determine After its legal owner, $ 21 million was confiscated from one of its payment processors-Quadriga is still profiting madly from the dizzying rise in Bitcoin. In 2017, as the price of Bitcoin soared to nearly $ 20,000, Quadriga processed nearly $ 2 billion in transactions for 363,000 personal accounts. This exchange takes a commission from each transaction.

On December 9, 2018, Coton died, and as a loyal believer in cryptocurrency, his reputation has not been affected. Nevertheless, the eulogy was very meaningful; at one point, these words hinted at darker possibilities. "He's not an evil guy, he's cautious and pragmatic," said Freddie Heartline, the founder of the Bitcoin cooperative, when asked about the disappearing huge sums. Another cooperative member, Michael Yeung, dismissed the argument that Cotten was only in the business to make quick money, saying, "He is planning for the long term."

In February, the Canadian Broadcasting Corporation interviewed Michael Patlin. He was described as "a former business partner who met Cotton on the web 5 years ago." "He's like a ray of sunlight," Patlin told the interviewer. "This guy always laughs stupidly. He always jokes about it all the time. He always says that he can't open up to many people, but he treats me honestly."

When asked where he was, Patlin said he was traveling between Thailand and Hong Kong.

"They want revenge"

"Everyone is a genius," Einstein said. On Reddit, every user is Einstein. The outstanding case has attracted amateur detectives, who search the Internet for clues. The most valuable advantage of amateur players is time. Law enforcement has advantages in almost all other areas: crime labs, informants, surveillance technology, forensic databases, arrest warrants. However, the situation reversed when it came to the huge sums Quadquaa lost. About 76,000 people have accounts on Quadriga, and some of the most technologically superior accounts hold hundreds of thousands of dollars or more. The rise of Quadriga and Bitcoin was largely driven by the speculation of some novices who heard something about cryptocurrencies from their nephew or cable news, and their enthusiasm was immediately ignited. And in Canada, almost every cryptocurrency expert has a Quadriga account. They used to believe in Corton, but now they feel betrayed. They want answers. They want revenge.

At the same time, traditional law enforcement agencies have only the most vague understanding of this issue. The questions posed by the RCMP are naive enough to shock the experts interviewed. "This is completely beyond their capabilities," said a Quadriga creditor and cryptocurrency expert who previously published his findings under the pseudonym QCXINT. "I spent several hours on the phone explaining the basic situation to the RCMP investigator. When I hung up, I still felt that what he wanted to see was a corpse, a loaded gun, and a Blood on the beach. "

The court-appointed regulator was Ernst & Young, which hired cryptocurrency experts but was widely mocked for a series of errors.

These errors began shortly after Corton's death. Shortly after controlling Quadriga's remaining funds, approximately $ 1 million was "inadvertently" transferred to an account, but Corton's death rendered the account inaccessible. In addition, the scope of investigation by the monitoring staff is limited. Its goal is not to track every lost bitcoin, but to maximize the funds that can be returned to Quadriga creditors.

Miller Thomson of Bay Street Law Firm has been appointed as an attorney for this type of creditor, and for months he has received hundreds of emails asking for financial losses every day, as well as answering one after another Phone—Creditors are distressed by their lost pensions and college savings. In the background of the phone, a baby is crying—but the team of lawyers can do nothing about it. Because Ernst & Young's investigation costs are collectively borne by creditors, it makes no sense to spend resources on highly uncertain investigations without a guarantee of success.

But indignant creditors-or true believers who believe Quadriga's collapse poses a threat to the integrity of cryptocurrencies-need not face such constraints. Bitcoin is built on the principle that no individual or institution should be trusted. Every Bitcoin transaction appears in a public ledger, that is, on the blockchain, and anyone who can access the Internet can check it. Within hours of the announcement of Cotton's death, an investigation using blockchain logic and methodology, through crowdsourcing, and a rigorous record of each operation began.

In the public narrative that appeared at the time, the most important information came from a detailed survey by the Globe and Mail of Canada. The article introduced that Coton was on the ninth day of his honeymoon in India and was in Jaipur. The five-star hotel Oberoi Rajvilas suffered an illness shortly after. He was taken to a private hospital where he was diagnosed with acute gastroenteritis. The next afternoon, his condition worsened, and blood tests revealed that he had septic shock. Before the doctor could stabilize his vital signs, his heart stopped beating; he briefly woke up, but then his heart stopped again. He was pronounced dead just 24 hours after the onset of stomach pain.

The official cause of death was "complications of Crohn's disease," but a gastroenterologist who had treated Corton told the Global Post that the death still haunts him. "We are not sure of the diagnosis," he said. No one asked for an autopsy of Corton.

Chaos worsens chaos. The corpses were returned to the Hotel Oberoi, and then sent for anti-corrosion treatment; the anti-corrosion workers refused to receive the corpses sent from the hotel, so the employees of Oberoi sent the corpses to a local medical school, where a staff member preserved deal with. The next afternoon, Robertson returned to Canada with the body. She left a dozen teddy bears, who had intended to send them to the orphan home of Jennifer Robertson and Gerald Cotton. (Robertson declined a request for an interview with Vanity Fair.)

Only a month later, Robertson announced on Quadriga's Facebook page that Cotton was dead. During this period, Quadriga continued to receive new funds, but did not return any sums. Creditors have begun to question the authenticity of official documents online. After all, India is a notorious country that can easily buy fake documents. They learned that they had misspelled Corton's name on the death certificate and the company that ran the hospital After the former chairman and general manager were sentenced to financial fraud two months ago, people became more suspicious.

It was also revealed that Corton had just written his will four days before going to India. The will details the ownership of the $ 12 million property, the Lexus, the Cessna and the Gulliver yacht; $ 100,000 is also left to take care of their Chihuahuas. In his will, there was no mention of external hard drives, so-called "cold wallets". Coton originally stored most of Quadriga's funds in them.

This is the detail that most shocked crypto professionals. If the first principle of Bitcoin is "don't believe anyone", then the second principle is "there is a plan B" and the third principle is "there is a plan C". If you lose your home key, you can call a locksmith; if you forget the password for your savings account, the bank will provide you with a new password. If you lose the private key of a cryptocurrency wallet, a randomly generated long password, it is almost impossible to remember that your funds will disappear forever. In bitcoin mythology, the alarming fable that the private key was misplaced and caused loss of money is just like the pastor's sermon at a religious assembly.

Michael Perklin founded the world's first blockchain security consulting company and has worked at CaVirTex. He met Cotton in Toronto in 2016, when Cotton was planning to list Quadriga in Toronto. Corton once refused to invite Pecklin to provide services for Quadriga, but the two worked side by side in office lease space Decentral Toronto, a blockchain company that can be regarded as the hub of Toronto's Bitcoin field. "Gerry is a very cautious person, and he knows the need to back up his private key. A person like Gerry with such a wealth of expertise and vision can never be lucky in the matter of keys. When Pecklin saw the report mentioning that Corton was the only person who had a password for the company's assets, and he did not have any emergency plans to deal with the situation where he was incapacitated, abducted, or unable to obtain the password when he died, "I His jaw dropped all the way down to the point where it was impossible to fall again. "

Coton himself warned of this danger in an interview in 2014. He said he wrote the password on paper and then locked it in the bank's safe, "because this is the best way to keep the tokens safe." According to two Cotton's assistants, shortly before Cotton's death, he told A close friend and family member, Quadriga has a "dead man switch" that allows him to manage the funds of the exchange in the event of his disappearance or death.

Some of the earliest discoveries by detectives on Reddit are not so much evidence, but more reverie. In the leaked text, Corton boasted of his extravagance ("I'm still cleaning up the trash at our cream hotpot party on the weekend, haha"); mentioning "there is a safe tied to a ladle in the attic"; Jokingly about to retire soon; also mentioning his honeymoon in a very bad tone. None of this looks great, but after all there is no confession for the crime. On his personal YouTube channel (account name "Gerryrulz"), he posted dozens of homemade videos that were naive and weird: Gerry burned a $ 20 in a microwave to ashes; Gerry used A giant teddy bear knocked down the tower; Gerry was trapped in the maze of the amusement park, repeating the same mistake, unable to escape.

Jennifer Robertson's Instagram account shows that she has traveled to Machu Picchu, Dubai, Oman, Myanmar, Maldives and Rio de Janeiro since 2016 and often travels by private jet. Robertson is not her real name; she was originally named Griffith, and then changed to Forgeron. After a marriage and divorce, she reused her real name, finally in 2016 Robertson The name has a firm foothold.

To be precise, the major breakthrough of the investigation is not something new, but something hidden under the eyelids. It is related to the co-founder of Quadriga. It turns out that Michael Patlin is not the real Michael Patlin-Michael Pecklin and almost everyone in the Canadian currency circle have known this dim sum for many years. This means that Cotton is not the person he is talking about.

"This is not his first acting"

Since the death of Corton, the Quadriga incident has been discussed on Telegram. Telegram is an encrypted messaging app similar to WhatsApp, but with enhanced privacy protections. This chat group called Quadriga Uncovered has nearly 500 members, many of them creditors, and they use this group to discuss the details of the claims process and share the inside story and ideas of the case. Journalists, FBI and RCMP detectives, as well as several target figures in ongoing criminal investigations, also often listen to news on it, including Patlin, whose exact whereabouts were unknown for a year or so. Known. In the comments posted by Patlin-whether in a group chat or a private chat-he tried to downplay his relationship with Quadriga and refused to talk about his past in detail. But it was his past that quickly became the focus of Quadriga's investigation.

Patrin once said that Cotton was "to me like a little brother." Those who know them see it the same way, although this description is usually not a compliment. Patrin makes people feel uncomfortable. He appears to be out of thin air in Vancouver. When the bitcoin cooperative was only a small group of crypto enthusiasts, and everyone was about to meet in each other's apartment, Patlin Lengbu wrote an email to them expressing their support. They are excited. Usually they take the initiative to establish contact with the outside world; no one has contacted them before. Partlin attended the next meeting. Hi, he said. This is Mike. I want to build a Bitcoin trading platform. Let's work together.

"It's weird," said Joseph Weinberg, who founded several digital currency companies and also served as CEO. He was a college student at the time and was an early participant in the Bitcoin Cooperative meeting. "It soon became clear that he wasn't the person he said. Sometimes he would call himself Michael from India. Sometimes he would call himself Michael from Pakistan. Or Michael from Italy. This was not his first act. (Patlin denies that he is from another country: "I am not a nationalist.")

Partlin is described as a compelling mysterious figure, which is not uncommon in the cryptocurrency circle. He is reminiscent of a gloomy past, a connection to the underground world.

He was sturdy and muscular, with a black tattoo on his body, and his face seemed cloudy when he calmed down. On Facebook, he posted a photo with a tiger and a lion, sometimes he drove a Lamborghini, and sometimes he drove a four-wheeled off-road vehicle in the desert. His friends said he talked about his father's indifference to himself, several family members who had a strong desire to control, and he had a tendency to obsessive-compulsive disorder. He has reprimanded scam artists, even though his definition of the word seems rather offbeat — identity theft is a clean, bloodless business, but it is unforgivable if you lie in front of others. He sees himself as an enforcer of rules, integrity and loyalty. He looks lonely.

One day, he brought Corton to the meeting. Corton acted like a younger brother. A friend described that Payton looked very obedient and slaps his horse from time to time. When Patlin tells a stupid joke that nobody finds funny, Coton laughs. They are a strange couple.

