Can re-collateralization prevent MEV theft? Exploring the new use case of MEV-Boost+ for EigenLayer re-collateralization.

Exploring the use of MEV-Boost+ for EigenLayer re-collateralization to prevent MEV theft.Author: 0XNATALIE

Background

More than 90% of Ethereum blocks are generated by MEV-Boost, mainly because its PBS mechanism allows validators to obtain more profits. PBS separates validators from block construction, outsourcing the behavior of constructing and ordering transactions to builders, with relays acting as the communication channel between the two. Validators only need to propose new blocks to the network, so they are also called proposers. Proposers can earn more income by selling block space to builders, which increases profits. This has led to more and more validators joining MEV-Boost.

However, the operating costs required to maintain relays can be very high, estimated to range from $500,000 to $1,000,000 per year, while the income is zero. This has led to vertical integration between builders and relays, affecting the neutrality of relays. Moreover, if the cost of relays is included in the builders’ expenses, builders need to earn about $3,000 per day to achieve a balanced income and expenditure. Currently, only three to five builders can achieve this, and most of their profits come from private order flows (CEX/DEX arbitrage).

- Solana’s Past, Present, and Future.

- Multicoin Capital DePIN Network Design Space Exploration

- ArkStream Capital Overview of Lens Protocol’s Trends, How to Break Through and Compete with FT and Telegram Ecosystem?

MEV-Boost+ Explained

EigenLayer believes that the centralization of builders and the fact that proposers have no transaction inclusion power in PBS means that they are only responsible for selecting the block header with the highest bid from the relay for signing and waiting for the relay to return the complete block for broadcasting and verification, which gives builders too much power. The censorship resistance of the Ethereum network will be unilaterally affected by builders. Therefore, the MEV-Boost+ mechanism is proposed to allow proposers to include transactions as well.

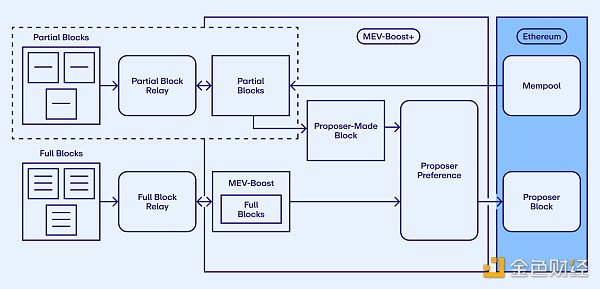

In PBS, proposers have no power to sort and select transactions, which is a necessary condition to protect builders’ MEV from theft. So how can proposers include transactions while protecting builders? MEV-Boost+ introduces partial block relays (LianGuairtial block relay) and a partial block auction mechanism, where proposers can create a part of the block (the remaining part of the block, RoB) and auction off another part (the top part of the block, ToB) created by the builder. In addition, the partial block auction serves as an alternative to crLists (censorship resistance lists) in PBS. MEV-Boost+ is a supplementary software to MEV-Boost, where MEV-Boost will handle the auction of the entire block, and MEV-Boost+ will handle the auction of the remaining part of the block.

Process:

-

Enrolling: Validators must use EigenLayer’s heavy staking to use the partial block relay of MEV-Boost+. They need to update their withdrawal credentials to point to the EigenLayer contract, which includes a Slashing function to punish any malicious behavior by validators.

-

Proposing: Builders construct the corresponding partial blocks and send them to the MEV-Boost+ relay. The relay verifies the validity of these partial blocks and sends the transaction Merkle roots of the partial blocks and relevant metadata (block number, transaction count, etc.) to the proposers. The proposers sign the data sent by the relay and send back the signed data to the relay. After verifying the validity of the signature, the relay releases the partial blocks. The proposers merge the partial blocks with their own transactions to complete the entire block and propose the entire block to the network. The atomicity of the partial blocks is guaranteed by the proposers, so if a proposer manipulates or changes the construction of a partial block, the builder will not be exposed to all the risks associated with the entire block.

-

Slashing: The slashing phase is triggered when any malicious behavior by the proposers is detected. Any changes to ToB are considered malicious behavior by the proposer. Observers (relays) can submit fraud proofs indicating that the proposer has modified the partial block provided by the builder. If the fraud proof is verified to be accurate, the proposer will be subjected to a slashing penalty (32 ETH) through EigenLayer’s heavy staking mechanism. 2 ETH will be allocated to the relay, and 30 ETH will be allocated to the block builder.

So what is the motivation for the proposer and builder to choose partial blocks? As for the proposer, it goes without saying that they can include their own transactions. One possible idea is that if the proposer detects network censorship pressure, and the difference between the bid for partial blocks and the bid for full blocks is less than 0.005 ETH, they will choose the partial blocks and construct the rest of the block themselves. In this setup, the proposer can flexibly choose between MEV-Boost (full blocks) or MEV-Boost+ (partial blocks). The motivation for the builder to construct partial blocks is to participate in block construction at a lower cost, gain a competitive advantage, and at the same time transfer the risk of atomicity of the block.

Block atomicity emphasizes that multiple operations executed on the blockchain should either all be accepted and confirmed or all be rejected, with no intermediate state. The purpose of guaranteeing block atomicity is to ensure the consistency and security of the blockchain. If the transactions or operations within a block are partially successful, it could lead to an inconsistent state and damage the credibility and integrity of the blockchain.

The MEV-Boost+ mechanism proposed by EigenLayer can balance the power between proposers and builders, providing more guarantees for Ethereum’s resistance to censorship. EigenLayer’s heavy staking mechanism is used to reduce penalties, ensure system security, and improve capital efficiency to encourage more validators to participate in the ecosystems of Ethereum and other networks, achieving a more decentralized and fair encrypted world.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Arca Chief Investment Officer summarizes nine important gains from managing cryptocurrency funds over the past five years.

- Exploring the Next Consensus Layer Revolution of Ethereum How Should the Post-Deneb Era Develop?

- Multicoin Three Necessary Considerations for Building the DePIN Network – Hardware, Supply Thresholds, and Demand

- Delphi Digital Co-founder ZK May Be the Endgame, Pondering My Unsolved Mystery

- Microsoft launches AI Copilot for Windows 11

- Based on the understanding of the exchange business logic, why does Binance’s aggregated wallet need to consume hundreds of ETH?

- AI Coin Issuance Era is Coming? How Does ChatGPT Automatically Deploy and Create Tokens?