12 prediction trends you need to watch out for if the bull market hits in 2020

Author: 0x60

Source: BlockBeats

2019 has quietly left, and the cryptocurrency industry's most concerned topic is whether the market will improve in 2020? Are there any trends you have to follow?

Today, BlockBeats starts with the 2020 trend prediction of cryptocurrency investment agency Outlier Ventures, and strives to capture the pulse of the market.

- 2020, Bitcoin mining is about to usher in the year of life and death

- Will Synthetix be the first Defi to replace MakerDAO?

- BitMEX's annual "closeout report card" was released, with more than 60% of the orders accounting for nearly $ 13 billion

Outlier Ventures Prophecy 1: Blockchain + Gaming Tide Strikes

In 2020, the game industry will become a field of blockchain technology and application breakthroughs. By the end of this year, blockchain game infrastructure such as high-performance platforms, convenient digital asset access channels, easy-to-use digital asset storage, and transfer wallets will be gradually built. The next thing to do is channel distribution and reach users. Players can rent their GPU and CPU hardware to perform calculations and rendering tasks to earn "points" that can be used in the game or can be used across games.

Forecast result: Valve (V agency) or Epic game platform will launch a blockchain-based game service.

Interpretation of block rhythm BlockBeats:

Vitalik, the founder of Ethereum, once said that finance and games may be the fastest landing areas in the blockchain, which has also made many people in the industry continue to be optimistic about blockchain games. Since 2018, we have actually seen many attempts to mix blockchain + games.

The most famous one is Cryptokitties (Ether cat). The Genesis cat shot a sky-high price of 770,000 RMB at this time. This game of raising cats on the blockchain allows the enthusiasts to spend a lot of money and make speculators stunned Upside down, the concept of non-homogeneous token NFT is deeply rooted in the hearts of the people. It has enlightened the first generation of blockchain games, and has also triggered a large number of followers.

Among the Internet imitators, the most innovative is Tencent's "Catch Monsters Together". This AR exploration mobile game not only borrows the ideas of Pokemon Go to develop a battle-type game, but also is exactly the same as Cryptokitties' gameplay-players The cat information cultivated in the APP can be chained, and cats between players can reproduce offspring, and each cat has its own different characteristics.

In the world of blockchain NFT, last year's trading card game Godsunchained performed well, with the largest transaction volume surpassing its predecessor Cryptokitties. With the gradual maturity of the second-tier capacity expansion technology and the lowering of the threshold for cryptocurrency users, we expect to see platformized and broader blockchain games beyond NFT in 2020.

Interestingly, with Google's official launch of stadia, Microsoft xCloud testing, and 5G commercialization, cloud gaming has become a hot topic recently. The so-called cloud game is simply a screen and network to operate without the need for players to bear computing or hardware resources. So, if the vision comes true, will it be combined with the blockchain again to prevent the central server from doing evil and single point of failure?

Outlier Ventures Prophecy 2: Using Telegram at Home

With about 200 million monthly users, Telegram has chosen a messaging service that has special features in terms of privacy and security, and many users are early users of cryptocurrency projects.

With the launch of Klatyn (kakatalk) and Link Network (LINE) live, TON (Telegram), Mobilecoin (Signal), and Libra stablecoin (Facebook), 2020 will begin to see the real use of blockchain-based applications, but Their audiences are not exactly the same.

Prediction results: By the end of 2020, Telegram will be the blockchain network with the most monthly living.

Interpretation of block rhythm BlockBeats:

If the active address of the token in the blockchain and the on-chain transfer are considered as indicators of monthly activity, then this is undoubtedly more difficult to achieve. Of course, if you only consider all users of the blockchain project (excluding tokens), Telegram is well deserved.

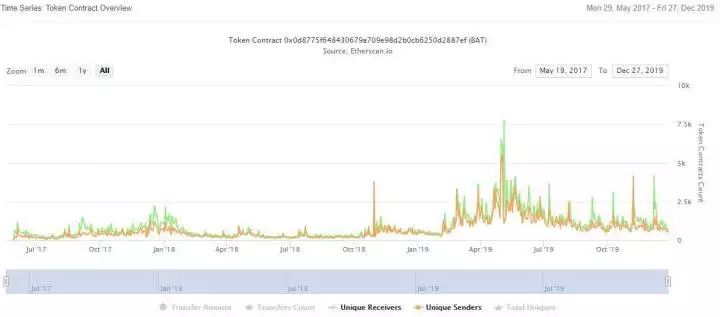

This conclusion is well-founded: Both BitTorrent and Brave have considerable users, but this does not mean that the project's tokens will be widely adopted in the short term. Taking the latter as an example, although the Brave browser claims to have more than 10 million daily activities, this does not mean that there are so many people watching advertisements every day to earn tokens. On the contrary, etherscan data shows that there are only 800 people who actually play BAT tokens every day. (Households) around.

As TON has not been officially launched, it is not yet clear what kind of economic design will be used, but from the current data, TON token does not seem to be a stablecoin, which will also cause huge difficulties in the actual promotion of TON token. In the recently launched Orchid Protocol, the OXT token can be used to pay for virtual private networks. However, compared to the traditional virtual currency payment virtual private network service, one of the crux lies in the fact that the price of OXT tokens fluctuates in real time, which will cause the current consumption amount to change continuously in the future. The high volatility of payment tokens does affect the application of real-world scenarios.

Outlier Ventures Prophecy 3: Use Corda at Work

Corda is a distributed ledger platform launched by R3 CEV, which borrows some of the characteristics of the blockchain, such as the UTXO model and smart contracts, but it is fundamentally different from the blockchain, and not everyone can use this This kind of platform is aimed at the interoperability scenarios between banks or between banks and their commercial users.

Prediction results: Corda will surpass the market share of Hyperledger, Ethereum and Quorum and become the market leader of enterprise-level blockchain networks.

Interpretation of block rhythm BlockBeats:

Hyperledger, Quorum, Corda are all first-class alliance chain platforms. The alliance chain is more easily accepted by regulators because it has an authorization access mechanism. Forbes previously reported that the European Central Bank will release a distributed ledger EUROchain based on the R3 Corda platform for services between financial institutions. However, previous media reports revealed that there was an internal struggle between the R3 company's engineering team and management, and the two diverged from R3's company culture and Corda's product direction.

Outlier Ventures Prophecy 4: China will vigorously develop digital currency

The 2018 BIS survey of 63 central banks showed that most central banks are studying the proof-of-concept of digital currencies, but most central banks are not yet ready for a real launch.

European Central Bank President Christine Lagarde said Central Bank Digital Currency (CBDC) "can meet the objectives of public policy, such as financial inclusion, security, and consumer protection; and provide areas that the private sector cannot provide: payments privacy". These CBDCs will be wholesale CBDCs, not retail CBDCs. It is likely that the central bank will focus on the wholesale market and leave the retail market to regulated institutions.

In 2020, China may officially launch Digital Currency Electronic Payment (DCEP), whose license will grant mainstream platforms of choice to hundreds of millions of users such as Alibaba, Baidu, and Tencent as distribution channels.

Forecast results: By the end of 2020, more than 500 million Chinese will use services connected to the DCEP network.

Interpretation of block rhythm BlockBeats:

According to public information, DCEP is a digital payment tool with value characteristics and M0 attributes issued by the People ’s Bank of China. It is a “digital fiat” in the true sense, not a “cryptocurrency” as some people understand it. With legal compensation, dual offline payment characteristics.

Mobile electronic payments have penetrated almost every corner of Chinese life. According to the information published so far, DCEP adopts a hybrid structure and does not preset a technical route. This means that it is possible for commercial institutions to use mobile payment tools for users DCEP. Existing mobile electronic payment service providers can still graft application services to DCEP. Pay on top. Therefore, Outlier Ventures's prediction result is relatively reasonable, but it is worth looking forward to whether it will reach 500 million users in just 12 months by the end of 2020.

In addition, Messari pointed out in the recently released 2020 Top Ten Stablecoin Trend Report that China's DCEP may be tested in Shenzhen and Suzhou by the People's Bank of China and the four major commercial banks in early 2020.

Outlier Ventures Prophecy 5: European Wave Breaks Out

In 2020, Europe will begin to occupy the United States as the center of Western blockchain projects, including in financing and infrastructure construction.

To some extent, London is still part of the process even after Brexit, and London was the second most popular city in the early global blockchain financing. This trend is largely due to the European Union's determination to shake off the US's dominant role in Internet development over the past few decades.

Forecast results: In 2019, European venture capital investment in blockchain companies will be 700 million US dollars, and by 2020 this number will exceed 850 million US dollars in 2018, reaching 900 million US dollars, becoming the highest level in history.

Interpretation of block rhythm BlockBeats:

Indeed, Europe is becoming more and more "present" in the western blockchain world. In October 19, the fourth largest stock exchange in Europe, the Swiss Stock Exchange, launched a new ETP trading product, which consists of 90% BTC and 10% ETH, and can be purchased directly using the Swiss franc. In March 19, Europe completed the issuance of the first STO token bond, with a hard cap of 100 million Euros.

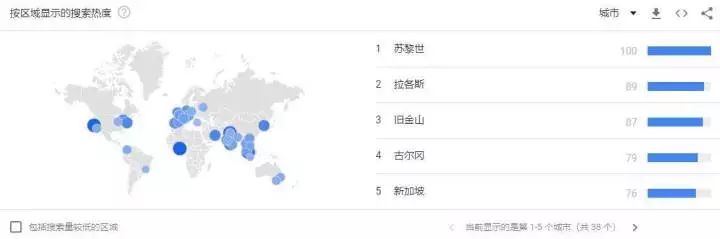

We enter "Blockchain" in Google Trends and sort by the search popularity displayed by region. We will find that the global blockchain discussion focus is concentrated in Europe, Southeast Asia and parts of the Americas. Zurich, the richest city in Europe, ranks first in the relative discussion popularity .

Outlier Ventures Prophecy 6: Blockchain will stage East-West war

Outlier Ventures spent a lot of time and energy in Asia, especially China in 19 years. They think that there will be more differences between the East and the West in the field of blockchain, especially in digital assets. Of course, this is nothing new. In fact, there have been two versions of the Internet, but with the development of China, the popularity of the Internet has surpassed expectations.

- Although China has officially embarked on an authorized blockchain path that does not involve tokenization, several (class) PoS networks such as Bitcoin Mining and EOS have been monopolized by several major companies or groups. Some people believe that These chains are controlled by Chinese companies.

- Most of the cryptocurrency transaction volume still comes from China, and it is understood that by the second quarter of 2020, only a few head trading platforms will be able to obtain formal licenses and may initially operate in a very limited manner.

- Provinces and state-owned enterprises (SOEs) will begin to maintain their own regional tokenization networks within the guidelines.

- China's digital currency electronic payment (DCEP) will benefit hundreds of millions of consumers overnight through mainstream payment and application platforms, but this also further strengthens their business models; in the West, many people think this is similar to the Web 2.0 platform Will be indivisible.

- Perhaps we will see a longer Web2.5 era in Asia, or a completely different form of Web3.0, but the result will be a field that is not only technical but also financially dominant Scramble.

Prediction results: Three cryptocurrency trading platforms have obtained official Chinese licenses and operate under restricted conditions.

Interpretation of block rhythm BlockBeats:

Outlier Ventures' speculation about trading platform compliance is extremely bold. In fact, all cryptocurrency trading platforms and illegal financing projects have been cleared in China. In the future, we do not know the regulator's policies on cryptocurrency trading and mining, and we cannot guess.

However, it is certain that the competition in the field of blockchain between China and the West will increase. Half of Libra's guarantee composition is in U.S. dollars, which means that once the compliance process is passed, it may be possible to use applications such as Facebook to expand the hegemony of the third world dollar; compared to Facebook (Libra Association), DCEP may be directly implemented by the People's Bank of China , It will be more efficient to execute, M0 replacement is also different from Libra that affects M2, and derivatives or services can be more yuan; Forbes recently revealed that EUROchain being developed by the European Central Bank is also a digital currency project, but the current design of EUROchain is only Focus on value flow between banks and financial institutions.

