Hedge fund managers: "deflation crisis" triggered by the Federal Reserve will cause Bitcoin to soar

The expansion of the Fed's balance sheet will result in low or negative yields. Investors will look for rare assets such as Bitcoin. A well-known hedge fund manager said that the Fed's policies fueled deflation, not inflation. A deflationary environment could cause Bitcoin to rise sharply.

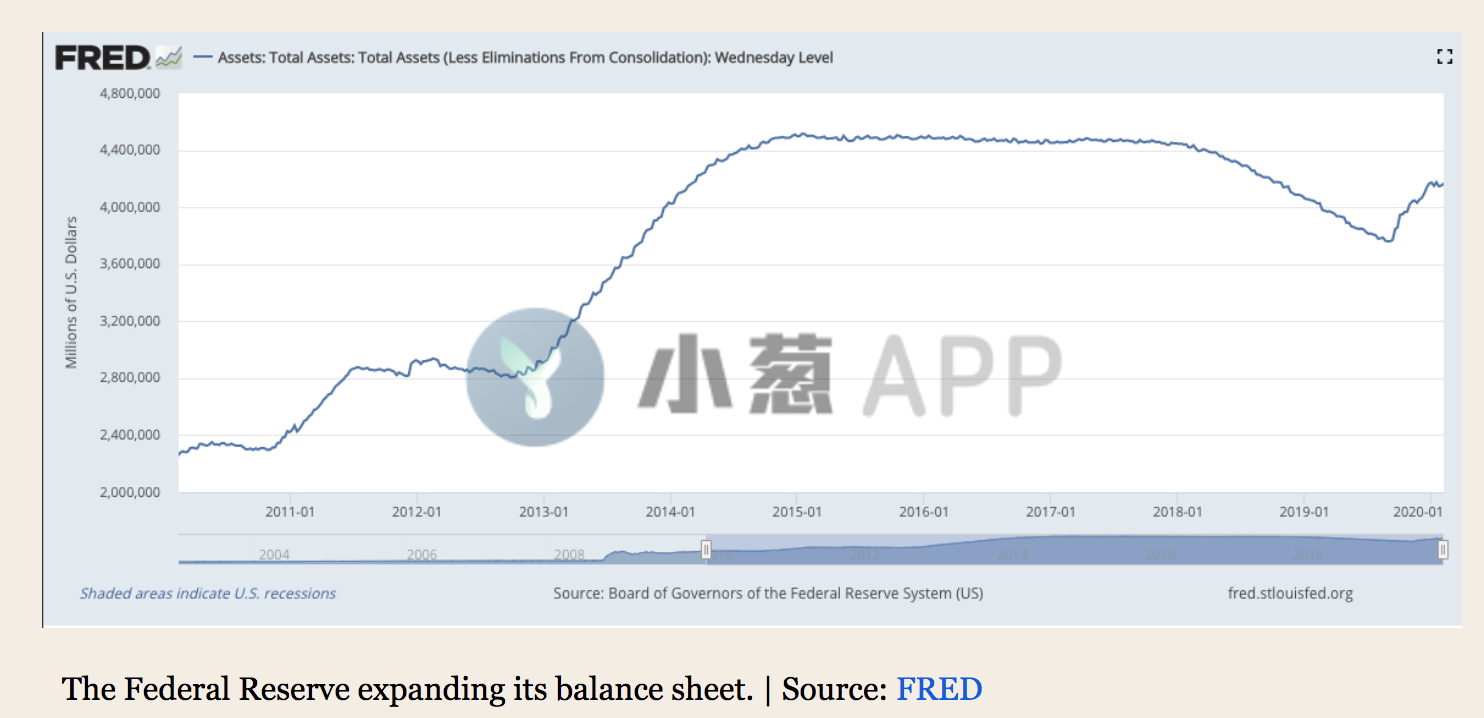

Until now, it was no secret that the Fed was responsible for pushing the stock market to record highs. The Federal Reserve has expanded its balance sheet from $ 3.7 trillion to nearly $ 4.2 trillion within a few months, and continues to inject billions of dollars into the financial system. During the same period, the S & P 500 and the Dow Jones Industrial Average soared to record highs.

One analyst believes that the Fed will continue to expand its balance sheet because it has no choice. Many factors have forced the Fed to fill the black hole in the US economy. These conditions may become the driving force for the rise of rare assets such as Bitcoin.

