Why is the price of “stable currency” stable? Investor mentality

Why is the price of stablecoin not fluctuating like other cryptocurrencies?

The answer to this question may surprise many people. According to the researchers, the stability of the stable currency price is not dependent on more advanced technology, nor on more reliable financial principles, but simply because investors The mentality of the situation.

The cryptocurrency research firm BitMEX Research has studied two popular distributed stable currencies in the market, BitShares supported by BitShares (BitUSD) and MarketDAO-based Dai, designed to analyze these two stable currencies. What kind of mechanism is used to keep its price stable.

The study found that the reason why stable coins can stay at the same price point seems to be a kind of investor psychology called “why trade at other price points.” To explain briefly, the vast majority of investors trade an asset at a specific price because they believe that the price is the actual price of the asset. This is also a “strange” market logic.

For those who don’t understand the nature of distributed stable coins, it may be seen as a cryptocurrency with the best of both worlds. On the one hand, it has the independence and decentralization of blockchain trading, on the other hand Have the stability of traditional financial assets like gold and legal currency. But in fact, the vast majority of distributed stable coins in the market are very different from the US dollar-backed Tether (USDT). Tether relies on the endorsement of financial assets to keep its price stable. It is not a decentralized cryptocurrency. And it’s easy to be shut down by regulators – and distributed stable currencies are not like this.

Analysis of the price stability mechanism of BitUSD

Bitcoin is the first stable currency launched on the BitShares platform, founded in 2014 by EOS founder Daniel Larimer (BM). The purpose of the Bitcoin to launch the Stabilization Coin is to trade at the US dollar price (that is, 1 bit USD = 1 USD). But the problem is that Bit Dollar is not actually linked to the US dollar, but is linked to the Bitcoin’s native cryptocurrency BTS.

Bit Dollar has taken a series of measures to prevent BTS price fluctuations to ensure its own price problem, but this situation can only be established if the price of Bit Dollar itself does not fluctuate. BitMEX Research pointed out that as long as the price of the bit dollar is not 1:1 compared to the US dollar, once the price of BitShares native token BTS fluctuates, it may cause large fluctuations in the bit dollar.

The results of the BitMEX Research study further show that even if the price of a 1-bit US dollar is stable at $1, if the BTS price falls by half or lower, this anchoring model will still face the risk of failure. In addition, if the collateral held by Bitcoin dollars falls to a very low BTS price, it will also cause its price to fall sharply.

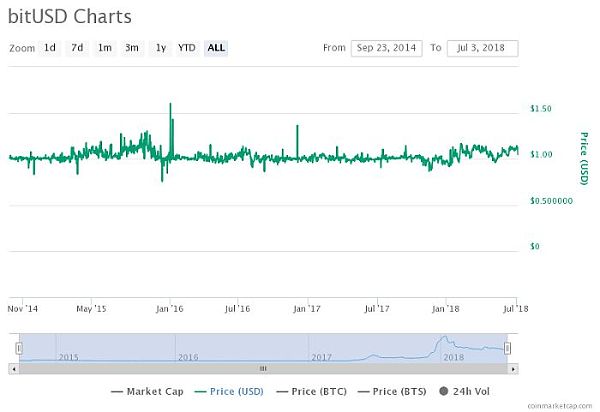

According to CoinMarketCap, the price of bit dollars mostly fluctuates around $1, but it does not develop linearly like Tether. Its biggest fluctuations occurred in January 2016 (prices rose to $1.6) and December 2015 (prices fell to $0.75).

(Bit US dollar price chart against US dollar since 2014)

Now, the most interesting thing has happened – the study found that Bit Dollar does not have any special mechanism to ensure that prices do not fluctuate, and all investors follow the same mentality:

“Why shouldn’t I trade at a price of $1?” – (Subconsciously, I should trade at a price of $1.)

And this is the main reason for the stability of the bit dollar price.

Not only that, but the price of the bit dollar seems to be very easy to manipulate by the super nodes on the BitShares blockchain. The super node can reduce the value of the bit dollar and get the BTS at a discounted price, and then reduce the transaction volume of the bit dollar against BitShares. You can profit from it.

Is it useful to maintain a stable currency price using a variety of mechanisms?

Compared to the bit dollar without any special mechanism to ensure that prices do not fluctuate, Daisy’s cryptocurrency Dai (DAI) uses a variety of mechanisms to ensure its price stability. But the question is, is this useful?

Dai is an ERC-20 token that is endorsed by the Ethereum collateral. The owner of the mortgage debt position generates the DAI token by locking the equivalent Ethereum in the smart contract—that is, each token has a valuable asset backing that is securely stored in the smart contract platform. Anyone can use their digital assets as collateral and generate DAI tokens, after which DAI tokens can be further traded and used within the ecosystem.

The study found that the main means by which DAI reduces volatility is that the owner of the mortgage debt position can convert the DAI token into an Ethereum to make a profit. If the DAI token price rises, the owner of the mortgage debt position can create a new DAI token for Ethereum to make a profit; if its price falls too much, they can also redeem their own DAI token. However, this mechanism is not completely reliable.

Obviously, this mechanism is more beneficial to owners of mortgage debt positions than DAI token holders because they can easily manipulate the market to make money for themselves.

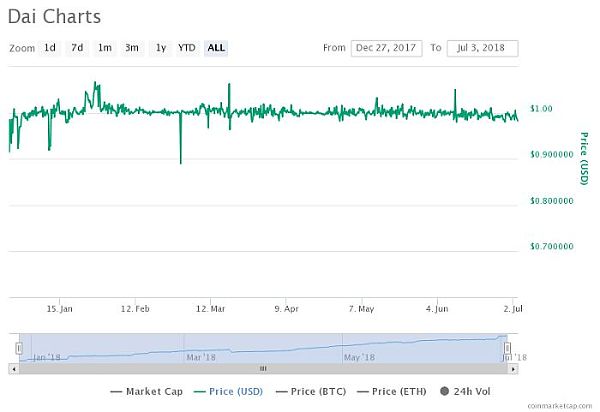

Of course, according to CoinMarketCap’s DAI price chart, this cryptocurrency did not show large-scale fluctuations like bit cash. The highest price of $1.06 occurred in March this year, and the lowest price of $0.88 appeared in February this year.

(DAI tokens against the US dollar price chart since last December)

The BitMEX Research study concluded that although DAI has a better mechanism than BitUSD, its price is still dominated by the “investors want to trade at that price”.

to sum up

Since the regulatory aspect is still exploring the market, there are still relatively few cryptocurrency services available in the market that link traditional financial assets with legal tender transactions. This situation has also led to the rising price of many price-secure cryptocurrencies. I hope to withdraw my cryptocurrency investment during the market turmoil.

However, the current market seems to lack a reliable choice.

Tether is currently the most commonly used stable currency, but it has also caused a lot of controversy. Investors suspect that it does not claim the equivalent dollar to endorse.

Recently, Goldman Sachs-backed cryptocurrency circle Circle is trying to launch a stable currency similar to Tether, and claims that their stable currency will meet regulatory standards, providing a reliable means for traders to withdraw their cryptocurrency investments when necessary. However, it remains to be seen whether Circle can deliver on its promises.

Now, governments around the world have begun to specify cryptocurrency regulations, which bodes well for normalizing cryptocurrency transactions—at least, the price of cryptocurrencies is not taken away by the mindset of investors.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful