10,000-word research report Design principles, required elements, and 4 related schemes of intent central architecture

10,000-word research report on intent central architecture design principles, required elements, and 4 related schemes.Author: YBB Capital; Translator: LianGuaicryptonaitive

Preface

The user experience issue of Web3 has always been one of the reasons why blockchain is difficult to adopt on a large scale. Recently, the concept of “intent-based protocols and infrastructure” released by LianGuairadigm, a well-known Web3 venture capital firm, ranked first among the top 10 potential cryptocurrency trends. When LianGuairadigm introduced the top 10 potential trends of their institution to the cryptocurrency field, the concept of “intent-based protocols and infrastructure” immediately caught the industry’s attention. This is a design concept that focuses on user needs. For example, “I want to order a $30 hamburger delivery” is an “intent”, and users only need to enter their name, phone number, and delivery address on the delivery platform to place the order and achieve this intent, without having to worry about how the merchant makes $30 or how the platform assigns the delivery rider and how the rider delivers the order to the user’s home. This architectural form greatly simplifies the user experience threshold, so each user only needs to express their intent, and various other protocols handle the intermediate process, waiting for the final result.

Intent-based Design Principles

Origin:

In the Web3 world, transactions are the most core function, whether it is DeFi, GameFi, NFT, or any other concept, it cannot do without basic transactions. However, the reality is that the decentralized nature of blockchain determines that different chains are independent islands, and we need to find a bridge to connect them to complete asset exchanges. Although centralized exchanges provide users with convenient trading experiences, countless Dapp applications still need wallet authorization one by one. In order to reduce the user experience threshold of decentralized applications, the concept of “intent-based” was born.

Although the concept of “intent” is not new, LianGuairadigm has sparked a wave of this concept, so we borrow their definition for reference: “By signing and sharing an intent, users are actually allowing the recipient to choose the computational path on their behalf.” In practice, the signing is mainly governed by the user’s spontaneous intent, but can assets really be handed over to third-party outsourcing to reduce the usage threshold? The following sections will discuss the content involved in realizing the vision of intent-based.

- The fraud trial of former FTX CEO SBF will begin on October 3rd.

- The voices of US presidential candidates on the issue of cryptocurrency are growing louder.

- Unveiling SBF’s Defense Draft of up to 250 Pages I Did What I Believe Was Right

What is Intent:

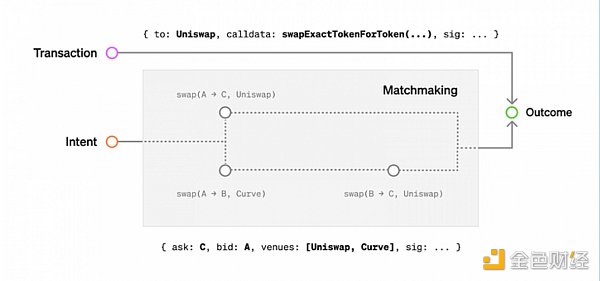

The explanation of the concept of “intent” by LianGuairadigm is reflected in the article “Intent-based Architecture and its Risks”, which was published on June 1, 23. In the user’s regular transaction process, the transaction signature allows validators to perform verification operations based on specific computational paths, and the gas fees of the process are used to incentivize validators to complete the computation. However, intent does not specifically point to a particular computational path, but only needs to satisfy specific constraints to be completed by any path to achieve the final result. In fact, by signing and sharing an intent, users are actually allowing the recipient to choose the execution path on their behalf (as shown in the figure below). In order to distinguish it from transactions, we define intent as a message signature that allows multiple paths to transition from a given initial state to reach the final state result.

As shown in the above figure, when submitting a transaction, the execution path needs to be explicitly specified. For example, when conducting token exchange on Uniswap, the execution path is determined by the matching result when submitting the intent. For users, they only need to express their intent, and the protocol/application based on intent will handle the rest of the work, namely matching the execution path.

In short: Transaction = I specify the operation to be executed; Intent = I want the result, but don’t care about the process of achieving it. Intents with different preferences can be matched in complex ways, and this process requires “counterparty discovery” and “solver solving”.