Partlin told reporters after Corton's death that they met online five years ago, but the water in this sentence is probably the same as what he claims to be a "consultant" to Quadriga, but is actually the co-founder of Quadriga. By painstakingly searching the archived data of deleted websites, communicating with anonymous sources on encrypted information services, and analyzing public registration data, Quadriga creditors under the pseudonym QCXINT, as well as other persevering users (including accounts runbtc and Zerononcense The most prominent), re-organized the entangled online life of the eldest brother and younger brother. They trace their relationship back to 2003 in a dirty corner of a website called TalkGold. It works on high-yield investment projects (HYIPs), the most common of which is the Ponzi scheme.

Gerald Cotton may have a deep understanding of cryptocurrencies, but his expertise-the formal training he received-lies in the art of manipulating confidence. TalkGold is a Ponzi clearing house, where blind faith and stubborn cynical dance with the devil's rhythm. Banner ads for investing in precious metals and the Exchange Fund, and buffer message boards with "true offshore returns" ads, provide everyone with something: scammers, victims, and people who fall into both categories. There are forums to promote promising new high-yield investments; scam warnings; suggestions on how to set up your own Ponzi scheme, or how to get out early to make a profit; and provide payments to promote a fraud scheme on the site. (TalkGold is run by twin brothers Edward and Brian Krasenstein. In 2016, U.S. Homeland Security agents seized their documents and frozen their assets, but never charged them. Subsequently, the brothers continued to attack Donald · Trump has a small reputation on Twitter, and they were subsequently closed for operating fake accounts and buying fans.) Patrin joined TalkGold on April 3, 2003, and the site was officially launched the same year. In his first blog posts, he boasted that he could get a 30% return on his HYIP investment every month. Three months later, shortly after Corton's 15th birthday, he opened his account.

Both became regulars on "board whores" and met each other on similar HYIP sites; Corton averaged four posts a day on TalkGold alone. Partlin would tell friends that they first met at a party that cheated masters—like thieves in the Ernst Lubitsch movie, they fell into each other's pockets Love river. Cotton tried to scam Patlin; Patlin tried to lie to Cotton. Soon, when replying to each other's public posts, they started telling jokes that they didn't understand.

Corton learned quickly. In December, he created his own HYIP chat site. On January 1, 2004, at just 15 and a half years old, he launched his first pyramid plan, S & S Investments. It promises a "103% to 150%, and possibly even higher" return within "48 hours (usually 18 hours)." Corton wrote in the release charter:

I'm afraid I won't fill this page with the usual nonsense, explaining how your returns come. We do not invest in stocks, bonds, shares, precious metals or antiques. I just want to say that we will bring you rewards. We do not engage in Ponzi schemes or pyramid schemes.

Three months later, S & S suspended its operations and took away most of its customers' funds. Patrin defended Cotton's integrity at TalkGold.

On its own, this may be considered a prank on the part of the teenager-at best a slight deception. Although Patlin was 6 years older than Cotton, he was only 21 at the time. However, the ranks of the two were quickly upgraded. In October 2004, members of TalkGold began to discuss whether Patrin was Omar Dhanani, one of 28 suspects arrested by the US Secret Service during a global raid The campaign targets an online marketplace that steals credit card information and forged documents. On another message board, everyone knew that Danani was an expert in "whitewashing" funds. He lived with his family in Southern California and was arrested there. After confessing to conspiring to resell the stolen ID, he was sentenced to 18 months in federal prison. After his release in 2007, he was deported to Canada.

In a blatantly careless or irresistible self-centered game, Danani officially changed his name to the pseudonym he used in cybercrime, first using Omar Patlin, and later It's Michael Patlin. ("Many people who were born without white privileges, including almost all Chinese I met in Vancouver, have Britishized their names," said Patlin. "Of the people working across the Vancouver capital market, Five are not white, and I am one of them. ") Patrin soon resumed posting on TalkGold and other HYIP forums, and opened a series of businesses that represent digital currencies. The most successful of these was Midas Gold, which was established in early 2008. It can be used as an independent payment processor for Liberty Reserve, a digital currency operated by an American in Costa Rica and used by drug syndicates, human traffickers, child pornography makers and Ponzi schemers Money laundering. Midas Gold is an intermediary between Liberty Reserve and its traders. It is responsible for converting cash into digital currency and then converting it back to ensure that all centralized records of customers are hidden. In the server registration file, the contact person for Midas Gold is [email protected].