- Data privacy dilemma: slow humanity in technology iterations

- Featured | Here are our top ten data discoveries for the crypto market in 2019

- Perspective | ENS: Why We Choose Ethereum Over Another Stove

The United States is in the "peril of a deflationary crisis"

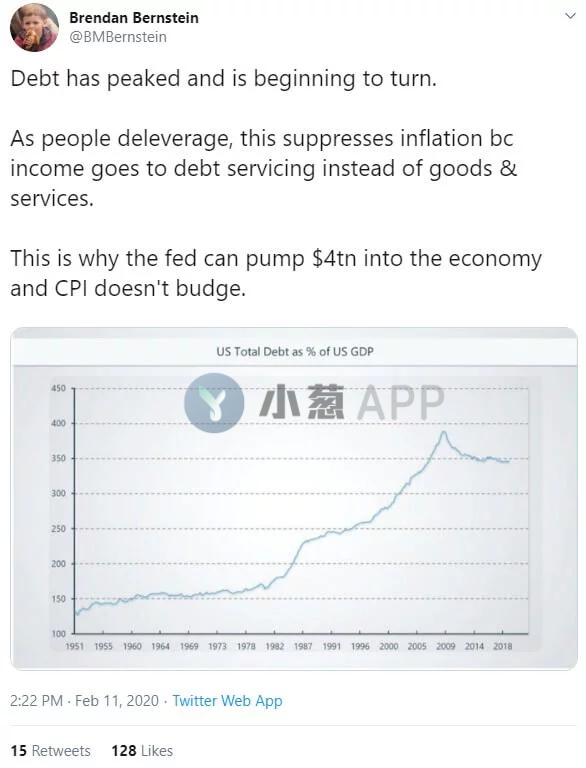

Many analysts bet that the Federal Reserve's printing of money will eventually lead to hyperinflation, but it seems to be the opposite.

The Fed deposits funds into banks and hedge funds, which either hoard cash or use it for the stock market. Brendan Bernstein, a founding partner of crypto hedge fund Tetras Capital, added that many people are using the money to pay off debts instead of buying goods and services. This is why the Fed injected $ 4 trillion into the financial system, but the consumer price index (CPI) has not overheated.