Bob, Intent Solver

Bob solver (hereafter referred to as solver, not specifically Bob solver) is an intent-based transaction infrastructure whose main purpose is to simplify the operation process and lower the user participation threshold. It integrates wallets and decentralized applications and essentially creates and executes outsourced transactions for users. Its implementation consists of two main related components:

● Solver for creating transactions: composed of AI chatbot + intent classification + transaction optimization, responsible for implementing the best execution path for user intent and sending it to the AA wallet. The solver is equipped with a machine learning (ML) model for classifying user intent;

● Abstract account wallet for transaction execution: adopts the AA wallet system based on EIP-4337 standard, consisting of bundler and LianGuaiymaster. It is integrated with the solver to simplify the transaction process.

Intent Layer and Solver

Is it possible to build an independent intent layer for solvers to compete for solutions? Theoretically, it is feasible, but in practice, it is very difficult to implement. We need to pay attention to Anoma, SUAVE (detailed introduction below) as solutions to the core MEV problem. In order to realize the intent-based vision and hand over the transaction packaging to a third party, what functions are needed to securely complete asset transfers?

1. Reliability:

In order to achieve the reliable decentralized blockchain characteristics, it may not be sufficient to assume the existence of a simple “intent network” to meet the guarantees of intent for users and solvers. After users express their intent, the solver will calculate the specific cost of each execution path, and the solver will be restricted by the rules set by the user. Users need to know that each execution path is reliable;

2. Privacy:

The complexity of the solver providing the best execution path to users will inevitably be affected by hacker attacks to steal assets or obtain user information, and in most cases, the user’s on-chain activity information will be observed. In order to ensure the security of user information, it is necessary to encrypt or hide at least some important information of users. However, it is very difficult to achieve the privatization of computable information on the blockchain;

3. Expressing Intent:

Intent is an abstract concept, and the way users express intent has similar problems to how users ask questions to AI; what should I say to make it understand what I want to say? If someone expresses some vague intent, will the solver generate more gas fees when selecting the execution path? An efficient and accurate parser is the key to realizing intent;

4. Consistency between maintenance intent and MEV:

Take SUAVE as an example of an independent blockchain that solves actual problems with EVM. When it processes Ethereum intents, it needs to perform cross-chain settlements, similar to the decentralized solutions for MEV (such as MEV-Geth and MEV-Boost) which have been hugely successful. They have been launched to meet the cross-chain MEV demand and have a more fair and transparent transaction processing mechanism;

5. Resistance to censorship:

Based on the explanation of LianGuairadigm, it is easy to see that there is a central problem, which is that there should not be a single AI capability parser. For example, if a single parser is attacked or disabled, it will cause the entire system to crash. And there are also issues such as parser refusal to execute and execution errors. Anoma may be able to solve this problem in the following section;

6. Competitive nature of solvers:

Different users will have different intents, and solvers will include various transaction types such as exchange, cross-chain, and staking. There will be no competition between single solvers because solvers can only charge fees when settling on-chain. By allowing solvers responsible for different transaction types to reasonably reallocate or optimize parser algorithms, so that every valid address is eligible to become a solver to successfully participate in the memory pool, the quality of transaction execution can be improved. Whether competition can be maintained between solvers;

7. Expected memory pool:

LianGuairadigm has proposed three new memory pool solutions:

Permissionless Intentpools: Open design allows anyone to submit intents to the memory pool and provides permissionless execution authority;

Permissioned Intentpools: Requires permission to submit and execute user intents, allowing users to pass them to trusted third-party representatives for execution;

Hybrid solution: Combining the features of the above two memory pools, aims to strike a balance between openness and control.

Elements needed to implement intents

Account Abstraction (AA)

Brief review: EtherCenter has two types of accounts, EOA (externally owned accounts) and CA (contract accounts). The difference is that the former can initiate transactions while the latter cannot, but it can host Solidity code. Most of the accounts we currently use are EOA accounts. In addition, there is Gonsis Safe, a multi-signature smart contract account (SCW). As mentioned earlier, contract accounts cannot initiate transactions, so EOAs are needed to initiate SCW, so that EOAs are only responsible for signing transactions, and smart contracts can execute any logic. This can enhance asset security and develop countless new application scenarios.

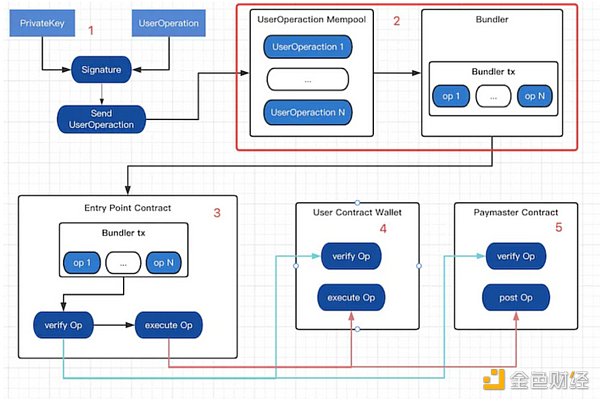

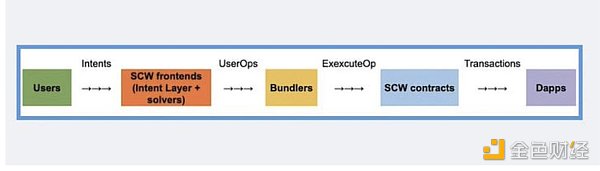

Implementing the Intent layer requires account abstraction (explained in the SUAVE section below). EIP-4337 consists of six parts: UserOperation, Bundler, EntryPoint, Wallet Factory, LianGuaiymaster, and Signature Aggregator. The brief operation process is as follows:

● Initiate user operations, i.e., execute transactions;

● Send the operation to the P2P “UserOperation memory pool” and let the bundler “bundle” the signed execution, gas fees, and other user operation transaction contents and submit them (in practice, this includes various scenarios not discussed here);

● The bundler “bundles” the content of user-operated transactions, including signatures, gas fees, etc., and submits them for upload (in practice, this includes various scenarios that will not be expanded upon).

● The bundler sends the “bundle” to the entry contract for processing and can choose to use a signature aggregator for legitimacy checks.

● The portal contract pre-sends transactions to the wallet contract or payment contract.

The payment substitute contract can have different types based on the business logic of the project. For simplicity, it will not be elaborated on in this article.

The smart contract wallet is undoubtedly the most significant role in account abstraction, with main competitors being Gnosis Safe (multi-signature wallet) and Candide, the latter focusing on building a smart contract wallet fully compatible with EIP-4337. Through the analysis of the above chart, it is not difficult to see that the account abstraction uses a bundler + alternative payment contract to achieve the “narrow” intention for developers, while LianGuairadigm uses a solver + AI to achieve the “general” intention for the general public. The concepts of “abstraction” and “intention” have a very appropriate order concept in the confusion.

Programmability of Intention

According to Researcher@tmel0211, the programmability of intention can be summarized as follows: If the intention is not programmable, the program cannot be executed, automation cannot be achieved, and intelligence cannot be discussed. How to understand that intention is a human thinking expression that contains emotional factors, and it itself has an abstraction that includes cold code and algorithms. For example, my intention is to make money, how can code and algorithms help me find the path to execute the intention? Design based on intention is not a new concept, but is based on the current existing simplified intention design. For this reason, existing intention-based projects and concepts have been organized.

Known representative projects:

● UniswapX: Off-chain extension solution intention

● CowSwap: Off-chain extension solution intention

● 1inch: Fusion order matching of off-chain + multi-DEX aggregator

● Solv Protocol: New ERC3525 standard to implement complex financial intentions

● Unibot: Automation intentions with preset parameters, rules, etc. in centralized server background

● Opensea: Completing intentions with off-chain signatures + on-chain contract combinations

Known representative concepts:

● ERC3525 standard: Proposed by Solv Protocol, designed to provide a semi-quantitative asset standard to describe digital assets in a more structured way to meet the needs of various application scenarios;

● Account abstraction: Provides a standardized account management interface for different types of accounts, abstracting the complexity of underlying implementations, not limited by gas, social recovery, etc.;

● MPC wallet: Uses private key splitting technology to divide the private key into multiple copies and store them on independent nodes. When performing operations such as transactions, these nodes cooperate to generate signatures through secure multi-party computation protocols, eliminating the need to reconstruct the complete private key.

In summary, these representative projects or concepts are a series of more complex instructions that allow users to achieve a simplified experience. From the descriptions above, they can be divided into four categories:

● Centralized intent: based on centralized resource aggregation and matching platforms, such as Unibot for CEX trading and Friend.tech, etc;

● Structured intent: based on smart contracts or proxy contract combinations, on-chain + off-chain preprocessing combinations, adapting to new ERC standards and other preset parameters for EVM virtual machine execution;

● Distributed intent: based on new blockchain architectures that do not require distribution, such as Solver+Executor, which can build a new market to execute users’ complex intent;

● Intelligent intent: based on AIGC as the input and result carrier, users’ complex intent can be programmed and executed through comprehensive training in DeFi.

MEV

MEV means that miners can add, delete, or rearrange transactions to gain additional income rewards, such as DEX arbitrage, frontrunning, backrunning, liquidation, sniffing robots, Time-bandit attacks, sandwich attacks, etc. This is harmful to the rights and interests of users who use DeFi normally. Furthermore, transactions on Ethereum are based on Gas, allowing miners to sort transactions, with high Gas transactions being processed first and low Gas transactions being processed slower. Transactions are first submitted to the Mempool memory pool, waiting to be included in the next block. Validators extract transactions from the memory pool and add them to the next block during construction. Since the memory pool is public, searchers have the opportunity to extract value from users by paying transaction fees to the validators to sort transactions in a specific way, thus benefiting MEV miners. Implementing users’ intents requires outsourcing transactions to third parties for processing, so MEV generated by transactions in the Intent-Centric architecture is also one of the issues that need attention.

The most direct impact of MEV: competition makes the market more efficient, but also causes harm to the entire network.

● Unequal capital distribution (big players have more ETH chips) may lead to centralization of validators (larger staking pools receive higher MEV income), thus reducing the overall security of the network. Although some mitigations have been proposed, the centralization risk caused by block production rights cannot be completely eliminated at present;

● In order to increase the likelihood of transactions being bundled, MEV competitors provide priority to searchers’ Gas bidding priority. This may cause congestion in the public memory pool due to high Gas fee transactions from searchers. However, at the same time, DEX arbitrage, lending, liquidation, etc. can help the DeFi market reach equilibrium faster to maintain market stability.

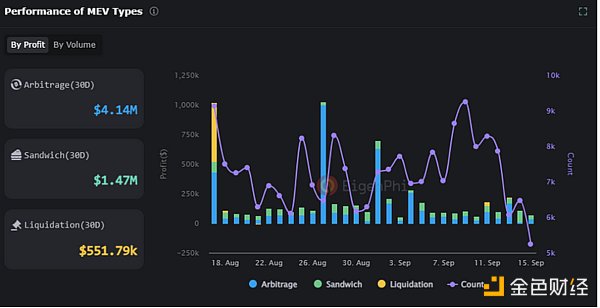

MEV has been an important topic explored by the industry for many years, and how to mitigate the adverse effects of MEV is also under discussion. This will be explained in the next section, “General Solutions for Implementing Intent.” According to EigenPhi’s data, as of September 15, 2023, there is still a lot of room for MEV income on-chain, and after the Ethereum merge, block nodes using Flashbots have already earned over 200,000 ETH, making it a huge cake for profit distribution.

Cross-Chain, Sorter, and Oracle

Intent-Centric is a massive system architecture that, according to LianGuaradigm’s explanation, will involve the entire blockchain field, and large asset transfers between all types of Layer1 and different Layer2 should be passed to the intent for processing. Nowadays, the industry’s development has led us into the era of multi-chains, where each chain is an isolated island, but there are different bridges between them, so cross-chain and sorter are also necessary bridges to achieve intent.

Based on the prosperity of the Ethereum Layer2 ecosystem, the currently recognized four mainstream L2s are: Arbitrum, Optimism, zkSync, and Starkware, each showcasing their respective narratives of Layer3 OPstack and ZKstack. The common problem faced by Layer2 at present is the centralization of the sorter. Although we are actively seeking viable solutions, the reality is that there is a huge cake hidden here. Taking OPstack as an example, we can simplify its profit model as “rental shop” to understand. Layer2’s profit = Layer2’s gas revenue + MEV revenue – Layer1’s gas expenditure. If we want to achieve intent, the toll between Layer2 and Layer1 is indispensable.

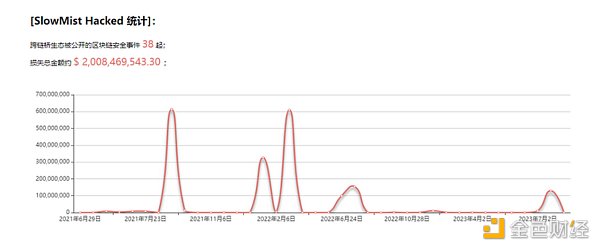

The topic then turns to cross-chain bridges. The prosperity of Layer2 at present has made us aware of the considerable profits from sorters early on, but the profits from cross-chains cannot be underestimated either. Cross-chain bridges are essential as they connect isolated islands of different chains. In the current bear market environment, besides meeting the cross-chain needs of normal trading users, they still have a real market demand for airdrops. However, it is worth noting that the problem lies in the security of cross-chain bridges. According to official data from hacked.slowmist, there have been a total of 38 security incidents in the cross-chain bridge ecosystem from June 29, 2021 to September 16, 2023, with accumulated losses reaching 2 billion US dollars. In short, achieving intent involves inevitable gas costs, but this article does not discuss the security of sequential execution and cross-chains, although it is a problem worthy of our attention.