During those years, Corton ran a series of investment projects on his own, and completed an undergraduate honors course at the Schulich School of Business at York University. In the HYIP chat room, Cotton and Patrin protected each other when facing angry investors, pretending to be customers of each other's various businesses, and very satisfied with their services; Patlin liked to study payment processors, and He focused on more complex iterations of S & S investments. The websites of these investment companies often share registration information and are operated from the same computer. It was during this period that Patrin changed the signature below his TalkGold post to: "The definition of madness is to do the same thing over and over again, but expect different results.-Benjamin Franklin."

On May 24, 2013, federal agents in 17 countries arrested Liberty Reserve managers, closed their websites, and seized their records and bank accounts. This is the largest online money laundering case in U.S. history: Liberty Reserve's 5.5 million user accounts made 78 million transactions worth more than $ 8 billion. Preet Bharara, then federal prosecutor for the Southern District of New York, said: "The global law enforcement action we announced today is an important step towards curbing the illegal Wild West bank." Midas Gold, which started accepting Bitcoin aggregates, was also seized.

By then, Gerald Cotton's new company had been open for six months. The Quadriga Fund is a HYIP that claims to invest in venture capital projects and the foreign exchange market; it can be funded by Liberty Reserve and Bitcoin using a payment processor operated by Patrin. Quadriga means a chariot with four horses side by side. The Quadriga Fund claims to be managed by four (unnamed) investment managers. "Wealth is freedom," wrote the project description. "When you invest in Quadriga, you still have control over the situation."

In October 2013, Corton posted a job advertisement on an online forum called BlackHatWorld, which sells fraudulent products and stolen goods. He wanted to find "a programmer familiar with Bitcoin" to develop a website as "an open market, like a stock market, where people buy and sell Bitcoin." The design must be "simple, but professional," and it must be built as soon as possible.

In less than three months, the Quadriga Fund died and Quadriga CX survived.

"A real asshole"

If Quadriga is considered a scam, what is it like? Most HYIPs, including those previously run by Cotton, are exiting the scam: like pyramids, they suddenly close after reaching a critical mass. In some exit scams, the operators will bluntly run their money. More often, however, he would blame the external forces (a nosy bank that freezes his account), withdraw some money at intervals, and be vague until investors give up hope. This delay strategy is more successful than expected, because HYIP customers actually fundamentally understand that the promise of excess returns is not as good as true; in addition, they can always find something else that looks very good as long as they move their fingers Midea Investment Project. The same blind faith attracted the victims and drove them away.

Or Quadriga could follow the example of Coton's and Patrin's previous partnership at Midas gold-a service that helps people launder money from every transaction. Quadriga's corporate accounts do trade tens of millions of dollars in bitcoin, which are linked to known Ponzi schemes and illegal markets. Some people who visited the company's Vancouver office when Quadriga was founded even thought that the exchange itself was a cover. "When you walk into the office, you feel like you're surrounded," said Joseph Weinberger. "Four tables are in a weird room without any business operations in progress. It looks very empty." Weinberger and several other people who came here to the Bitcoin party saw a bunch of payrolls, probably there were Hundreds, but the company name above is not Quadriga, and the recipient is not an employee of Quadriga. (In response to these allegations, Patrin denied the existence of check printers and payrolls, and hinted that visitors to the office "confuse scanners and cashiers.")

The ethical differences between these models may already be very subtle, but this deceptive logic can predict its fate-and the fate of Corton. In other words, was Quadriga created to build a lasting business or to destroy itself?

In the beginning, Quadriga was not created to make money. According to the last public filing submitted by Quadriga in 2015, the company was losing money. According to the most forgiving interpretation of Cotton's behavior, the public bidding signaled his decision to change a bright path. This explanation speculates that perhaps Coton believes that the bull market of cryptocurrencies will continue indefinitely, which will lead to higher trading volume and profits; Coton could have staged a forced palace show and forced Patlin to withdraw because he knew As public oversight becomes more stringent, his past will become a burden.

This will be an amazing big change; in the early days, anyone who knew them thought the company belonged to Patrin, and Cotton was just a cover for outposts. Weinberger said: "Michael was apparently hosting the show, but it was very quiet throughout. There seemed to be a tacit understanding between them, maintaining the same motivation. Gerald was innocent, he could speak to everyone, and Michael Is responsible for the work behind the scenes. "(Patlin:" I think the opposite is more accurate. Gerry and Alex [web developer] created and run Quadriga, and Gerry is responsible for the specific operation. ") However, by 2015 The information gathered by the TalkGold community 10 years ago has finally begun to appear on Reddit: Michael Patlin is actually Omar Danani, a convicted thief and a scammer connected with organized crime.

At this time, Ryan Mueller was arranged to review Quadriga's listing application. He was also responsible for overseeing a third-party processor in Vancouver. After hearing that Patrin was bragging about his money laundering skills in Vancouver, Mueller Discovered the connection between him and Danani. He rejected Quadriga's application and referred the investigation to a contact point at law enforcement. No one followed up the investigation. Mueller didn't understand how a federal criminal changed his name, continued the crime, and escaped the charges. He had to guess that Danani had friends in the underworld and federal law enforcement. "He's the kind of person you are talking about-a real bastard," Mueller said. After that, he began to quietly warn people.

Among the people Mueller warned were Amber Scott, an anti-money laundering expert at a Toronto-based compliance company called Outlier Solutions. She told clients and friends not to associate with Quadriga in any way. But when she met Corton in Toronto's Bitcoin hub Decentral, she felt he was both funny and cute. She trusted him. She thinks his involvement may mean that Quadriga is still legal after all. She and he often went in and out, and even introduced him at meetings.

Now she says, "The cryptocurrency community has a high tolerance for risk, especially in 2015. We all want Bitcoin to succeed, and we want businesses in the Bitcoin industry to succeed, which to some extent encourages ourselves. Deceive yourself. There is also the fact that these people are Canadians, Canadian companies. We do not want to be suspicious of ourselves. Although I have warned people privately, I have not stood on the roof and shouted. I do not consider myself innocent "On one occasion, Coton mentioned that his business partner was coming to Toronto and invited her to have coffee together. She froze and said in a vain manner that she would bathe the cat, thus fooling it over. Cotton's face turned red. He never raised Patlin before her.

After Patlin left, other members of the board also left, including Patrin's fiancee Lovie Horner and Patlin's partner Anthony Milewski– There are reports that he has the support of Russian mining companies. "Gerry seems to be in full control of the situation," Andrew Wagner said. "We're all thinking, this day is finally here, and Gerry finally has a showdown with Mike. The little brother under control has a little courage. At least, that's our opinion."

Patrin's view is exactly the opposite: he withdrew Quadriga because he disagreed with Cotton's decision to abandon the listing. "In January 2016, after all employees, supervisors and managers left, Gerry has ceased to manage the company from a legal and rational level, from a filing perspective," he wrote recently. "We know nothing about the Ponzi scheme."

In the fall of 2016, Bitcoin began to rise wildly. But it all came too quickly and violently: young, inexperienced cryptocurrency purists face no code at all, censorship from banks, incompetent contractors, and improper payment processing programs. To save his dream, he had to take an increasingly problematic approach. If you're willing to talk to the world, this narrative of "Gerry wants to change course" is almost justified.

"Their wallet is empty"

More likely is the story of "Prince Gerry messed up." In this version of the story, scams trigger new scams, incapable of breeding recklessness and splurge. Public bidding is the last step to rescue a shaky Ponzi scheme, using positive media reports and public sympathy to scam funds from investors. We now know that Cotton has been stealing customer funds by 2015 at the latest. He also created dozens of fake trading accounts to stimulate trading volume on the platform-a fact he even disclosed in a 2015 document. However, he did not disclose that he injected fictitious funds into these fake accounts in exchange for fake Bitcoins for real Bitcoins, Canadian dollars and US dollars. By the time of his death, Cotton's fake trading accounts (named Aretwo Deetwo, Seethree Peaohh, etc.) had already made about 300,000 transactions.

He failed to keep any internal records after the public bid failed, which is incredible for a company with more than $ 1 billion in annual transactions. Ernst & Young claims that at this company, "typical segregation of duties and basic internal controls do not seem to exist", and hearing this wording, one would probably imagine that a group of harsh accountants had been stimulated during the review of Quadriga Got a stroke. In most years, Coton did not report personal income tax at all, and when he filed his tax, he did not report any income from Quadriga.

Corton offers manual withdrawals. It seems that whoever complains the most in public forums will give him the strongest discount. He packed the money in paper bags and shoe boxes and sent them to coffee shops, laundromats and billiard halls. He also accepts cash deposits. One year before his death, he sent a colleague a picture taken in the kitchen at home. On the smooth granite counter, there is a bottle of pink roses, the lid of a discarded ice cream carton, a copy of National Geographic magazine, and dozens of stacks of Canadian banknotes as thick as a dictionary, Denominations range from $ 20, $ 50, and $ 100.

However, Cotton should not be directly responsible for all his troubles. As Canadian banks refused to accept cryptocurrency companies as customers, Quadriga had to rely on third-party processors, which were charging ridiculously high fees and, in some cases, directly stealing funds. A Quadriga contractor now claims that payment processor WB21 stole $ 14 million and another processor stole $ 5.8 million. WB21 is currently under federal lawsuits in the United States, Switzerland, and the United Kingdom. (Patlin, Jennifer Patterson, and at least several other Quadriga contractors each operate their own payment processing company. This is a major conflict of interest, but it is not illegal.) In addition, the Imperial Canadian Commercial Bank temporarily withheld 2,100 C $ 10,000 and software failures also cost Quadriga C $ 14 million overnight.

Nonetheless, Quadriga should keep its customers' 200 million Canadian dollars in cold wallets-that is, use external hard disks to disconnect from the Internet, and its functions are similar to bank vaults. But one month after Corton was pronounced dead, blockchain investigators proved that almost all inaccessible wallets were empty. It turned out that Cotton had transferred funds to a personal account on a rival exchange. At least some of these accounts have been emptied. The operator of the exchange where Corton opened an account told EY that Corton wasted most of its assets on reckless transactions. On a margin account alone, he made 67,000 transactions and made huge bets on emerging coins such as Dogecoin, OmiseGO, and Zcash.

In 2014, Corton publicly stated that he wanted to transfer currencies between exchanges to take advantage of arbitrage opportunities. He may be trading Quadriga funds frantically to make up for the losses he has suffered. As a gambler destined to fail, he used a martingale strategy to continuously double the bet, desperately trying to recover the book, but the result could only be digging a bottomless hole and burying himself in Inside. After he squandered the remaining money in the Quadriga vault, the price of Bitcoin plummeted and the exchange ran into a run. Then he flew to India, where things got worse.

"Honeymoon"

Another possibility exists, and investigators in the case are reluctant to ignore it. We call it planning theory.

It began with discoveries that were totally incompatible with the phrase "Prince Gerry messed up." Corton once mentioned that there was a safe tied to a mule in the attic of his house, where he stored the passwords of various cryptocurrency accounts. Upon hearing of his death, one of his contractors ran to the house to look for it. He did find four holes in the mule in the attic. But the safe was gone.

