Digging deep into the NFT whale’s position everyone is making money and showing off in various ways, only Huang Lixing is getting beaten up.

While everyone else is profiting and flaunting their wealth in different ways, Huang Lixing is the only one facing losses.Author: CoinGecko Lim Yu Qian Translation: Odaily Planet Daily Jessica

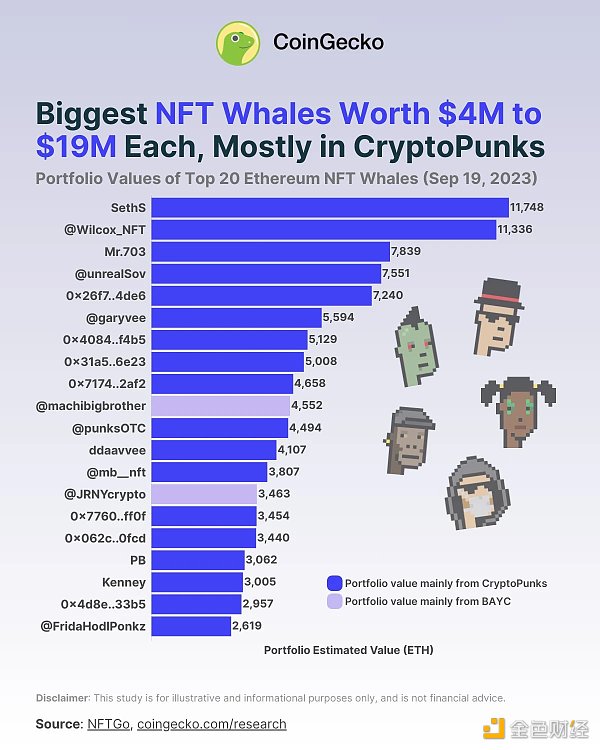

Who are the Top 20 Ethereum NFT Whales?

The top NFT whale is SethS, with a portfolio value of 11,748 ETH (approximately $19.23 million as of September 19). Wilcox follows closely behind with a portfolio value of 11,336 ETH (approximately $18.55 million).

These top NFT whales on Ethereum are all multi-millionaires in terms of NFT holdings, but they have not yet reached the billionaire level.

Among the top 20 NFT whales, 18 of them hold CryptoPunks, with the only exceptions being Huang Licheng, who holds Bored Ape Yacht Club (BAYC) with a value of 4552 ETH, ranking tenth.

- Summary of the 118th Ethereum Core Developer Consensus Meeting Devnet-9 Preparation, Cancun/Deneb Activation Time

- Solidity VS Rust Should smart contract developers choose classics or innovation?

- Can re-collateralization prevent MEV theft? Exploring the new use case of MEV-Boost+ for EigenLayer re-collateralization.

The top Ethereum NFT whales are ranked by portfolio value (in USD), ranging from approximately $4.29 million to $19.23 million.

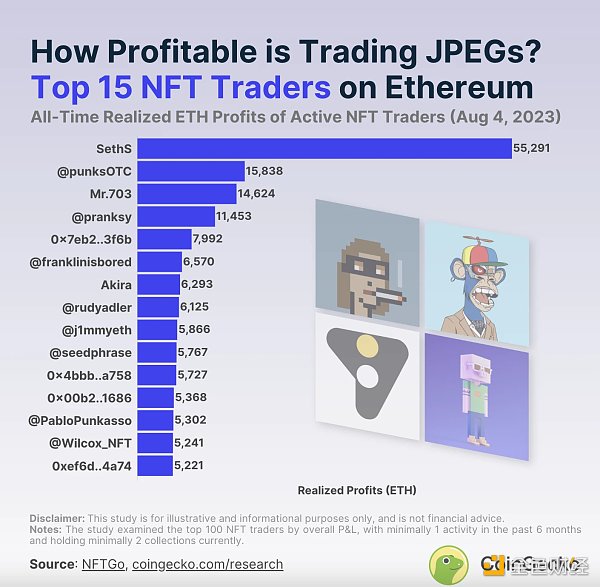

Top NFT Whales vs Top NFT Traders

According to CoinGecko data, as of September 20, top NFT traders have earned profits ranging from 5221 ETH to 55,291 ETH by investing in Ethereum NFTs, with a value of $9.6 million to $101.63 million.

Among the top 20 NFT whales, 4 of them are also among the top 15 NFT traders. SethS is the top NFT whale and trader, ranking first. Similarly, Mr.703 ranks third in both categories.

In other words, SethS and Mr.703 may be among the most successful early NFT investors.

On the other hand, the second-largest whale Wilcox has a lower ranking as an NFT trader and relatively average profits. Meanwhile, the smaller-scale NFT whale Punks OTC is the second most profitable NFT trader. This may highlight two different NFT investment strategies, with Wilcox focusing more on long-term appreciation, while Punks OTC prioritizes short-term high profits.

Which NFTs do the whales hold?

Almost all of the valuable portfolios of the top NFT whales come from holding CryptoPunks. For 18 out of the top 20 NFT whales, blue-chip PFP NFT collectibles make up at least half of their portfolio value.

Many NFT whales are considered “OGs” of CryptoPunks and were involved in the series’ minting. In particular, Wilcox currently owns the most CryptoPunks, with 215, while SethS owns 668 CryptoPunks V1.

An exception is Machi Big Brother Huang Licheng and JRNY Crypto, who have joined the ranks of top NFT whales with Bored Ape Yacht Club (BAYC). Machi achieved his NFT whale ranking with 135 BAYC, while JRNY Crypto (or Tony) holds 103 BAYC. As of the writing of this article, neither of them holds any CryptoPunks in their portfolios.

Unlike the other 19 largest NFT whales, Huang Licheng is the only whale who has suffered losses due to NFT investments, with an estimated total profit and loss (PnL) of about -6,776 ETH, most of which are unrealized losses.

The Largest NFT Collectors

Among the top 20 NFT whales, there are 7 who are also major collectors: SethS, Wilcox, Mr.703, Gary Vaynerchuk, Machi, ddaavvee, and JRNY Crypto. They each own over 1,000 NFTs in their respective whale portfolios. For example, NFT whale ddaavvee holds a large number of 4,872 NFTs in their athrab.eth address.

Of the top 20 NFT whales, 5 have exceptionally diversified portfolios, with each NFT coming from over 60 Ethereum collections. The collection of ddaavvee is very diverse, with over 202 different series held, followed by Machi, who has 101 different series. In contrast, the average number of different NFT collections held by top NFT whales is about 34.

Note: This study is based on the NFTGo rankings as of September 18th. The NFTGo rankings rank whale addresses with NFT portfolios valued at least $1 million. NFTGo identifies highly correlated addresses based on the volume of received and sent transactions and investigates whether they belong to the same whale, grouping them together in relevant cases.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Solana’s Past, Present, and Future.

- Multicoin Capital DePIN Network Design Space Exploration

- ArkStream Capital Overview of Lens Protocol’s Trends, How to Break Through and Compete with FT and Telegram Ecosystem?

- Arca Chief Investment Officer summarizes nine important gains from managing cryptocurrency funds over the past five years.

- Exploring the Next Consensus Layer Revolution of Ethereum How Should the Post-Deneb Era Develop?

- Multicoin Three Necessary Considerations for Building the DePIN Network – Hardware, Supply Thresholds, and Demand

- Delphi Digital Co-founder ZK May Be the Endgame, Pondering My Unsolved Mystery