This topic involves Oracles. From a macro perspective, the powerful financial attributes of blockchain make it a system environment that pursues determinism. Although the narrative of RWA (real world assets) has been discussed for many years, the reality is that blockchain cannot access real-world data outside the chain and can only access on-chain data because the virtual machine (VM) does not allow smart contracts to make network calls, so the operations of smart contracts must produce consistent results, which also closes the data to the external world. The results must be consistent, so blockchain data is also closed to the external world.

Let’s zoom in and take a micro view. Oracles are an important element in the DeFi world. Although the security of different protocols is usually inherited from the underlying smart contract network, their normal operation still depends on oracles. If an oracle of a protocol is attacked or compromised, the entire protocol can be manipulated. Nowadays, DeFi tends to define itself as “primitives” and hopes that more teams will build products or combine protocols on top of it. However, the new DeFi contracts derived from this iterative process will upgrade their own operational logic to host a larger ecosystem, which also brings some external dependencies and unforeseen risks.

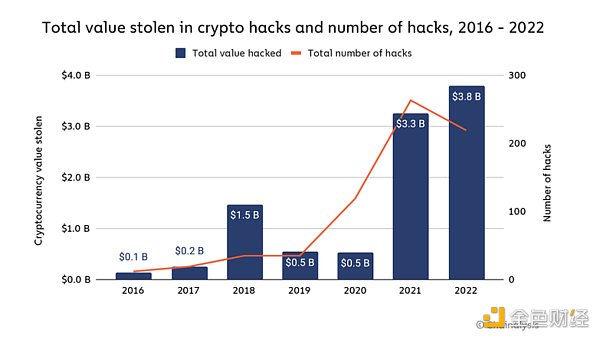

Over the years, the DeFi space has experienced billions of dollars in cumulative theft, such as the hack on Euler Finance’s lending protocol in March of this year, resulting in losses of up to $200 million. The protocol allows users to provide collateral and borrow, but the issue arose in a specific feature that did not undergo security checks, allowing users to break the fundamental invariant of the lending market (e.g., the UniSwap invariant: tokenBalanceX * tokenBalanceY == k). Derivative protocols that rely on oracles for pricing but lack internal price discovery mechanisms are susceptible to price lag and lack of updates, severely limiting their scale and user experience. This is why trader Avraham Eisenberg was able to successfully attack Mango Markets and steal $116 million from the cryptocurrency trading platform.

In summary, the dark rules of the blockchain forest are often filled with unknown risks, and there is still a long way to go to achieve the vision of an Intent-Centric architecture.

Aggregators and Gas

The emergence of aggregators is to eliminate the hassle of users searching for the best trading paths and return strategies. There are various types of aggregators, such as trading aggregators, information aggregators, return aggregators, liquidity aggregators, asset management aggregators, etc. The Intent-Centric architecture requires a certain degree of centralization, and various types of aggregators may help the resolver in searching for intent paths by providing a certain degree of “reference answers.”

Gas is the necessary fee for executing various transactions on exchanges. How to optimize Gas fees is also a perennial topic in the industry. Currently, the overall situation focuses on optimization by product providers, abstract account wallets, and DeFi protocols. In the future, aggregators, abstract accounts, and DeFi protocols can be optimized from a completely new product perspective to improve Gas efficiency. Let’s wait and see.

Wallet Authorization

The first step in Dapps interaction is wallet authorization. Let’s go back to the transaction itself. The Intent-Centric architecture aims to simplify transactions and lower the user’s threshold. However, every intentional transaction involves countless authorization signatures. How to securely and conveniently address the authorization issue is also a consideration. Perhaps abstract accounts and the upcoming dappOS V2 are good solutions.