Outside the stablecoin field, competition between public and alliance chains will also become more intense. Although the blockchain is globally distributed, in the actual implementation of the project, geographic isolation and language isolation will inevitably occur, so some blockchain projects have obvious regional characteristics, such as Tezos in Europe, Russia Waves, Vietnam's Tomochain, and some of our familiar "domestic public chains" and alliance chains. As these projects grow into a global consensus blockchain, they are bound to be affected and supported by local resources, policies, and even compete with each other.

Outlier Ventures Prophecy 7: The token market will be cleared

The big event throughout 2020 will be "The Reckoning."

Cryptocurrency trading platforms will develop in the direction of specialization as the situation forces them, and "zombie tokens" will be removed from the market, and investors will gradually abandon them. Projects that do not fit the product market but are still worth $ 100 million will no longer exist. The valuation of cryptocurrency projects no longer depends on a vision or an idea to maintain them. In 2020, it will all focus on the project's market drivers and landing applications, not just press release partnerships, beta releases and funding rounds. What we want to see is that, like the Brave browser's multi-million-month-level market driving force, this is the pride of the crypto industry.

Prediction results: In 2020, five new projects will have a market value of more than $ 5 billion.

Interpretation of block rhythm BlockBeats:

When everyone abandons obsolete and decaying projects, it will be possible to accept a large-scale new generation of blockchain projects on a large scale. Under this logic, 2020 will be a year of "changing blood" in the cryptocurrency market value list.

In fact, in 2019, we can already see the signs of the "changing blood" trend. Some technology stagnation, or the consensus of the scattered head items, the market value rankings fall and fall, such as IOTA fell out of the top 20, Qtum fell out of the top 30, OmiseGo even fell past the top 50. Instead, BNB and XTZ successfully ranked in the top ten, Cosmos broke into the TOP15 in the fourth quarter, Chainlink maintained the top 20 with its excellent performance in the second quarter, and DeFi rookie SNX advanced into the TOP35 …

In 2020, we expect that this trend will be strengthened. Projects with upward momentum and technologies, products, ecology, and consensus that have been maintained will continue to move forward, while Filecoin, Polkadot, Conflux, TON (, Dfinity) and other batches are competing Li's new blockchain projects will be launched one after another, and those forgotten project tokens will be completely abandoned.

Outlier Ventures Prophecy 8: Bitcoin Will Get Practical Use

We believe that in 2020, regarding the development of Bitcoin, it will shift from a simple "value store" to an open financial "platform" with the most secure and trusted settlement layer in the market.

Halving the output of Bitcoin will attract most of the attention of the industry and the media, and price behavior will dominate investor thinking. However, the growth of LApps (Lightning Network Application) and wider data support will be a stronger signal for the development of the Bitcoin network fee market and the long-term viability of Bitcoin.

Forecast results: By the end of 2020, Bitcoin's market value will increase from 66% to at least 75% in the cryptocurrency market.

(# Blockchain 律 动 BlockBeats Note: The Lightning Network application, also known as "LApps". It allows Bitcoin holders on the Lightning Network to take advantage of its low-cost and instant transactions to pay. Lapps will be used in the development of Bitcoin as well as How to scale to fit more users and play an important role in trading.)

Interpretation of block rhythm BlockBeats:

Perhaps the biggest significance of Bitcoin is still value storage, not practical payment. The deflationary economic design and high volatility make daily business payments difficult, but for large cross-border payments or some gray areas, Bitcoin will still perform well.

Another interesting phenomenon that can be seen this year is the invasion of Bitcoin assets on Ethereum to DeFi, such as wBTC, zBTC, imBTC, etc. BTC has better liquidity and stability than ETH, so can the bitcoin assets mapped on the Ethereum chain replace the native currency ETH, become the preferred collateral object, or become a non-negligible part of DeFi? At present, this question cannot be answered, and we can observe the development trend of this year.