Eric Schletz, a pilot who bought a matchmaker for the Cessna 400, said he had seen Coton walk around the airport with $ 50,000 in cash. There are rumors that other employees also flew around with money. Corton is obsessed with traveling abroad-he boasted that he has been to more than 50 countries but has never been "searched by customs"-perhaps he didn't run around because he loves traveling but because of strategic considerations. In this way, it is entirely possible for Cotton to deposit a large amount of money in a foreign bank account in preparation for his great retreat.

Is it possible: At the end of his life, his crazy trading on other exchanges was not careless, but a well-planned move? This is a question posed to cryptocurrency experts by Jennifer Vander Veer, the lead investigator of the FBI's cybercrime unit. In theory, it is possible to carry out large transactions in the form of money laundering, as long as these transactions are weird enough to ensure that the losses are borne by another account controlled by Cotton or its partners. Corton's transaction is so bizarre and so risky, so when it comes to money laundering, it seems to be credible-just as Corton is really optimistic about Zcash, so he put all his net worth on it.

The RCMP and the FBI declined to comment, but some of the interviewees they approached had the feeling that these agencies thought Coton might be alive. "They asked me about 20 times if he was still alive, and they would always ask this at the end of the conversation," said a witness familiar with Quadriga's operations and who had been investigated by both agencies. Creditor and blockchain expert QCXINT said that the FBI's Vanderville told him that with hundreds of millions of dollars missing and no corpse, "this is always a pending case." To confirm the one Robertson brought back from India The body did belong to Cotton, and the only way was to dig it out. The RCMP, which has jurisdiction over the case, has so far not done so. (As for Patrin, he said that he "has no reason to think that Cotton is alive.")

According to planning theory, Cotton runs Quadriga just like he does S & S investments and follow-up investments, just to ensure that people have money to pay when they demand withdrawals and maintain their credibility. From the beginning, his plan was to keep the scam as long as possible until the money disappeared. After Bitcoin collapsed, withdrawal requests became a threat to lawsuits, negative reports, and formal investigations. Corton got married, wrote a will, flew to India for a "honeymoon," and then disappeared.

If planning theory seems far-fetched, it's worth pointing out that an exit scam can only succeed if it looks far-fetched. Cotton's career is built on the insight that most people are willing to believe most of the things they hear most of the time. As the mastermind, Gerry will make the world believe that he is a reckless, greedy dead. He counted on most people to forget him completely. Most people have indeed forgotten him a year after his death.

In October of this year, Robertson signed a settlement agreement in the Quadriga bankruptcy case, agreeing to hand over about $ 12 million in assets to creditors. In a statement issued by her lawyer, she said she was unaware of Cotton's "improper" business practices, and that she was "anxious and disappointed" when she learned of these practices through investigation. She expressed her wish "to continue the next chapter of my life." To fulfill this desire, she may have to change her name again.

If the mastermind Gerry is still alive, what is he doing? He will have a new name and passport, and maybe a new face. He may still be working with Patlin, or Patlin may be trying to find him in an ultimate scam showdown. Cotton may want Robertson to meet him after the investigation is over, or she may just be another of his victims. He may live on a private island, or he may live in Hong Kong, Thailand or Monaco and travel by yacht, helicopter and private jet. He might even be eating a cheeseburger and drinking beer. The mastermind, Gerry, may think he will be lucky to succeed. He did succeed, as long as everyone else was tricked by him.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Clash of Bulls and Bulls, 50-Week Golden Line Operation! 11/30 market analysis

- Go to the center, go to the intermediary, what type of center and what type of intermediary does the blockchain system remove?

- Babbitt Exclusive | Read the legal issues of blockchain projects. Is token incentive and chain reform feasible?

- Three major domestic virtual currency exchanges focus on compliance business and actively engage with local governments and state-owned enterprises

- Blockchain Science Fiction: "Recalling Computing Power" (Part 2)

- Why can Singapore's financial industry break through technology silos?

- Ethereum developer Virgil Griffith arrested in U.S., accused of helping North Korea escape sanctions up to 20 years