Four General Solutions to Implementing Intent

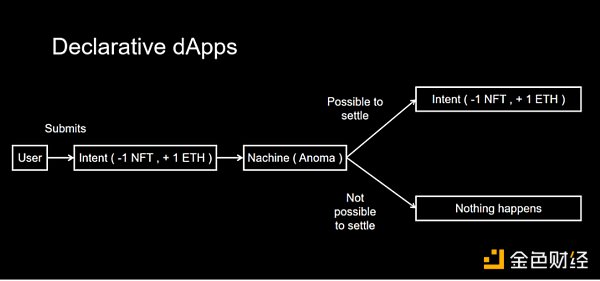

Anoma

Overview:

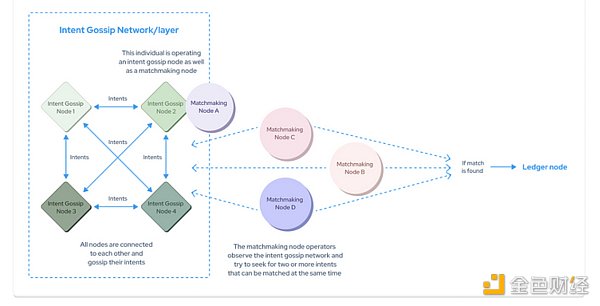

According to a report from Coindesk on May 31, 2023, the Anoma Foundation has successfully completed a $25 million investment from CMCC Global, Electric Capital, and 14 other capital providers. The intent architecture of the project was proposed in a whitepaper released on August 22, 2022: the Intent Gossip Layer is used to propagate intent, discover counterparts, and match execution paths. It is designed to be the default validation path, and all Gossip messages are signed by the sending node, forming a signature chain that can be traced back to the initiator. This feature is particularly important in terms of anti-surveillance and DoS (Denial of Service) attacks, making Anoma indispensable in implementing Intent-Centric.

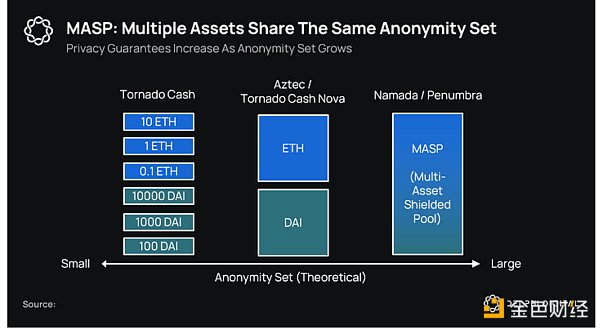

Anoma initially developed and used a Byzantine Fault Tolerant (BFT) consensus mechanism based on Tendermint, and later transitioned to another Proof of Stake (PoS) consensus mechanism called “Typhon” developed by Heliax, to allow for consensus partitioning between independent chains. The project team has developed various technologies such as Taiga, Typhon, MASP, Vamp-IR, Juvix, etc., and has driven experiments in cryptography and distributed systems.

Continuing from the “Intent-Programmable” paragraph above, programmable algorithmic structures and transaction counterpart discovery are essential features for realizing the Intent-Centric architecture vision. This needs to be built on top of multi-interaction and multi-application, thus introducing Anoma, a unified architecture for full-stack decentralized applications, to collectively build the decentralized application paradigm.

Design architecture and its innovations:

● Privacy Payments

To protect user privacy and prevent data tracing by others, the sender, receiver, amount, and asset denomination are all encrypted. The transfer of funds is ensured through zero-knowledge proofs zk-SNARKs, which provides composable asset protection in the case of allowing all assets to share the same MASP, increasing the level of user anonymity by grouping assets together, rather than individually masking each asset. The more participants there are, the higher the level of anonymity for asset transfer data, rather than individually masking each asset.

● Bartering Exchange

The “bartering” exchange plan is repeatedly emphasized in this project, and its core idea comes from ancient bartering practices. In short, this is a bartering plan that does not require a medium of exchange, does not involve cash transactions, and requires at least a double coincidence of wants from the interacting participants for a successful transaction: on one hand, both parties happen to possess what the other party wants, and on the other hand, both parties are willing to transfer the convenience of the transaction. This helps users to pass the node operators that propagate to the intent propagation layer and the matching node operators that run compatibility checks on these intents, to create and match relevant transactions and send the corresponding executed transaction ledger. Anoma implements a digital bartering exchange plan that facilitates transactions of goods, services, or value represented by digital tokens.

● Intent Matching System

In the Ethereum Virtual Machine (EVM), transactions do not require future states, but authorize specific execution paths. Anoma includes a matching system that allows users to use Gossip to broadcast transaction intents. In short, Anoma consists of two main components: a distributed ledger and an intent matching system, which complement or work independently of each other, helping users automatically discover transaction counterparts by using intent Gossip, running node operators, token exchange solvers, and RPC parsers, requesting new intents from matching intents, and submitting transactions to the distributed ledger.