However, we do not agree with the prediction that the market share of Bitcoin is increasing. It is doubtful whether the growth of Bitcoin in the lightning network and consensus diffusion will exceed the hype and value of the new generation of blockchain projects.

Outlier Ventures Prophecy 9: There will be no more applications on Ethereum, but DeFi will continue to be hot

We want to see the application of layer 2 except crowdfunding and DeFi; we want to see that games that currently use EOS and Tron can be migrated to Ethereum and use the DeFi module components. With the development of MAST / Taproot on the Bitcoin network and the launch of the main network of the new smart contract platform in 2020, we may see more and more platforms with stable development teams. This will lead to a reduction in the number of new dapps developed on Ethereum, but will retain boutiques such as MakerDAO and Compound, which can drive monthly active users and increase the value of hedging in smart contracts. However, it is difficult to predict whether an explosive application developed using the DeFi module will use Ethereum as the base layer, or if interoperability projects such as the GEO protocol will reduce the importance of the base layer over time. And value.

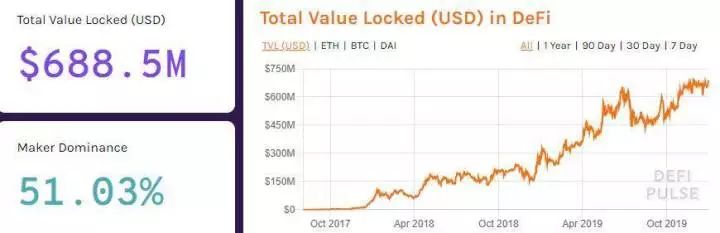

Forecast result: In 2020, the total value of locked positions in Ethereum will exceed $ 1 billion.

Interpretation of block rhythm BlockBeats:

Judging from the current development trend, Ethereum is the existing open financial platform of choice, and has already absorbed nearly 700 million US dollars of digital assets. Neither Cosmos, Polkadot, or Celo, which Olaf recently advocated, has yet to have a devastating blow to Ethereum. On the contrary, with the maturity of interoperability technology, more and more bitcoin assets and other public chain assets will also be pledged into the Ethereum ecosystem. In 2020, the total value of Ethereum hedging over US $ 1 billion is almost a foregone conclusion.

Outlier Ventures Prophecy 10: If you only focus on old giants, you will miss the new blockchain network

The "oversupply" of the new smart contract platform will emerge in 2020, and will begin to focus on the acquisition of developers and customers. Over time, most developers will become more familiar with blockchain platforms. Currently, less than 1% of developers worldwide are familiar with the development of blockchain platforms.

Most developers want to be able to use stable, secure, fast, and easy-to-use software. Polkadot, Fetch.ai, Dfinity, Hashgraph, Near Protocol, Spacemesh, Solana, Telegram Open Network, Thunder Token, nCent, and all blockchain platforms already on the market, such as Cardano, Tezos, Holochain, Algorand, Blockstack, etc., They all differ to some extent, but the biggest problem is: how do they cut off with developers who need to create "killer" applications? And how to attract consumers?

Different developer acquisition strategies include: accelerators, ecosystem funds, and developer conferences. Although the total number of developers and market share of some projects have increased, most projects will start fiercely with Ethereum and Bitcoin in 2020. competition.

Prediction results: By the end of the year, no new smart contract platform had more than 400 applications.

Interpretation of block rhythm BlockBeats:

The description of "oversupply" is very appropriate. The market is full of new but useless public chains. Too many projects end up just being hilarious, without attracting real users, and becoming an on-chain city. In 2020, such a public chain project is destined to be eliminated by the market. The project party may gradually disappear and stop updating, or it may be returned to the community to do nothing.