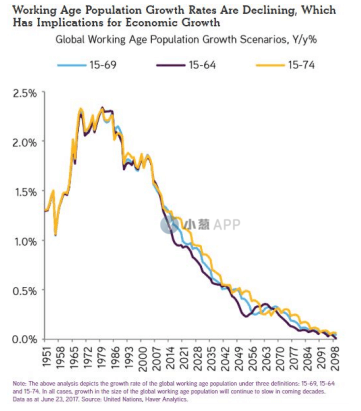

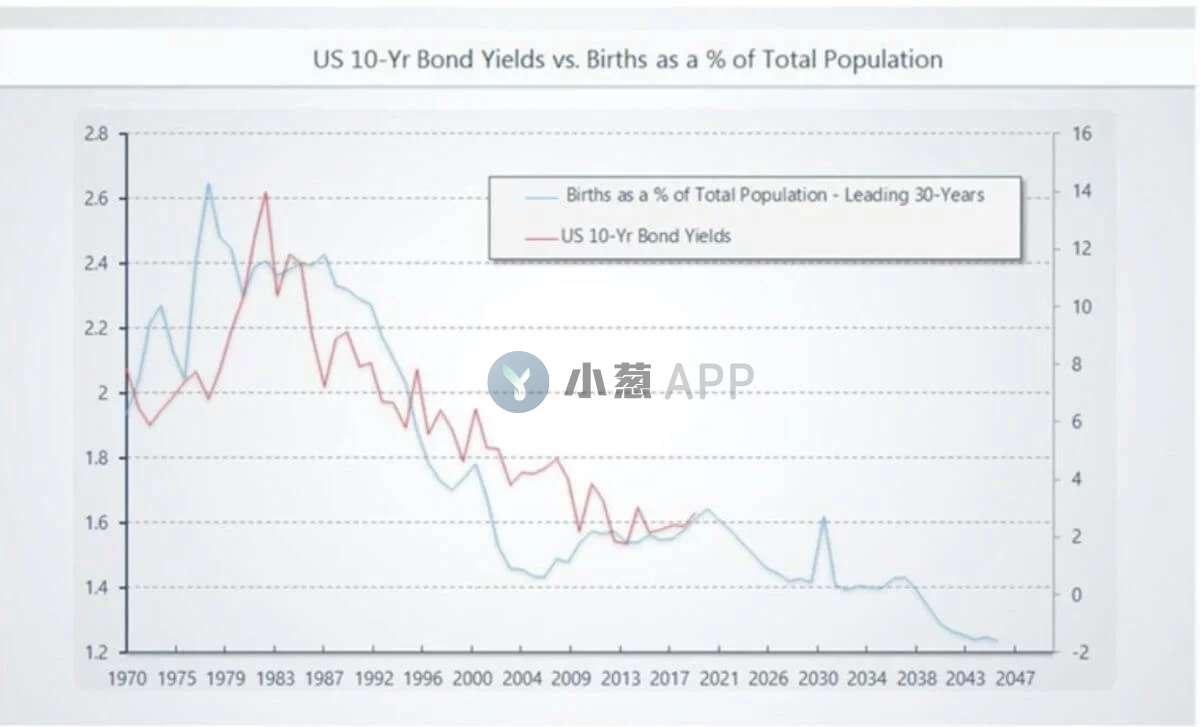

The crypto hedge fund executive explained how deflation will hit the United States. First, the baby boomer generation (1946-1964) will leave the labor market within the next five years. This will lead to a sharp decline in the country's working-age population. Falling labor means falling consumption.

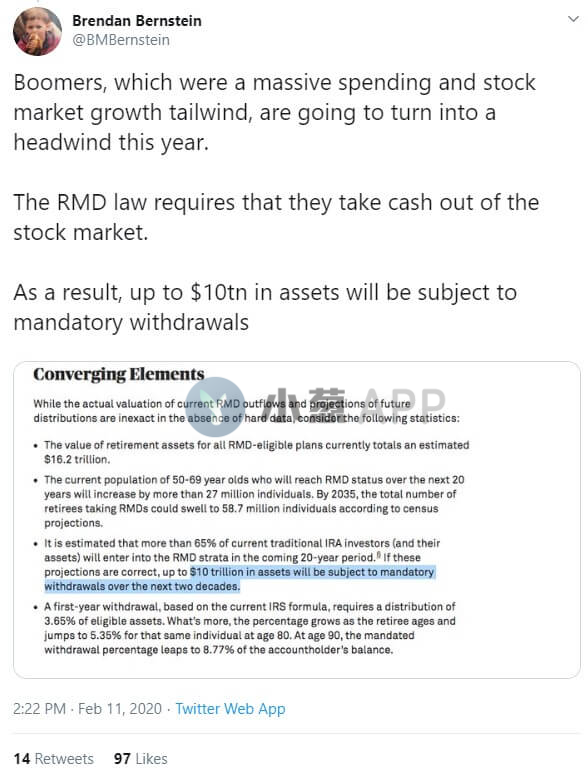

The baby boomer is the main force of consumption and the stock market. If they withdraw from the labor market, they will bring funds out of the stock market. Bernstein revealed that they will take away up to $ 10 trillion in assets from the stock market if they make mandatory withdrawals in accordance with RMD (Required Minimum Distributions-RMD).

Bernstein said that weak labor growth and baby boomer retirement will force the Fed to double its balance sheet in the short term to maintain economic stability. Bernstein predicts that even if the Fed injects trillions of dollars, the economy will hardly grow.

Negative interest rates will make Bitcoin skyrocket

As the Federal Reserve continues to expand its balance sheet, yields will be affected. Otherwise, the US government will not be able to repay its debt.

In this environment, investors will turn to other assets to generate returns. Bitcoin is the main candidate.

Economist Alex Kruger agrees. Asked if the top virtual currencies would thrive in a deflationary environment, Kruger replied,

Yes, Bitcoin is the same as gold. Gold benefits from hyperinflation or negative real yields. Bitcoin should be the same in this regard.

Ikigai fund analyst Hans Hauge shares the same view,

I think this is where Bitcoin can transition from risky assets to safe-haven assets. Currently, Bitcoin is benefiting from the huge asset bubbles we have seen in private equity, stock markets, venture capital, etc. Bitcoin is also taking root in the global financial system.

Translated from: CCN " https://www.ccn.com/fed-induced-deflation-crisis-will-cause-bitcoin-to-soar-analyst/ "

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Video | A "Blockchain Village" Story (Part 2)

- Depth | Beyond 2020: BTC Fundamentals Analysis

- Lingting: Under the disaster, the blockchain needs a "medical observation"

- Analysis: why Bitcoin will rise periodically around halving

- China files 84 patents for central bank digital currency

- Views | Gao Bin, China Communications Industry Association: After the epidemic, blockchain enables business

- Opinion | Defi's most noteworthy in 2020, Bitcoin price may reach $ 20,000