● Multi-chain Support

Anoma uses the Interchain Communication (IBC) protocol of the Cosmos ecosystem for blockchain intercommunication, which utilizes relayers to achieve data transfer between different blockchains, aiming to become a multi-chain privacy layer. Currently, although relayers are typically operated by node operators, anyone capable can run them and earn fees in the process.

● Fractal Scaling Solution

Anoma uses a fractal scaling solution to address the scalability issue in blockchain, allowing users to create local instances for other transactions. Fractal refers to dividing Anoma into different application chains to handle different tasks, allowing each Anoma application chain to be highly customizable, thus achieving scalability and responding to user growth (similar to supporting the IBC protocol to achieve scalability goals). Its security will be enhanced in the future through the IV Interchain Security, IV Mesh Security, and IV Interchain Alliance plans.

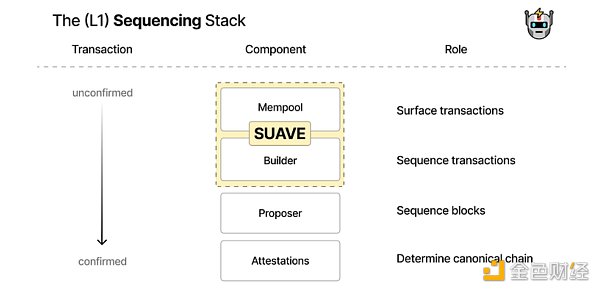

SUAVE (Single Unified Auction for Value Expression)

Overview:

According to news on July 25, 2023, Flashbots, an Ethereum infrastructure service provider, completed a $600 million Series B financing round, bringing its valuation to $1 billion, for the development of the SUAVE platform. SUAVE separates the mempool and block generation from the existing blockchain, forming an independent blockchain network layer (ordering layer), and provides a highly professional plug-and-play alternative solution aimed at addressing infrastructure challenges related to MEV.

Although SUAVE is a new blockchain, it is not a general-purpose smart contract platform and cannot compete with Ethereum or any other participating chains. If Anoma is likened to building an intent-centric blockchain, then SUAVE is building intent-centric infrastructure.

Three goals of SUAVE:

● Expose the Dark Forest: Expose unfair events in the current opaque MEV ecosystem to every user, quantify their impact, and eliminate information barriers among participants;

● Democratize Mining: Integrate miners and retrievers in an open manner, promote competition among parties, provide maximum restrictions and free access to all miners to prevent the integration and centralization of MEV;

● Benefit Distribution: Give MEV to the people who create it – Ethereum users.

According to the intent-centric solution of SUAVE, cross-chain settlement is required when processing transactions from external sources (e.g., Ethereum). It can attempt to address various risks in the EVM, just like the successfully launched decentralized MEV solutions such as MEV-Geth and MEV-Boost. However, it is worth noting that, in the process of implementing the intent for users to deposit funds into SUAVE and unlocking the funds after demand is resolved, smart contracts on SUAVE need to perform asset verification and involve an oracle. Therefore, to some extent, SUAVE will also face all the risks of existing cross-chain bridges today.

From AA-enabled SCW to Intent-centric SUAVE:

Reviewing the section above on “Account Abstraction AA,” considering the main functionalities brought by account abstraction: private key retrieval, gasless payments, multisignature authorization, multiple transfers in a single transaction, rate limiting, etc., account abstraction is a perfect combination of the advantages of regular accounts (EOAs) and smart contract accounts (CAs).

The vision of SUAVE is to become a universal ordering layer between different chains (including cross-chain transactions and MEV). Therefore, if the user’s intention involves cross-chain asset transfer, the Account Abstraction (AA) and Multi-Signature Smart Contract Wallet (SCW), such as Gonsis Safe, combined with SUAVE’s EVM solution, could theoretically be a better theoretical solution.

CoWSwap

Overview:

If we want to choose a project that is closest to the intention-centric architecture, CoWSwap can definitely be ranked first. Its protocol is different from other protocols because users only need to send a signed order to complete the execution of the transaction, delegate the execution of the transaction to the solver network, and complete the transaction in the network (without specifying the execution path). At the same time, due to the right of “batch packaging” by the solver, the gas cost of the process will be borne by the solver, and no fee will be paid if the transaction fails.

CoWSwap Hooks:

Talking about Hooks reminds us of Uniswap V4? But in fact, the usage of these two features is very different. CoW Hooks are a series of transactions, bridges, staking, deposits, etc., which can be executed in the form of single transaction sequencing before/after the execution of the order.