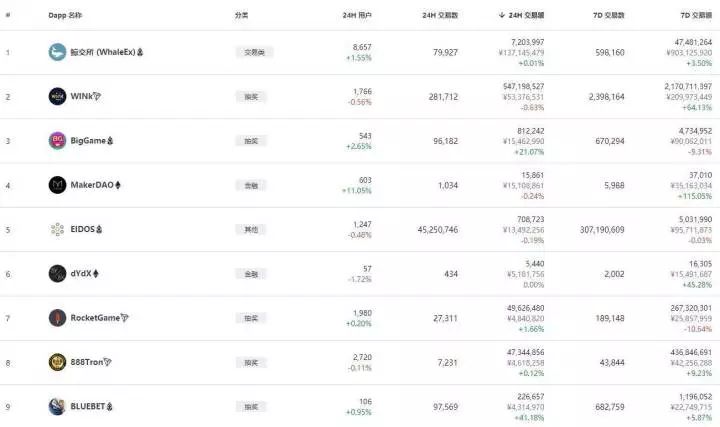

At the same time, an interesting phenomenon is that financial applications will basically choose Ethereum, spinach applications will choose EOS and Tron, and a number of non-industry-native applications will appear on BSV and Blockstack. We expect such "application ownership It will continue in the future. Public chains with different consensus mechanisms and growing soils are applicable to different public chains.

(Block Beats Note: DAPP TOP9 of December 30, 2019 listed by Dappreview)

Outlier Ventures Prophecy 11: 2020 is a baptism

There will be very few new tokens coming up, and the development will be more mature. By the end of 2020, public offerings and Shanghai Stock Exchanges will no longer be seed companies. Although they will not be as mature as traditional IPO companies, at least one product will fit the market.

Forecast result: more than 50% of the listed tokens will be removed.

Interpretation of block rhythm BlockBeats:

As mentioned in Prophecy 7, we believe that 2020 will still be a baptism for those stalled projects.

Outlier Ventures Prophecy 12: Investors don't want to be customers, they want earnings

Since the collapse of the ICO market and weak IEO earnings, various projects have been exploring other token distribution strategies to coordinate the consistency of fundraising and the interests of network participants.

The ideal token distribution method can solve the problems of speculation, supervision, network asymmetry, market irrationality and stakeholder alliances. Strategies from different teams have been proposed or tested, such as lock-drop, warlock, liquid airdrops, etc. By 2020, a clear trend is that the market size of investors among active network participants has become smaller, making it impossible to raise enough funds to build a global network. We will return to the way startups sell equity to investors to raise money, and use tokens as a way to reward users.

Prediction results: Before the launch of the main network, 90% of Western cryptocurrency projects use equity as the main financing tool.

Interpretation of block rhythm BlockBeats:

It is undeniable that equity is still the main financing tool, and institutions that are willing to accept token financing before the main net goes online are often limited to professional institutions in the crypto field. Broader venture capital has begun to spread to later rounds of blockchain project financing.

2019 seems to be a year of disappointment for the cryptocurrency industry. Except for the bitcoin price hype and the short-term rise of IEO, we still haven't waited for a substantial breakthrough in the fundamentals of the blockchain. The only good thing may be the gradual popularity of DeFi, but this is also limited to the scope of the cryptocurrency industry. As for the outsiders, DeFi still has no influence.

Of course, there is also hope in disappointment. Facebook as a behind-the-scenes driver is trying to issue the global stablecoin Libra, Bakkt with a background of the NYSE parent company's physical delivery of BTC futures, the listing of mining giant Jia Nan Technology (CAN) …

In 2020, we expect that the cryptocurrency industry will bring about new changes in the baptism and truly come into life.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The difficulty of BTC mining hits a new high. Is the miner optimistic about halving expectations and continuing to increase? Still riding a tiger?

- Coin Indian mining pool CEO talks about the self-cultivation of Hodler in the mining circle on the eve of the halving | Chain Node AMA

- How to tell the story of the public chain in 2020?

- Tencent's Blockchain Opportunities: Throbbing, Planning, and Attacking

- Behind the "Blockchain" Top Ten Buzzwords: Public Opinion Analysis in 2019

- Blockchain financial industry application: How does the financial industry embrace this disruptive technology?

- Xinhua News Agency looks forward to 2020 "black technology": including blockchain, private space travel, etc.