Main features:

● Pre-hooks can be used to set conditions for orders. For example, the execution requires code verification of on-chain signatures or setting the required approval through EIP-2612 permit;

● Post-hooks are executed after the exchange occurs and the funds are received by the receiving address. Post-hooks provide immediate access to funds, including methods such as collateralization, providing liquidity, bridging tokens to L2, etc.

Examples of DeFi using CoW Hooks:

● Debt repayment and staking: Set Pre-Peg operation to perform debt repayment and liquidation operations, then use CoWSwap to exchange assets, and finally use Post-Peg operation to deposit the new assets into a fixed position treasury;

● Creating LP positions: Use either pre-linked or post-linked transactions only;

● JIT (Just-In-Time) Smart Orders: Write Safe smart contract wallets that execute custom smart contract approvals and exchanges through the composable CoW framework (ERC-1271);

● NFTs: NFTs can be bought or sold within the CoW Hooks functionality;

● Cross-chain: Assets can be sent to bridging contracts through CoW Hooks to complete cross-chain transactions;

● Airdrops: Airdrops can be sold using CoW Hooks without using ETH as gas;

● Unlocking and re-staking: Validators who have staked 32 ETH can unbond to receive rewards or re-stake assets on other chains using CoW Hooks;

● Auto-increasing LP positions: Assuming someone becomes a liquidity provider for the Euro-USDC pool to earn GNO token rewards. They can use CoW Hooks to automatically convert their GNO to Euro-USDC in a 50/50 ratio, thereby automatically increasing their LP position.

dappOS V2

After discussing the intention layer and related infrastructure layer, let’s explore the dappOS V2 protocol, which is hailed as the “new wave of the intention layer”. It is understood that dappOS V2, with a valuation of up to $50 million, completed a seed financing round on July 21, 2023, led by IDG Capital and Sequoia Capital China, attracting attention from other major VCs and Coinsafe.

dappOS V2 is an intent protocol that introduces dappOS accounts and dappOS networks to simplify user interaction with dApps and achieve a user experience similar to CeFi level. It also eliminates the fragmentation barriers of multiple chains through the “chain abstraction” technology (chain abstraction is similar to the account abstraction behind it).

Whether for intent or transaction purposes, the focus of users is always the total amount in the account, rather than individual asset balances between different chains. Based on the understanding of dappOS V2, there should be a unified account wallet to realize the vision of “one signature completes all” intent and introduce the concept of one-click multiple “TXN (transactions)” design to eliminate barriers for users to complete TXN and achieve intent-oriented transactions.

For example, it is borrowed to achieve GMX interaction between Arbitrum and Avalanche different chains without assets, thus realizing the basic rule of intent-oriented transactions for future DeFi. Therefore, achieving the concept of intent-oriented transactions requires the involvement of chain abstraction, account abstraction, and more “protocol abstraction”. But there is a question to consider: assuming that all types of abstractions have been implemented, will the intermittent user interaction rules and various project airdrop rules change?

Summary

Intent is still full of risks and challenges in its execution process. It relies on intermediaries or specific executors, which poses risks of centralization and monopolization, affecting the trust of the entire middleware. Secondly, handing over transactions to third parties is related to security and privacy risks, which is worth considering. It is expected that intent application developers can find a balance between security, privacy, and convenience.

The concept of intent has mature applications in Web2, such as taxi software, ticketing software, map navigation, etc. However, the success of these applications is based on the solid foundation of Web2 infrastructure. Therefore, in the Web3 field, mature application scenarios need to wait for the industry to continue to mature. The intent center is a grand concept that involves various aspects of blockchain and is also one of the best paths for combining blockchain with artificial intelligence. However, whether it can develop and grow in practical applications still requires our continuous attention.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- With the support of 800 million Telegram users, how is the development status of the TON ecosystem?

- With the support of 800 million Telegram users, what is the current development status of the TON ecosystem?

- 41% of asset management companies believe that cryptocurrencies will have a very strong growth in the future.

- The story behind the exorbitant withdrawal fees A complete review of the JPEX incident

- ArkStream Capital Social veteran native ecology breaks through the competition with FT and Telegram ecology – Lens creates the ambition of Layer 1 social chain

- Consensys and zkSync have successively launched the Fellowship program, is the competition in Layer 2 entering the melee stage?

- What investment opportunities does the Ethereum Cancun upgrade hold?